| | In today’s edition: Abu Dhabi conjures a $250 billion asset manager and Alwaleed’s big bet on Elon M͏ ͏ ͏ ͏ ͏ ͏ |

| |  | | | Global Capital Edition |

| |

|

- Bitcoin bleeds, UAE builds

- Alwaleed’s big bet on Elon

- Private credit is too opaque

- China’s rich flock to Dubai

Bahrain’s downmarket horse race lures British stallions. |

|

As if Abu Dhabi didn’t have enough state-linked investment firms, it just launched another one. International Holding Co., the largest listed firm in the UAE and part of a web of companies controlled by Sheikh Tahnoon bin Zayed, the UAE’s national security adviser and the deputy ruler of Abu Dhabi, said it is creating Judan Financial. The new firm — which will be chaired by Sheikh Tahnoon — will consolidate financial services assets from across his holdings, including alternative asset manager Lunate, reinsurance startup RIQ, and digital lender Wio Bank. Judan is expected to have a valuation of $27 billion and $237 billion in assets under management. Yet Judan is not just another restructuring in Abu Dhabi. For one, it shows that Sheikh Tahnoon’s grip on Abu Dhabi’s financial ecosystem remains firm. The emergence of L’IMAD Holding, controlled by Crown Prince Sheikh Khalid bin Mohammed, hinted that a new center of sovereign investing was rising, but it’s clear that any potential redistribution of influence will be gradual, not abrupt. Second, Judan’s intention to raise capital from third parties marks an ongoing evolution: Abu Dhabi’s moneymen are increasingly confident in using their decades-long track record of managing Abu Dhabi’s oil wealth as a pitch to run other people’s money. This shift reflects the city’s broader transformation. Abu Dhabi’s financial center just isn’t seen as a place to open an office to try and tap sovereign wealth, but a place to meet global investors. Family offices from around the world are there, as are the biggest global investment institutions. When Abu Dhabi branded itself the “capital of capital” a few years ago, it was mostly a reference to the nearly $2 trillion pool of sovereign-linked wealth controlled by the emirate — a reminder that anyone raising serious money would need to make a trip. Increasingly, Abu Dhabi is looking to bring in capital, and not just send it out. |

