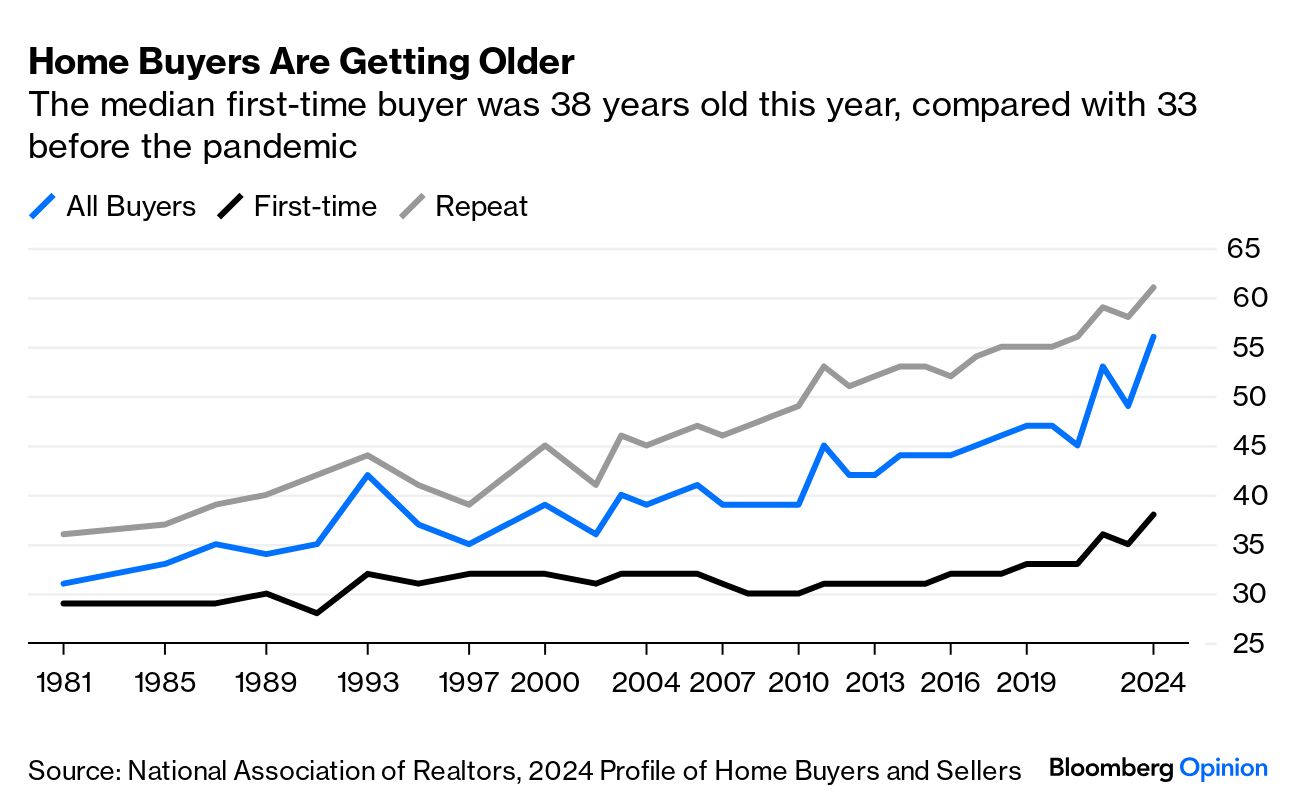

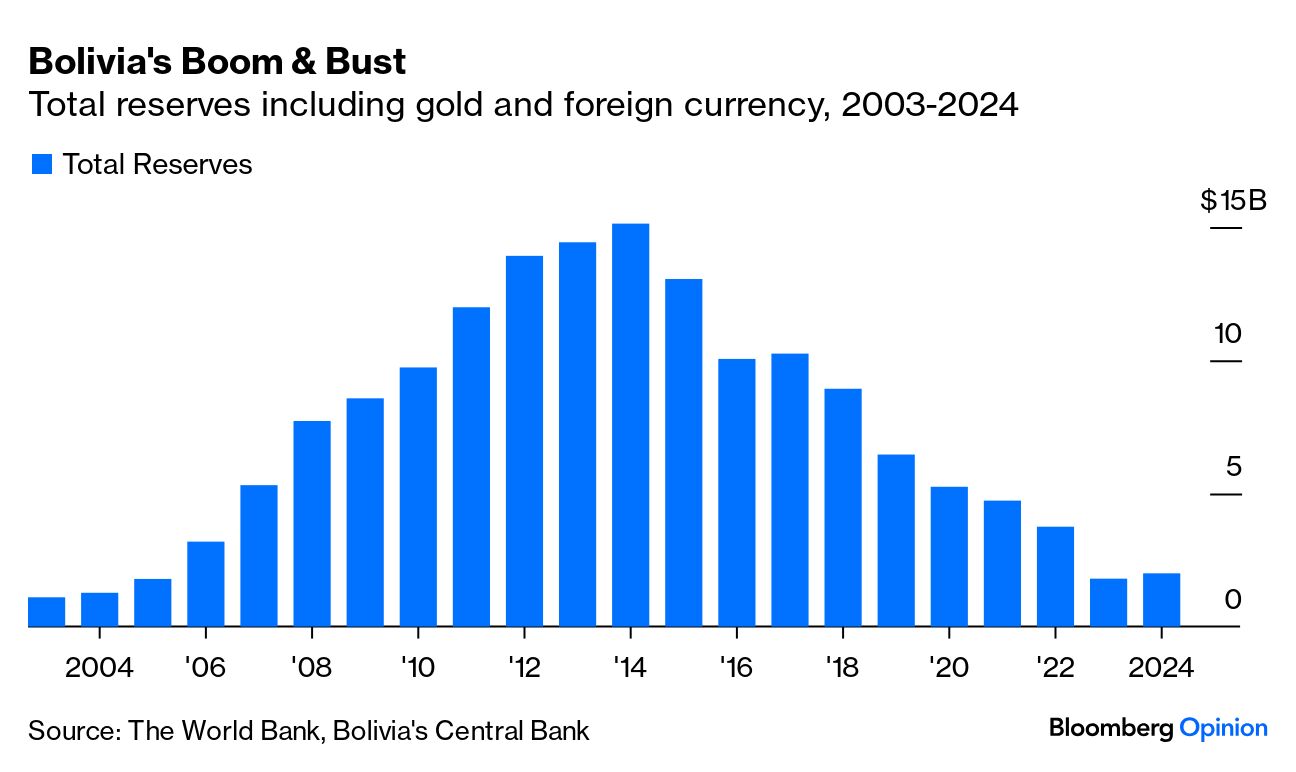

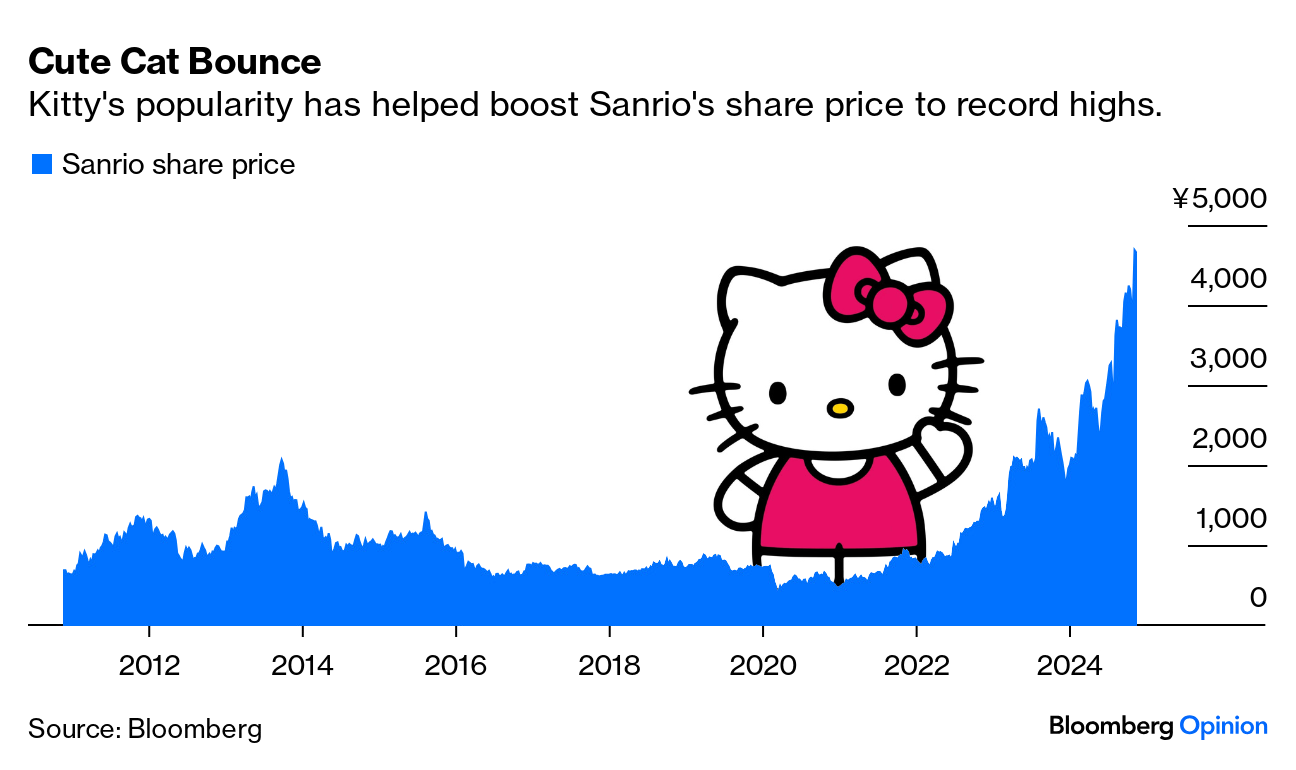

| This is Bloomberg Opinion Today, an international reserve of Bloomberg Opinion’s opinions. Sign up here. Hallmark isn’t known for being the most creative cable network in the world. It follows a very specific formula, and everyone likes it that way: But what happens when that formula runs its course? Do they just... stop making movies? I guess so: As NPR’s Linda Holmes says, Hallmark ran out of pronouns for their “Time for ______ to Come Home for Christmas” franchise this year. But she offered two easy fixes, which leads me to believe that the pronouns were never the problem. Instead, I think they ran out of homes. Think about it: How many abandoned inns are there for two star-crossed DIYers to repair in rural America? How many well-appointed Tudor homes can there be for a woman with amnesia to shack up with a handsome nurse in? How many childhood farmhouses with wraparound porches exist in snow-covered mountain towns? I’m sorry, but recent widows can’t lead a church choir at Christmastime if they don’t have a roof over their head. Yes, I’m being dramatic — what’s new! — but Conor Sen says housing is hard to come by these days. And it’s increasingly unrealistic to imagine that Hallmark characters could even afford to live in them. Like, you’re telling me that a hopelessly single 20-something-year-old cupcake baker owns a pristine three-bedroom New England cottage with a Wolf range? No way, unless the cottage is made out of gingerbread. Or she has a trust fund.  “Young American families chasing the dream of homeownership have found conditions increasingly difficult in recent years, with affordability challenges spreading from always-expensive cities such as San Francisco to previously affordable places such as Orlando,” Conor writes. The culprit isn’t easy to pinpoint. Instead, it’s a combo of sudden price spikes and stubborn mortgage rates. “The