| | The Midwestern utility giant wants permission to get back in the game of making its own power.͏ ͏ ͏ ͏ ͏ ͏ |

| |   Chicago Chicago |   Brussels Brussels |   Cape Town Cape Town |

| Energy |  |

| |

|

- Exelon’s affordability play

- Google’s new grid tech

- Sanctions bill stalled

- Massive EV writedowns

- Controversial mining deals

A dispatch from Mumbai Climate Week, and Gavin Newsom’s new power deal. |

|

The Trump administration’s latest policy moves set up an interesting test of the power of different styles of government intervention to actually drive decarbonization. Many environmentalists were aghast last week when the Environmental Protection Agency moved to toss out the so-called “endangerment finding,” a legal precedent that essentially required the EPA to regulate greenhouse gases the way they would more traditional toxic air pollutants. Interestingly, the agency was careful to avoid arguing that climate-warming gases are not in fact dangerous. Instead, it advanced a more nuanced argument about the limits of the Clean Air Act, essentially challenging Congress to intervene more specifically if it’s so worried about CO2 and methane. Is this policy shift a catastrophe for the US contribution to climate change? That depends. In the electricity sector, EPA regulations have never been a particularly important driver of decarbonization, because the iterations rolled out by Presidents Barack Obama and Joe Biden were perennially tied up in court or scrapped by Trump. Biden’s Inflation Reduction Act, by contrast, was built on the theory that regulations seeking to restrict legacy activities are a far less powerful tool than tax incentives that proactively drive new investment. To that end, a bigger threat to clean power than the endangerment finding repeal could be new rules issued by the Treasury Department late last week that will restrict access to tax credits for projects that source parts from China and other adversaries. The rules are less onerous than some analysts feared, but still, Ted Brandt, CEO of energy investment bank Marathon Capital told me, “the practical result will be a pull back from US developers buying any product or components that are even remotely perceived to have any content [from those countries],” which in the case of clean energy hardware is sure to be both difficult and expensive. For other sources of air pollution — oil and gas operations, vehicles, landfills — the endangerment finding change could be more meaningful, because the options for incentivizing change, rather than penalizing the status quo, are more limited, said Meghan Greenfield, a former EPA senior attorney. The EPA shift could also trigger a third form of government control, one that oil and gas companies in particular are unlikely to be happy with: Orders from a judge. Up to now, many climate-related lawsuits against fossil fuel companies have actually been stymied by the endangerment finding, because industry lawyers have successfully argued that as long as they are in compliance with existing regulations, they can’t be responsible for the public harms of climate change. Without regulation, that argument won’t hold up, Greenfield said — which could make tort lawsuits the new key driver of decarbonization. |

|

Exelon’s affordability play |

| |  | Tim McDonnell |

| |

Dado Ruvic/Illustration/Reuters Dado Ruvic/Illustration/ReutersOne of the largest US electric utilities has a new plan to tamp down spiraling power prices for its customers, but some experts warn it could have the opposite effect. Exelon CEO Calvin Butler told Semafor the company is hoping to get back into the business of generating its own electricity, something it hasn’t done since it spun off Constellation Energy and its fleet of nuclear power plants in 2022. “You can’t keep operating with the same rules and get a different effect,” Butler said. “I’m trying to respond to a marketplace that’s not stepping up.” The trouble with the strategy is that it hinges on a bullish forecast for data center demand. If that demand doesn’t actually materialize, then Average Joe customers could be left paying for infrastructure they don’t need. And as one analyst noted, this could put into competition with existing merchant power producers, potentially driving the latter out of business — ultimately perpetuating, rather than solving, the supply crunch. “What sounds like it adds supply,” he said, “might do the opposite.” |

|

Lisi Niesner/Reuters Lisi Niesner/ReutersGoogle and the grid tech company CTC Global launched a new AI-driven product designed to squeeze more juice from electricity grids. The technology uses fiber-optic sensors to capture data about real-time activity and strain on power lines, which it will process using Google software, including Google Earth Engine and the data warehousing service BigQuery, and then feed insights into Tapestry, a grid modeling project by Google parent Alphabet’s moonshot lab X. This will allow utilities to push more power through the lines, up to 120% of their previous capacity, at a lower cost than building new power generation stations, CTC CEO J.D. Sitton told Semafor. The project is in a pilot stage for now and plans to add more utility users in the year ahead. Efforts like this are becoming more common as a growing number of tech and utility companies realize they won’t be able to build new infrastructure fast enough to keep up with rapidly increasing demand. |

