| | Beijing accuses the US of hurting India-China ties, Tesla’s stock slips over a safety probe, and a n͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - China slams Pentagon report

- Japan tourism hit by Beijing

- The US’ K-shaped economy

- Tesla stock dips over probe

- Energy as a coercive tool

- Gulf’s IPO boom fades…

- …and art market blooms

- Kenya’s CO₂ experiment

- Chips down for video games

- Christianity’s new face

Photos that capture the kitsch of the holidays, a 68-year-old film that explains US politics today, and our latest Substack Rojak. |

|

Beijing: US is hurting China-India ties |

Xi and Modi in 2024. China Daily via Reuters Xi and Modi in 2024. China Daily via ReutersBeijing accused the US of trying to jeopardize easing tensions between China and India in a bid to establish “military hegemony.” A Chinese official said Thursday that a recent Pentagon report “sows discord between China and other countries” by suggesting Beijing could use its recently improved relations with India to prevent Washington from deepening ties to New Delhi. Last year, China and India defused a yearslong standoff over their disputed border, and their leaders met this August during the Indian prime minister’s first visit to China in seven years. Beijing maintains the situation at the border “is generally stable.” Still, India is massively ramping up its military infrastructure there to deter China in a potential future conflict, The Wall Street Journal reported. |

|

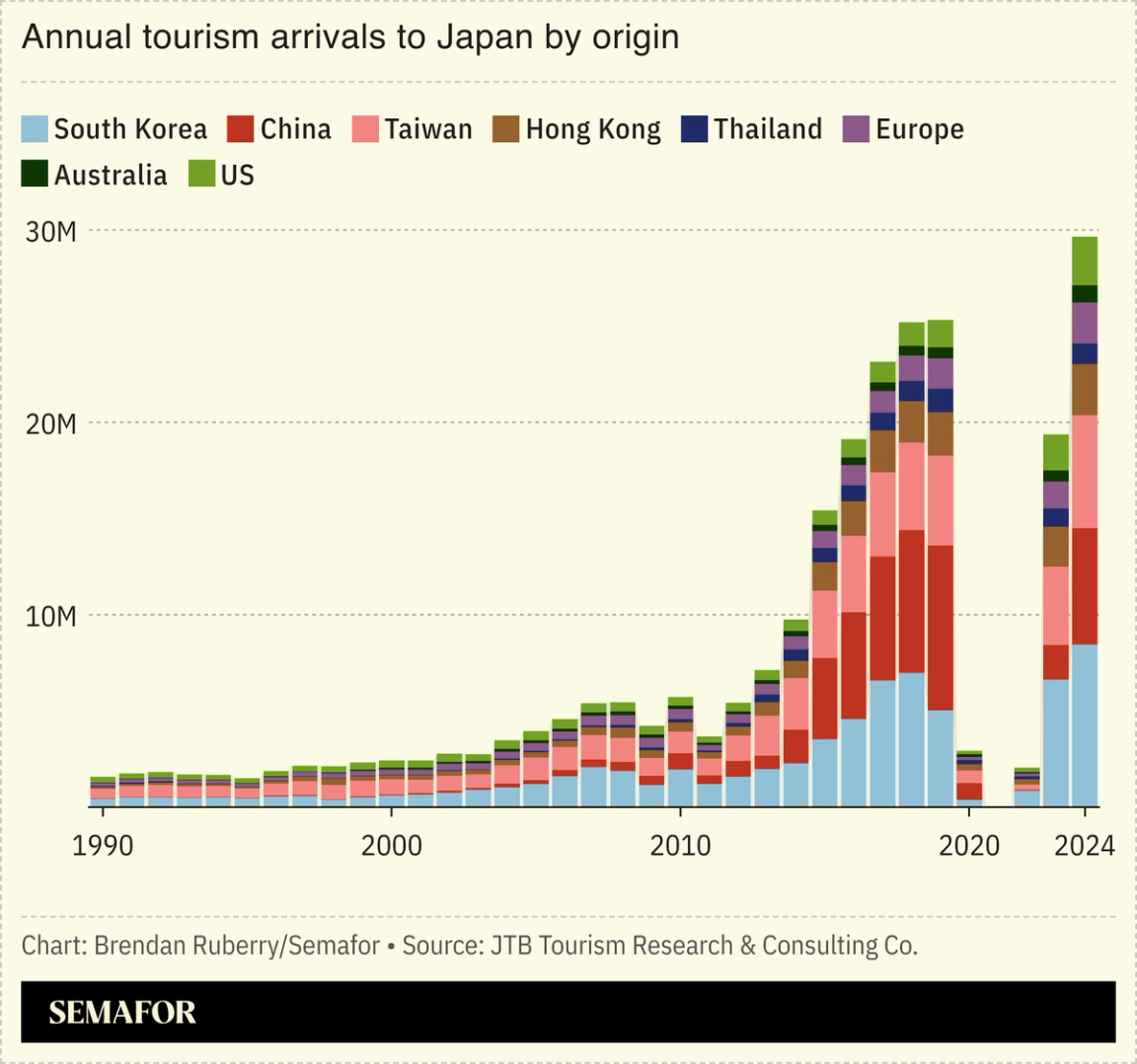

Japan tourism hit by China row |

Japan’s tourism sector is bracing for a rough holiday season as its geopolitical row with China simmers. Japanese hotels have seen cancellations, and poor sales have hammered stores; the country’s “one dragon” system that caters specifically to Chinese tourists has been particularly affected, Nikkei reported. The industry is especially worried the slowdown could drag through the Lunar New Year holiday in February, though many Hong Kong travelers are still visiting popular Japanese winter destinations like Hokkaido. China urged its citizens not to visit the country after Japanese Prime Minister Sanae Takaichi made a comment signaling support for Taiwan. Takaichi said Thursday the door remains open for communication with Beijing. |

