| | In today’s edition: Prince Alwaleed plans to buy Riyadh soccer club, Saudi luxury train gets funding͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Alwaleed to buy his club

- Luxury train in Saudi

- Gulf turns inward…

- …and IPOs slump

- Yemen on the brink

Why Saudi is Washington’s most difficult ally, and other weekend reads. |

|

Prince Alwaleed eyes Saudi soccer club |

Prince Alwaleed bin Talal. Stringer/Reuters Prince Alwaleed bin Talal. Stringer/ReutersSaudi billionaire Prince Alwaleed bin Talal is close to buying his favorite local soccer club. He plans to buy a 75% stake in Riyadh-based Al Hilal for around $400 million from the kingdom’s sovereign wealth fund, according to people familiar with the matter. Kingdom Holding Company, Prince Alwaleed’s investment vehicle, has been in talks with Saudi Arabia’s Public Investment Fund for several months. The deal could value the team — currently ranked second in the Saudi Pro League — at about 2 billion riyals ($530 million). PIF and Kingdom Holding declined to comment. If finalized, the deal would mark the kingdom’s biggest club privatization so far, bolstering Saudi’s multibillion-dollar bet to turn its league into one of the top 10 globally through investments in high profile players like Cristiano Ronaldo. Prince Alwaleed has provided financial support to the team in the past. PIF, which owns a 17% stake in Kingdom Holding, took control of four Saudi teams in 2023 to develop more commercial and investment opportunities with an eye toward privatization at a later stage. US sports executive Ben Harburg is the only foreign investor to buy a Saudi soccer team — and he recently told Semafor he’s considering buying a women’s club in the kingdom, too. — Matthew Martin |

|

$8,000 train travel comes to Saudi |

Courtesy of Dream of the Desert, Stephan Juillard Courtesy of Dream of the Desert, Stephan JuillardSaudi Arabia’s luxury train has secured funding. Italian hospitality firm Arsenale agreed to a partnership with SIMEST, which supports Italian firms expanding internationally, and the Saudi Tourism Development Fund in order to develop the “Dream of the Desert.” Italian backers are injecting €37 million ($44 million) in equity, while the Saudi fund is providing a €35 million loan. The 66-passenger train will offer one- and two-night journeys from Riyadh to destinations including Hail and the UNESCO-listed AlUla. Cabins start at 30,000 riyals ($8,000) per night. The project is the kingdom’s latest bet on wealthy travelers as part of its broader tourism push, building on a portfolio that includes resorts on the Red Sea and AlUla’s development. |

