| | Sanae Takaichi’s win sends Japan stocks surging, Hong Kong sees an IPO revival, and the UK’s Keir St͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Ripple effects of Takaichi win

- Japan defense stocks surge

- Hong Kong’s IPO revival

- Alphabet’s century bond

- Trump proud of US economy

- Keir Starmer holds firm

- Another oil tanker seized

- No problems in the UAE

- Fake Saudi Arabian prince

- The obsession with curling

A book about the UK Labour Party’s Machiavellian figure who just resigned over the Epstein fallout. |

|

Takaichi alters Asia power calculus |

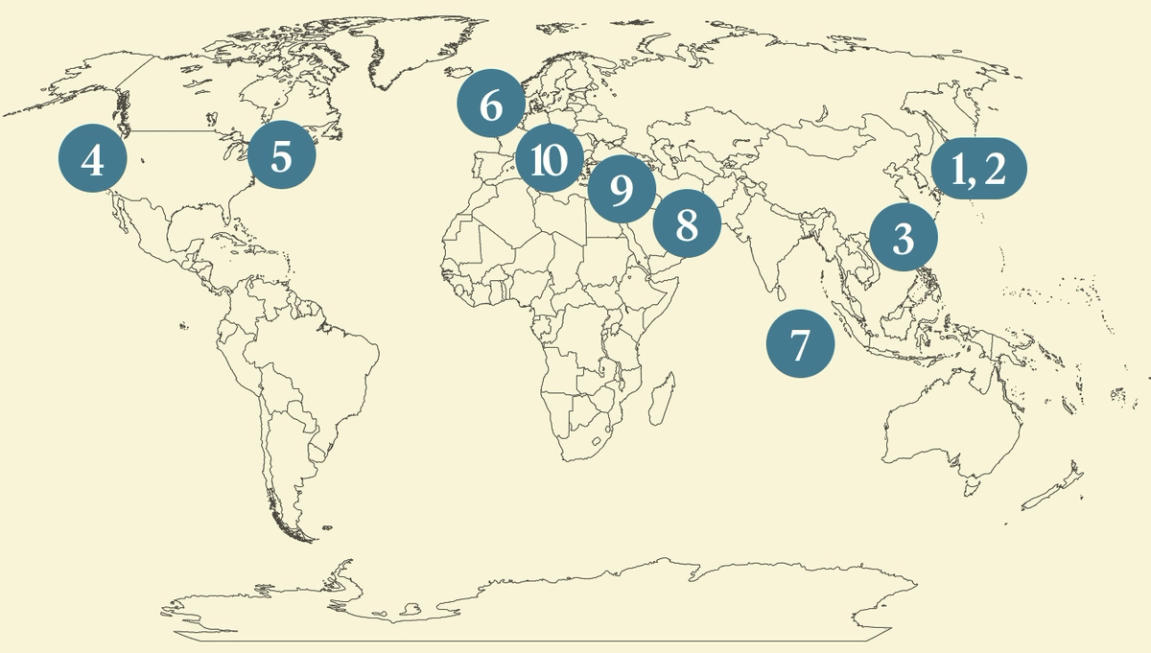

Kim Kyung-Hoon/Reuters Kim Kyung-Hoon/ReutersJapanese Prime Minister Sanae Takaichi’s landslide election victory on Sunday could rewire the regional power calculus in Asia as Tokyo takes a more assertive stance toward Beijing, analysts said. Given Takaichi’s plans to boost defense spending, Japan may bolster its cooperation with Southeast Asian nations looking to counter China’s maritime influence, ThinkChina wrote. India could also seek to strengthen ties with a more confident Japan and reduce reliance on China. For South Korea, which has tried to court both nations, heightened hostility presents a challenge: “Neither China nor Japan can be easily distanced,” a Korean paper wrote. Still, some Japanese officials are hopeful China will seek a diplomatic off-ramp because Beijing knows Takaichi will likely be around for a while. |

