| Bloomberg Evening Briefing Americas |

| |

| Stocks climbed on Monday, the start of a busy week for corporate earnings and one with key economic data on the way that will set the stage for the next Federal Reserve decision. All major groups in the S&P 500 gained, with the exception of energy shares that joined a plunge in oil as markets acknowledged the receding threat to Iran’s oil infrastructure. Crypto companies surged, with Bitcoin up about 3%. A week before the Fed gathers to consider next steps when it comes to rates cuts, data is set to show continuing resilience in the US economy. Investors meanwhile await results from companies that account for almost 42% of the S&P 500’s market capitalization, including tech giants such as Apple, Microsoft and Meta. Here’s your markets wrap. —Natasha Solo-Lyons | |

| Boeing launched a nearly $19 billion share sale, one of the largest ever by a public company, to address the troubled planemaker’s liquidity needs and stave off a potential credit rating downgrade to junk. The company offered to sell 90 million common shares and about $5 billion of depositary shares. The infusion would be a big help to Chief Executive Officer Kelly Ortberg as he grapples with a balance sheet strained by the consequences of previous air disasters, near-disasters, years of additional turmoil and the fallout from a strike that’s crippling manufacturing of the company’s main cash cow.  Photographer: Qilai Shen/Bloomberg | |

| |

|

| Private-credit firm 5C Investment Partners, co-founded by two former Goldman Sachs partners, will begin investing after amassing $1.6 billion for senior direct-lending transactions. The figure includes leverage and a co-investment program, with Liberty Mutual Investments joining Michael Dell’s family office, DFO Management, as an anchor partner, said Tom Connolly and Michael Koester,5C’s founders and co-managing partners. “The private-credit market that we are addressing is nearly $2 trillion in size and growing,” Connolly and Koester said. “There is plenty of room for private-capital providers as well as banks.” | |

| |

|

| Volkswagen plans to close at least three factories, eliminate thousands of jobs and slash wages for tens of thousands of German workers as Europe’s biggest automaker tries to halt its tailspin. The proposals to fix the struggling brand represent unprecedented cuts and underscore the extent of the crisis at Volkswagen. The German manufacturer has never closed a factory in its home country and a plan to reduce salaries by 10% could affect some 140,000 workers there. VW’s employees are worried that the cuts are just the beginning of plans to downsize the carmaker’s operations in Germany, which is struggling with relatively high energy and personnel costs. The moves would be another blow for Europe’s largest economy, which is expected to contract in 2024 for the second straight year. | |

| |

|

| Starbucks is telling its corporate staff they could be fired if they don’t come to the office three days a week. Starting in January, Starbucks will implement a “standardized process” to hold workers accountable if they don’t abide by the coffee chain’s return-to-office policy, according to a memo sent to one of the company’s divisions that was seen by Bloomberg News. Consequences are “up to, and including, separation,” the email stated. The message marks an escalation in enforcement of the company’s hybrid work rules less than two months since Brian Niccol took over as chief executive officer. | |

