| | Cabinet nominee Chris Wright plans to embrace LNG, but otherwise maintain many Biden-era energy prio͏ ͏ ͏ ͏ ͏ ͏ |

| |   Washington, DC Washington, DC |   Davos Davos |   Paris Paris |

| Net Zero |  |

| |

|

- Trump’s first day

- Energy ‘dominance’

- Business-class carbon

- Carbon credit upside

- Nuclear renaissance

Carbon removal is hiring, and Biden carves out space for clean data centers. |

|

Semafor is descending on Davos next week and hosting a lineup of world-class events, including one on AI’s Energy & Climate Innovations (more on that below). We’re also bringing back Semafor Davos, our pop-up newsletter to give you the big ideas, small talk, and behind-the-scenes happenings from the global village. Stay in the loop and subscribe to Semafor Davos. |

|

REUTERS/Kevin Lamarque REUTERS/Kevin LamarqueUS President-elect Donald Trump has a busy schedule on energy policy mapped out for his first day in office Monday. Trump reportedly plans to sign numerous executive orders to boost his energy “dominance” agenda, which will likely include reopening the permitting process for LNG terminals and replacing it with a suspension of permits for offshore wind turbines. He will probably withdraw the US from the Paris Agreement and scrap the Biden administration’s emissions reduction targets. He is expected to halt any activity on new climate regulations, and initiate new tariffs against clean energy tech from China. And he plans to form a new national energy council that will include his energy and interior secretaries, tasked with coordinating on policies supportive to fossil fuels. Some of Trump’s climate and energy overhauls will face legal challenges; others will need to survive fights in Congress. Either way the US energy transition is in for a stretch of turbulence. |