|

‘Takaichi trade’ accelerates |

Japanese stocks hit record highs on Monday as the “Takaichi trade” fueled gains in defense and tech-related sectors. Prime Minister Sanae Takaichi’s strong showing in Sunday’s election effectively gives her four years to pursue expansive stimulus measures like tax cuts without facing legislative resistance. Weapons-makers’ stocks rallied on expectations of looser export restrictions and plans for a possible revision to Japan’s pacifist constitution, furthering momentum for Asian defense firms. But just as traders signaled enthusiasm for Takaichi’s policies, the market will also “set an important constraint here,” HSBC’s chief Asia economist said. Given Japan’s heavy debt burden, she will have limited room to run up deficits, lest bonds and the yen come under pressure. |

|

Hong Kong’s IPO scene bounces back |

Kane Wu/Reuters Kane Wu/ReutersShares of Chinese chip designer Montage Technology soared on Monday following the company’s IPO, the latest sign of Hong Kong’s market rebound. The city’s outlook as a global business hub was gloomy a couple of years ago, after a tighter Chinese regulatory environment chilled IPO activity. But more companies and capital are now flocking to Hong Kong: Swiss agricultural chemicals firm Syngenta is reportedly eyeing a public listing there, potentially the city’s largest in years. High-tech innovation out of the mainland is central to the revival. Beijing has prioritized technological self-sufficiency, boosting domestic chip companies. Chinese robotics firms are also gearing up for a wave of Hong Kong IPOs, industry analysts say. |

|

Alphabet tees up 100-year bond |

Justin Sullivan/Getty Images Justin Sullivan/Getty ImagesGoogle’s parent company is going on a borrowing spree to fund its AI ambitions — including through a rare 100-year bond. Alphabet is lining up various offerings in dollars, Swiss francs and British pounds. No tech company has sold a century bond since IBM during the late 1990s dotcom frenzy; ultra-long-term bonds, issued by governments, were more common when interest rates were lower, as a way to lock in cheap borrowing costs. Big Tech firms are spending heavily in the quest to dominate the AI age — Alphabet, Amazon, Meta, and Microsoft could collectively spend close to $700 billion on AI buildout this year — and the bond market is increasingly funding that outlay: Oracle last week garnered record demand for a $25 billion bond sale. |

