| Dear reader: Money Distilled is now behind the Bloomberg paywall. Existing readers will continue to get it for free until December 11th, but after that, it’ll only be available to Bloomberg.com subscribers (and terminal users, of course). So sign up if you haven’t already at the bonus rate outlined in the box above. You get a lot more than just this newsletter (though some would say that justifies the price of entry in itself), you get access to the entire Bloomberg website with its unrivalled global coverage of markets across the world. If you want to be informed, rather than told what to think — a rare commodity these days — sign up now. Farming is in the news. Farmers are protesting against the imposition (from April 2026) of inheritance tax (IHT) on agricultural and business property at the recent budget. This will also affect family businesses more broadly — a farm is, after all, just a type of family firm. So I thought we’d take a look at the topic today. Before we get started, I want to be clear — this piece is not about the rights and wrongs of IHT itself. People hate IHT and it’s clear why. Even though most don’t have to pay it, there’s a sense that it’s an extremely impertinent tax. It conjures up the image of a busybodying bureaucrat badgering the bereaved for a cut of something that most instinctively feel the state is not entitled to. Beyond the emotional case, there are many practical arguments that it’s not the best way to structure such a tax. My colleague Merryn Somerset Webb has written about this on several occasions. But for now, we’re stuck with it. So the main questions in this piece are: what do the government’s changes mean in practice for those affected? And is there a case for certain groups being excluded? How Will IHT on Farms Now Work? First things first — if you’re concerned about IHT, then speak to an adviser. I can give rough outlines here, but I am neither a farmer nor a tax specialist, and this stuff rapidly spirals in complexity depending on your circumstances. So get help if you need it or if you’re feeling panicked. Right, so what’s changed? From April 2026, agricultural and business property relief will be capped at £1 million, combined. Above that, IHT will be due at 20%. The tax due will be payable over the course of 10 years, interest free. What does this mean? Before this, working farms and other businesses were exempt from IHT, assuming that they remained working farms and going concerns when they passed to the next generation. Now they must consider IHT in succession planning. How much allowance does this all add up to? It's worth understanding this, because one big problem with IHT (in my experience) is that it can create a lot of fear, often out of proportion with the actual liability. This is one major reason why it’s a bad tax. We’ll take a very simple example. Let’s say a married (or civil-partnered) couple own a working farm together. They have their standard IHT allowance of £325,000 each. We’ll assume they own a family home, so they have the £175,000 per person allowance for that too. So that’s £1 million between them. That’s pretty standard stuff. You then have a £1 million tax-free allowance for combined agricultural and business property. In this case, each of the spouses can benefit from this allowance. But you have to do some admin to make sure this is the case. Back in the bad old days, before the law was changed in 2007, your IHT allowance was not automatically passed on to your spouse when you died. So if you hadn’t written a will that made sure you explicitly used it up by passing £1 million to someone other than your spouse, then that allowance died with you. The specific allowance that farmers are now facing operates in the same way. So the couple owning the farm need to make sure they think about this and get a will written, probably with the help of a lawyer. Now, of course you should have a will anyway, but you’re starting to see the admin creep. So that’s you got a total of £3 million in this particular case. Or do you? Not necessarily. Remember that £175,000 nil-rate IHT band on the family home, another of George Osborne’s elaborately fussy daft ideas? Well, that “tapers” away at a rate of £1 for every £2 above £2 million that the estate is worth. The ever-helpful Roger Holman over at tax specialists Blick Rothenberg points out that farms valued at between £4 million and £5.4 million will, as a result, face an effective IHT rate of 40% on that bit, not 20%. (It’s a bit like the ludicrous marginal income tax rate you have to pay once you earn more than £100,000 a year and your personal allowance gets tapered away at the same rate). Now there are still plenty of ways to manage this. The most obvious being to make sure you hand over ownership to your heirs in a timely manner and then try not to die for seven years. But what it does all add up to is an almighty admin headache, and it also just exacerbates one of the big pre-existing issues that already bedevils the system — the fact that luck and access to specialist advisors plays a big role in how much IHT you end up having to pay. And of course, if you’re a really wealthy individual — perhaps the sort of individual who invested in farmland primarily as a way to avoid paying a load of IHT when you die — then your ability to manage succession and who controls which bit of your estate will be far greater, although it’ll probably cost you more in adviser fees and the like to do so. Is There an Alternative? There’s going to be a lot of political flak flying about and a lot of class war nonsense talked about this. In my view, you should try to park the debates about food security, land stewardship, who owns England, all of that stuff. Those are good debates to have — particularly on the nature of land and how it differs to other economic “factors” and forms of property — but they’re distractions from this one. At the end of the day, businesses were spared IHT because whacking a working business with a big tax bill during the succession process (an infamously high-risk period for businesses in any case) just seems like a bad idea. You’re going to kill at least some of the golden geese in this process, and then they won’t lay any more eggs. Merryn had a good idea on this, which she put out on X/Twitter this morning. Summing up — you only charge IHT on a family business when it’s sold, rather than passed on. You minimise the disruption, and you still get your cut in the end. And the ostensible targets of this legislation — people who own farms just to avoid IHT — either pay the tax or pass their farms onto working owners. It’s a good idea, and one that would probably raise more money in the end (partly by not dragging on the growth of otherwise solid businesses). Whether the government will pay attention is another matter. PS Just before I go, just wanted to alert you to a new Bloomberg event taking place in London on December 10. It’s called “Women, Money & Power” and it brings together the most influential female voices in finance from around the world to debate and discuss the future of investing, asset management and banking as well as the role of women as consumers, owners and CEOs. Speakers include Banco Santander Executive Chair Ana Botín, Revolut UK CEO Francesca Carlesi and Man Group CEO Robyn Grew. Request an invitation here. Send any feedback, opinions or questions to jstepek2@bloomberg.net and I’ll print the best. If you were forwarded this email by a friend or colleague, subscribe here to get your own copy. - Are markets really ready for Trump? Bloomberg’s John Authers and Tim O’Brien talk to Stephanie Flanders and Adrian Wooldridge on the Voternomics podcast about market expectations and reality.

