| | In this edition: Trade wars, the mother of all bubbles, seismic shifts in China and the Gulf, Europe͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

Merry Christmas! As a startup, we like to think we’ve brought some innovation to the news business. But some things can’t be reinvented and the year-end review is one of them. So here’s our list of the biggest business and finance stories of 2025 — the wildest of my 15 years on the beat. And it’s hard not to feel like it’s the prelude to something, not the peak of anything. - The bubble is here

- State capitalism

- Casino economy

- The Gulf grows up

- Europe’s big moment

- Millionaire ennui

- China’s equalizer

- Media mayhem

- Revenge of the ex

Next week, we’ll look ahead to 2026. But for now, let me thank you for reading and for helping us make sense of these stories. You shared your expertise, tips, and feedback as we continue to build Semafor into a newsroom fit for this strange and fast-changing moment in the global economy. |

|

➚ BUY: Gold. Bullion hit an all-time high this week, cracking $4,500 an ounce. It’ll cost you a bit more at Costco, but there is, naturally, a credit-card-points arbitrage trade. ➘ SELL: Frankincense. Overharvesting is putting the world’s supply of the resin-bearing trees — and the livelihood of African farmers who rely on them — at risk, the BBC reports. |

|

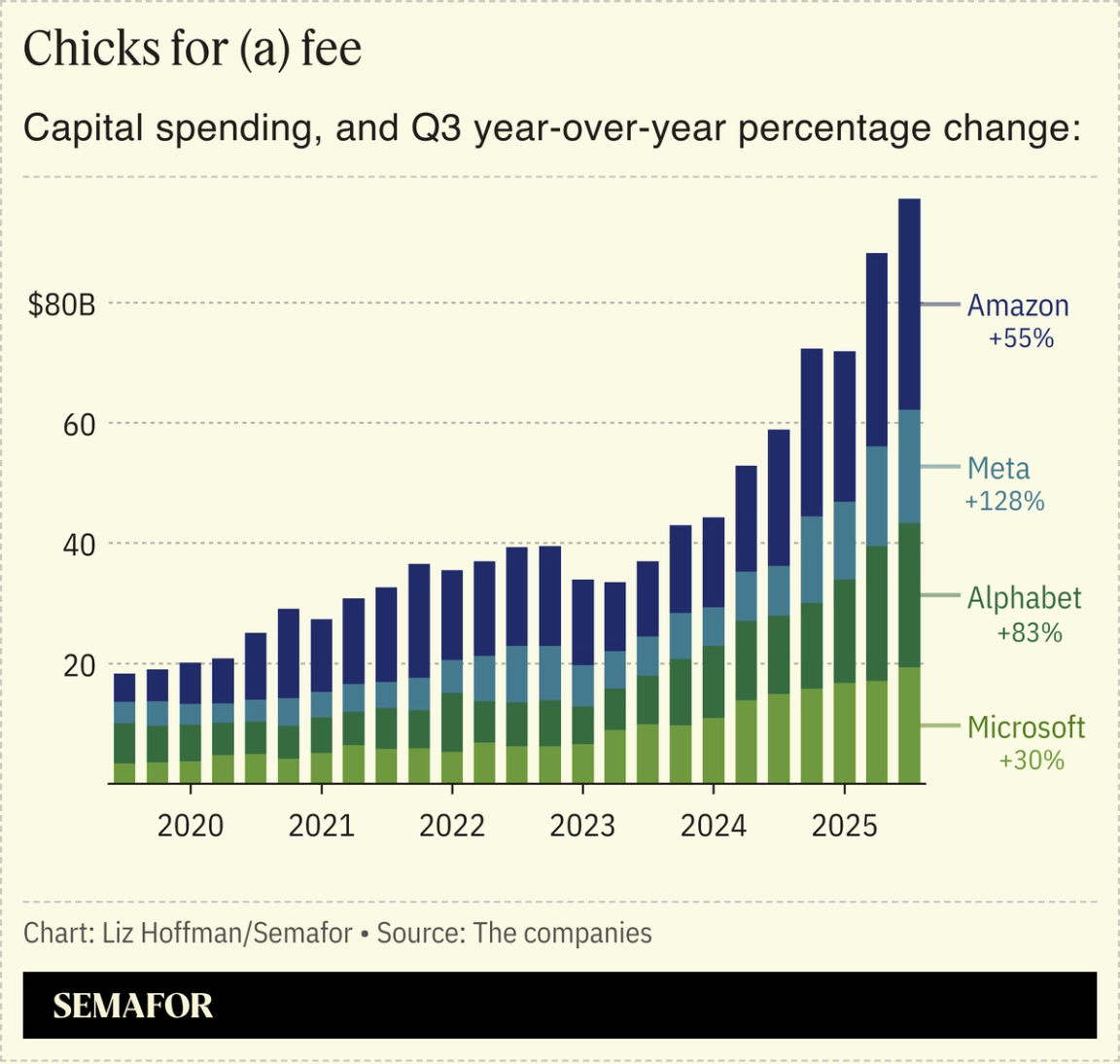

The fastest-hardening cement in business this year was around the certainty of an AI bubble and the damage that will ensue when it bursts. Big tech companies spent more than $400 billion on AI, a number Bloomberg analysts expect to hit $630 billion next year. Investors are already souring on the industry’s perceived weak links, Oracle and CoreWeave, and debt is creeping in at every level. Lamentable public performances by the industry’s frontmen aren’t inspiring confidence. The big question is where the value AI creates will accrue. For now, it is with the developers of large language models. But past booms show the long-term winners will be upstream (the “picks and shovels” purveyors) and downstream (makers of applications to translate LLMs into profitable enterprises). Shares of electric utility Constellation, which has gone all-in on powering data centers, handily beat Nvidia’s this year. |

|

The White House muscles in |

Laure Andrillon/File Photo/Reuters Laure Andrillon/File Photo/ReutersPresident Donald Trump’s tariffs were either a needed corrective to years of doormat trade policy or an unnecessary and market-warping tax on Americans. What they weren’t, to the surprise of many economists and investors, was an economic disaster. Businesses adapted, prices rose a bit, and executives, correctly reading the room, scrambled to recast their priorities as national security. “Liberation Day” was the opening salvo of a wholesale rewriting of US economic policy that saw the government direct state resources toward both crucial national industries and sideshows that enriched the president’s inner circle. Both Republicans and Democrats are now in the business of picking winners and losers, pushing the US toward a state-run model that other countries, notably in Asia and the Middle East, are shifting away from. |

