| | Qatar backs a London asset manager, Abu Dhabi blockchain project expands in Africa, and a big fine f͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Qatar backs asset manager…

- …and awards gas contract

- UAE blockchain in Africa

- Gulf carriers need planes

- UAE fines for AI ‘slop’

This week in Gulf history: a joint defense plan takes shape. |

|

QIA backs Janus Henderson takeover |

Mahmud Hams/AFP via Getty Mahmud Hams/AFP via GettyQatar’s sovereign wealth fund — along with investors led by billionaire Nelson Peltz’s Trian and General Catalyst — backed the $7.4 billion takeover of asset manager Janus Henderson. The deal is expected to close in mid-2026. Janus Henderson, with main hubs in Denver and London, manages about $485 billion. Not content with simply putting money into foreign funds, Gulf sovereign investors have increasingly looked to bet on some of the world’s biggest asset managers directly, or develop partnerships that allow them to deploy more capital into specific regions or asset classes. This year, QIA’s acquisition of a 10% stake in China Asset Management Co, the country’s second largest mutual fund company, was approved, and the fund also holds a stake in BlackRock, along with sovereign funds of Abu Dhabi, Kuwait, and Saudi Arabia. The latest deal caps a busy few months for QIA, which is expected to become increasingly active as Qatar’s North Field gas expansion begins production in 2026 and leaves the country with large budget surpluses to invest. In recent weeks, the fund has announced a $20 billion partnership with Brookfield to invest in artificial intelligence infrastructure in Qatar and select other countries, and committed $1 billion to Japanese private equity deals with ORIX, one of Japan’s biggest financial services firms. — Matthew Martin |