|

Bitcoin plunges but blockchain persists |

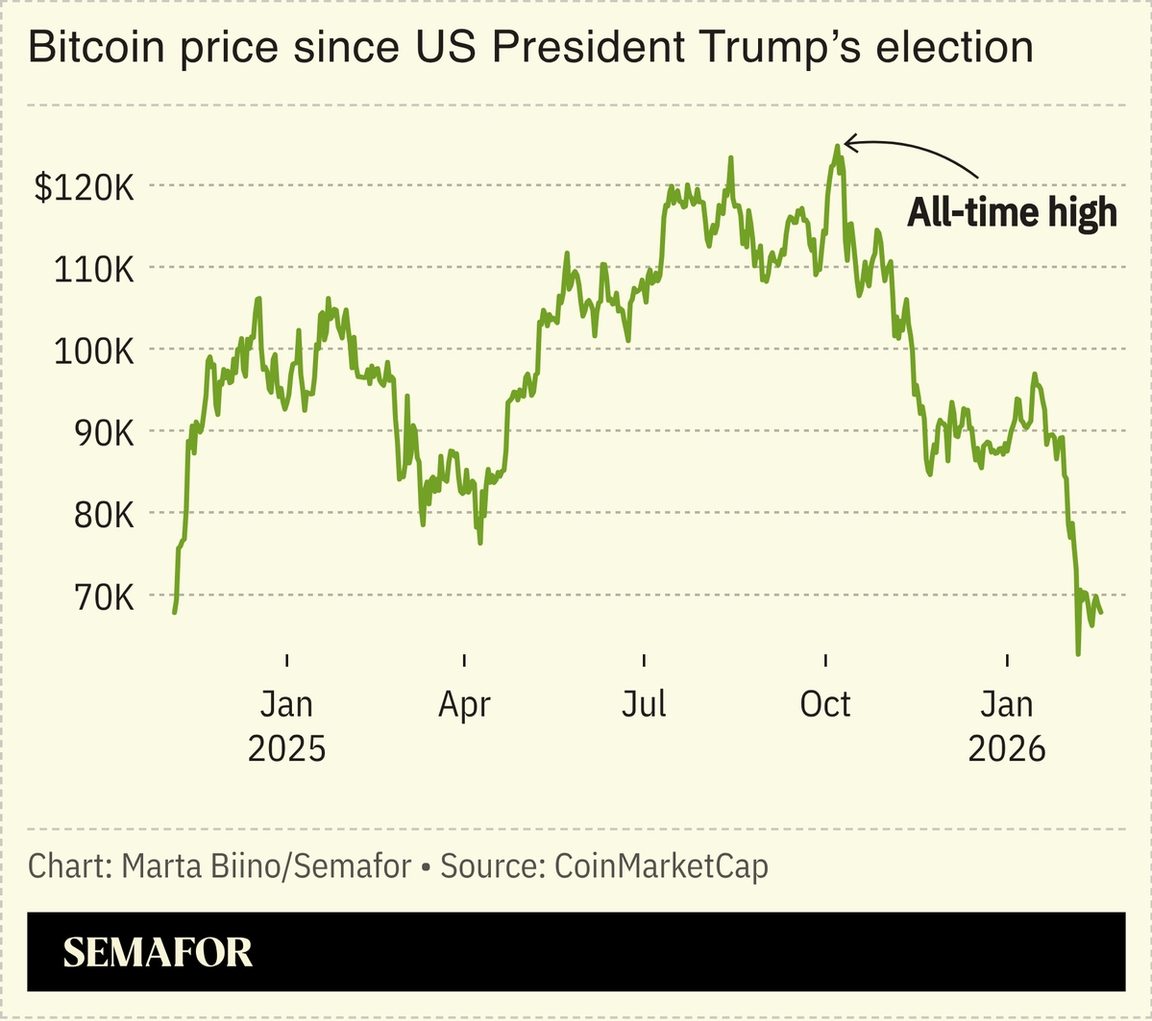

Bitcoin has lost its gains since crypto-friendly US President Donald Trump took office. The digital asset has slumped more than 40% from its October peak, notching its fourth straight weekly decline, with some analysts warning there is no bottom in sight. Standard Chartered slashed its 2026 price target for Bitcoin to $100,000 — it was once as high as $300,000 — warning it could fall to $50,000 this year. Investor Michael Burry, famous for betting against the US housing market, warned of a “death spiral” that could extend to company balance sheets exposed to the cryptocurrency. It has been a gloomy month for digital assets, but there is a glimmer of hope in the UAE, where the underlying blockchain technology is gaining traction. A new report by Blockchain Center Abu Dhabi and crypto exchange Binance found that distributed ledgers now underpin national digital identity systems, about $4 billion in real estate tokenization plans, and a growing number of stablecoins used in payments and remittances. International Holding Co. (IHC), First Abu Dhabi Bank, and Sirius International Holding recently won approval to launch a dirham-backed stablecoin that will run on an Abu Dhabi-developed blockchain. Units of the $240 billion conglomerate IHC, chaired by Sheikh Tahnoon bin Zayed, plan to embed the token across their operations, potentially reaching millions of users outside traditional financial systems. — Mohammed Sergie |

|

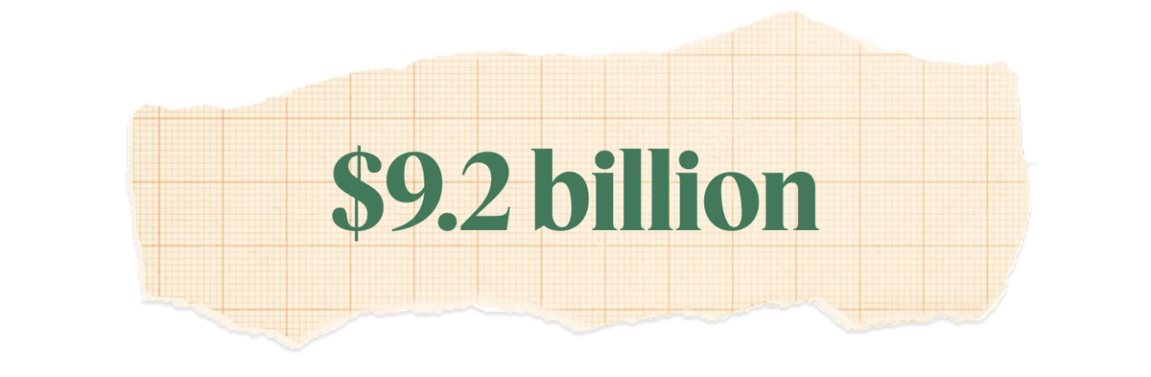

Alwaleed’s stake in Elon Inc. |

The combined value of Prince Alwaleed bin Talal’s stake — and that of the Saudi conglomerate he controls, Kingdom Holding — in Elon Musk’s SpaceX (through its units such as xAI and X). The prince invested $130 million in X’s predecessor, Twitter, in 2011 and supported Musk’s 2022 takeover of the platform. It’s unclear what the cost basis is, but in an interview with Tucker Carlson last year, Alwaleed said he invested $3 billion in X and has never marked down his shares. He added that X’s valuation recovered after plunging for a few years, in part because of Musk’s close relationship with US President Donald Trump. (Alwaleed has known Trump for decades and bought the Plaza Hotel and the Trump Princess yacht from him in the 1980s.) |

|

Private capital’s black box problem |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersThe wave of capital flowing into private markets is making it more difficult to predict a crash. Riskier borrowers, less due diligence, the unknown ripple effects of default, and a reliance on proxy indicators are all contributing to a growing fear: The next blow to the market may come from the recesses of private capital, Bloomberg reported. Private credit has grown too quickly to implement adequate oversight, leaving “policymakers flying blind” if a downturn hits, a former European Central Bank official told Bloomberg. Saudi Arabia is taking steps to address some of the kingdom’s data gaps as demand picks up. Saudi Venture Capital Company has developed an AI-powered platform to guide investment decisions within the firm. The aim is to organize fragmented market signals for a clearer sense of the kingdom’s dynamics and where money is being pooled. — Kelsey Warner |