low inventory of homes for sale is keeping prices elevated and resale housing activity stuck near generational lows. People who can afford to purchase in this market are likely to be older and repeat buyers,” he explains. A recent paper by the Federal Reserve Bank of Minneapolis proposes a solution: higher property taxes. If you own a home — or homes — and you’re reading this, know that I can hear your groan across the ether. This is by no means a popular idea! But Conor says the housing market is in such dire straits that it’s a proposal worth floating. “Increasing property taxes, while painful for local politicians and homeowners, would improve the structural dynamics of the housing market,” he explains. “It would raise carrying costs for people who own multiple homes, for instance, incentivizing them to sell one of them. It would also incentivize downsizing among empty nesters living in huge single-family homes, freeing those up for young families who need the space.” If not for young families, do it for Hallmark! I need my brainless, regularly scheduled holiday programming like I need oxygen. Bonus Housing Reading: Will Trump get his $280 billion housing trophy? The future of Fannie Mae and Freddie Mac hangs in the balance. — Marc Rubinstein Imagine living in a landlocked country and the aviation industry suddenly informs the government that it can’t pay for fuel supplies anymore. If they can’t find a solution, the entire population could end up isolated, with no planes flying in or out for the foreseeable future. If you’re reading this from Bolivia, I suppose you don’t have to imagine: You lived through the exact same nightmare already, just mere weeks ago. Luckily, an agreement was worked out with suppliers, but the threat alone is scary enough. Juan Pablo Spinetto says it’s the latest headache from the nation’s “old-fashioned balance of payment crisis.” To understand the disaster, one must rewind the clock to 2011, when Bolivia fixed its exchange rate to the