|

Qatar awards $4B gas deal |

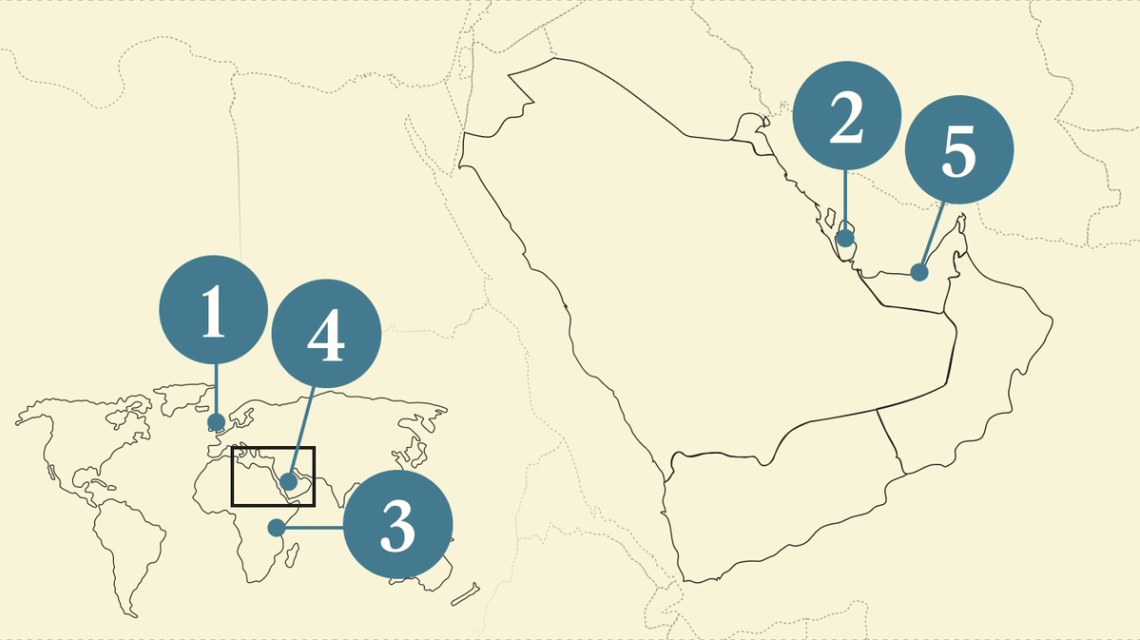

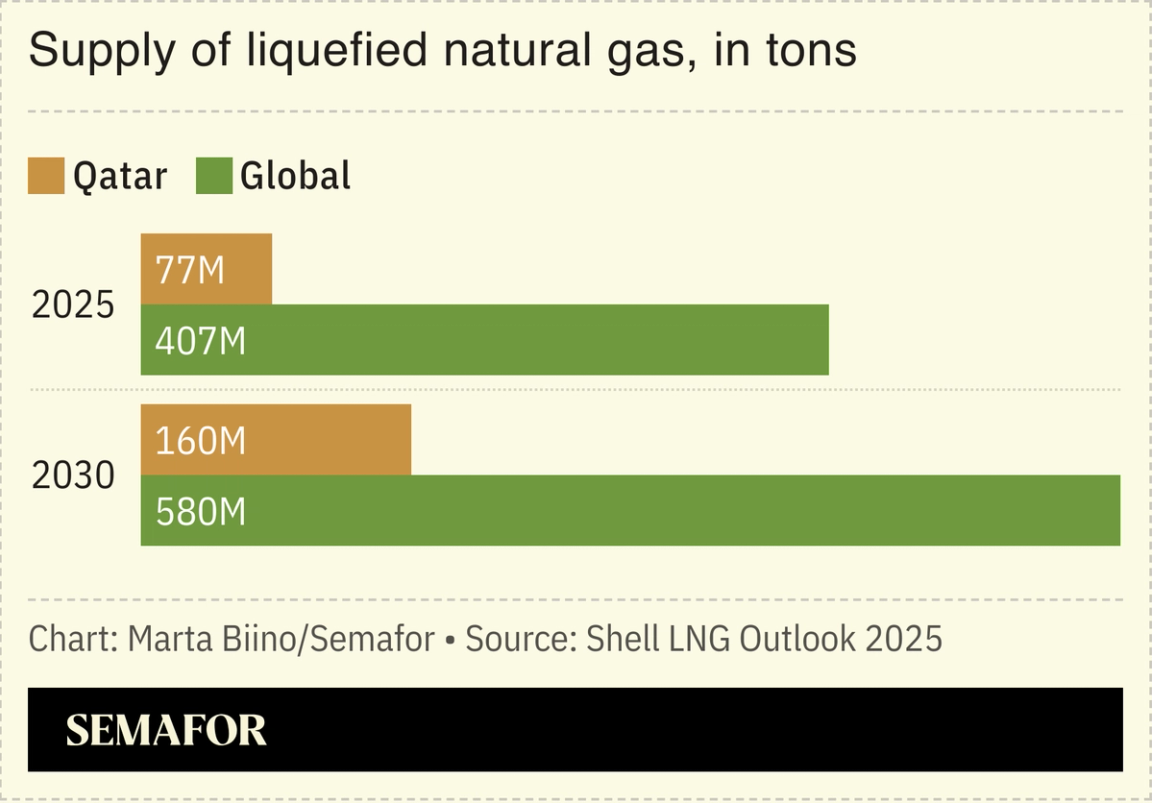

QatarEnergy LNG has awarded a $4 billion contract to an Italian-Chinese group for work on the North Field, the world’s largest non-associated natural gas reserve — the latest step in a push to almost double the country’s liquefied natural gas (LNG) output. The engineering, procurement, construction, and installation contract will take five years to complete. Italian energy services company Saipem will take on the majority of the work, worth $3.1 billion, alongside China’s Offshore Oil Engineering Co. Qatar plans to boost its production from 77 million tons a year now to 142 million tons by 2030, along with a further 18 million tons from the Golden Pass LNG project in Texas. Adding to its strong market presence, it is also trading increasing amounts of non-Qatari LNG. |

