|

|

A week ago I wrote about the possibility that the world would pull its money out of the United States of America:

I noted the rise in the price of gold as a sign that the world might be entering a time of international financial anarchy:

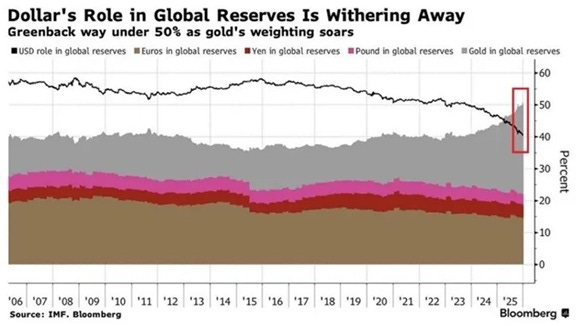

[G]old’s volatility and limited supply might not stop it from becoming the world’s reserve asset once again. In fact, although the dollar is holding its own against other national currencies, its share of global reserves is falling steeply once you bring gold into the picture:

Source: Bloomberg via Lukas Ekwueme Bloomberg reports that governments and private investors are both buying gold at rapid rates, and that fear of the Trump administration’s policies is a big reason why…[T]he world may be preparing for a time of financial anarchy — an era in which the U.S. is no longer a safe haven and the dollar is no longer the reserve currency, but where China has chosen not to step up to fill the void, and Europe and other powers are unable to do so.

A lot of people asked me whether gold’s rise as a share of reserves was due to people putting their money into gold, or to gold going up in price. In fact, those are the same thing. When demand increases for gold, it means that investors buy more gold, and it also means that the price goes up.¹ So basically, this all means that investors have been demanding more gold.

Anyway, I thought that the idea of “international financial anarchy” was worth expanding on. A lot of people have this vague idea that the world’s finances are based on the U.S. dollar, but they don’t really know exactly what that means, and they don’t know what it would mean for the dollar to lose that status. In fact, people are right to be a little confused, because there are basically a few different ways that the dollar matters to the international financial system:

A lot of countries and companies make payments in dollars.

A lot of countries hold dollar-denominated assets (like U.S. government bonds) as reserves.

A lot of banks and other companies use dollars as collateral for lending.

For a long time, the dollar has been predominant in all of these use cases, leading people to think that these are all the same thing. But they’re not. So when we think about “international financial anarchy”, we should think about how the dollar’s role might change for all of these uses.

Anyway, I don’t have one big grand thesis about the direction in which the international financial system is heading. But the events of the past few weeks have provoked a few thoughts.

The goldbugs were partly right, the Bitcoin maximalists were wrong

One clear lesson of the past few weeks — and of the past two years — is that people still view gold as a safe haven in times of international uncertainty. Here’s a chart of gold’s price: