| | One of the year’s biggest surprises was the reemergence of energy a tool of political coercion. ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

Today is a day for surprises, so I’ll share one I’ve been thinking about this year, although it’s not very jolly: In 2025, energy reemerged as the most important coercive tool in global politics. I wasn’t surprised to see the Trump administration go after renewables; anti-green animus is apparently still strong enough to withstand all economic arguments to the contrary. But I was surprised at the extent to which the administration sought to pull strings in the global fossil fuel trade in service of its political and trade agendas: Pressuring Europe to buy more LNG in exchange for friendlier tariffs, imposing harsher sanctions on Russian oil companies, commandeering oil tankers near Venezuela, are all examples of the new energy “dominance” paradigm that’s a departure from the status quo of recent years. As Jason Bordoff and Meghan O’Sullivan, two of the foremost experts on energy geopolitics, recently observed in Foreign Affairs, since the disastrous Middle East oil embargoes of the 1970s, energy has rarely been weaponized for geopolitical gain. Governments were happier to build productive energy trade relationships, let the market do its thing, not intervene very much, and resolve disputes through other means. That has certainly changed now, whether you look at the White House, China’s skillful manipulation of critical mineral and battery supply chains, or the tit-for-tat devastation of energy infrastructure by Russia and Ukraine (the blackouts here in Kyiv have been bad enough, but now we’re bracing for more attacks on the gas network and dangerous cuts to heating). Why is this all happening now? One reason is changing perceptions of scarcity. Former US President Joe Biden was more reluctant to target adversaries’ oil operations because oil was expensive; sanctions and seized tankers would make it more so. Now oil is cheap, in fact seeing the steepest annual price decline since the pandemic, and the market has basically shrugged off everything Trump has done. Instead, now electricity is perceived as the more expensive commodity. That gives China enormous leverage. Closer to home, this shift has also allowed Democrats to weaponize energy affordability against Trump. Relatedly, I was also surprised by the speed at which climate policy fell off so many politicians’ radars this year. It was easier to talk about bold plans to cut emissions when energy generally felt more abundant. Now, even for Europe, cutting fossil fuels and aggressively leaning into China-dominated clean energy supply chains both look less feasible. We’re in for more curveballs this year; as analyst Amena Bakr argued in Semafor this week, oil prices are likely due for an upswing as underinvestment in drilling catches up to persistent demand. It will be fascinating to see how that changes the political calculus. That’s a problem for another day — now, I’m off to figure out how to make Christmas dinner without an oven. Wish me luck! Happy holidays. |

|

Qatar awards $4B gas contract |

A view of Golden Pass LNG facility in Texas. Joel Angel Juarez/Reuters. A view of Golden Pass LNG facility in Texas. Joel Angel Juarez/Reuters.QatarEnergy LNG has awarded a $4 billion contract to an Italian-Chinese group for work on the North Field, the world’s largest non-associated natural gas reserve — the latest step in a push to double output of the country’s liquefied natural gas (LNG) output. The engineering, procurement, construction, and installation contract will take five years to complete. Italian energy services company Saipem will take on the majority of the work, worth $3.1 billion, alongside partner China’s Offshore Oil Engineering Co. Qatar plans to boost its production from 77 million tons a year now to 142 million tons by 2030, along with a further 16 million tons from the Golden Pass LNG project in Texas. Adding to its strong market presence, it is also trading increasing amounts of non-Qatari LNG. |