|

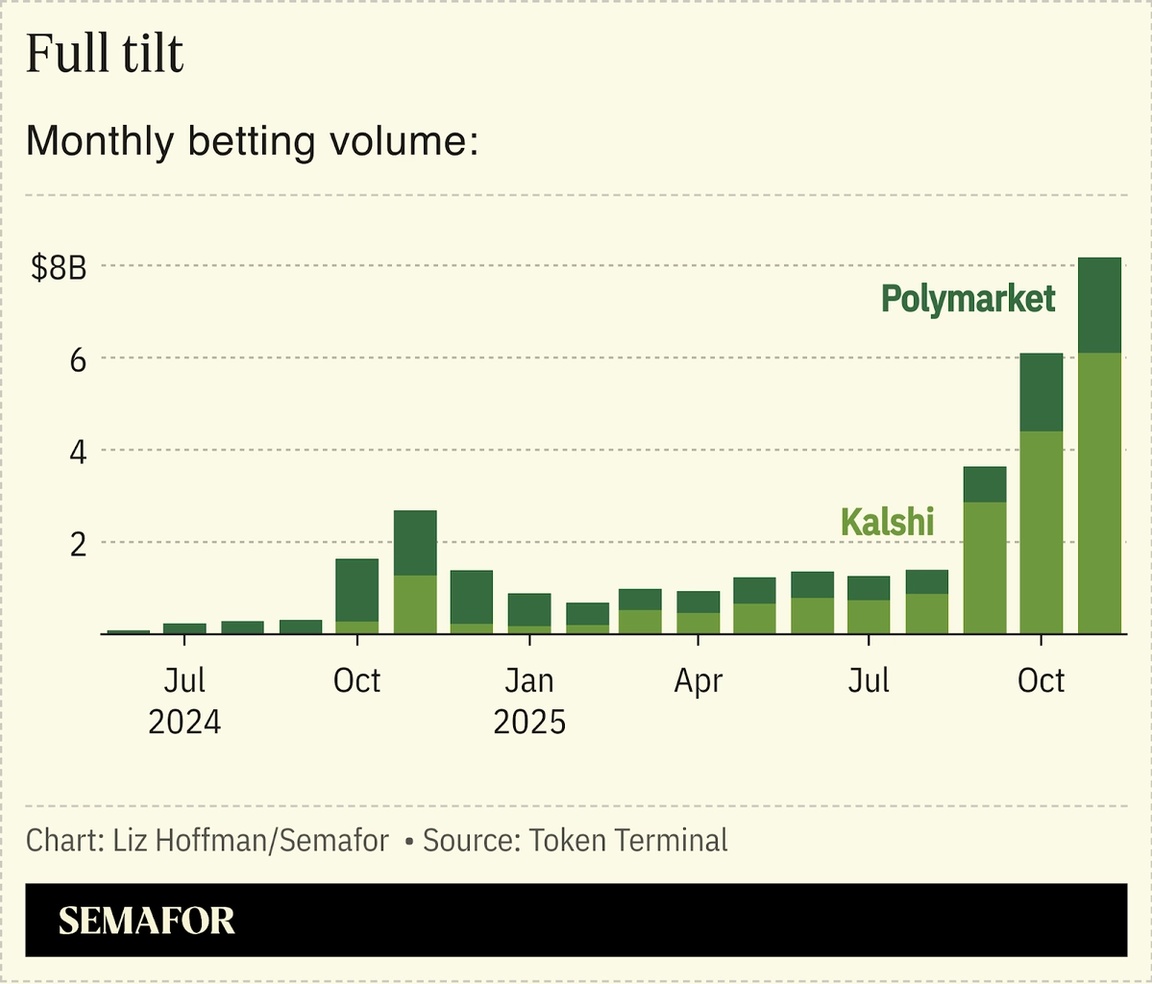

Prediction markets’ origin story may be the 2024 presidential election, when they foresaw Trump’s win, but they came of age in 2025. The 2010s unicorn bubble and the pandemic’s froth showed the economy’s casino stirrings; Kalshi and Polymarket are purer expressions of those impulses, divorced from any pretenses of economic activity. Regulation has been slow to catch up because these sites weren’t open to US investors. That changed this year, and there are already signs that prediction markets will be subsumed into traditional finance: NYSE invested $2 billion in Polymarket in October, when the exchange’s president told Semafor clearer rules of the road were needed for the sake of “sanity.” |