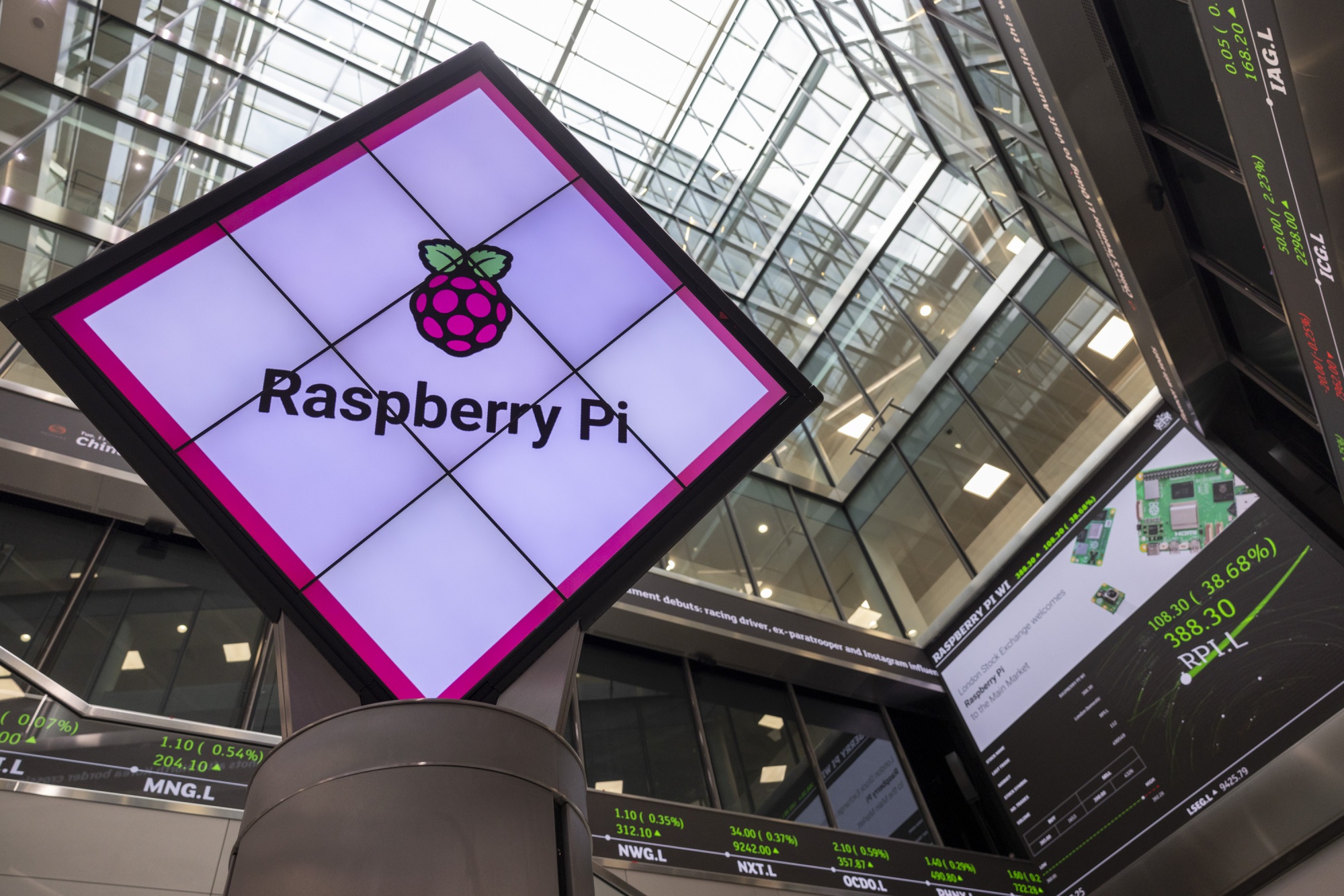

One of the year’s highlights for UK listings. Photographer: Carlos Jasso/Bloomberg Looking at wider markets — the FTSE 100 is down 0.4% at around 8,080. The FTSE 250 is down 0.2% at 20,350. The 10-year gilt yield is sitting at 4.42%, in line with similar moves seen in its French, German and US equivalents, which seems mostly down to a flight to safe assets provoked by Russia’s nuclear sabre-rattling. That “flight to safety” instinct can perhaps be seen in gold, which is up 0.9% at $2,640 an ounce, although oil (as measured by Brent crude) by contrast, is down about 0.5% to $73.00 a barrel. Bitcoin is up 0.9% at $92,200 per coin, while Ethereum is down 0.2% at $3,140. The pound is down 0.3% against the US dollar at $1.263, and is flat against the euro at €1.196. Follow UK Markets Today for up-to-the-minute news and analysis that move markets. |