|

UAE blockchain firm inks M-Pesa deal |

Seun Sanni/Reuters Seun Sanni/ReutersAn Abu Dhabi-based financial technology initiative plans to extend its blockchain technology to millions of Africans through a partnership with mobile money platform M-Pesa, one of the executives leading the project told Semafor. The ADI Foundation, which is backed by the digital arm of a $240 billion conglomerate chaired by the UAE president’s brother, aims to bring 1 billion people onto its blockchain, ADI Chain, by 2030. Huy Nguyen Trieu, council member on the ADI Foundation’s board of advisers, said he wanted a “large proportion” of ADI Chain users to be in Africa. He said a memorandum of understanding agreed with M-Pesa this month was part of a drive to scale-up ADI Chain access. M-Pesa — used to transfer money and pay for goods — has more than 60 million monthly users across eight African countries. The agreement marks the latest step in Abu Dhabi’s efforts to bolster ties between the Gulf and Africa. The UAE, one of the biggest investors in Africa, recently said its total investments in the continent totalled over $118 billion between 2020 and 2024. Last month, it said it will invest $1 billion to expand AI infrastructure and services across Africa. — Alexis Akwagyiram |

|

Gulf airlines soar, jets lag behind |

Benoit Tessier/Reuters Benoit Tessier/ReutersGulf airlines are the most profitable in the world, but their supply of jets may be about to stall. More than a fifth of expected aircraft deliveries from Airbus and Boeing could be delayed due to backlogs, production bottlenecks, and certification issues, AGBI reported. Emirates, the region’s biggest buyer, has 280 Boeing 777s on order, including freighters. Rapid expansion by Gulf carriers — and the launch of newcomers like Riyadh Air — is driving economic diversification away from oil. Qatar Airways and Emirates are among the largest employers in Doha and Dubai, with Emirates estimating that aviation contributes more than a third of Dubai’s economy. |

|

AI decision in Abu Dhabi court |

The fine issued by an Abu Dhabi judge to lawyers using AI slop. It was UAE’s most explicit decision yet on the misuse of artificial intelligence in legal practice, and the first ruling of its kind in the country. (Courts from New York to Australia have penalized chatbot-reliant lawyers). The ADGM Court of First Instance held the law firm’s lawyers responsible: The “fault for reliance on AI ‘hallucinations’… lies not with the research program used but with the person responsible for conducting the search,” calling the failure to verify AI-generated content “reckless,” Enterprise News reported. — Kelsey Warner |

|

Join us on the promenade for another year of world-class live journalism. Semafor editors will host on-the-record conversations with industry leaders, delivering clear insight into the forces reshaping business, technology, and geopolitics. |

|

Art- Fine art sales were down nearly 10% this year, but the Gulf could give the market a lift in 2026. Art Basel lands in Doha, Frieze debuts in Abu Dhabi, and Art Dubai returns, meaning the industry’s bigwigs are almost certain to make at least one stop in the region next year. — artnet

Crime- Saudi Arabia has executed at least 347 people so far in 2025, more than any year on record, according to UK-based campaign group Reprieve. The majority were for non-lethal drug offenses. — BBC

- Several top-ranking government and military officials who served under the Assad regime in Syria are living in the UAE. The sanctioned figures are said to have agreed to keep a low profile to stay in the emirates. — The New York Times

Gambling- UAE regulators have called for better coordination between the General Commercial Gaming Regulatory Authority and other organizations, to tackle the risk of money laundering and other financial crimes in the country’s nascent gambling industry. It is one of several recommendations in a new policy paper, alongside enhanced due diligence of customers and regular sectoral risk assessments. — AGBI

|

|

| This Week in Gulf History |

Saudi Press Agency via Reuters Saudi Press Agency via ReutersTwelve years ago, Gulf leaders gathered in Kuwait to lay the groundwork for a unified military command and a new security academy in Abu Dhabi. Analysts at the time viewed it as a leap forward for Gulf integration. But Oman quickly distanced itself, and the bloc diverged on how to approach Iran, Syria, and even relations among its own members, culminating in Bahrain, Saudi Arabia, and the UAE’s embargo of Qatar. All countries continued to build up their militaries, becoming among the world’s biggest arms buyers. The internal rift was healed, and after Iran’s and Israel’s attacks on Qatar this year, the 2013 framework was dusted off and used as the basis for regional coordination. Gulf defense ministers met in Doha in September and agreed to activate regional deterrence plans, giving teeth to the agreement. |

|

|