|

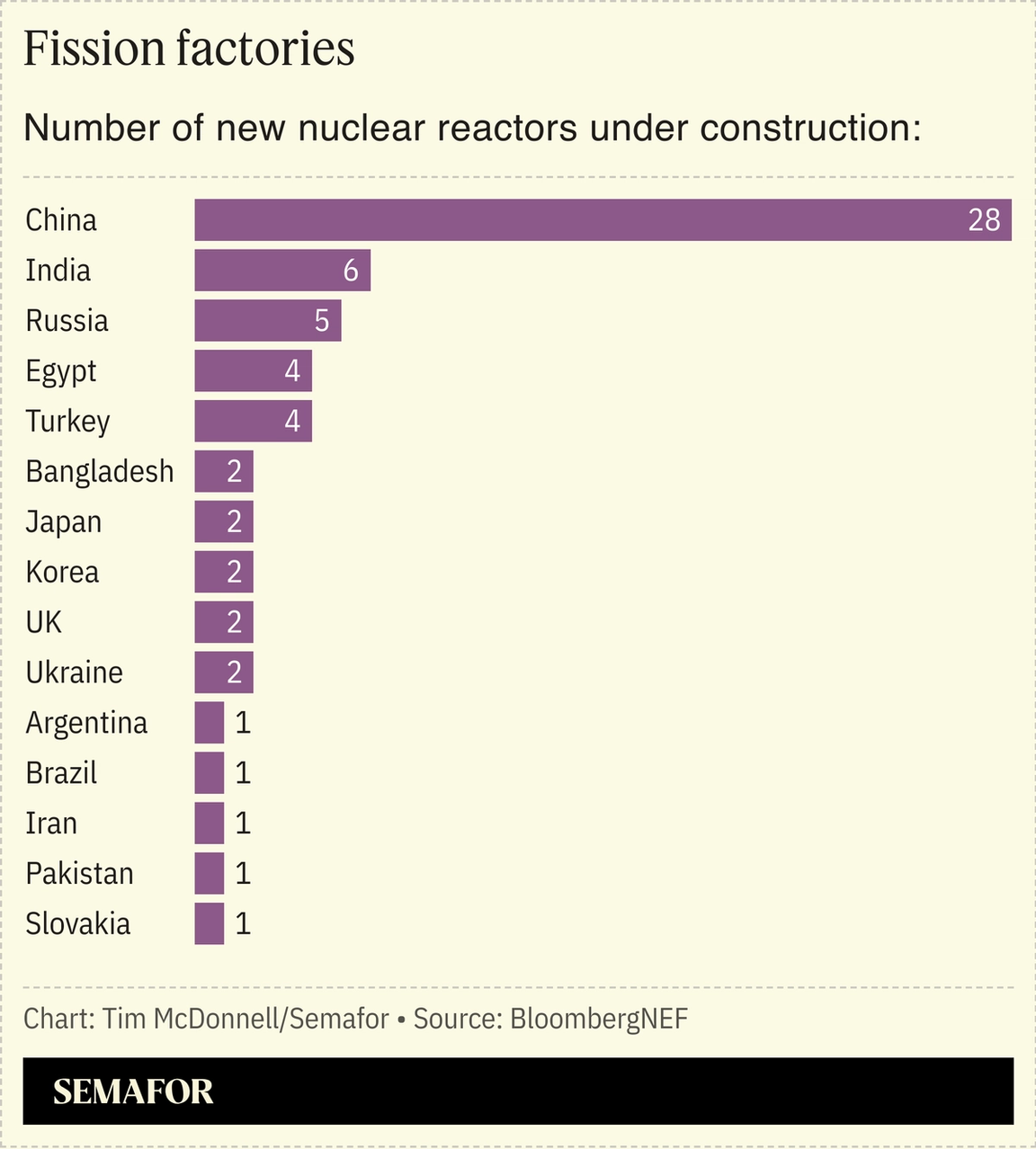

China dominates nuclear construction |

China dominates global construction of new nuclear power plants, hosting nearly half of the reactors currently under construction, according to a BloombergNEF report. Although nuclear power gained political traction, and many nuclear-focused utilities and startups raised money and signed large delivery contracts, in 2025 global retirements of old nuclear plants outpaced new reactors coming online, by about 1 gigawatt. But that trend is expected to reverse next year, BloombergNEF forecast, with 15 new reactors due to connect to the grid. In the AI race, nuclear power has some advantages that make it tempting to tech companies, including its low carbon emissions and round-the-clock generating ability. But it remains plagued by high costs and slow construction, challenges the industry will need to overcome to play a more substantive role in the future energy mix. |

|

Recommending reads about China |

Stanford University Press/W. W. Norton & Co./Scribner Stanford University Press/W. W. Norton & Co./ScribnerThree in-depth reads on China’s sprawling tech and manufacturing sector topped an inaugural poll of the year’s best China-related books. In a survey of 51 leading sinologists conducted by Semafor’s Andy Browne, some of the top finishers were Patrick McGee’s Apple in China, which charts the company’s deepening relationship and ultimate dependence on China; Dan Wang’s Breakneck, which has driven conversation in Washington and elsewhere by synthesizing the US-China tech race; and Eva Dou’s House of Huawei, which follows the Chinese company’s journey since its founding. The list also includes a biography of Xi Jinping’s father and a book on an American war hero who was once embedded with Mao Zedong’s guerrillas. Read the rest of the list here, and sign up for our forthcoming China briefing for more on how the second-biggest global economy is reshaping the world around it. → |

|

|

Henning Gloystein is the managing director for energy, climate & resources at Eurasia Group.  |

|

| |