| | This year’s Munich Security Conference will test how willing the EU is to risk closer energy ties wi͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Slow progress in Venezuela

- Pentagon shopping for coal

- Water wars coming

- Automakers’ battery pivot

- China’s emissions flatten

TotalEnergies’ Russia worries, and Baker Hughes’ Syria prospects. |

|

This weekend will test how willing the EU is to risk closer energy ties with the US. Secretary of State Marco Rubio will head to the Munich Security Conference, an annual opportunity to check the pulse of the trans-Atlantic alliance, which, according to the conference organizers, is nearly on life support because of US President Donald Trump’s “wrecking ball politics.” Energy will be high on Rubio’s agenda — specifically, pushing Europe to speed up its phaseout of Russian oil and gas and accelerate its plans to buy more US LNG. It’s a delicate subject for European policymakers. They are under increasing pressure from industrial executives, who warned in a group letter this week that high energy prices pose a “dire” threat to the region’s economy. And Trump has repeatedly made clear that buying more US energy is a prerequisite for favorable trade terms. Yet building more gas import infrastructure could conflict with the EU’s climate goals. And more to the point for a security conference, one of the biggest lessons from the war in Ukraine has been the financial costs and security risks of relying too much on fossil fuel imports from anywhere. European leaders will likely use Munich as a platform to publicly call for stronger US-EU cooperation. But Kurt Volker, a former US ambassador to NATO and lead Ukraine negotiator during Trump’s first term, told me that in private, many will “state that they can’t be too dependent on the US for gas either, now that the US has also shown [through its aggressive posture toward Greenland] it is a predator.” That response, Volker said, is “definitely emotional and overblown.” The fact is, the US is in the middle of a massive, very expensive buildout of LNG export infrastructure, while Europe remains in the midst of an aggressive push toward decarbonization. A Kremlin-esque weaponized gas cutoff would hurt the US more than the EU. So both sides have a lot to gain from smoothly functioning energy trade. While Trump rails against Europe’s lackluster security spending and threatens to blow up NATO, gas may actually be the last thing holding the alliance together. And one last thing, on a similar subject: We just announced our first slate of speakers for the 2026 annual convening of Semafor World Economy, taking place April 13-17 in Washington, DC. More than 400 top CEOs, including titans of the energy industry like TotalEnergies CEO Patrick Pouyanné, GE Vernova CEO Scott Strazik, Constellation President & CEO Joseph Dominguez, and USA Rare Earth CEO Barbara Humpton will convene for five days of on-stage conversations with my colleagues and me. See the first lineup of speakers, and apply to join us, here. |