|

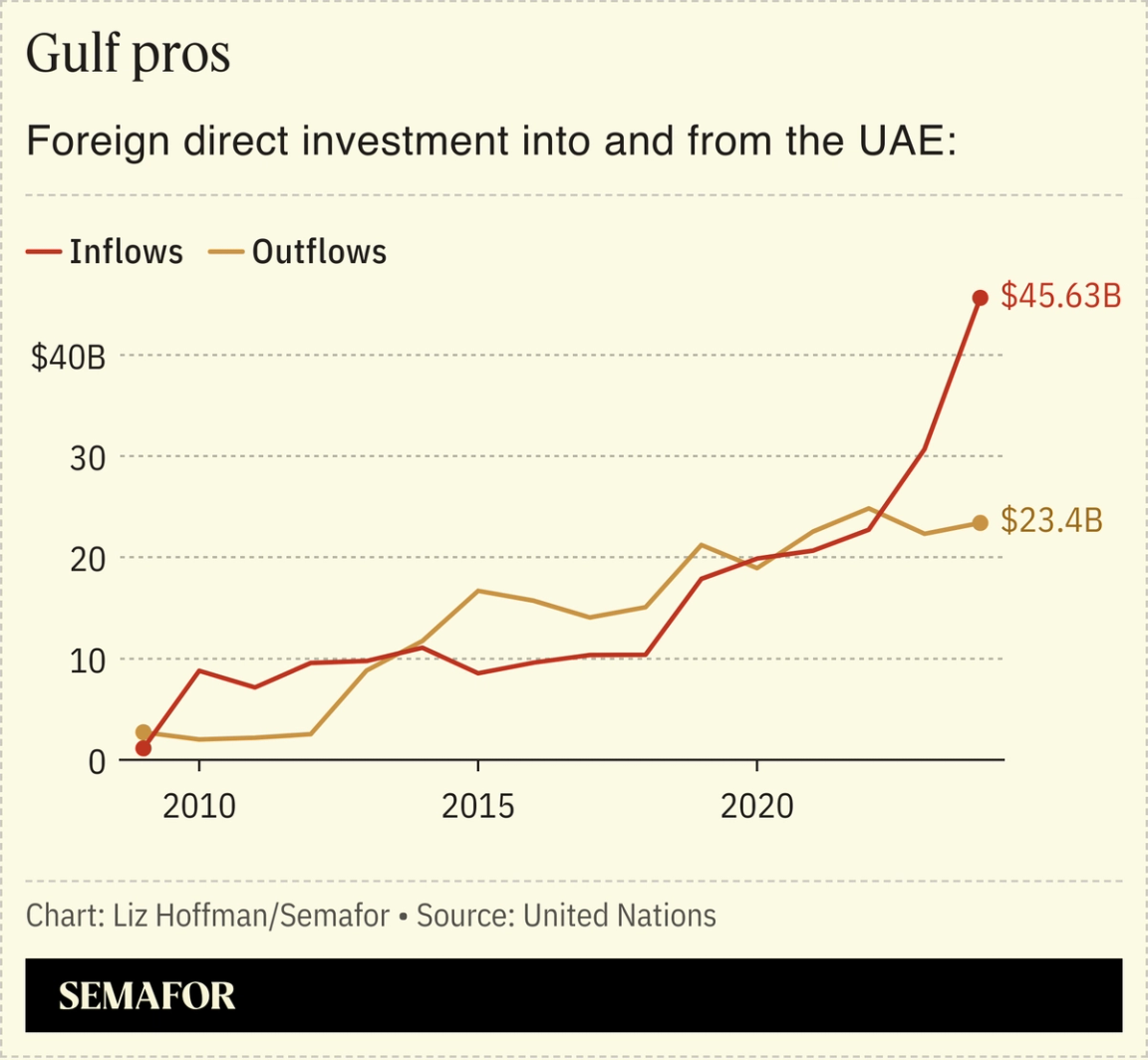

Gulf governments finally shed their image as the world’s ATM, a shift driven by low oil prices and the need to invest back home in tech, tourism, and entertainment (which, in the thinking of the region’s economic planners, may be the only thing left when AI pushes us all toward the top of Maslow’s Hierarchy). Saudi Arabia’s giant Public Investment Fund shifted its spending toward domestic projects and scrapped their most futuristic elements in favor of more achievable, profitable goals. At a Saudi-US Investment Forum hosted by the Trump administration in November, most of the deals ran in one direction: toward Riyadh. Wall Street firms coming to the region to fundraise will still find cash available, but it increasingly comes with demands to invest on the ground. Western asset managers “used to end the meeting with ‘this is how much we expect from you,’” Khaled Al-Marri, an executive at Abu Dhabi’s government-backed Mubadala, told Liz recently. Now, he said, “we are co-architects of deals together.” |

|

Semafor is heading to Davos — where global leaders converge to strike deals, posture, and if we’re being honest, schmooze. Semafor will bring you the big ideas and behind-the-scenes chatter from the global village in Semafor Davos, your must-read guide. Get the insider’s guide — subscribe to Semafor Davos. |