|

Manon Cruz/File Photo/Reuters Manon Cruz/File Photo/ReutersUS President Donald Trump is stalling a vote on a bipartisan bill to ramp up sanctions on Russia’s energy sector, two senior Democratic senators warned. Speaking in Kyiv after spending the weekend at the Munich Security Conference, Sen. Richard Blumenthal (D-CT) said the sanctions measures he has proposed alongside Sen. Lindsay Graham (R-SC) would impose a “sledgehammer of economic pressure” on Russian President Vladimir Putin as US-mediated talks between Kyiv and Moscow resume in Geneva this week. Existing US and European sanctions have recently begun to curb Russia’s oil output, but Blumenthal said more pressure is needed, and that he has been promised a vote before the end of this session of Congress by Senate majority leader John Thune (R-SD). The only obstacle is Trump, Blumenthal said: “We’ve been waiting for a green light, and he has been vacillating back and forth so much that anyone watching him has whiplash.” Still, the administration is making progress in confronting Russia’s “shadow fleet” of sanction-dodging oil tankers, Sen. Sheldon Whitehouse (D-RI) said, and has demonstrated from its interventions near Venezuela that the US military is well-prepared to seize more. |

|

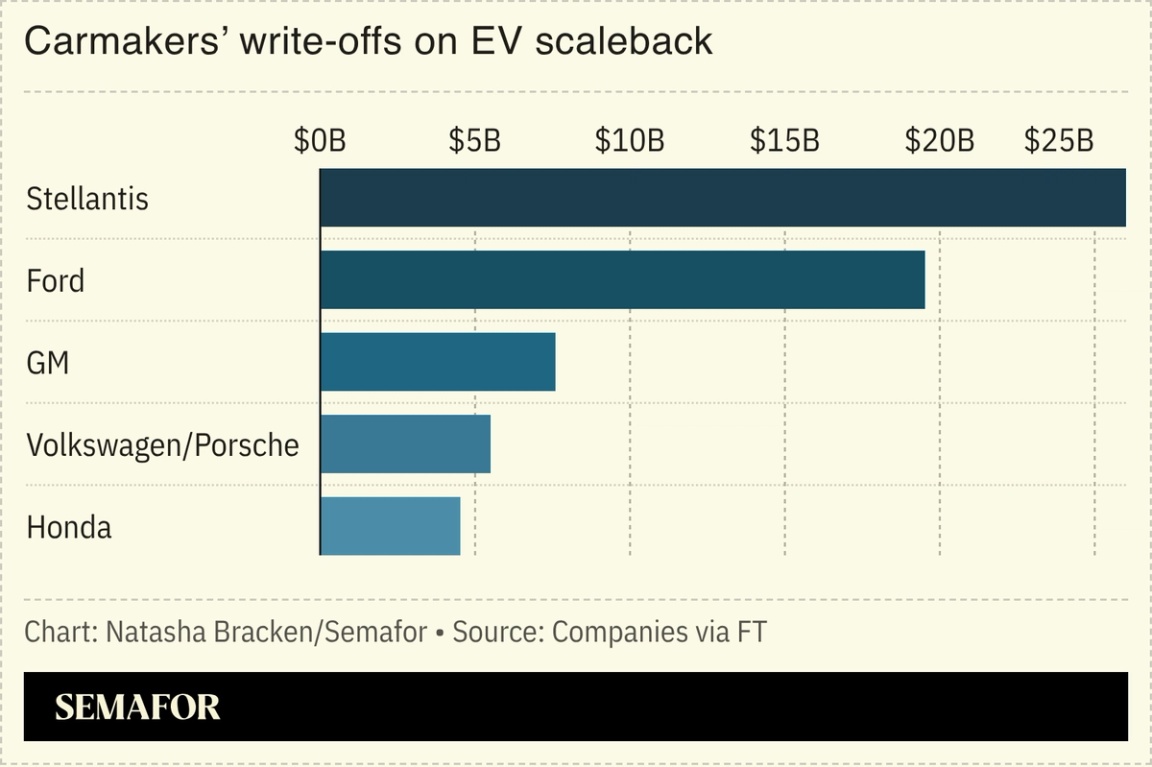

Carmakers registered $65 billion in write-offs globally as companies were forced to overhaul their EV investments, squeezed by a pivot in US climate policy and an overstated enthusiasm for the green transition. Since the US axed its $7,500 federal tax credit in September, automakers and battery manufacturers have been scaling back by canceling projects, downsizing investments, and reviving plans to produce more traditional gas-powered vehicles. It’s not a uniform retreat, however; sales of fully electric cars surpassed those of petrol-only vehicles in the EU for the first time in December, but European giants are still badly bruised from diminishing US demand: Stellantis, which once believed EVs would make up half of its US sales by 2030, took a $26 billion hit after scrapping several fully electric models and reviving its 5.7-litre engine for the US market. Industry leaders now expect EVs to account for just 5% of the new US vehicle market in the coming years. — Natasha Bracken |