|

Chris Wright’s vision for energy ‘dominance’ |

| |  | Tim McDonnell |

| |

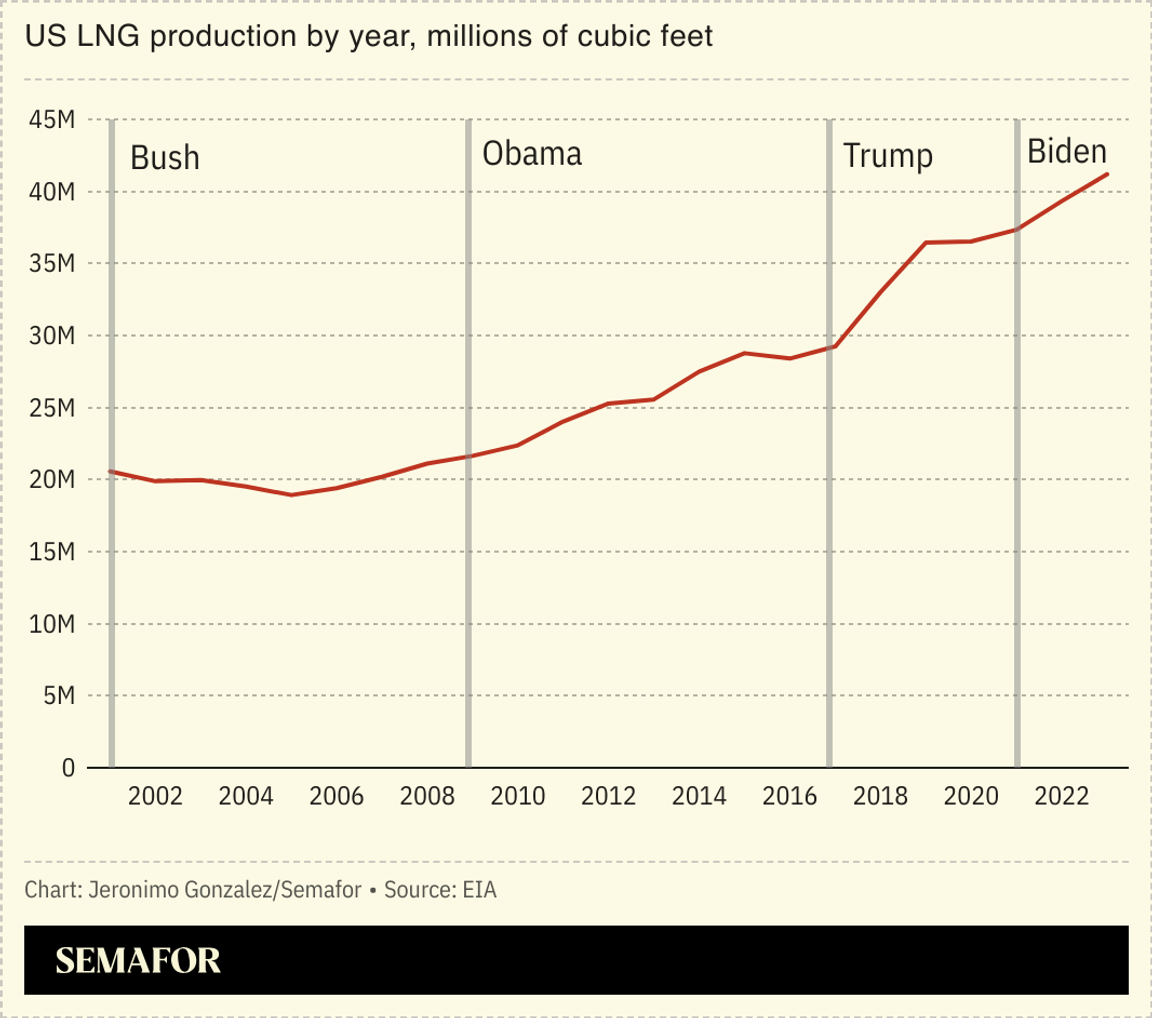

US President-elect Donald Trump’s nominee to lead the Department of Energy laid out his vision of how to achieve energy “dominance” by elevating the role of US energy and technology exports — fossil and otherwise — as a primary lever of US economic competitiveness globally.  Chris Wright, CEO of the fracking company Liberty Energy, used his mostly-chummy Senate confirmation hearing Wednesday to make clear that he believes in man-made climate change and supports ongoing federal investment in the scale-up of low-carbon technologies. But reducing emissions is relatively low on his priority list. The country’s most urgent energy problem, he said, is improving the reliability and affordability of electricity, followed by capitalizing on the country’s natural and entrepreneurial resources to challenge adversaries and support allies. “Previous administrations have viewed energy as a liability instead of the immense national asset that it is,” Wright said. Becoming the world’s top oil and gas exporter, he continued, has yielded “enormous growth in our geopolitical leverage.” |

|

Rapid advancements in artificial intelligence present a transformative opportunity to drive the global energy and climate transition. Join Ricardo Manuel Falú, AES Executive Vice President, Chief Operating Officer, and President of New Energy Technologies, along with Semafor’s Technology Editor, Reed Albergotti, as they explore how AI can enhance mitigation efforts, support adaptation strategies, and develop the infrastructure for a low-carbon future. Jan. 22, 2025 | Davos, Switzerland | Request Invitation |

|

American Express is rolling out a new service that will allow companies to charge themselves a carbon fee for business flights.  Aviation emissions are a significant component of many large companies’ carbon footprints. A growing number of businesses are shelling out for credits that match miles traveled to gallons of sustainable aviation fuel. But SAF remains expensive and in short supply. As an interim measure, AmEx had already allowed its business customers to tack a self-selected carbon fee onto flight purchases. That money gets socked away in a special account that the business can tap to pay for SAF credits or in-house sustainability measures. Now, the feature will be expanded so that the carbon fee is pegged to the real-life emissions of a selected flight. That should make it easier for business travelers to either choose lower-carbon flights, or to channel more cash into their decarbonization efforts, Nora Lovell Marchant, American Express Global Business Travel’s head of sustainability, told Semafor. |

|

Anticipated increase in prices this year for carbon credits in the cap-and-trade markets of California and Europe, according to Australian investment bank Macquarie. In an outlook for the year, Serafino Capoferri, the bank’s global carbon strategist, warned that the carbon market in both places is oversupplied with credits, as it has been for the last couple of years, which has driven prices down. But both are expected to see their carbon “cap” lowered by regulators this year or early next, and in the carbon market those future expectations are often a more powerful driver of prices than the real-time balance, Capoferri said. |

|

| |  | Mizy Clifton |

| |

Nuclear energy is set to generate record levels of electricity in 2025 but significant hurdles remain for the industry, particularly in advanced economies, the International Energy Agency said in a new report.  Some 63 reactors are under construction, representing more than 70 gigawatts of added capacity, but the renewed momentum is “heavily reliant” on Chinese and Russian technologies, the IEA warned: 92% of all reactors that have started construction worldwide since 2017 are of Chinese or Russian design, while France and the US are losing market leader status as they struggle to rejuvenate ageing fleets and fund new projects beset by delays and cost overruns. The risks associated with such highly concentrated nuclear-technology markets have been laid bare by Russia’s invasion of Ukraine, with soaring fuel prices in part attributable to Moscow dominating global uranium conversion and enrichment capacity. |

|

New Energy Tingshu Wang/Reuters Tingshu Wang/ReutersFossil FuelsFinanceTechPolitics & PolicyMinerals & MiningEVs |

|

|