|

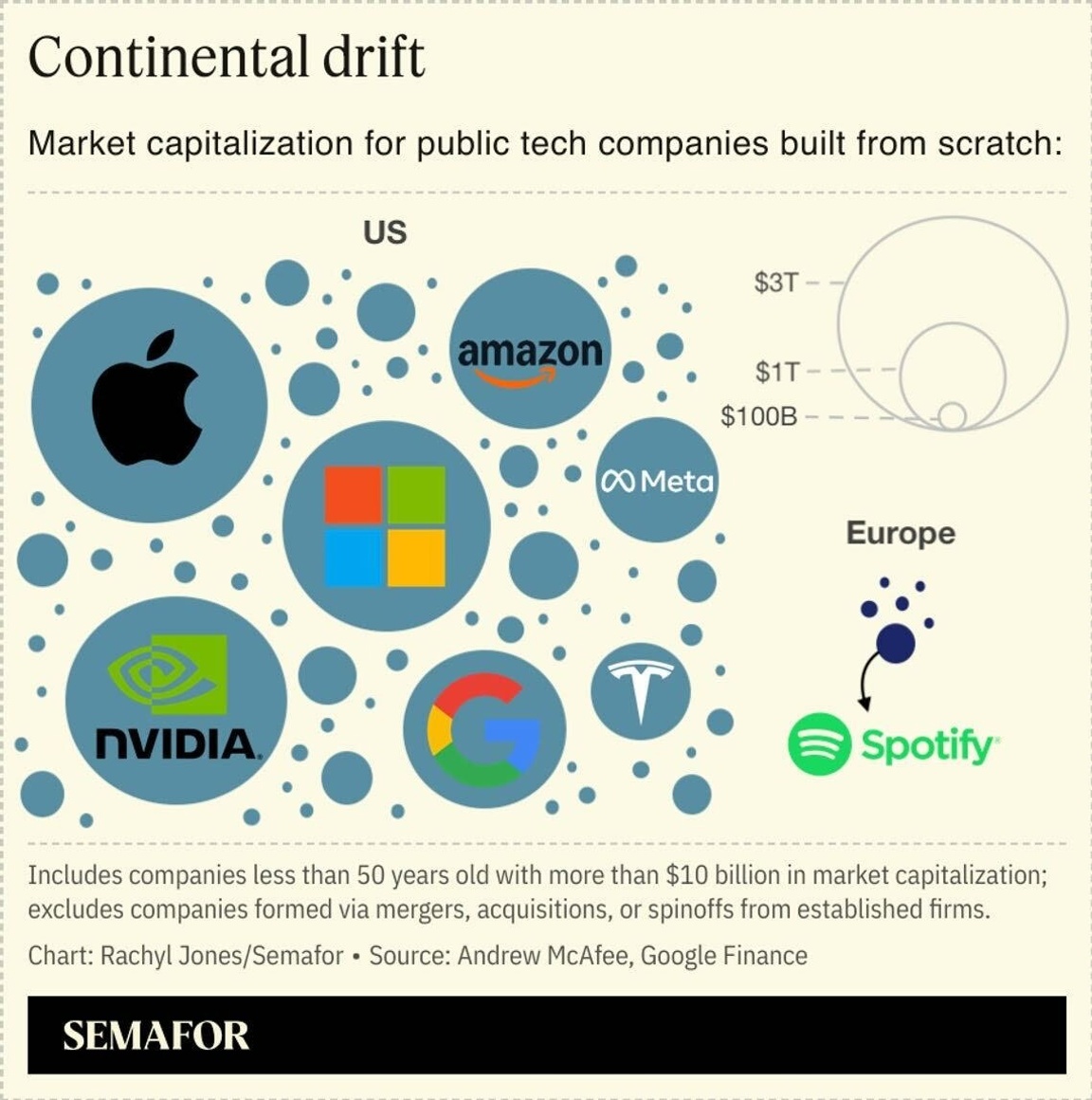

Europe squanders its big moment |

Europe spent 2025 in economic purgatory. The continent seized the opportunity offered by Trump’s trade war to find the outlines of an industrial policy, and the bloc’s economy is on course for slightly higher-than-expected growth. But governments collapsed in France, Germany, and the Netherlands, which set back economic agendas, sent borrowing costs soaring, and stalled the kind of continental financial cohesion Europe needs to catch up in the tech race. Meanwhile, the UK — where the Starmer government barely avoided a Liz Truss-style mini-budget crisis — is losing its corporate champions. “The first hurdle is to prove we can have political stability,” France’s new finance minister, its third in just over a year, told Liz during a November goodwill tour of Wall Street. “Then it’s all about the economy.” |

|

The capital class, outside looking in |

Kylie Cooper/Reuters Kylie Cooper/ReutersThe merely millionaire set squeezed between modern oligarchs and a powerful populist movement lost its clout in 2025. Their money failed to stop Zohran Mamdani from becoming mayor of New York. And the knuckling under of Wall Street law firms to Trump captured the diminished power of Rockefeller Republicans who became, without a lot of drama, Clinton and then Obama Democrats, and now find themselves politically homeless. Traditional lobbying also proved powerless in the face of MAGA whisperers and the rise of crypto, whose success in Washington prompted the country’s biggest banks to rethink their influence playbook. |

|

