| | The CEO of the top global manufacturer of electric grid transformers, Hitachi Energy, speaks to Sema͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Transformer delays ahead

- Trump budget cuts

- Clean energy court wins

- US emissions rise

- EV milestone

New critical mineral legislation, and Meta’s new nuclear deals. |

|

More winners and losers are emerging as the first phase of restarting Venezuela’s oil industry takes shape. The White House meeting last Friday between US President Donald Trump, top cabinet officials, and executives from most of the world’s top oil companies didn’t produce the kind of quick-win, headline-grabbing investment promises Trump is accustomed to extracting from tech moguls and other executives. ExxonMobil CEO Darren Woods called Venezuela “uninvestable” for the time being, a comment which Trump later said left him “inclined to keep Exxon out.” Trump also told ConocoPhillips CEO Ryan Lance to essentially give up on trying to recover the $12 billion the company claims to be owed by Venezuela for the 2007 seizure of its assets. That message can’t have been very encouraging to the big European companies in the room — Eni and Repsol — which are also owed billions of dollars by Venezuela, and which produce much of the gas that is used by the Venezuelan electric grid; the country’s future economic stability depends on their ongoing investment. “The White House understands it needs to have a broad swath of Western companies,” former senior State Department energy official Geoff Pyatt told me. “That will require a certain amount of subtlety to the ‘America First’ approach.” An important fact about Venezuelan oil to bear in mind is that it’s not a monolith: Different parts of the country have different types of natural resources that are more, or less, expensive to extract. So while the multibillion-dollar heavy lift Trump is asking for may not be forthcoming, there are very likely to be smaller fortunes made in the near term: Risk-tolerant Texas “wildcatters” are already lining up; service companies like SLB and Halliburton have also seen their share prices jump. A final notable set of winners is consumers: Goldman Sachs lowered its forecast for oil prices in the next two years as a result of, among other factors, more drilling in the US and Venezuela. |

|

| |  | Tim McDonnell |

| |

Shelby Tauber/Pool/Reuters Shelby Tauber/Pool/ReutersLong delivery delays for electric grid transformers won’t ease up anytime soon unless utilities, tech companies, and other buyers change their strategy, the CEO of the top global manufacturer of the equipment told Semafor. Andreas Schierenbeck of Hitachi Energy said the handful of companies capable of manufacturing transformers and other grid hardware are still catching up to the new reality of the “big race going from molecules to electrons,” after many years of tepid demand growth for those products. “Nobody wants to overinvest” in new production facilities, he said, even though it’s clear that demand is growing. Hitachi has adopted a strategy of only investing in new transformer manufacturing capacity when it has customers to back them up, like a recent $700 million deal with the German utility E.ON. Tech companies that need hardware for data centers are also showing a willingness to accept standardized, rather than highly bespoke, equipment, which will help ease the AI power bottleneck. Deals with US customers have allowed Hitachi to plan $1 billion in new US manufacturing capacity, he said, “but that’s probably not enough to close the gap between supply and demand… There are still customers who are just in the old world with transactional behavior, and they’ll have to be lucky to get a slot.” |

|

| |  | Kelsey Warner |

| |

Francesco La Camera, the Director-General of IRENA. Maxim Shemetov/Reuters. Francesco La Camera, the Director-General of IRENA. Maxim Shemetov/Reuters.The Trump administration has weakened the budget of the International Renewable Energy Agency (IRENA) after falling behind on payments, according to a person familiar with the matter. The Abu Dhabi-based group joins dozens of other agencies hobbled by the US’ broader retreat from global causes: IRENA is one of 66 international organizations, many of them linked to climate action, that the Trump administration said at the start of the year it would withdraw from. But even before that, the US had not paid $5 million in dues to the agency in 2025 and is not expected to make its annual contribution this year either, leaving IRENA to grapple with a 22% hole in its operating budget, according to the person, who spoke on condition of anonymity. The budget gap has led the agency to halt hiring senior staff in recent months, backfilling with interns and more junior roles, the person said. |

