| |

| |

| |

|

Hi,

This week we launched our 2nd Collective Switch (since the energy crisis) – a regulated process where energy firms bid to offer special deals that undercut their own public deals. The first was huge, and encouraged many of you to save.

|

| |

|

|

|

| |

| |

| |

| |

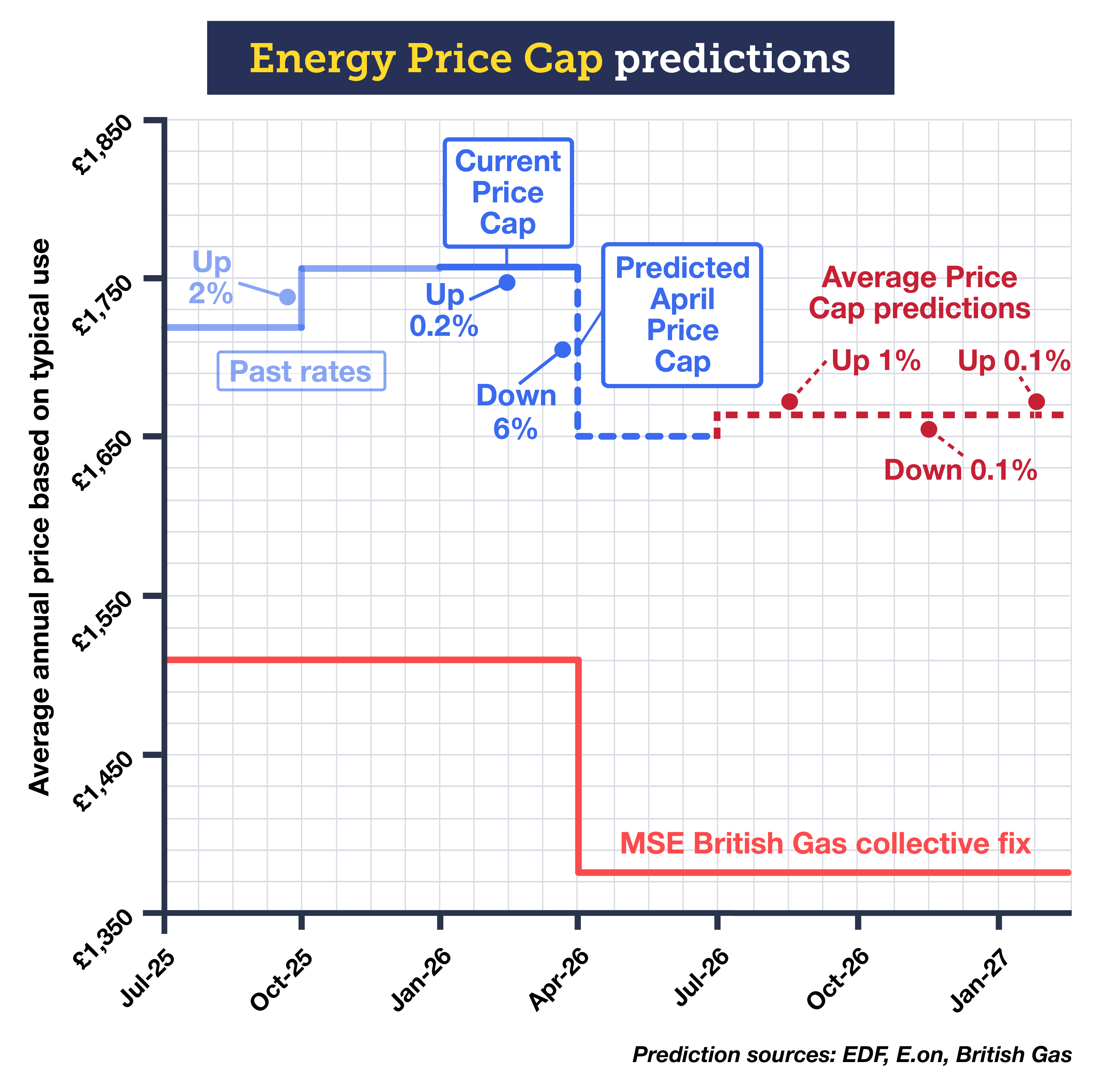

Yet millions are still overpaying for energy... if you're on your firm's standard tariff, you're on the Price Cap and it's pants. So we've picked two fixes - the first, from a big beast, a

British Gas Collective

- and a slightly cheaper one from small firm

Fuse.

Both lock in the maximum rate so it's guaranteed not to rise for a set time, giving you peace of mind of price certainty.

And the timing is key. The Govt is about to cut some underlying structural costs from energy bills (some shifted to general taxation, some cut) - what it calls the April '£150 off bills'. That means the Price Cap is predicted to drop but also, unprecedentedly, those on most existing fixes will see their rates cut too.

|

| |

|

|

|

| |

| |

| |

| |

So with these fixes, you get a cheap rate now, and they get even cheaper in April...

One of our Collective conditions was as much detail on the post-April rates as possible. So the British Gas tariff is 14% cheaper than today's Price Cap and should stay that much cheaper (or likely slightly more) once it drops. Fuse is a little more complex. So we'll take you through the details...

|

| |

|

|

|

| |

|

The MSE Big Switch Winners

Both have agreed to MSE Enhanced Service

Ends: When all gone or 12 Feb.

Your exact winner depends on your location and usage. Do a full comparison via the links below, so you can see how these Collective tariffs stack up for you, and also compare them to any new tariffs that launch after we send this.

- Big Name Winner: Cheap 1yr fix. British Gas 12mth

- Available to new and existing customers.

- 9,000 switches remaining, so 1st come, 1st served (we'll try to get more if it runs out).

- Early exit penalties: £50/fuel.

- Smart Meter required: No.

- For: Dual fuel/elec or gas only. Direct Debit & Pay on Receipt of Bills.

When we launched this in our weekly email on Tuesday, we wrote 'this is currently cheaper on typical usage than all open market fixes', averaging

14.1% less

(including MSE cashback) than the current Jan to March Price Cap - rare for such a big name.

Since then, Outfox Energy has cut its price to about the same level as our BG deal. That's good news - you've even more choice, and you'll be able to see both when you do a comparison, as your winner will depend on usage and region.

British Gas is making its 1yr fix available to existing customers too, and it's a massive saving compared to even the cheapest deals BG is offering direct (typically it's £130/yr cheaper than its cheapest). Plus, if you're already fixed with BG, it won't charge you early exit fees to switch to this (so see if it's cheaper - if it is, move.)

British Gas says it will pass on the full Govt structural bill changes on its fixes on 1 April. So it will get cheaper then...

|

Average UK Direct Debit costs...

Though exact rates vary by region

|

|

Now |

1 April

(predicted) |

| Electricity |

| Price Cap Standing Charge |

54.75p/day |

63.9p/day (a) |

| BG collective Standing Charge |

52.52p/day |

52.5p/day (b) |

| Price Cap Unit Rate |

27.69p/kWh |

24.2p/kWh (a) |

| BG collective Unit Rate |

23.83p/kWh |

20.3p/kWh (b) |

| Gas |

| Price Cap Standing Charge |

35.09p/day |

35.9p/day (a) |

| BG collective Standing Charge |

29.63p/day |

29.6p/day (b) |

| Price Cap Unit Rate |

5.93p/kWh |

5.5p/kWh (a) |

| BG collective Unit Rate |

5.10p/kWh |

4.8p/kWh (b) |

|

(a) This is EDF's current 1 Apr - 30 June prediction. Forecasts change weekly, but as we're near the end of the assessment period, it's hopefully in the right ball park, though nowt's 100%.

(b) This is British Gas' 'expected' estimate for the remainder of the fix, but it says it awaits final info from the Government.

|

- Small Firm Winner: Cheapest long fix. Fuse Energy 18mth

- Available to new and existing customers.

- Uncapped, so will run until 12 Feb.

- Early exit penalties: £50/fuel.

- Smart Meter required: No.

- For: Dual fuel/elec only 'variable' Direct Debit (so you pay each month based on what you've used).

Fuse was set up in 2023 by former Revolut executives. It has about 200,000 customers and gets a decent (4 out of 5) customer service rating. This is a longer fix, so you get an extra period of price certainty.

It is currently cheaper than the British Gas fix above, averaging 16.1% less (including MSE cashback) than the current Jan to March Price Cap. Yet the picture of what happens in April is less clear...

