| | In today’s edition: Expanded ambition for a UAE smelter in the US, job postings go up for bartenders͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Saudi borrows to develop

- Mubadala’s private credit play

- UAE eyes US smelter backers

- Bartenders wanted in Riyadh

- Museum consultant boom

An expanded single-use plastic ban is good news for UAE camels. |

|

Saudi development fund plans bond debut |

An entrepreneurship event hosted by the Cultural Development Fund. cdf_sa/instagram. An entrepreneurship event hosted by the Cultural Development Fund. cdf_sa/instagram.Saudi Arabia’s National Development Fund (NDF) will start issuing bonds in the next two years, adding to a wave of debt issuance that is making the kingdom one of the biggest emerging market borrowers. The fund is preparing to obtain a formal credit rating and could begin selling bonds within 24 months, Governor Stephen Groff told Semafor in an interview. NDF oversees $430 billion in capital across a network of 12 funds and banks and aims to support the kingdom’s “economy of today,” Groff said, adding “we want to leverage our capital, not just spend it.” The fund was set up in 2017, bringing together legacy financing programs spanning industry, agriculture, and social development. Its mandate overlaps with the Public Investment Fund and the two regularly co-invest, but Groff sees NDF as complementary to PIF’s heft. Last week, NDF and affiliate funds signed $1.6 billion worth of financing agreements in sectors such as agriculture, infrastructure, tourism, and local talent development. Other deals aim to expand AI and data use in development finance, and promote local manufacturing in the railway industry. — Manal Albarakati |

|

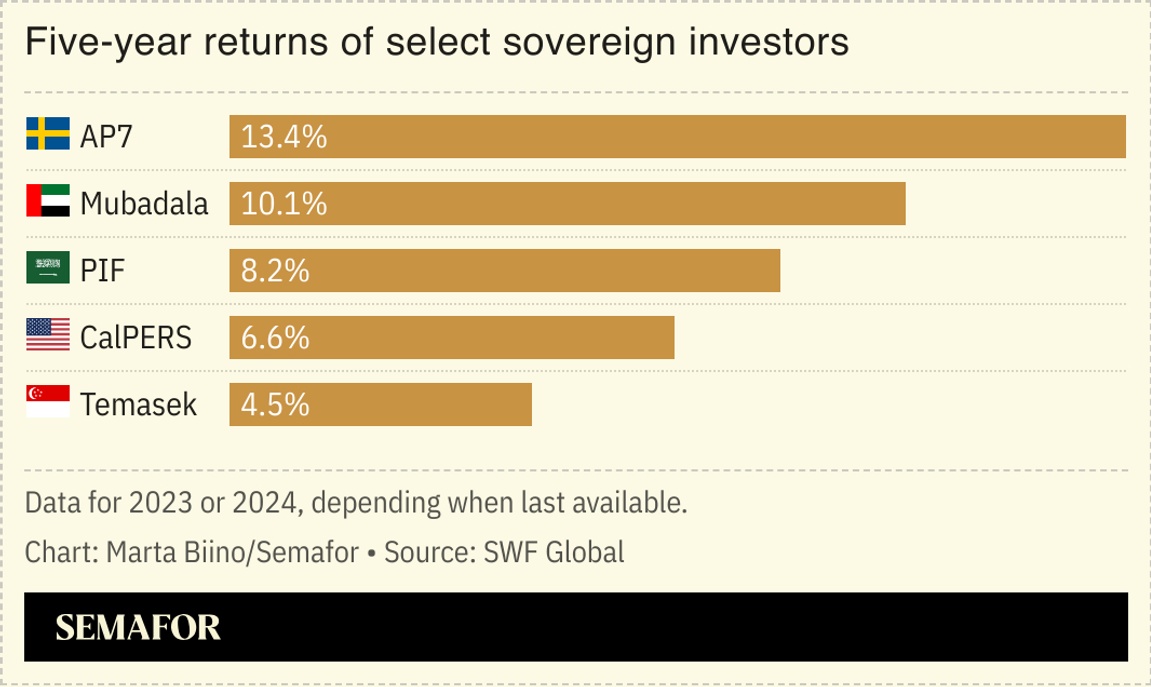

Abu Dhabi’s private credit push |

Abu Dhabi’s Mubadala and US asset manager Barings launched a $500 million real estate debt fund to invest across the Asia-Pacific, Europe, and the US, in the latest sign of Emirati funds’ continued appetite for private credit. The partnership aims to capitalize on banks retrenching from the real estate market at a time when many borrowers need to refinance debt. It will also diversify Mubadala’s property portfolio and boost Barings’ role as one of the world’s largest real estate investment managers. Private credit has been Mubadala’s top performing asset class for the past three years, the sovereign wealth fund’s Deputy Chief Executive Waleed Al Mokarrab said this month. Mubadala has built up a $20 billion portfolio and formed partnerships with Apollo, Carlyle, and KKR. Mubadala, probably the region’s most active sovereign wealth fund, separately also said it was partnering with Bain Capital to buy a US heating, ventilation, and air conditioning business. — Matthew Martin |

|

UAE seeks US aluminum backers |

Patrick Pleul/picture alliance via Getty Images Patrick Pleul/picture alliance via Getty ImagesEmirates Global Aluminium (EGA) is talking to potential investors about building a US aluminum smelter, with its ambitions having grown substantially since the idea was floated in May. The Abu Dhabi producer is negotiating with Japan’s Mitsubishi Corp. and others for a smelter in Oklahoma costing up to $6 billion and producing 750,000 tons a year, Bloomberg reported. In May, when setting out its plans, EGA spoke of a $4 billion facility with a capacity of 600,000 tons annually. As well as capital, the project relies on securing long-term power supplies — no simple matter at a time of surging demand from AI data centers. The US imports about half of the aluminum it uses, including some from the UAE, but President Donald Trump’s tariffs have led to a surge in prices for US buyers. EGA and China’s Sunstone are also pushing ahead with a UAE plant that will make anodes needed for aluminum smelting, which will turn the Gulf country from an importer to an exporter of the carbon blocks. |

|

Bartenders wanted in Saudi Arabia |

A pop-up non-alcoholic bar in Riyadh. Fayez Nureldine/AFP via Getty Images. A pop-up non-alcoholic bar in Riyadh. Fayez Nureldine/AFP via Getty Images.A surprising new line of work is emerging in Saudi Arabia: bartenders. High-end hotel chains including Four Seasons, Rixos, and Shangri-La are all advertising for drinks specialists at their hotels in Jeddah, Riyadh, and the Red Sea coast, according to Arabian Business, with knowledge of wines and spirits listed as a must. The job advertisements come as signs are mounting that the kingdom could further loosen rules around alcohol sales as soon as next year. Non-Muslim expatriates in the country earning above a certain threshold can now buy alcohol at stores previously reserved for diplomats, Semafor reported last month — the first time in decades that alcohol has been legally available for anyone other than foreign envoys. Ahead of the anticipated changes, hotels and bars have sprung up offering a variety of exotic, but still firmly non-alcoholic, beverages. Saudi Arabia has made attracting tourists a key part of its economic diversification plan, developing luxury hotels and winning rights to host global events like the men’s soccer World Cup in 2034 to bring in visitors. Offering something more than mocktails should further widen the country’s appeal. — Matthew Martin |

|

Museum outsourcing prompts unease |

Courtesy of the Louvre Abu Dhabi Courtesy of the Louvre Abu DhabiThe Gulf’s museum boom is building a new cultural landscape, but the dominant position of Western consultants is prompting criticism. From Abu Dhabi’s Louvre and Guggenheim partnerships to the dozens of museums planned in Saudi Arabia, international consulting firms are deeply embedded in strategy, staffing, and delivery, Artnet reported. Abu Dhabi has spent billions importing expertise and branding from French institutions, while Saudi Arabia, which has long been heavily reliant on global consultants like McKinsey across a range of sectors, faces growing criticism over the extent of outsourcing. Saudi artists like Ahmed Mater have warned that imported KPIs and blockbuster mindsets risk flattening local culture. For now, consultants remain central to delivering the transformation Gulf states are pursuing, but Qatar — which arguably started the regional cultural push with the opening of the Museum of Islamic Art in an iconic building in 2008 (designed by the Chinese American architect IM Pei) — shows that, over time, it is possible to shift to local leadership. — Manal Albarakati |

|

Energy- Saudi Arabia’s Midad Energy has emerged as one of the leading contenders to buy Russian oil major Lukoil’s international assets, valued at about $22 billion and hit by US sanctions. — Reuters

- ALTÉRRA will back a Copenhagen Infrastructure Partners fund to invest in wind, solar, and battery storage projects, as Abu Dhabi’s $30 billion climate finance fund looks to forge new partnerships two years after launching.

Real estate- Mecca in Saudi Arabia is the site of Indonesian sovereign wealth fund Danantara’s first foreign investment: The acquisition, for an undisclosed amount, of a hotel as well as land near the Grand Mosque, which welcomes 1 million Indonesian Umrah pilgrims annually.

- PIF is offloading shares in a facilities management company to US-based real estate services firm JLL. FMTECH works with PIF portfolio companies, as well as public and private sector clients across Saudi Arabia. PIF will retain a majority stake in the business.

Sports- Saudi royal entrepreneur Prince Alwaleed bin Talal is close to completing the acquisition of local football giants Al Hilal from the government’s Public Investment Fund — the first of what the authorities hope will be a wave of buyouts of state-owned teams. — Saudi Gazette

|

|

Naseem Zeitoon/Reuters Naseem Zeitoon/ReutersThe UAE’s camels will be able to breathe a sigh of relief in the new year, as a ban on single-use plastics is expanded. Camels, which number in the half million in the Emirates and are considered a symbol of national heritage, were sometimes found dead with large lumps of indigestible plastic in their stomachs. Research by a team of veterinarians found such incidences had fallen by up to 80% since restrictions had been introduced in recent years, The National reported. From Jan. 1, the UAE will expand the list of banned freebie single-use plastics, including beverage cups and lids, cutlery, chopsticks, plates, straws, and stirrers. |

|

|