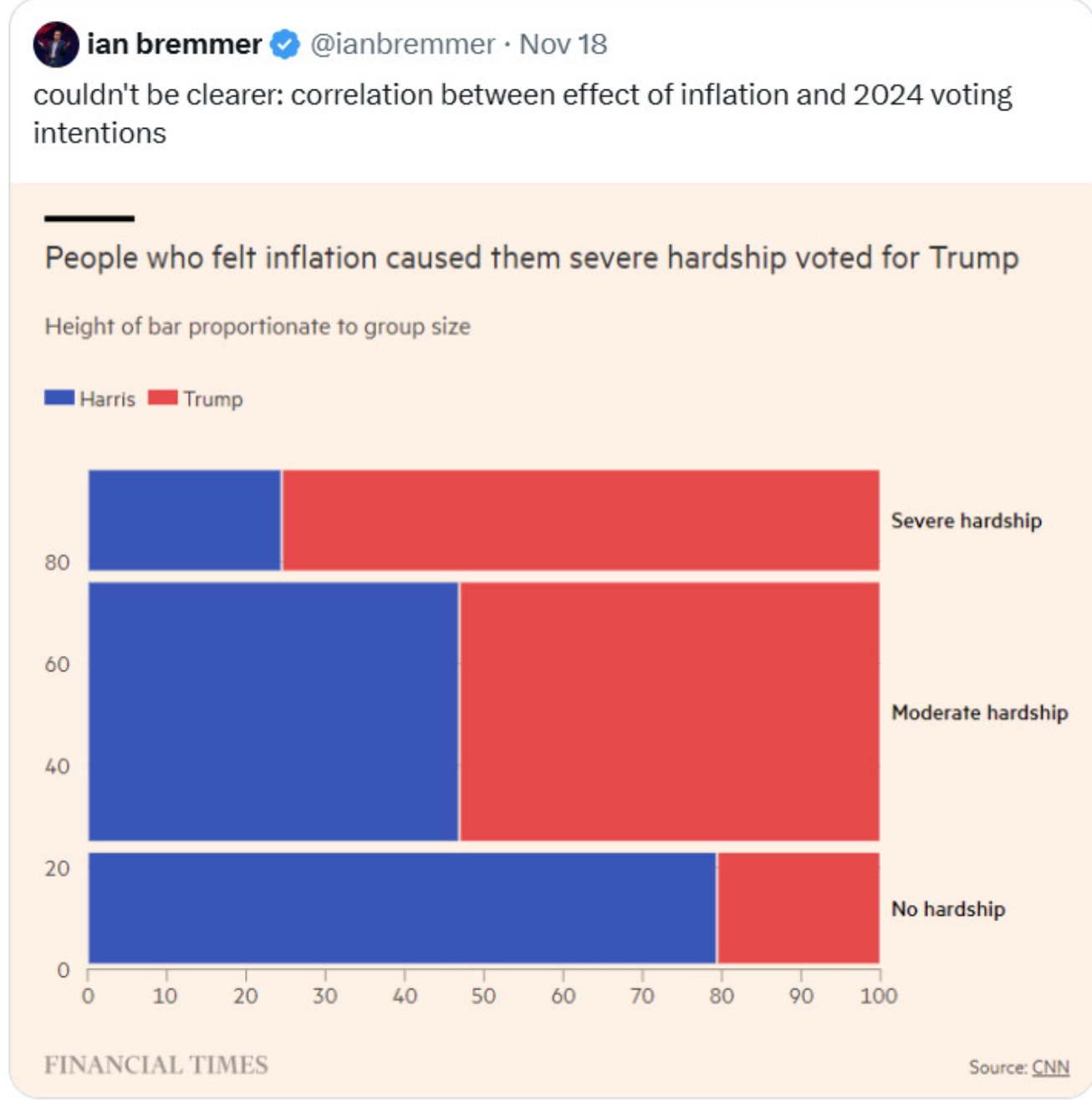

| When it finally dawned on financial markets in 2020 that Covid-19 was a pandemic that would affect everybody, there was a panic that threatened to usher in another financial crisis. Among the many things the Fed did was cut interest rates to zero and keep them there. In fact, it was exactly two years before rates moved higher.  For those of you fortunate enough to have recognized this as a once in a lifetime opportunity to lock in a fixed 30-year mortgage rate below 4%, even below 3%, I applaud you. The borrowing cost, the liability, on your biggest asset won’t ever be as low again in our lifetimes. Of course that means you’re kind of stuck where you are unless you’re willing to pay a higher rate if you sell and buy another home. But it also means that Millennials, now desperate to get on the property ladder, don’t have a lot of housing inventory to choose from. They have to buy a house whose price was bid up throughout the pandemic and afterwards using a costly mortgage. Or they have to rent. That makes rent inflation as onerous as owning. Two terrible choices. And a lot of this is driving both electoral politics and inflation statistics. On the inflation side, rent inflation in the year through October came in at a whopping 4.9%. The corresponding figure for homeowners, owners’ equivalent rent, was even higher, registering 5.2% in the last 12 months. If you’re a Baby Boomer or Gen X’er who already owned a home, none of that factors into your personal inflation. But for those still renting or looking to buy, it’s a big deal. And the US presidential election shows that. Exit polls show that those most likely to rent — young people and people of color, swung against the Democratic Party the most. Even if they are more likely to vote for Democrats, that likelihood swung tremendously in favor of Donald Trump in 2024. Conversely, those most likely to own homes and insulated from shelter inflation, older people, swung against the Democrats the least. Ian Bremmer gets it!  My takeaway: everyone hates when prices go up. “Despite substantial postpandemic increases in food costs, wages have now more than caught up with prices”, people still feel poorer from the rise in food prices. Call it money illusion, but the reality is even if groceries are getting more affordable in real terms, people see the price compared to 2019 before the pandemic and just don’t feel it. So what does the Fed do about this? Go back to that quote from Jeffrey Schmid right up front. He’s telling you that, if inflation fails to go down, the Fed is not going to cut rates a lot more. I’m telling you the more they do that, the less housing inventory there will be, keeping house prices elevated. That will continue the one-two punch of high mortgage rates and high house prices that is hurting Millennials (a generational cohort still trying to get out from underneath large student debt problems). So higher rates may actually fuel inflation, first by adding to shelter inflation and secondly by boosting spending among Gen Xers and Baby Boomers who are getting 4% on their money market fund savings and who dominate upper-income household spending, which in turn has driven this economy’s boost. Let me give you an example. The headline from Bloomberg says “Walmart Raises Outlook on Strong Spending From Value-Seekers.” But when you read the article you see this right near the top: A lot of that growth was driven by upper-income households making $100,000 a year or more. That cohort made up roughly 75% of share gains for the quarter.

Translation: Bargain-hunting but upper-income Gen X’ers and Baby Boomers are driving both the spending and the profits at formerly more down-market stores like Walmart. We’re not talking about Target aka Tarjay here. This is Walmart, the store known for dominating staple purchases for ordinary Americans. In fact, Walmart is courting these people by advertising a complimentary Walmart+ subscription for all American Express Platinum Card holders. This mirrors what I highlighted about GM a few weeks ago, “even though the broader market for GM’s cars is pretty soft, the high-end stuff is doing so well that GM was able to post better-than-expected profits.” Add Walmart to that list. |