|

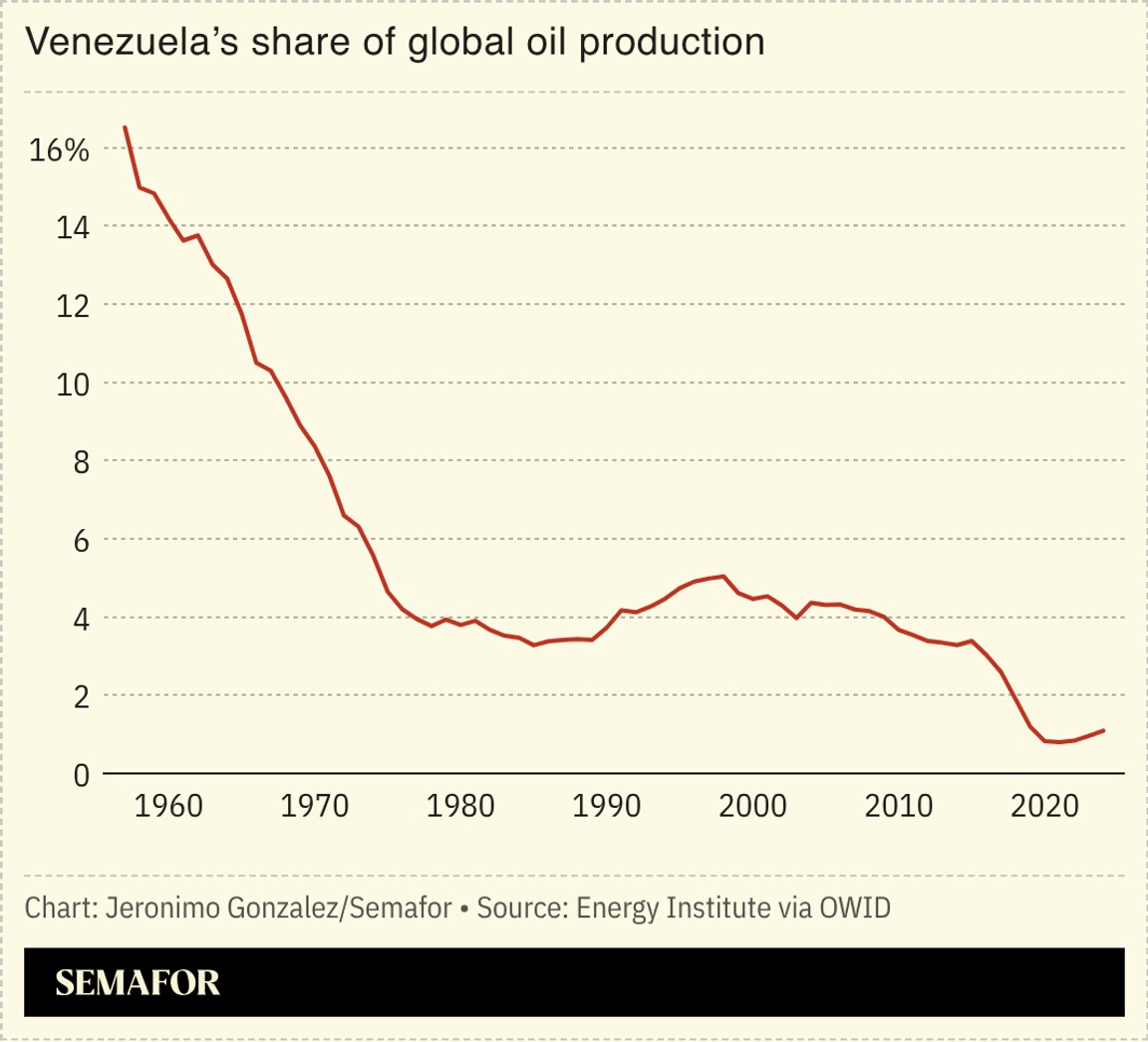

Slow progress in Venezuela |

US Energy Secretary Chris Wright landed in Venezuela to assess progress on revamping the country’s oil industry following the ouster of former President Nicolás Maduro. The first steps are underway, including an overhaul of Venezuelan law to curb state-owned PDVSA’s control, and the issuance on Tuesday of a license from the US Treasury Department to authorize foreign companies to import drilling equipment. But in general, as my colleagues Eleanor Mueller and Shelby Talcott reported, the administration’s strategy for converting its successful arrest of Maduro into a longer-term revitalization of Venezuela’s economy is increasingly opaque. There are no signs of a second sale of Venezuelan oil. “Obviously, the business community would have to be brain-dead to make major capital investments without some certainty,” Sen. Thom Tillis, R-N.C., told Semafor. |