dollar. The artificially strong rate has long been a drag on the economy, but now it’s reached a tipping point: “With international reserves at about a tenth of their $15 billion peak in 2014, the government of President Luis Arce is safekeeping every dollar bill and gram of gold, depressing activity, sparking fuel shortages and stoking social unrest — all in the name of avoiding a devaluation of an untenable 6.9 boliviano-per-dollar peg,” he writes.  Now, maybe you’re wondering: Wasn’t Bolivia, like, the poster child for natural gas? How did the “socialist success story” crash and burn so badly? Thanks to a series of strategic blunders by Bolivia’s former strongman Evo Morales (and his then economic czar Arce, who’s now the president, of course), the country is on the verge of collapse. Inflation spiked to 8% in October and the national deficit is at an all-time high. The shortage of greenbacks is so bad that there’s even an increasingly healthy black market for dollars. Bandaging over the decline with foreign fuel incentives to offset gasoline shortages isn’t going to cut it anymore. “What Bolivia desperately needs today is a huge fiscal adjustment, a devaluation of its currency and the refinancing of its foreign debt with the support of the International Monetary Fund,” JP argues. “As Javier Milei’s case in Argentina recently showed, when the economy reaches a point of no return, only an outsider can disrupt the establishment and make the drastic policy changes needed.” Read the whole thing. Happy belated birthday to Hello Kitty, who turned 50 years old on Nov. 1. I would offer to throw her a party, but I think she can afford the tab for a few balloons and a cake: Gearoid Reidy says the Sanrio character is now worth more than ¥1 trillion — or $6.5 billion. She’s “the second highest-grossing media franchise in the world, according to TitleMax, earning more than the likes of Harry Potter or Star Wars,” he writes, making her the crown jewel of Japan and the international face of kawaii. The next place she plans to conquer? Hollywood. Sanrio confirmed earlier this month that a Hello Kitty movie — a “hybrid of live action and anime” — is in the works, but we don’t have many details beyond that.  