| Thanks for reading Hyperdrive, Bloomberg’s newsletter on the future of the auto world. Read today’s featured story in full online here. Mercedes-Benz was once a standard-bearer of automotive refinement, but swooning sales and profits underscore how even the lucrative upscale end of the car market is feeling the heat from China. Manufacturers led by BYD have opened a new front in the fight for dominance of the auto industry by redefining “Made in China” as a global symbol of luxury for the electric-vehicle age. After challenging the likes of Mercedes and BMW in their home market, they’re taking the fight to Europe and making inroads. The clearest sign of their impact came on Friday, when Mercedes reported its weakest profitability since the former cars-to-trucks conglomerate broke itself up in 2021. Porsche, the maker of the 911 sports car, said it’s weighing cost cuts and reviewing its model lineup after a demand slump in China caused earnings to plunge. While China has roiled the auto industry with cheap EVs — triggering tariffs from the European Union to fend them off — luxury brands were seen as safer because of their heritage and high-end status. That assumption is now in doubt and puts the $1.2 trillion global market for premium and luxury vehicles in play.  A BYD Sealion 7, left, and a Yangwang U8 electric vehicle at the Paris motor show. Photographer: Nathan Laine/Bloomberg “We don’t take the competition lightly,” Mercedes CFO Harald Wilhelm said Friday. While he questioned whether Chinese brands could sustain their aggressive pricing, “I don’t assume that the pressure will just go away tomorrow.” At the Paris car show this month, FAW Group’s Hongqi and BYD’s Yangwang showed off limousines and SUVs that aim to compete for European customers against vehicles from Mercedes, Porsche and even Rolls-Royce. With the latest in digital technology alongside creature comforts like leather dashboards and champagne coolers — all for a competitive price — they threaten European manufacturers in a segment that’s essential for profits. Nio — known for battery swapping to help ease range anxiety — has opened luxury showrooms in cities including Berlin, Oslo and Amsterdam to showcase models like its €95,000 EL8 sport utility vehicle. Geely-owned Polestar has started deliveries in some European markets and plans to enter France, Hungary and Poland in 2025. BYD, whose Yangwang brand sells a luxury off-roader that can float on water, is building relationships with local dealer groups.  A Nio ET7 electric vehicle on display at the Chinese company’s showroom in Berlin. Photographer: Krisztian Bocsi/Bloomberg The level of technological sophistication is evident in Xiaomi, the company known as the “Apple of China” that’s pledged to invest $10 billion in entering the car market. It launched the SU7 in March with the aim of challenging vehicles including the Porsche Taycan. The sleek Chinese sports car has already caused waves in the auto industry. “It’s fantastic,” Ford CEO Jim Farley said after importing an SU7 for testing. “I’ve been driving it for six months now, and I don’t want to give it up,” he said during a podcast published last week. Xiaomi has hinted at its European automotive ambitions by showcasing the SU7 during the Olympic Games in Paris and setting up a pit garage at Germany’s famed Nürburgring race track. The company’s billionaire founder Lei Jun has said he plans to make the vehicle available globally, without providing a time frame. China’s luxury-car push comes at a delicate time for Europe’s automakers. BMW, Aston Martin and Porsche’s parent Volkswagen have all warned of weaker-than-expected profits in recent weeks. They’re projecting only muted growth, in large part because of a slowdown in the world’s biggest car market. For years, consumers in China bought more Mercedes S-Class sedans than anywhere else and the country was one of the few markets where the brand’s ultra-luxury Maybach was in demand. A downturn in those lucrative sales showed up in the third quarter, when the company’s key gauge of profitability tumbled to 4.7%, undershooting its minimum target of 8%. A quick turnaround isn’t expected. “We are taking a prudent view about market evolution going forward,” Mercedes’ CFO Wilhelm said. “We will step up all efforts on further efficiency increases and cost improvements across the business.” While Europe once had a lock on the upscale car market, the launch of the Tesla Model S in 2012 challenged that by shifting consumer perceptions of automotive excellence toward digital features. The likes of BYD and Nio are following that playbook, touting their lead in software and battery technology. They have a tailwind from their home market, where their share of the premium segment roughly tripled in the past two years, to over a fifth at the end of May, according to China Fortune Securities. “The premium Chinese brands are very confident that, given some time, a bit of investment and patience, they’ll see a huge opportunity in Europe,” said Tu Le, founder of consulting firm Sino Auto Insights. “The Chinese are trying to convince the Europeans that their vehicles can be as dynamic and performance-oriented.” While it will be a challenge to overcome the allure and heritage of Porsche and Mercedes, the appeal for the Chinese companies is clear. Luxury vehicles command some of the highest profit margins in the industry, and customers tend to be more loyal and make repeat purchases. The segment is expected to outpace the mass market, offering a rare path to sustained expansion, according to McKinsey. Europe is the main battleground because tensions between China and the US all but shut out expansion there, and Chinese carmakers are desperate for sales amid economic struggles and intense competition at home. To win over Europeans, BYD displayed its 1.1 million yuan (€143,000) Yangwang U8 in Paris. The boxy off-roader has motors on each wheel that allows it to move sideways like a crab. While Mercedes’ electric G-Class has many similar features, the German model costs about twice as much.