|

Gulf in K-shaped US economy widens |

Keith Bedford/Reuters Keith Bedford/ReutersWealthy Americans and large companies are driving the country’s economic growth, furthering the K-shaped nature of post-pandemic recovery. Strong third-quarter GDP figures this week masked the reality that high-income consumers are behind much of the robust spending and wage growth, while a majority of Americans say they’re struggling with rising costs and a softening job market, Politico wrote. That divergence extends to businesses, where small firms are cutting jobs while large ones add them. “Those at the bottom can’t help but notice the overabundance above them,” said a professor who popularized the term “K-shaped.” The economic anxiety has spilled into US politics, where rising rent, energy, and grocery costs were at the heart of elections this year. |

|

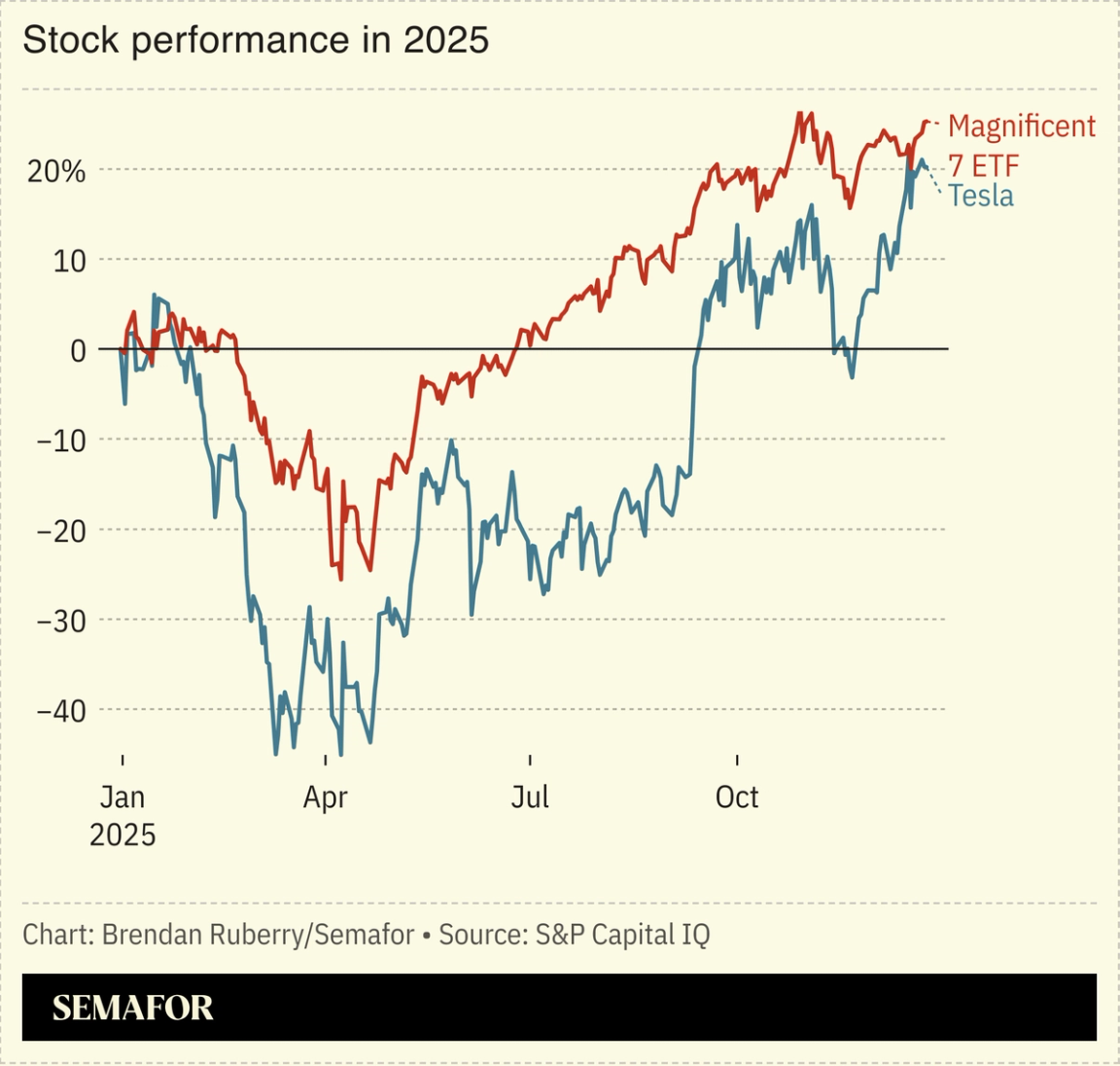

Investors prize Tesla taxis over EVs |

Tesla’s stock took a hit Wednesday after US authorities began probing the safety of the EVs’ door handles, though investors are still bullish on the company, thanks to its robotaxis. The investigation followed a Bloomberg report that found people have been injured or killed after becoming trapped in their Teslas; the automaker’s electrically powered handles can stop working after a crash. It comes amid broader struggles for the company’s core EV division, which reported falling sales this year. Still, Tesla’s stock has risen thanks to excitement over its nascent robotaxi sector, even though it has “a lot of catching up to do” as rivals like Waymo expand globally, The New York Times wrote. |

|

Nations weaponize energy again |

Alexander Ermochenko/Reuters Alexander Ermochenko/ReutersEnergy became “the most important coercive tool in global politics” in 2025, Semafor’s climate and energy editor argued. While world powers have largely avoided weaponizing energy since the disastrous Middle East oil embargoes of the 1970s, this year saw the US pressure Europe to buy more liquefied natural gas for lower tariffs and seize oil tankers near Venezuela. China, meanwhile, used its critical mineral and battery supply chains as an economic bargaining chip, and Russia and Ukraine targeted each other’s energy infrastructure. One reason for the shift is “changing perceptions of scarcity,” Tim McDonnell wrote. Oil is cheap, making it less risky for the US to go after adversaries’ operations. Electricity is instead seen as the more precious commodity. |

|

IPOs in the Middle East fell to a post-pandemic low this year as oil prices dropped, pressuring Saudi Arabia’s economy. A strong pipeline of IPOs in Gulf markets was expected at the start of 2025, led by Riyadh and fueled in part by sovereign wealth funds floating their assets. But the kingdom missed out on an emerging market stock rally this year as fuel revenues declined; the government’s plans to trim spending and review its massive development projects also cooled investor enthusiasm. A rebound in China has pulled capital elsewhere, while a series of underwhelming debuts created “a big overhang” across the region, one banker told the Financial Times. |