In April, while Fuse says it will pass on the full cut, its price won't fall by as much as British Gas, as it isn't currently part of the Eco scheme (one element being wiped off bills). So that means its reduction will, we guess, be about half that elsewhere. However, it is in discussion with the Energy department.

|

Average UK Direct Debit costs...

Though exact rates vary by region

|

|

Now |

1 April

(guesstimate) |

| Electricity |

| Price Cap Standing Charge |

54.75p/day |

63.9p/day (a) |

| Fuse Standing Charge |

43.54p/day |

43.5p/day (b) |

| Price Cap Unit Rate |

27.69p/kWh |

24.2p/kWh (a) |

| Fuse Unit Rate |

23.87p/kWh |

22p/kWh (b) |

| Gas |

| Price Cap Standing Charge |

35.09p/day |

35.9p/day (a) |

| Fuse Standing Charge |

24.7p/day |

24.7p/day (b) |

| Price Cap Unit Rate |

5.93p/kWh |

5.5p/kWh (a) |

| Fuse Unit Rate |

5.18p/kWh |

5.2p/kWh (b) |

|

Rates always vary by region.

(a) This is EDF's current 1 Apr - 30 June prediction. Forecasts change weekly, but as we're near the end of the assessment period, it's hopefully in the right ball park, though nowt's 100%.

(b) We have guessed at this. Fuse told us the potential savings it'll pass on could be around £50 (estimated) - we took this off the current average price, and worked backwards to get the unit rates. Only elec unit rates will come down for this tariff. This is very rough, though.

|

Both have agreed to 'MSE Enhanced Service'. That means if there's an issue, go to it first, but if it doesn't sort things, contact our Cheap Energy Club and we can and will escalate it and try to help.

Both include MSE £20 dual-fuel cashback. Unlike other sites, we don't default to hiding tariffs that don't pay us to facilitate a switch. Instead, we show the whole market, but when we get paid to switch you, we give you some of it as cashback and factor that in, meaning those that pay us are relatively cheaper, so you're more likely to switch to them. Win-win.

|

| |

| |

| |

|

-

What happens if you're in credit/debt when you switch? Your old energy provider should pay you all the credit you are owed within eight weeks of you no longer being its customer. You will need to give a final meter reading to ensure everything is as it should be.

If you're in debt, then it's usually fine to switch, as long as it's not huge, but there are no hard rules except for prepay, when it's a £500 per fuel maximum debt. Of course, you will still have to pay back the money you owe (you may be able to sort out a repayment plan if needed, ask it).

-

What if prices drop further and you've fixed? In the unlikely event that prices dropped rapidly during the fix's term, you can leave, you may just have to pay the early exit penalties.

The Price Cap rate (see how to check if I'm on the Price Cap?) changes every three months. The Cap limits the max Standing Charges and unit rates firms can levy. The next one starts on 1 April.

One of the main reasons for underlying movements is average wholesale costs though it's time-lagged, so for April's cap, the assessment period is mid-Nov to mid-Feb. Yet policy costs are actually just as important - they make up a huge chunk of bills, and that has to be factored in too.

If the only move was the Government's '£150 off bills', we'd expect to see the Price Cap drop by 8% in April. But the current prediction is it'll drop 6%. This is as other costs - mainly for connecting new renewable elements of the network to the grid - are likely to increase.

As we're only two weeks away from the end of the assessment period, the current predictions will very likely be in the right ballpark.

After that, predictions are more crystal ball-gazing but currently analysts predict the Cap will remain around the same level in July. So if right, fixing cheaply now will be a big winner.

Yet we're hoping (nothing is 100% confirmed) to see the full 8% permanently coming off most fixes with larger firms (see will my firm's existing fixes get cheaper). So we could find that a fix that's 14% cheaper now is roughly 16% cheaper in April.

Fixes are the easy peace-of-mind option. But there are alternative models, though some of them are tough to display via a traditional comparison site, so here's a quick checklist...

Thanks,

Cheap Energy Club team

You're getting this email because we think you're on a Price-Capped tariff (or on a fix with British Gas). Not right?

Update your details in Cheap Energy Club

.

|

| |

|

|

|

| |

| |