Parmy Olson says the tech world erupted with questions upon hearing that the US Department of Justice intends to force Google to sell Chrome: “Sure, Chrome is an important moat for Google’s business, but is it really the source of the company’s power? And if a company buys Chrome for an estimated a0 billion, wouldn’t that mean someone else controls two-thirds of the browser market?” Logistics aside, she suspects that a divorce from Chrome “isn’t just strategic” for the DOJ. “It’s the opening move in what could eventually become the biggest antitrust showdown since AT&T.” Free read: Biden just gave Trump another bargaining chip in Ukraine. — Andreas Kluth In a fight against China, the US Navy could run short on munitions. — Bloomberg’s editorial board Prediction markets don’t deserve quite this much post-Trump afterglow. — John Authers Trees can’t cancel out SUV emissions: We’re misunderstanding the science of net zero. — Lara Williams Richer developing nations must play a bigger role in the climate finance system. — David Fickling Trump’s cabinet blitz is straight from Viktor Orban’s authoritarian playbook. — Frank Wilkinson The Bank of England has hit the pause button on rates until at least February. — Marcus Ashworth Disney ended its fiscal year with a bang. But Bob Iger’s hero act could backfire later. — Beth Kowitt Gautam Adani got charged for massive fraud. Archegos founder Bill Hwang got 18 years in prison. Laken Riley’s murderer got a life sentence without parole. Comcast is spinning off MSNBC and CNBC. Trump’s education pick has a credential crisis. Adult field trips? Not today, Satan. Kim Kardashian is a Republican now? Anne Hathaway is Colleen Hoover’s next victim. Jay Leno got his face knocked in by a 60-foot hill. The greatest |