Dado Ruvic/Illustration/Reuters Dado Ruvic/Illustration/ReutersChina is now America’s peer. Beijing not only soaked up the punishment in the form of tariffs, sanctions, and technology export controls, but pushed back with its own parallel regime of coercion while accelerating its drive for technological self-sufficiency. The Chinese startup DeepSeek shocked Silicon Valley with its own AI model, CATL unveiled a battery that delivers a 320-mile range on a five-minute charge, and Huawei forged ahead in chip manufacturing. Treasury Secretary Scott Bessent’s post-“Liberation Day” comment that Beijing was “playing with a pair of twos” proved to be disastrously wrong. President Xi Jinping’s ace card — weaponizing control over rare earths and magnets — undercut the US strategy of containment aimed at holding back China’s economic advance. When Trump meets Xi in Beijing in April, it will be a meeting of equals. — Andy Browne |

|

Media companies pick up sticks |

Mike Blake/Reuters Mike Blake/ReutersThe media industry split, splintered, and began a messy rebundling. Some of the tumult stems from the era’s chief programmer, Trump, whose influence was evident in Disney’s decision to briefly pull Jimmy Kimmel off the air and the new direction of CBS. News businesses like MSNBC and CNN — blips on the bottom line but lightning rods for controversy — are being spun off, leaving their corporate owners free to make movies and run theme parks. But changing viewer habits and investor preferences are perhaps the more durable forces reshaping New York and Hollywood. Netflix, which dominated streaming without owning a legacy studio, agreed to buy Warner’s, which is jettisoning its melting-ice-cube cable channels. The rise of long-form podcasts is a counterpoint to the narrative of diminishing attention spans, which Ken Burns doesn’t buy anyway, and a challenge to CEOs trained on earnings scripts and controlled broadcast hits. Plus, everything is TV now. |

|

|