|

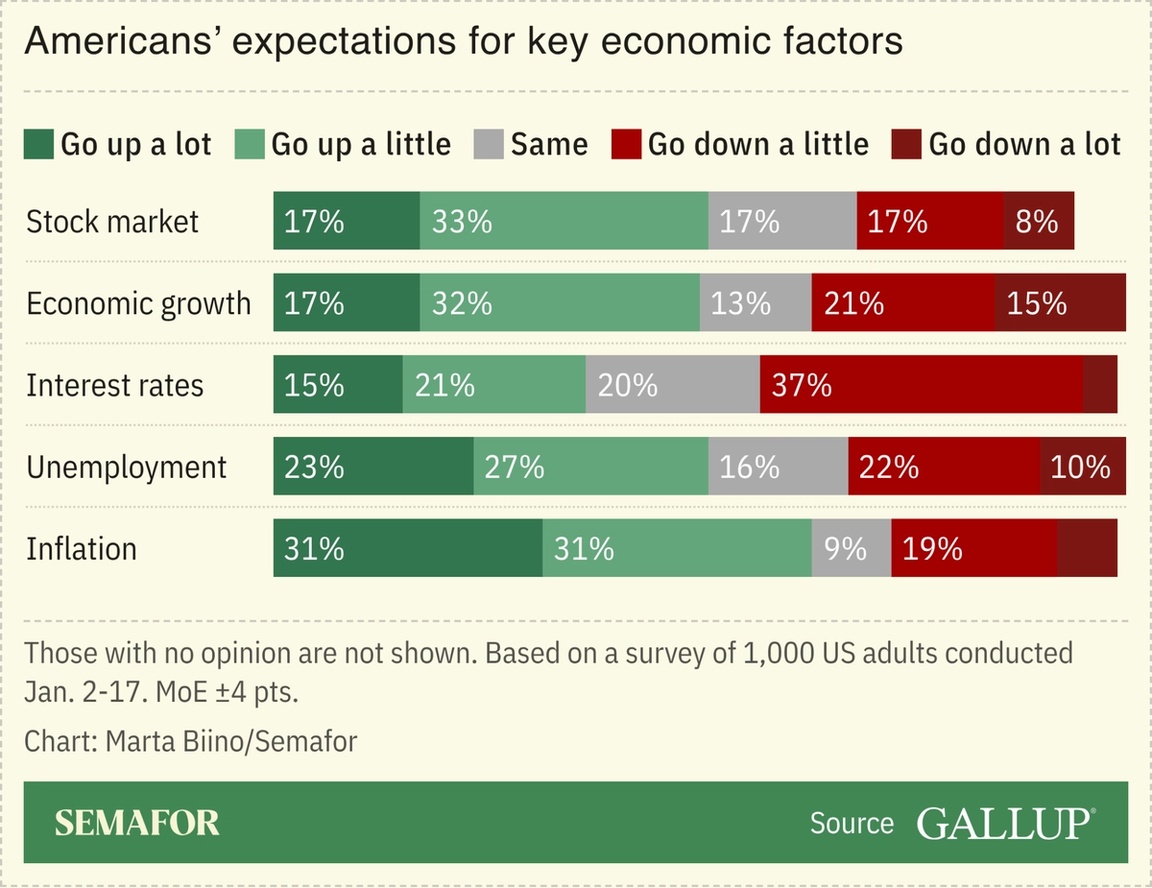

Trump says he’s ‘proud’ of economy |

US President Donald Trump said he is “proud” of the country’s economy, an effort to reclaim the public narrative as concerns over high costs persist. Trump’s owning of the economy — including a strong stock market and cooling inflation — comes as the White House bets that AI-driven productivity gains will keep inflation at bay ahead of November’s midterm elections. Trump “aims to run the economy hot,” The Washington Post wrote, with generous tax refunds, interest rate cuts, and regulatory trims. It may be an uphill battle; polls show most Americans still hold negative views on the economy. A new Gallup survey found a plurality of respondents expect economic growth, stocks, inflation, and unemployment to all rise in the next six months. |

