| | In this edition: Somaliland’s president courts Trump, Nigeria’s energy revamp reaps rewards, and Gha͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Somaliland courts Trump

- S. Africa-China trade deal

- Nigeria’s energy revamp

- Electricity demand grows

- Dubai firm eyes data centers

- Ghana’s gold ambitions

The Week Ahead, and tributes for a highlife legend. |

|

No single issue will affect African nations’ economies this year — not trade, not geopolitics, not elections — more than the fortunes of the global mining sector. The wild price swings we’ve seen over the past week only serve to hammer home how the continent could ride a commodity boom, or be wrecked by a commodity bust. The world’s wealthiest nations are scrambling for access to metals and minerals buried underground in Africa in order to safeguard their economic and geostrategic interests, from gold to protect against Washington’s erratic trade policies to copper needed for the AI boom. But have African policymakers identified ways to retool their industries, and their economies, to benefit from this supercycle? I’m in Cape Town for the Mining Indaba, Africa’s biggest annual mining conference, where I’m hoping to get some answers to this central issue of how the continent’s mineral-rich nations can make the most of their natural resources. The moves being made by policymakers and mining companies could define the course of some African economies for the next few decades. This issue is particularly pertinent in light of Washington’s attempt to form a trade zone for critical minerals to counter China’s dominance of the sector. The plan involves creating a price floor for critical minerals to reassure investors. It would make it easier to extract the minerals needed for batteries and defense equipment, by removing the risk of price volatility. That’s great news for international investors. But there’s no suggestion that this move would help African producers to overcome the bottlenecks, such as poor energy infrastructure and high financing costs, that hold back attempts to add more value locally. The continent’s top commodity exporters — such as DR Congo, the world’s largest source of cobalt, and iron ore producer Ghana — all repeat the same mantra: They want to add more value locally by processing and manufacturing. Yet it remains unclear how African countries will benefit in a way that creates jobs and develops local expertise to drive their economies. If you’re going to be at the Mining Indaba, send me an email — I’d love to meet up. → |

|

|

Somaliland president courts Trump |

| |  | Mohammed Sergie |

| |

Somaliland President Abdirahman Mohamed Abdilahi. Monicah Mwangi/Reuters. Somaliland President Abdirahman Mohamed Abdilahi. Monicah Mwangi/Reuters.Somaliland plans to use the momentum from Israel’s recent recognition of the breakaway state to press its case to Washington, pitching the territory as a strategic and resource-rich partner to US President Donald Trump, its leader said in an interview. Somaliland President Abdirahman Mohamed Abdilahi reiterated previous overtures to Washington, highlighting his country’s coastline and access to the Red Sea: Somaliland supporters in Washington have long viewed the territory as a potential security ally in the Horn of Africa, arguing that recognition could allow US intelligence to establish a base to monitor weapons flows, Houthi activity in Yemen, and China’s growing footprint, including Beijing’s military base in neighboring Djibouti. Abdilahi also explicitly offered Somaliland’s mineral resources to Trump. “We have an abundance of natural resources, including minerals. We have oil and gas. We have very large arable land for agriculture,” he said. |

|

S. Africa, China sign trade deal |

China’s leader Xi Jinping and South Africa’s President Cyril Ramaphosa in 2023. Alet Pretorius/Reuters. China’s leader Xi Jinping and South Africa’s President Cyril Ramaphosa in 2023. Alet Pretorius/Reuters.Pretoria signed an economic partnership agreement with Beijing, a step toward securing zero tariffs on South African exports to the Chinese market. The two countries agreed to expand bilateral trade and investment in areas including mining, agriculture, renewable energy, and technology. A follow-up agreement, due by the end of March, “will see China provide duty free access to South African exported products,” South Africa’s government said in a statement. The deal comes amid ongoing political tensions between the continent’s biggest economy and Washington: The Trump administration imposed a 30% tariff on South African exports to the US in August, the highest rate in sub-Saharan Africa. Beijing has emphasized its role in upholding a global trading system that was upended by Washington’s new tariffs last year. “Against the backdrop of rampant unilateralism and protectionism, China will continue to strengthen communication and coordination with South Africa within multilateral frameworks such as the WTO and BRICS,” its commerce minister said. |