|

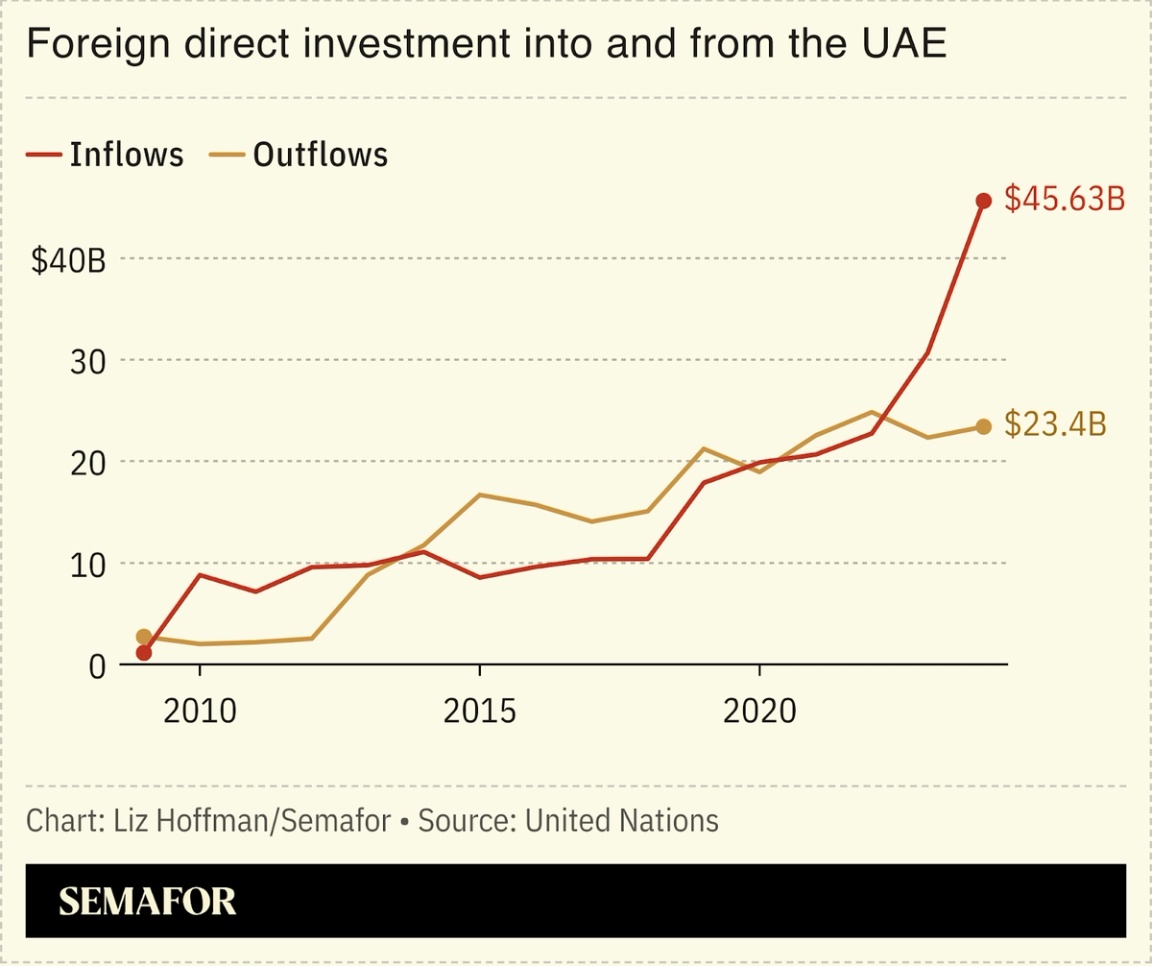

More money comes to the Gulf |

Gulf governments shedding their image as the world’s ATM — a shift driven by low oil prices and the need to invest back home in tech, tourism, and entertainment — was one of the biggest stories of the year, Semafor’s business editor Liz Hoffman wrote. Saudi Arabia’s giant Public Investment Fund pivoted its spending toward domestic projects and scrapped their most futuristic elements in favor of more achievable, profitable goals. Wall Street firms coming to the region to fundraise will still find cash available, but it increasingly comes with demands to invest on the ground. Western asset managers “used to end the meeting with ‘this is how much we expect from you,’” Khaled Al-Marri, an executive at Abu Dhabi’s government-backed Mubadala, told Hoffman recently. Now, he said, “we are co-architects of deals together.” |