|

Tom Little/Reuters Tom Little/ReutersUS President Donald Trump’s campaign against clean energy projects suffered back-to-back defeats in court. A federal judge in Washington, DC, ruled that Danish wind farm developer Orsted can proceed with the construction of its major project off the coast of Rhode Island, which was 90% complete before the Interior Department ordered a pause on several offshore wind projects last month. The $5 billion project “would be irreparably harmed” by the suspension of work, the judge wrote, sending Orsted’s stock price up and also sending a signal, analysts said, that other judges could rule similarly in the cases of other blocked wind projects. Still, top wind industry executives warned this week that the Trump administration’s animosity toward them is raising their cost of capital and could endanger projects around the world. Separately, another federal judge ruled that the Energy Department’s decision to slash $30 million in funding for seven clean energy projects was unlawful because the decision appeared to be based on political bias, with all the projects located in Democrat-majority states. But more than $7 billion in related DOE funding cuts are still in place. |

|

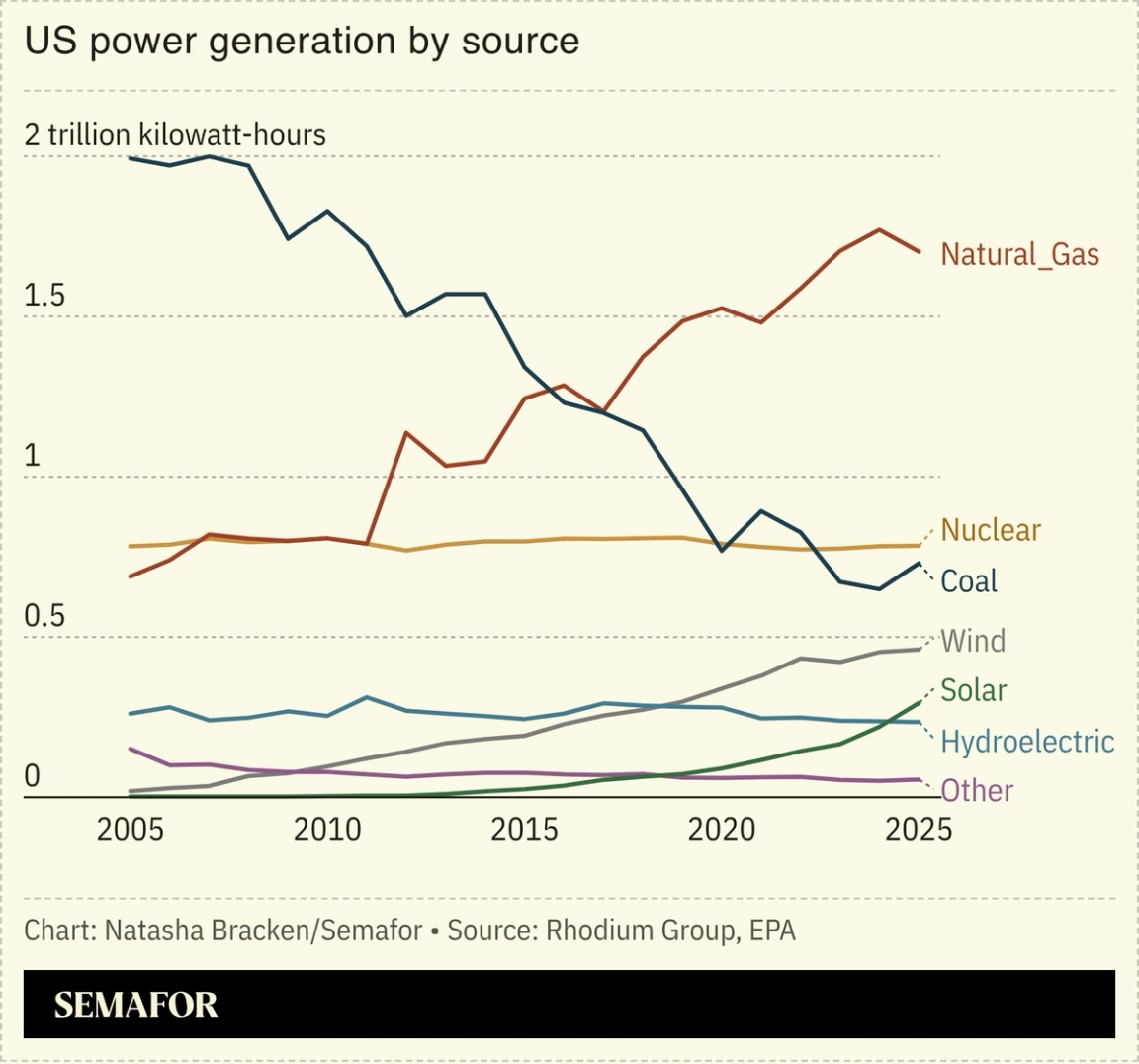

US emissions rose 2.4% in 2025, reversing a two-year decline and breaking a three-year streak in which economic expansion outpaced emissions growth, a new report found. The main drivers of the emissions increases were commercial buildings and the power sector, according to estimates by the Rhodium Group, a research firm. Harsh winters boosted heating demand, pushing fossil fuel emissions up 6.8%. Data centers and other large-load customers were the biggest contributors to higher electricity use, and that coupled with higher natural gas costs made it more economic for utilities to turn to coal, leading power plants to burn 13% more coal than they did in 2024. Fossil-fuel-friendly policies from the Trump administration played only a minor role, mainly by keeping a few coal plants running through Department of Energy orders. But Rhodium warns this could shift in the next couple of years as data center demand rises and the grid leans more heavily on existing fossil generation. On a brighter note, solar was the fastest-growing power source in 2025, surging 34%, its highest growth rate since 2017. And transportation emissions were largely flat despite record travel activity thanks to the proliferation of EVs. —Natasha Bracken |

|

In today’s fast-changing global environment, business leaders are responding by innovating and seizing opportunities in real time. Shifting dynamics, emerging technologies, and rising expectations demand leadership that is both decisive and forward-looking. On Tuesday, January 20, Semafor editors will sit down with global executives in Davos, including President & Chief Investment Officer of Alphabet and Google, Ruth Porat and Aon CEO Greg Case to discuss agility, cross-border collaboration, and bold action in the next era of business. Jan. 20 | Davos | Request Invitation |