|

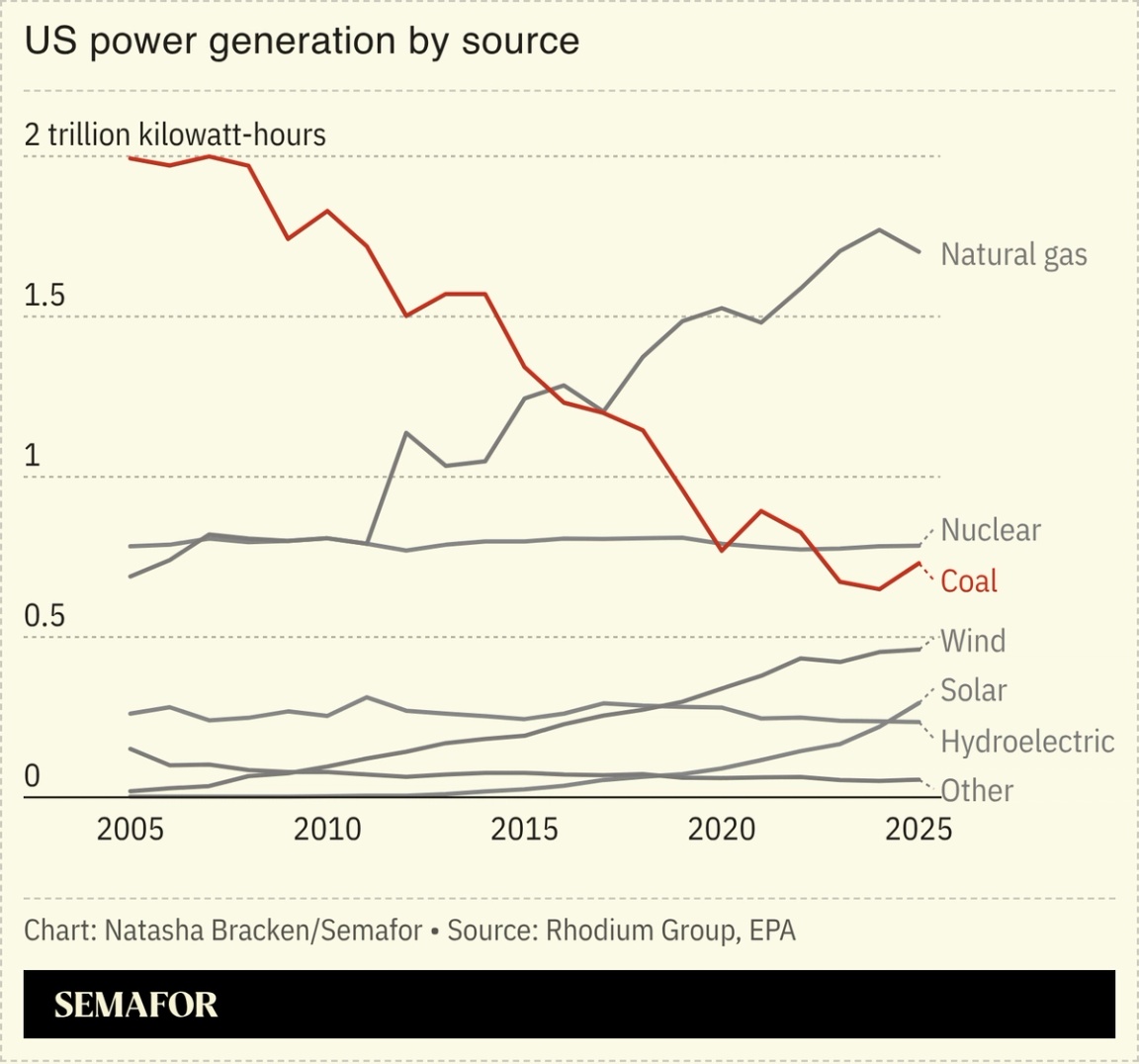

Pentagon shopping for coal |

US President Donald Trump ordered the Pentagon to purchase more electricity from coal plants in order to power military installations, the latest effort by the White House to revive the dirtiest and most expensive fossil fuel. Trump signed the executive order on Wednesday, when he also announced that the Energy Department would award $175 million in government funding to upgrade six coal plants. The announcements follow a string of moves by the administration to revive the fossil fuel under an “energy emergency,” including the Energy Department’s allocation of $625 million to help reinvigorate the struggling industry, and the Interior Department’s decision to open more federal land for coal leasing. The enthusiasm has spread beyond the White House: The nation’s largest public utility announced this week it would keep two large power plants open in Tennessee that had been slated for retirement within two years. Beyond reviving dormant coal plants, Trump is also easing the path for coal by dismantling federal policies that raised its costs (he is expected to announce today the end of the endangerment finding), while eliminating tax incentives for renewables. — Natasha Bracken |

|

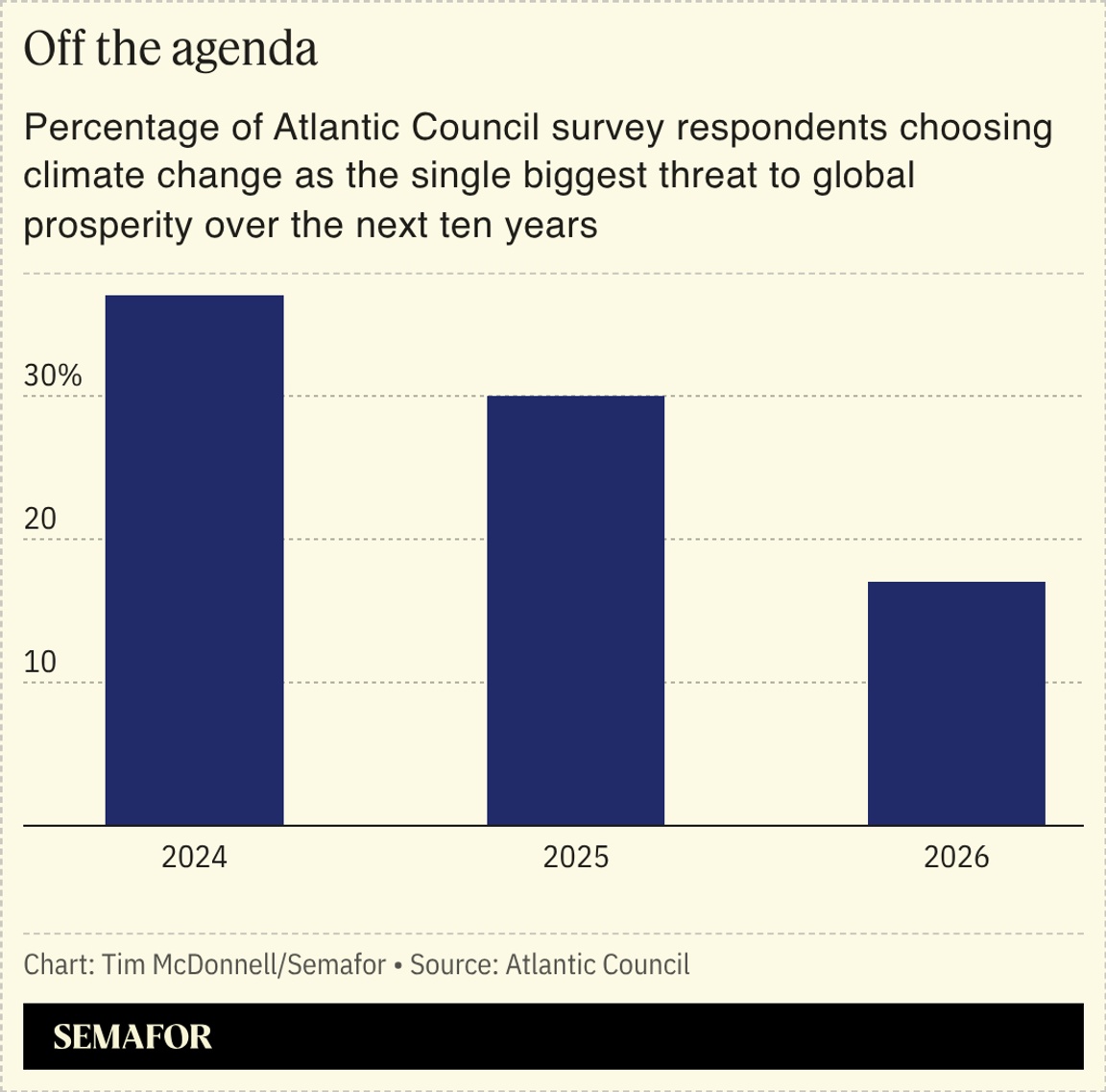

Fewer geopolitical experts see climate change as an urgent global security threat, but many still expect to see conflict over water access in the near term. In an Atlantic Council survey of nearly 450 experts, shared first with Semafor, 80% expect the world to become hotter over the next decade, and fewer than half think global greenhouse gas emissions have peaked. But whereas, two years ago, half of this group of experts expected climate change to be the chief driver of global political cooperation, now less than 20% share that view, and only 17% see climate change as the top threat to global prosperity. Yet 64% think a war over access to fresh water is likely before 2036. Meanwhile, in part due to the global shift from fossil fuels to alternative energy sources, a majority of experts said they expect China to be the world’s dominant economic power in the coming decade. |

|

Automakers’ battery pivot |

Number of electric vehicle battery factories in North America that are being retooled to instead produce batteries for grid storage. As US EV sales slow, in part due to the elimination of federal tax credits, demand for residential and utility-scale batteries — whose tax incentives were preserved by the Trump administration — is booming, and automakers are ready to pivot in response. Ford, Stellantis, and General Motors are among the manufacturers making the change, bringing them into a new sphere of competition with Tesla. |