|

China’s rich find a home in Dubai |

Ahmed Jadallah/Reuters Ahmed Jadallah/ReutersWealthy Chinese are bringing their money and businesses to Dubai. Slower growth in China and a crackdown on the excesses of the rich are driving many to the emirate, which they see as neutral, freewheeling, and ready to do business. More than 370,000 Chinese citizens now live in the UAE, and around 15,000 Chinese firms operate there — both figures have doubled since 2019, according to The Economist. “In China, even if you are super rich, you cannot drive a Lamborghini,” a Chinese resident in Dubai told the magazine. (At the top jewelry and couture shops in Dubai Mall, many salespeople speak Mandarin.) The influx of wealth is most visible — though hard to measure precisely — in the rise of family offices and asset management firms in the UAE’s financial centers. Dubai is likely to remain welcoming as long as Washington doesn’t push the UAE to curb commercial and financial ties with China. |

|

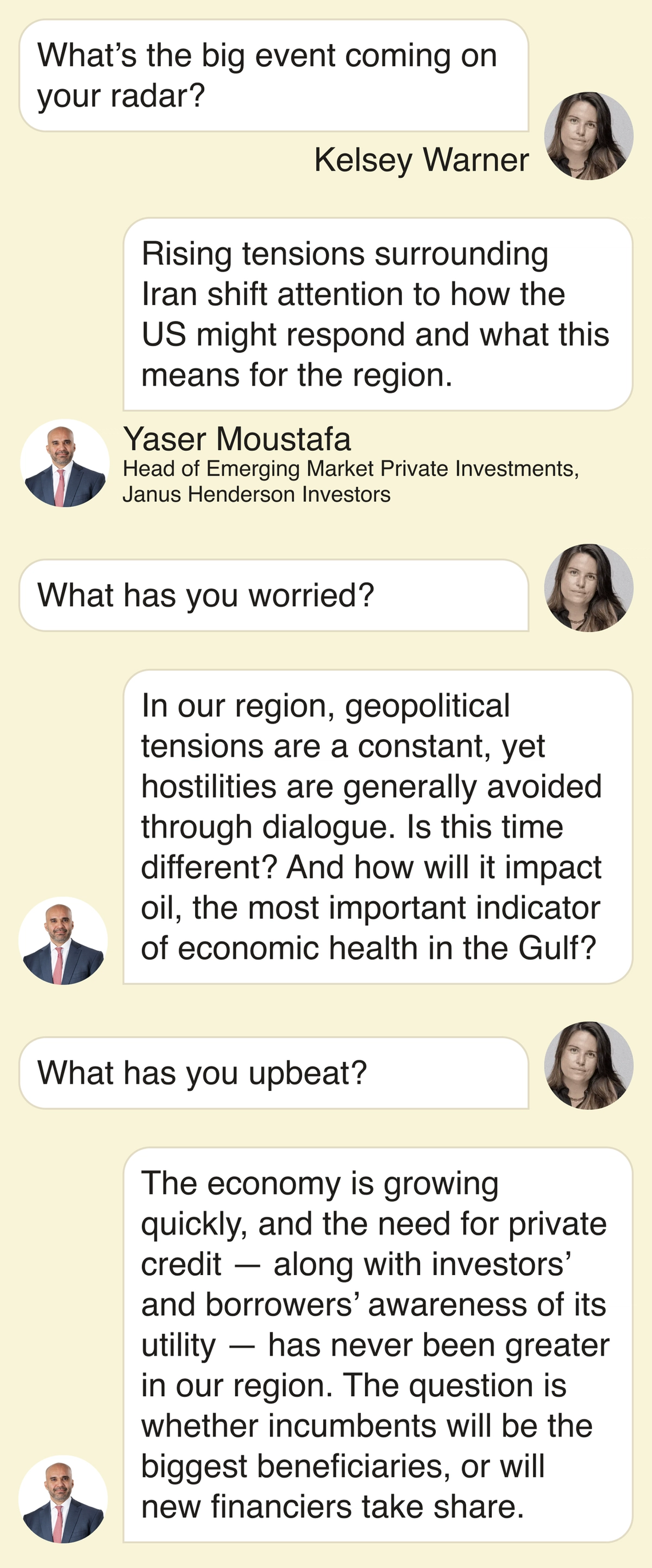

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Yaser Moustafa, head of emerging market private investments at Janus Henderson Investors.  |

|

Stringer/Reuters Stringer/ReutersBahrain’s $1 million horse race — dwarfed by a $20 million purse in Dubai and $30 million in Saudi Arabia — has carved out a niche among mid-tier owners, reflecting a broader Gulf realization that global appeal doesn’t always require the richest or glitziest prize, Camilla Wright, a media commentator, writes in a Semafor column. “British horse racing, renowned as the Sport of Kings, is under pressure,” Wright wrote. “Prize pots have seen a precipitous decline, and those who run the sport seem always to be at war with the betting operators who pour a lot of money in. For some owners, the opportunity to compete in the fallow winter months in Bahrain has proved compelling.” |

|

|