|

Nigeria’s energy sector revamp |

| |  | Alexander Onukwue |

| |

Temilade Adelaja/File Photo/Reuters Temilade Adelaja/File Photo/ReutersNigerian energy companies have ramped up oil production over the past year as the government intensifies its efforts to restart dormant refineries and monetize untapped gas reserves. Reviving the energy sector has been a top priority of Nigerian President Bola Tinubu’s administration as it tries to rapidly grow an economy rocked by two recessions in the last decade. Several multinationals have fled the country’s onshore oil and gas scene in recent years due to rampant theft along pipelines that has in turn strained crude output and created uncertainty. “The big positive change in Nigerian energy in the last three years has been that there are now targeted frameworks in place to ensure speedier contracting timelines,” said Clementine Wallop, an analyst at London-based consultancy Horizon Engage, adding that a new cohort of energy regulators has “sent favorable messages to investors.” |

|

China’s ascent is far more than a domestic story — over the past 50 years, it has steadily transformed global markets, technology, and international affairs. In today’s world economy, China is woven into every industry and influences trade and policy decisions across the globe. To provide clear context on China’s sweeping impact on deals, policies, and the emerging global order, Semafor is launching its flagship China Briefing. Authored by Pulitzer Prize-winning journalist Andy Browne, Semafor China will deliver original reporting, expert analysis, and sharp insight into how China is reshaping the world around us. Subscribe for free. |