|

China’s emissions flatten |

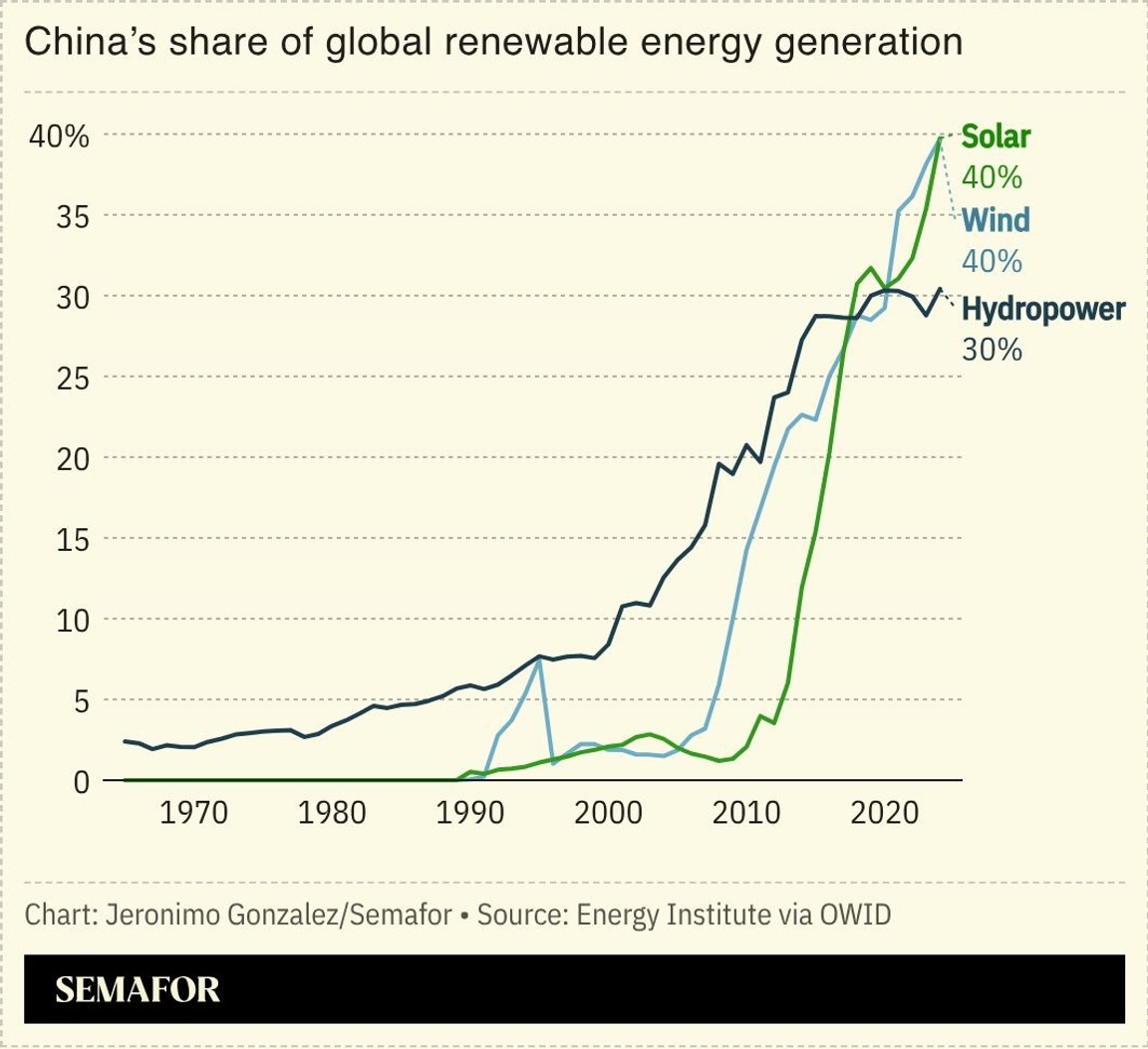

China’s carbon emissions have been flat or falling for nearly two years, analysis found. Research carried out for Carbon Brief found that CO₂ output plateaued from March 2024; fossil fuel emissions grew 0.1%, more than offset by a 7% decline in cement production. The numbers, alongside China’s economic growth, imply that its carbon intensity — emissions divided by GDP — is down 12% over the period 2020-2025. That is, however, well below its 18% target and short of its Paris Agreement commitments. Still, China’s is perhaps the most extreme example of the remarkable global growth of renewables: In 2014, they generated half as much electricity as coal, Nature reported; now they generate 1.5 times as much. |

|

New EnergyFossil Fuels- India’s coal use could more than double by 2050 before declining steeply as the country transitions to cleaner energy sources.

Amit Dave/File Photo/Reuters Amit Dave/File Photo/ReutersFinancePolitics & PolicyEVs |

|

|