| |

|

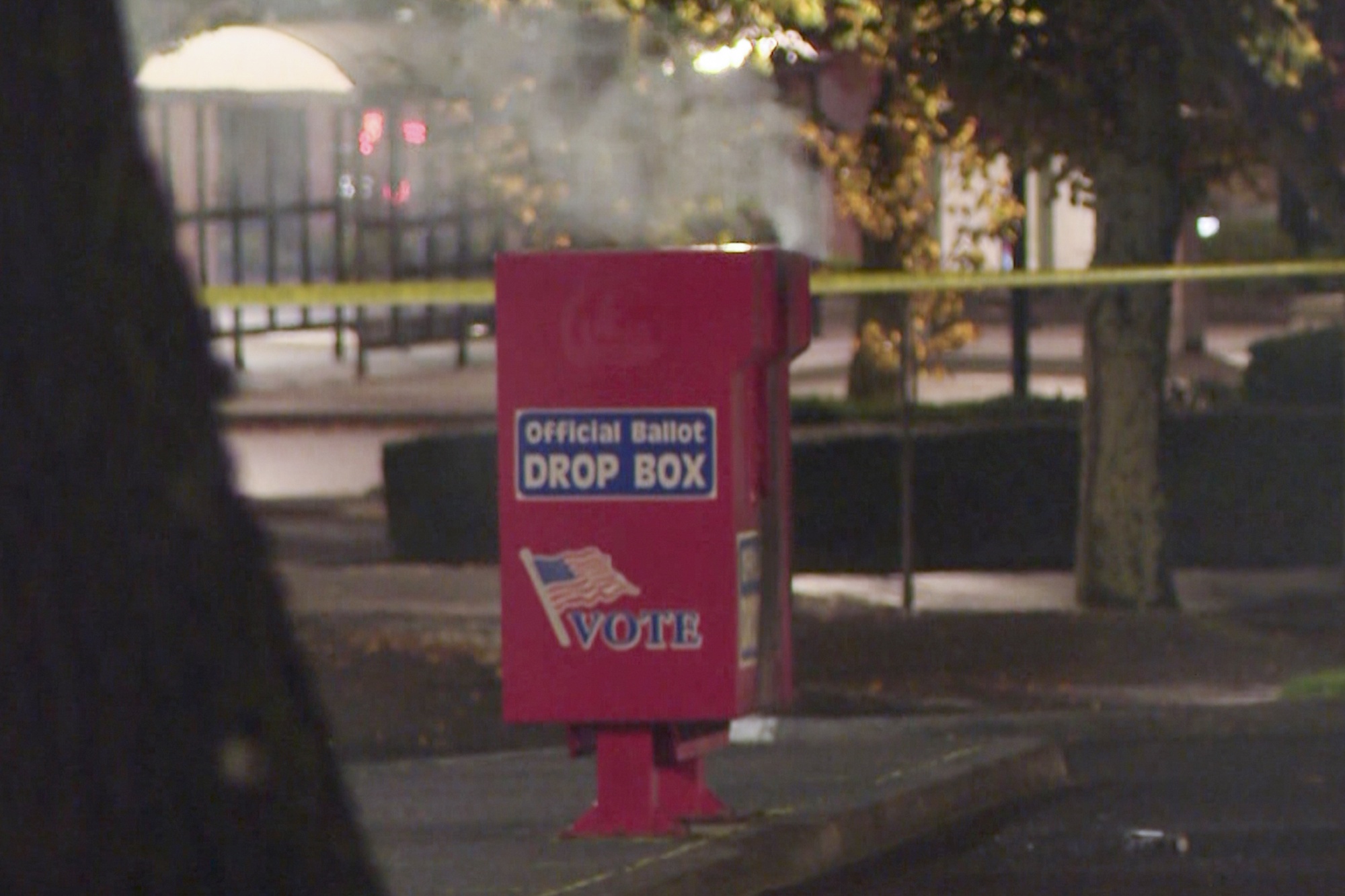

| A fire in a ballot box in southwestern Washington destroyed hundreds of ballots in a county where the congressional race could help determine control of the US House of Representatives. Clark County Auditor Greg Kimsey said county officials are working through the damaged ballots to contact as many voters as possible and send them replacements. Washington state automatically sends mail-in ballots to every registered voter, which can be returned by mail or through official drop-boxes. “It’s heartbreaking,” Kimsey said in a phone interview. “It’s a direct attack on democracy.” Law enforcement reportedly said it has identified a vehicle suspected of being used in several ballot box fires in the area.  In this image made from a video provided by KGW8, authorities investigate as smoke pours out of a ballot box in Vancouver, Washington, on Oct. 28. Source: KGW8/AP Photo | |

| |

|

| Elon Musk was sued by the Philadelphia district attorney over his political action committee’s $1 million a day sweepstakes targeting swing state voters in the final days of the US presidential election. The prosecutor, Larry Krasner, is asking a state court to stop Musk, Donald Trump’s wealthiest donor, from engaging in what he called an “unlawful lottery.” Musk’s pro-Trump America PAC had been giving away $1 million every day until Election Day on Nov. 5 to a randomly selected signatory of a petition related to free speech and gun rights. To qualify, however, a signatory must first register to vote. The lawsuit is the first official legal challenge that Musk has faced over the program. Legal experts have questioned the lawfulness of the effort since it was announced, and last week the US Department of Justice sent Musk’s PAC a letter warning that it might violate federal law. | |

| |

|

| A November victory for Vice President Kamala Harris would bring some more relief to Americans on housing costs while a win for Trump would be more beneficial for investors holding stocks and Bitcoin, according to the latest Bloomberg survey. The stock market, up about 22% so far in 2024, is more likely to pick up steam under Trump than Harris, according to the poll. Some 38% of 350 Bloomberg Markets Live Pulse survey respondents see gains accelerating a year from now under the Republican candidate, versus 13% under the Democratic candidate. | |

| |

| |

| |