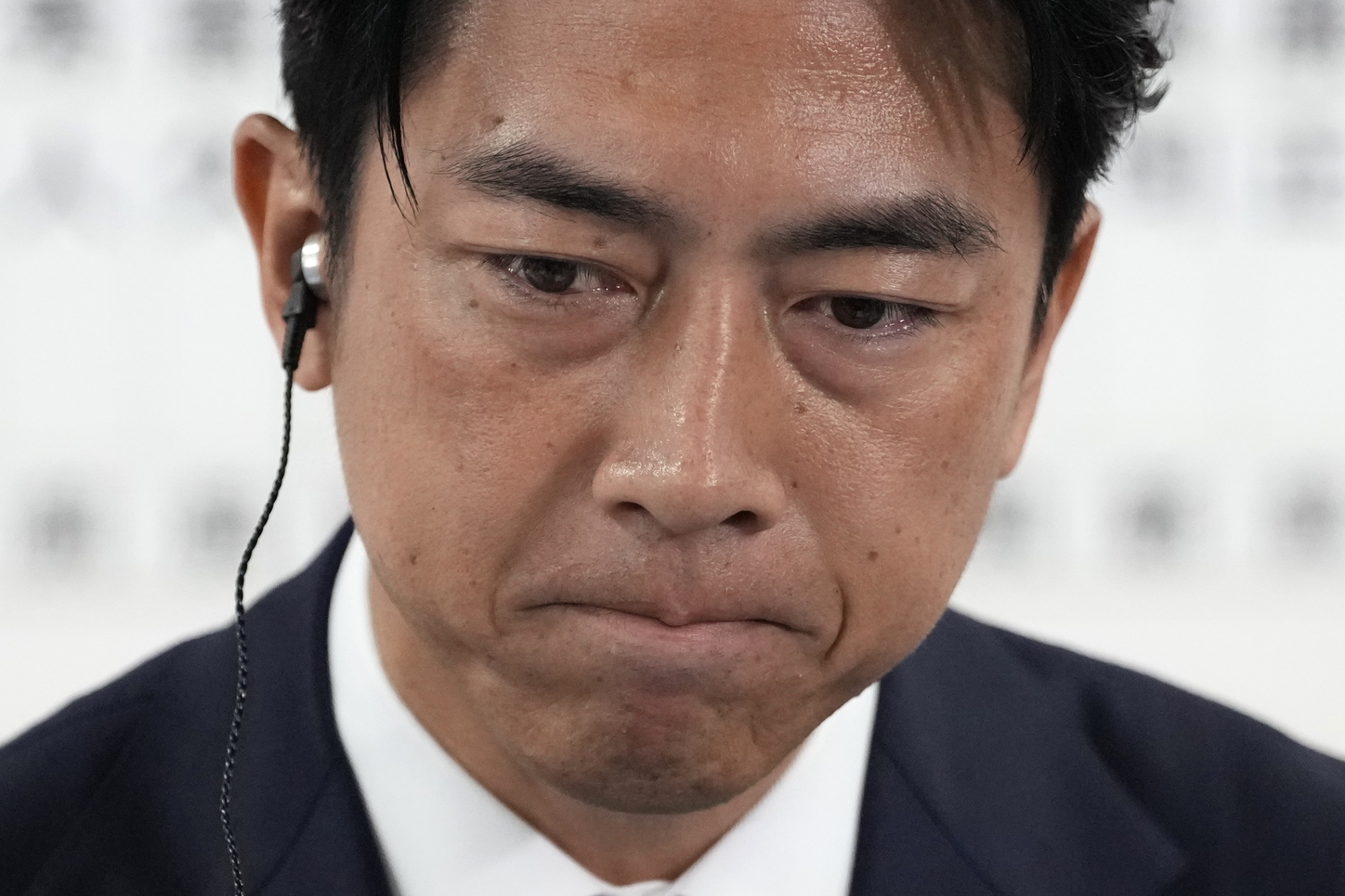

| Welcome to the Year of the Elections, Bloomberg’s newsletter on the votes that matter to markets, business, and policy amid the most fragmented geo-economic landscape in decades. Japan’s election on Sunday was nearly as bad as it gets for a ruling party that has governed for all but a handful of years since its founding in 1955. The Liberal Democratic Party got smacked around by voters, failing to win a majority for the first time since it got trounced in 2009. That’s largely due to the fallout from a slush fund scandal, in which politicians underreported campaign donations and used the money for personal gain, an affront to many voters now dealing with rising prices for the first time in decades. To form a government, the LDP is now in the unfamiliar position of reaching out to other parties who aren’t rushing to join hands with a party many voters rejected. The only good news for the LDP is that the opposition — while now strengthened — remains divided. No matter who ends up forming a government, policy won’t change drastically. Japan operates by consensus on a wide range of issues, most crucially its alliance with the US. The opposition may push for more accountability for US soldiers based in the country, but fundamentally there’s little appetite to jolt the relationship given the increased threat from China and North Korea, which are providing support to Russia’s Vladimir Putin after his invasion of Ukraine.  WATCH: The failure of Japan’s ruling coalition to win a majority in parliament has added to complexities in the country’s relations with China and the US. Source: Bloomberg Markets will be looking for any sign of changes to the Bank of Japan’s move to raise interest rates and normalize monetary policy. The main opposition party wants the 2% inflation target changed to “above zero,” which could mean tighter policy, though it would likely be tough to get other parties in a coalition to agree with that stance. Prices over the past few years have risen at the fastest clip in decades. A bigger worry for investors, however, is that Prime Minister Shigeru Ishiba — who took office on Oct. 1 and vowed to stay on after the election drubbing — may not last long. One potential replacement if the LDP forms a government is Sanae Takaichi, who favors monetary easing and narrowly lost to Ishiba last month in a vote to head the party. Either way Japan is poised for a weak government just as military and trade tensions pick up around the world. And there’s the possibility that Donald Trump could return to the White House, pressuring Japan even more. For Japanese citizens, it’s more important to vote in politicians they can trust. Whether that will actually happen remains to be seen. — Daniel Ten Kate  Shinjiro Koizumi, chairperson of the LDP’s election strategy committee, at the party's headquarters in Tokyo yesterday. Photographer: Toru Hanai/Bloomberg |