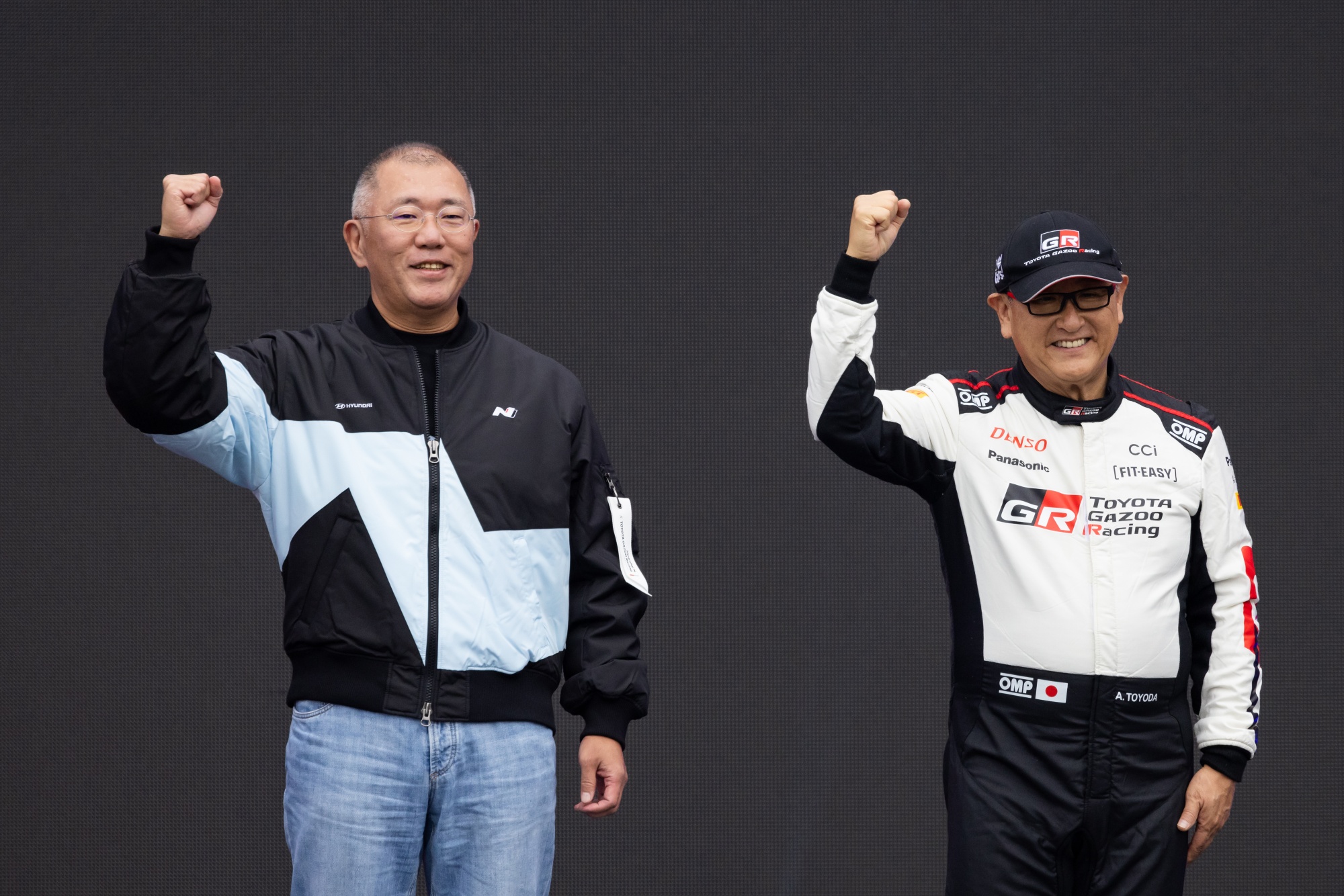

Aito — an upscale EV brand co-developed by Seres Group and Huawei — showed off the Aito 9. The SUV is equipped with a drop-down cinema screen and lie-flat leather seats, but costs about half as much as German models. “It has so many features, I’m impressed,” said Maxim Fromont, a 23-year-old Parisian. “If I were going to buy a car that I was going to be driven around in, I might buy that.” So far, the Chinese brands have had limited impact. But Toyota’s Lexus has shown Europe’s premium segment isn’t completely shut off. Initially met with skepticism, the Japanese brand has carved out a niche, selling nearly 56,000 cars in the first nine months of this year, a jump of more than a quarter. “The European luxury buyer still loves his or her three-pointed star,” said Michael Dunne, head of Dunne Insights, an automotive advisory firm. “Customers in the West do not seem to attribute the same level of importance to the digital experience — at least not yet.” In Paris, Hongqi, or Red Flag, promoted its own type of heritage — but notably not its role as Mao Zedong’s favorite brand. It offered tailored suits and fine ceramics, evoking Chinese strengths in craftsmanship. On the automotive front, its main attraction was the Hongqi Guoya limousine, featuring an interior with fine leather, grained wood and chrome. The exterior was dominated by an elongated front topped with a winged hood ornament reminiscent of Rolls-Royce’s famed Spirit of Ecstasy.  A Hongqi Guoya limousine at the 2024 Beijing International Automotive Exhibition in Beijing in April. Source: VCG/Visual China Group The resemblance wasn’t a coincidence. Former Rolls-Royce design chief Giles Taylor has worked for Hongqi since 2018, steering the brand toward a modern aesthetic meant to appeal to global luxury buyers. Nio, Yangwang and Xpeng have also tapped designers from the likes of BMW, Mercedes and Ferrari. Success