|

Art market shifts east amid volatility |

Amal Alhasan/Getty Images for Sotheby’s Amal Alhasan/Getty Images for Sotheby’sThis year’s art market was defined by volatility, retrenchment, and closures. “The art market stopped making sense” in 2025, as global economic turbulence made for both feast and famine, ARTnews wrote: A half-dozen top galleries closed in London, New York, and Hong Kong, and buyers hedged toward Modernist masterpieces by artists like Frida Kahlo and Gustav Klimt, which “in this economy [is] like buying the S&P 500,” one dealer said. Meanwhile, as “the stability… of the West has been called into question, the Gulf has emerged as the key driver of new business,” The Art Newspaper reported: Sotheby’s held its first Saudi Arabia auction, and Frieze and Art Basel opened spaces in Doha and Abu Dhabi. |

|

On Tuesday, Jan. 20, Bridgewater Associates Founder Ray Dalio will join Semafor for The CEO Signal Exchange: Achieving the AI Advantage in Davos. As AI continues to shape the modern enterprise, business leaders are confronting new questions about how to translate technological promise into measurable performance. Semafor editors will speak with senior executives, including Bank of America CEO Brian Moynihan, to examine how companies are applying AI to drive growth, gain competitive advantage, and remain competitive in the next era of global business. Jan. 20 | Davos | Request Invitation |

|

Kenya’s carbon capture experiment |

Eric Lafforgue/Art in All of Us/Corbis via Getty Images Eric Lafforgue/Art in All of Us/Corbis via Getty ImagesAn experiment in Kenya’s Great Rift Valley is testing whether scientists can efficiently remove carbon dioxide from the air. A startup is using excess energy from geothermal facilities to power machines that pull CO₂ from the atmosphere. Experts say the process, known as “direct air capture,” could be a useful tool to combat climate change by extracting past emissions. The world’s largest DAC plant started up in Iceland last year. But scalability remains a challenge; the tech “seems always on the verge of kicking in but never does,” MIT Technology Review wrote. “You need billions of dollars of investment in it, and it’s not delivering, and it’s not going to deliver anytime soon,” a Tunisian economist said. |

|

Spending on video game hardware falls |

The video game industry is having a rough time, with data centers’ demand for chips sending prices up. US spending on hardware fell 27% year-on-year in November to $695 million, a 20-year low, and unit sales plummeted to their lowest since 1995. Average prices for gaming models are at all-time highs despite the latest Xbox and PlayStation consoles being five years old. Sales of games are down too, with even the mega-popular Call of Duty franchise seeing a double-digit drop year-on-year, The Verge reported. The situation is unlikely to improve: Nvidia reportedly plans to cut production of its GeForce gaming chips by 30-40% next year, as it reallocates resources toward higher-margin products, including data center GPUs. |

|

The new face of the Church of Norway |

|

|