|

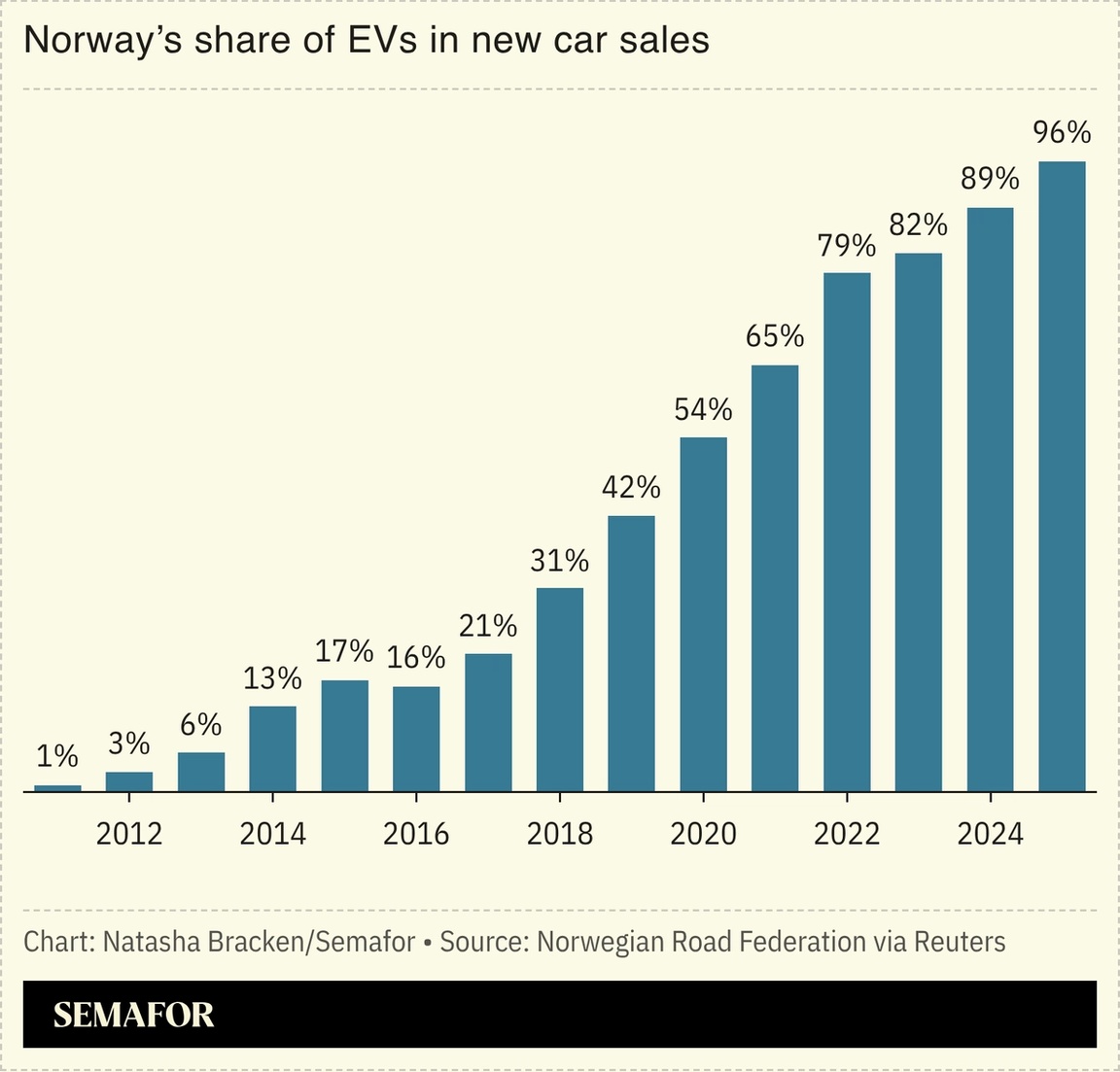

More than 97% of cars sold in Norway last year were electric or plug-in hybrids, and EVs now outnumber both diesel and petrol cars on the country’s roads. In 2017, Oslo set an ambitious target of ending fossil-fuel car sales by 2025, “and it basically got there,” Electrek reported: December numbers were even starker than the whole-year figures. Norway has long led the way on EVs, with generous incentives for consumers to buy them, and despite a few wobbles for the industry, the rest of the world is heading in a similar direction. EVs now account for 25% of global market share, with Europe and Asia leading the charge, an Ember Energy report found. |

|

New Energy- China is set to reduce or eliminate tax rebates on hundreds of products as the world’s largest goods exporter attempts to ease tensions with its trading partners.

- Egypt signed renewable energy deals worth $1.8 billion, including with Norwegian and Chinese firms.

TechPolitics & PolicyMinerals & Mining - Glencore and Rio Tinto revived merger talks that would create the world’s largest mining company, as global demand surges for metals and minerals key to the energy transition and AI infrastructure buildout.

EVs- California Governor Gavin Newsom proposed $200 million in state EV tax rebates to replace the federal $7,500 EV tax credit that Congress eliminated earlier this year.

- The European Commission outlined how Chinese EV makers could avoid EU tariffs by agreeing to minimum prices, and said it would consider their investments in Europe.

|

|

|