|

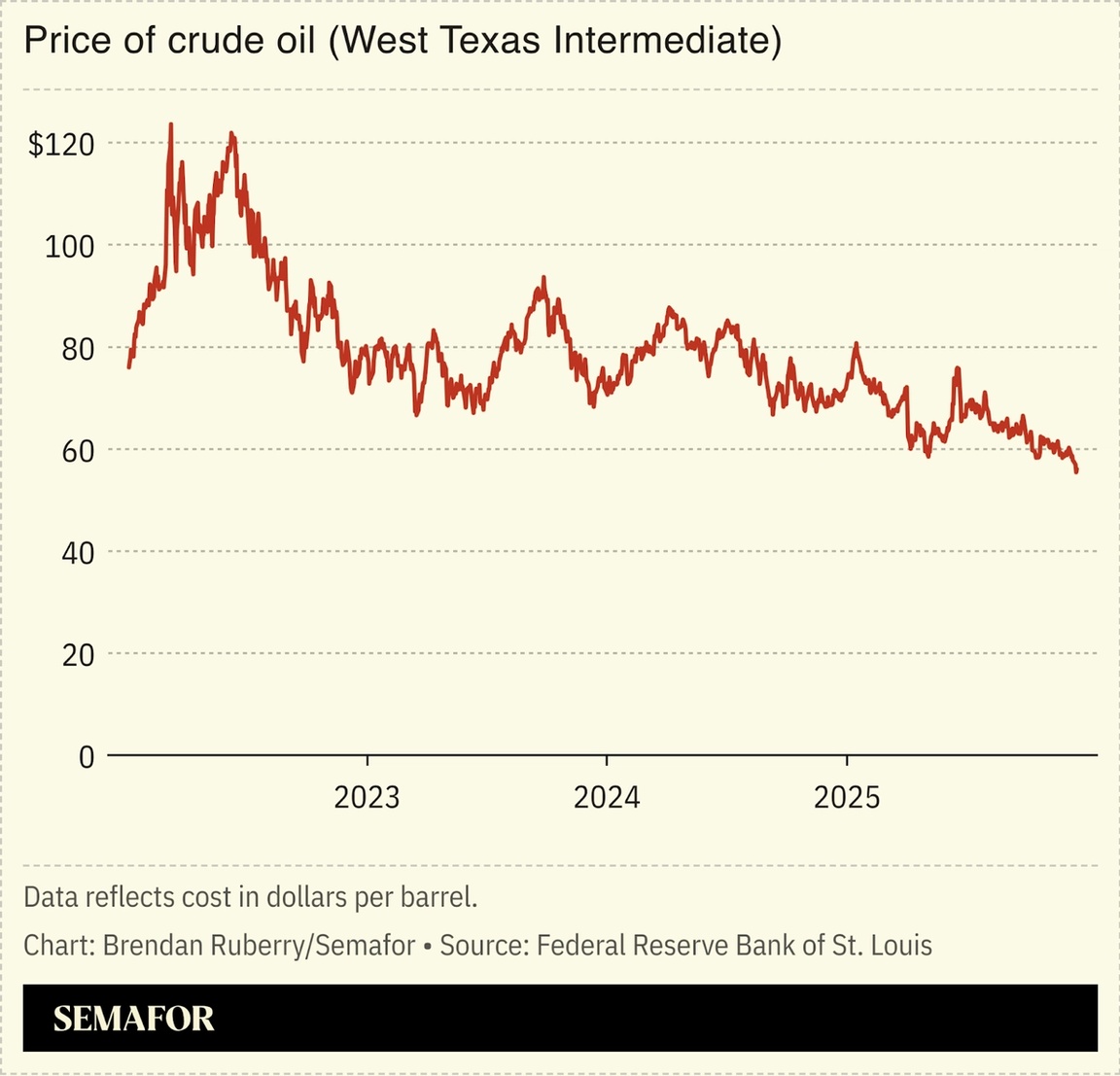

Oil slump dents Gulf IPO market |

IPOs in the Middle East fell to a post-pandemic low this year as oil prices dropped. A strong pipeline of IPOs in Gulf markets was expected at the start of 2025, led by Riyadh and fueled in part by sovereign wealth funds floating their assets. But the region’s biggest exchange in Saudi Arabia missed out on an emerging market stock rally this year as oil revenue declined; the government’s plans to trim spending and review its massive development projects also cooled investor enthusiasm. A rebound in China has pulled capital elsewhere, while a series of underwhelming debuts created “a big overhang” across the region, one banker told the Financial Times. |

|

In today’s fast-changing global environment, business leaders are responding by innovating and seizing opportunities in real time. Shifting dynamics, emerging technologies, and rising expectations demand leadership that is both decisive and forward-looking. On Tuesday, January 20, Semafor editors will sit down with global executives in Davos to discuss agility, cross-border collaboration, and bold action in the next era of business. Jan. 20 | Davos | Request Invitation |

|

Saudi presses Yemen separatists |

Fawaz Salman/Reuters Fawaz Salman/ReutersSaudi Arabia called on UAE-backed separatists in southern Yemen to withdraw from two strategic governorates they recently took over, raising the risk of a rupture within the coalition fighting Houthi rebels. The Saudi foreign ministry urged Yemen’s Southern Transitional Council to pull its forces out of Hadramout and Mahra, which border the kingdom and Oman, and hand the provinces over to a Saudi-backed group in Yemen. Separatists accused the kingdom of launching air strikes against them on Friday. The escalation risks renewing a war that has been largely dormant for almost four years and pits US allies in the Gulf against each other, according to April Longley Alley, a former adviser to the UN’s Yemen envoy. “US allies are on a collision course in Yemen,” Alley wrote for the Washington Institute for Near East Policy, adding that US President Donald Trump will likely need to engage directly to get Abu Dhabi and Riyadh on “the same page.” — Mohammed Sergie |

|

- The relationship between Saudi Arabia and the US has been “reordered.” The kingdom can now withstand prolonged “diplomatic coolness with Washington” with few consequences, writes Kuwait-based analyst Layan Mandani.

- The Gulf is betting big on LNG, just as Asian buyers find ways to use less of it. Coal and cheap renewables are becoming the default across China, India, and Southeast Asia, a shift that could leave slow demand growth, energy analyst Robin Mills writes in AGBI.

- Abu Dhabi and Dubai are the beneficiaries of a big British exodus. With a fight for talent getting tougher, EU countries must find new ways to compete, writes Bloomberg Opinion columnist Lionel Laurent.

|

|

| |