in the premium market doesn’t mean just selling flashy, expensive cars, but there’s a value component, said Brian Gu, vice chairman at Xpeng. The Chinese automaker offers the G9 SUV — which can be decked out with massage seats and a 22-speaker sound system — for around €60,000. “We can actually offer more convenience, more comfort, more safety and more features,” Gu said at the Paris show. “All for a more affordable price.” — By William Wilkes and Chunying Zhang  Volkswagen workers taking part in a rally Monday at the company's headquarters and auto plant complex in Wolfsburg, Germany. Photographer: Liesa Johannssen/Bloomberg Volkswagen plans to close at least three factories in Germany as Europe’s biggest automaker tries to slash expenses. Proposals to fix the struggling namesake VW brand include a 10% wage cut and shrinking all remaining sites in Germany, works council chief and supervisory board member Daniela Cavallo said. The plans underscore the extent of the crisis at Volkswagen, which has bungled a transition to electric vehicles and lost relevance in China, where it’s giving up market share to local automakers. VW’s plans threaten tens of thousands of jobs in Germany, Cavallo said Monday in a speech to VW workers in Wolfsburg. “This is starvation, a weakening in installments.”  Hyundai’s Euisun Chung and Toyota’s Akio Toyoda at the Hyundai N x Toyota Gazoo Racing Festival in South Korea over the weekend. Photographer: SeongJoon Cho/Bloomberg The chairmen of Asia’s two largest automakers made a rare joint public appearance at an event to showcase their companies’ high-performance vehicles, underscoring the trend of rivals joining hands in the face of electrification. Toyota’s Akio Toyoda and Hyundai’s Euisun Chung were at a racing festival in Yong-in, south of Seoul, over the weekend. Jay Y. Lee, chairman of Samsung Electronics, and Hankook Chairman Hyunbum Cho also attended to meet Toyoda and Chung. |