|

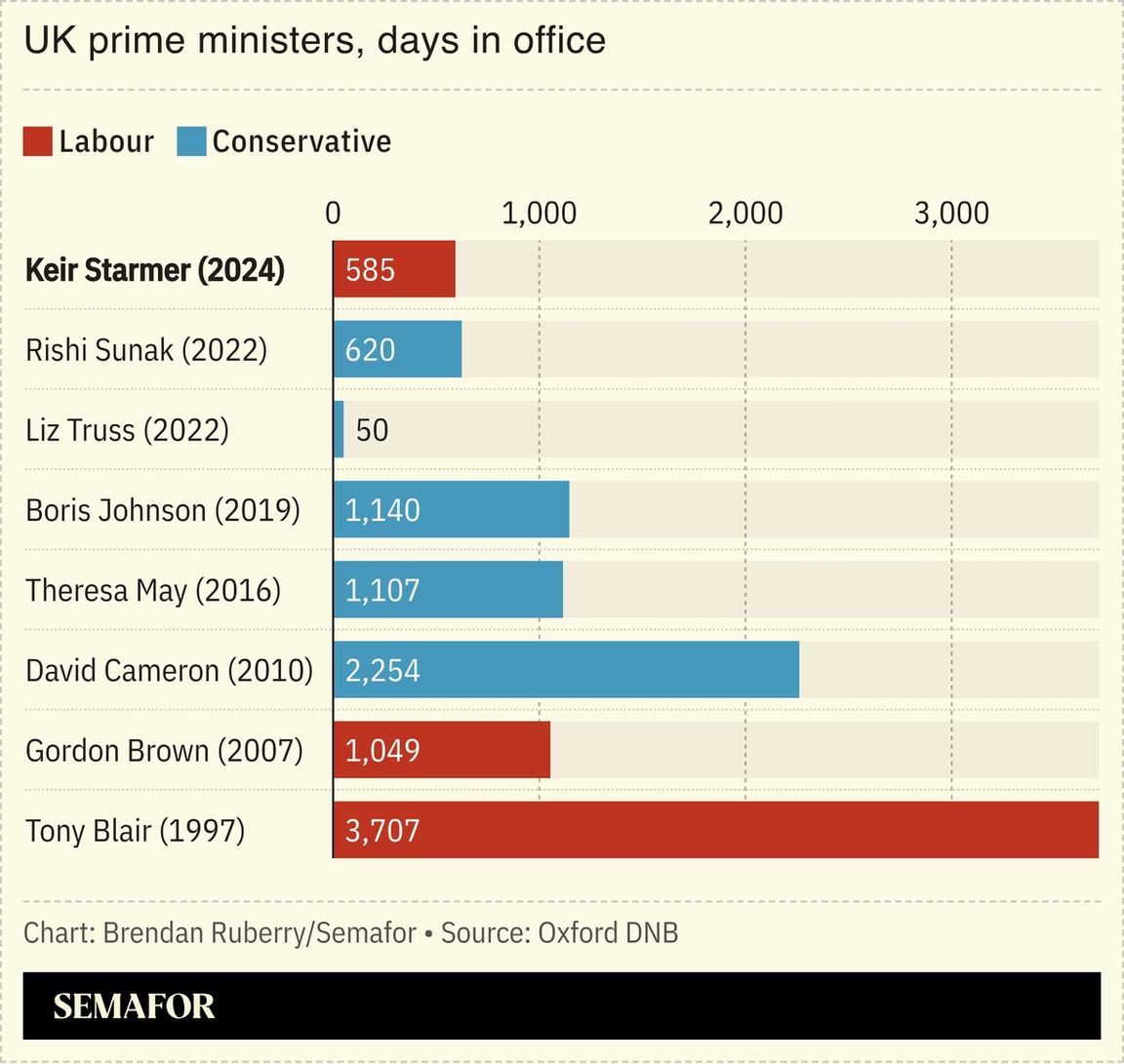

Starmer holds firm as walls close in |

UK Prime Minister Keir Starmer defied calls to step down over the fallout from the Jeffrey Epstein scandal. A senior leader in Starmer’s own party became the first political heavyweight to demand his resignation Monday, after the latest batch of Epstein files raised questions about the premier’s judgment in appointing a former US ambassador with close ties to the late sex offender. Starmer’s communications chief quit Monday, following the exit of the prime minister’s closest aide. While the political herd has yet to turn on Starmer — his cabinet has publicly rallied around him — London is engulfed in a “tinderbox atmosphere in which anything could completely ignite and sort of blow up the Keir Starmer premiership,” a Sky News journalist said. Keep reading for a book recommendation to help you better understand Starmer’s government. → |

|

|

New global oil order takes shape |

Aquila II. Department of War/X Aquila II. Department of War/XUS forces seized an oil tanker in the Indian Ocean after chasing it down all the way from the Caribbean, expanding the global breadth of Washington’s campaign against shadow vessels. The month-long pursuit of the ship, which had fled the quarantine around Venezuela, marked the eighth seizure since the Trump administration began intercepting illicit oil shipments to pressure Caracas. With Washington now asserting control over Venezuelan crude, “contours of a new oil order” are emerging, the Middle East Council on Global Affairs wrote, in which the US and Gulf share “bifurcated control of the marketplace.” The US energy secretary said he plans to visit Venezuela soon, with a focus on improving the country’s state-run oil company. |

|

China’s ascent is far more than a domestic story — over the past 50 years, it has steadily transformed global markets, technology, and international affairs. In today’s world economy, China is woven into every industry and influences trade and policy decisions across the globe. To provide clear context on China’s sweeping impact on deals, policies, and the emerging global order, Semafor is launching its flagship China Briefing. Authored by Pulitzer Prize-winning journalist Andy Browne, Semafor China will deliver original reporting, expert analysis, and sharp insight into how China is reshaping the world around us. Subscribe for free here. |

|

UAE shrugs off economic concerns |

Ahmed Jadallah/Reuters Ahmed Jadallah/ReutersThe Persian Gulf is a carefree place, polling suggests. A Gallup survey asked people in 107 countries what they thought their nation’s most important problem was; 32% of respondents in the UAE said they had “no problems,” the world’s highest level, with Kuwait and Bahrain in second and third. Those who did have worries cited concerns over the environment and infrastructure, perhaps because major flooding in 2024 exposed the region’s vulnerability to extreme weather events, Semafor Gulf noted. The Emirates largely shrugged off the economic uncertainty that topped global concerns; 23% of adults worldwide said the economy was their country’s most pressing problem, with governance issues particularly prevalent in countries with low trust in institutions. |

|

Fake Saudi prince scams Lebanon’s elite |

|

|