|

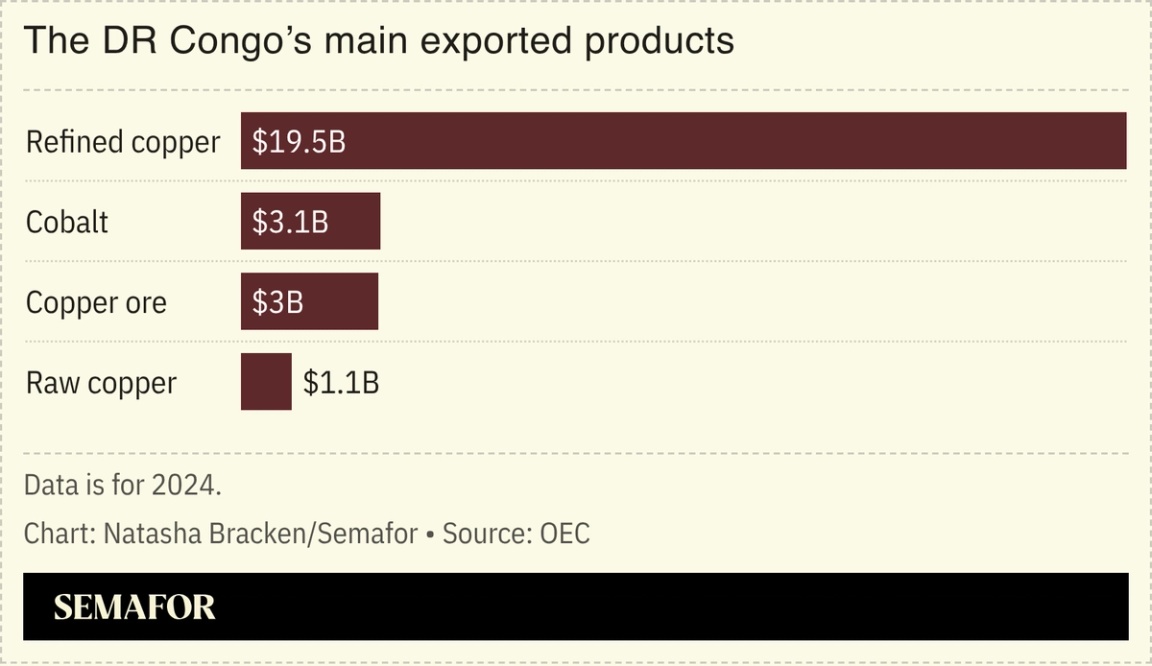

Controversial mining deals |

South Africa’s mining minister criticized DR Congo for signing a minerals deal with the US, saying it threatened the sovereignty of the continent’s states by intensifying the scramble for Africa’s natural resources. Gwede Mantashe, speaking at the Mining Indaba conference in Cape Town last week, instead urged African states to “deepen collaboration” with each other. “It can’t be about you. It should be about us all in the region,” said Mantashe. He told reporters that he clashed with his counterpart from DR Congo at a ministerial meeting a day earlier due to the deal Kinshasa signed with Washington in December. Mantashe’s remarks came days after the US announced plans to create a trade zone for critical minerals — with price floors intended to stabilize markets — to counter China’s dominance of the sector. |

|

Fossil Fuels- Oil revenues from Venezuela controlled by the US have amounted to more than $1 billion since Washington captured its leader and are expected to bring in another $5 billion, according to Energy Secretary Chris Wright.

- Meanwhile, the US Treasury Department issued a general license allowing several major oil companies, including Chevron, Shell, and BP, to invest in new oil and gas operations in the country.

- Italian energy giant Eni’s 300-meter floating natural gas facility off the Republic of Congo’s coast, which can process millions of tonnes of natural gas a year from the offshore fields below, began supplying Europe last week.

- Major oil executives are under growing pressure to lay out growth strategies after a prolonged focus on cost-cutting and shareholder returns amid peak demand concerns.

Politics & Policy Nina Liashonok/Reuters Nina Liashonok/Reuters- Russia carried out 229 drone, rocket, and artillery attacks on natural gas infrastructure in Ukraine in 2025, the state-owned company Naftogaz reported, more than in the previous three years combined.

- Venezuela’s power generation was once one of the country’s strongest sectors, but following the nationalization of the industry in 2007, the power system rapidly deteriorated. Two energy experts argue that rebuilding it will require restoring generation capacity (especially thermal power), boosting wind and solar output, and investing in battery energy storage systems.

- The UK’s Energy Secretary Ed Miliband and California Governor Gavin Newsom signed a clean energy pact in London aimed at boosting mutual investment and technology sharing, while US President Donald Trump’s continued his efforts to curtail climate policies.

- EU leaders are split on how to proceed with the bloc’s carbon trading system, as it tries to balance ambitious climate targets without raising energy prices that could make their companies less competitive internationally.

EVs- Global EV registrations fell 3% in January, as a purchase tax and reduced EV subsidies in China, along with policy changes in the US, hindered sales.

Personnel- Barbados’ Prime Minister Mia Mottley secured a third consecutive term as prime minister after her party won all 30 parliamentary seats in this week’s general election. Mottley is known for leading a climate disaster financing initiative aimed at increasing access to international funding for developing nations.

|

|

Woochong Um, CEO of the Global Energy Alliance, is participating this week in Mumbai Climate Week.  |

|

|