|

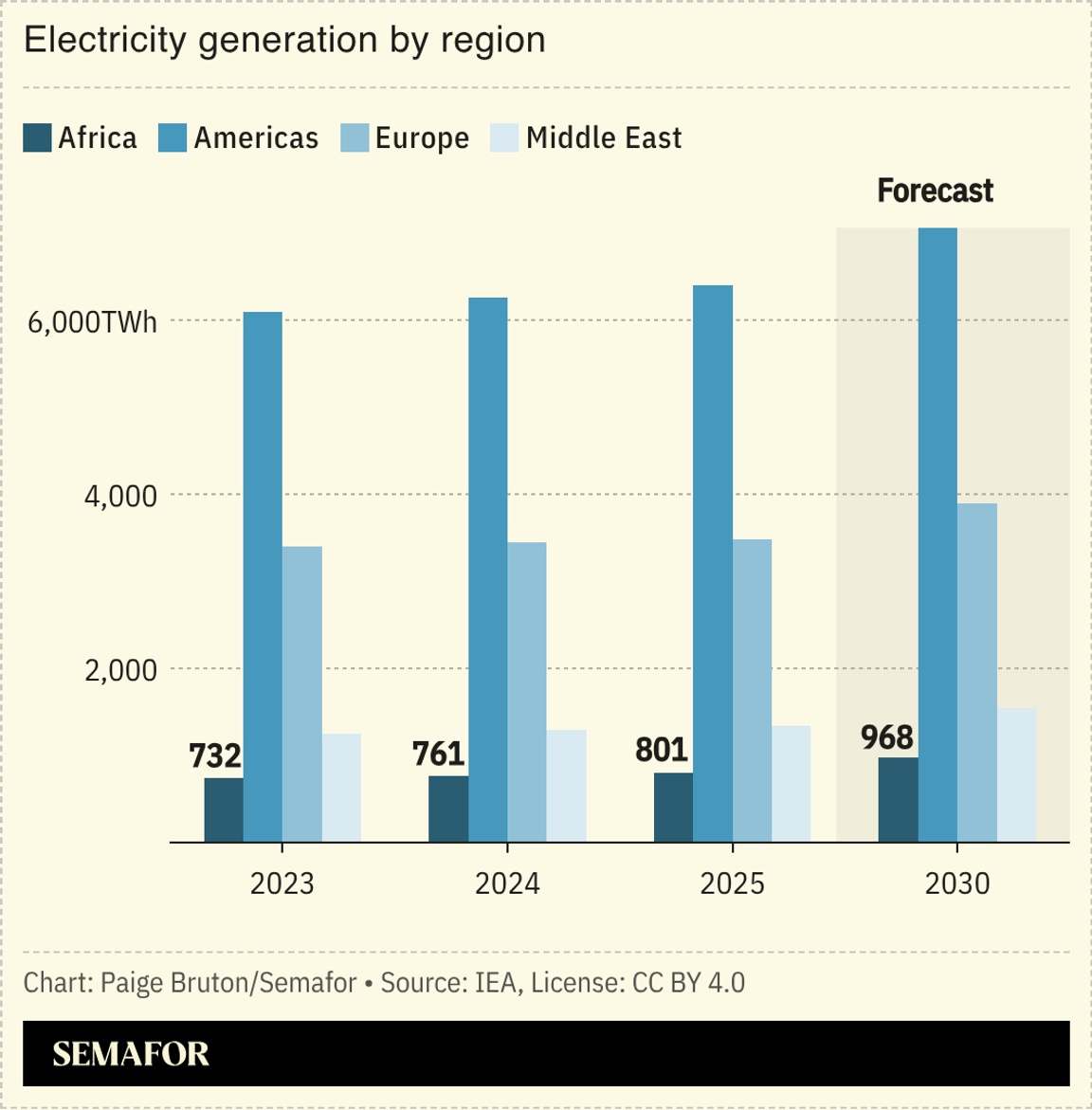

Electricity demand grows on continent |

Electricity demand growth accelerated in Africa, rising 5.2% last year from 4% in 2024, an International Energy Agency report found. Improved electricity supply in South Africa — which accounts for a quarter of the region’s consumption — led the boost: Better maintenance of the country’s grid and repairs to coal-fired power stations saw it enjoy 161 consecutive days of power last year. Kenya and Senegal also made considerable progress towards universal electricity access, which both are forecast to achieve by 2030, on account of industrial expansion and increased urbanization. Wind, solar, nuclear, and natural gas-generated power are expected to see strong growth on the continent over the next five years. Oil-fired output, meanwhile, is projected to fall by almost 5.5% over the same period. However, the IEA warned that challenges remain in matching the continent’s demand growth with timely capacity additions, with both Nigeria and Kenya experiencing periodic supply bottlenecks in recent years. — Paige Bruton |

|

UAE firm to fund African data centers |

The amount that a Dubai-based electronics company plans to invest in farmland and data centers in Africa. Maser Group makes consumer appliances such as television sets, headphones, and smartwatches, according to its website, and plans to invest the sum in Ghana, Kenya, and Nigeria over the next two years, according to Bloomberg. Founded and run by an Indian entrepreneur, the company is also said to be exploring other projects in mining, real estate, and agriculture in Rwanda, Tanzania, Zambia, and Zimbabwe. The scope of the company’s presence in Africa is unclear, but the intent to invest in data centers points to the rising interest in infrastructure to power cloud computing, artificial intelligence, and digital services on the continent. However, a $1 billion geothermal-powered data center proposed by UAE AI firm G42 and Microsoft has failed to break ground, serving as a cautionary tale for data center optimism in Africa. |

|

View: Ghana’s flawed gold ambitions |

Gold Fields/Handout via Reuters Gold Fields/Handout via ReutersAs gold prices soar, Ghana’s leaders have a rare opportunity to solve the country’s “long-standing challenge” with the precious metal, a regional expert argued in a Semafor column. As the world’s sixth-largest producer, Ghana sits in a position “most countries would envy,” Bright Simons, Honorary Vice President of IMANI think tank in Accra, wrote. Record prices have catapulted gold to nearly 70% of all export earnings, but still leaves Ghana far from the upper-middle income status it craves. By developing a “knowledge ecosystem” around gold, like Thailand and the Philippines, Accra could finally transform the country’s vast gold reserves from “an occasional foreign exchange windfall into a strategic development lever,” wrote Simons. |

|

- Feb. 9-11: Invest Africa hosts its annual Mining Series for key stakeholders and investors in Cape

|

|

|