| | In today’s edition: Saudi Arabia’s government and sovereign wealth fund tap debt markets, and what e͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Saudi debt to grow…

- …but oil demand is secure

- PIF is also borrowing

- Omani hydrogen setbacks

- Making it in family offices

Jeddah’s homage to its trade route history. |

|

Abu Dhabi is becoming the Greenwich, Connecticut, of the Gulf: a bastion for financiers lured by a high quality of life and proximity to capital. In place of New England charm and a quick train ride to Wall Street, the Emirati capital promotes its infinite sunshine and the sprawling sovereign wealth overseen by the ruling family, one of the world’s wealthiest families. (Ray Dalio keeps an address in both.) Abu Dhabi has, of late, been leaning into an image of a safe suburb for a globalized elite, pouring money into what pleases them, like longevity hacks, museums, and niche sports, while bucking a stereotype that the Gulf is all glitz and conspicuous consumption. A polo match this Sunday will kick off events for Abu Dhabi Finance Week, a departure from the event’s fintech-conference origins. The most in-demand real estate no longer offers a neighborhood Gucci, but a tranquil coastline. And an upcoming performance by John Mayer, that horophile Lothario, is certainly finance-bro coded. If demographics are destiny, what does this shift — the events, the properties, the entertainment — say about where Abu Dhabi is headed? In an emirate of more than 4 million representing 200 nationalities, an influx of Westerners is a small slice of Abu Dhabi. But with neighbors mounting their own efforts to add financial might, attracting bougie millennials and high-net worth boomers is now a crucial part of its playbook in a high-stakes competition of taste. A programming note: Many of my Semafor colleagues and I will be at ADFW, and are eager to chat with readers. Please reply to this email if you want to connect. And join us for the Dec. 11 ADFW edition of our Next 3 Billion On Tour series, in partnership with the Gates Foundation. You can request an invitation here. |

|

Saudi will keep borrowing to fuel Vision 2030 |

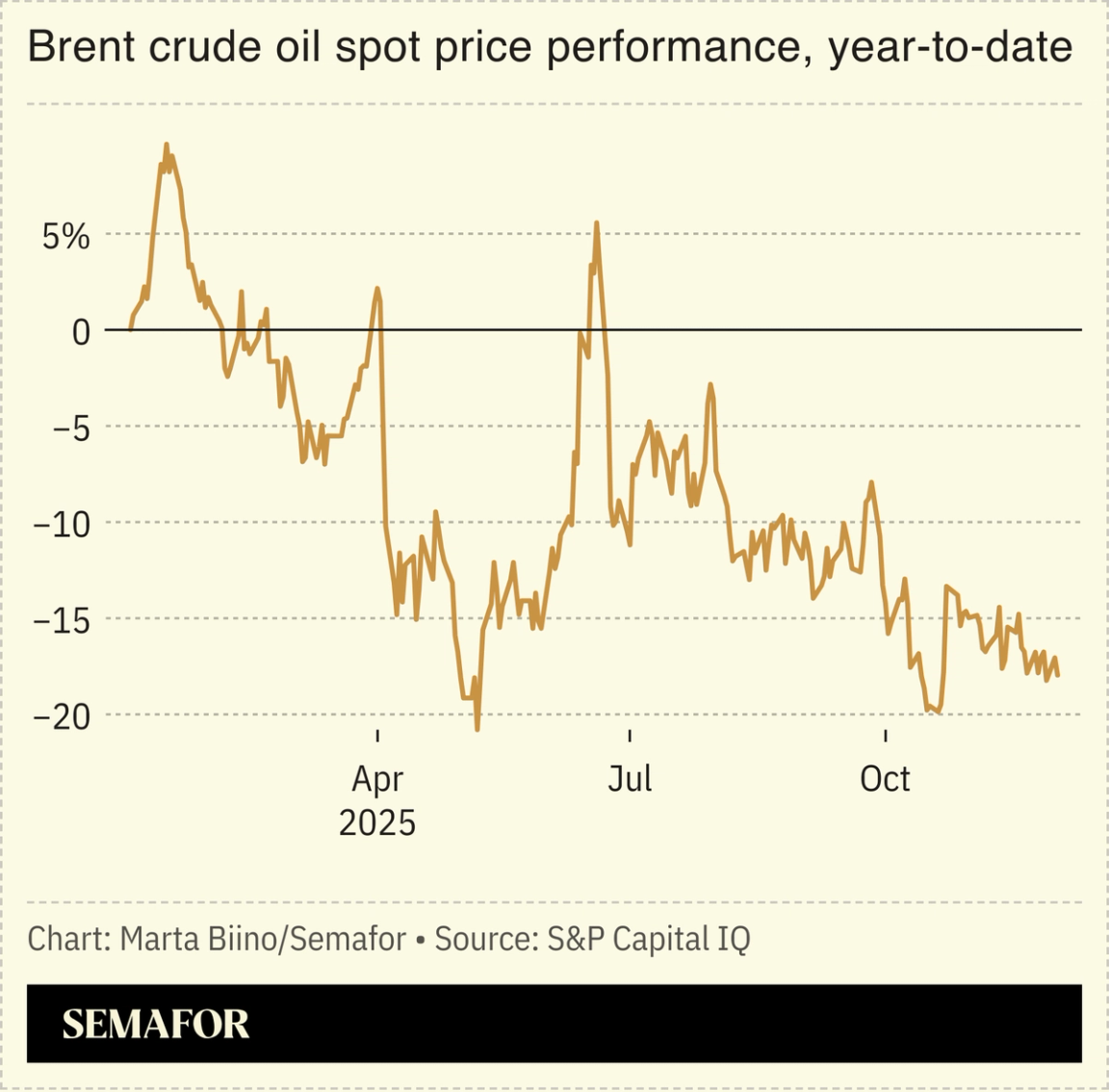

Bernd von Jutrczenka/picture alliance via Getty Bernd von Jutrczenka/picture alliance via GettySaudi Arabia will keep borrowing next year to fund its economic transformation as returns on domestic investments outweigh financing costs, Finance Minister Mohammed Al-Jadaan said. Continued deficit spending comes even as the 2026 budget, released Tuesday, outlined a cut in capital expenditure for a second consecutive year. “The policy choice is we need to invest in our economy and its diversification to enable the private sector,” Al-Jadaan said at a briefing this week. “So long as the return on these investments is higher than the cost of the debt, we will continue that drive.” The government is forecasting economic growth of 4.6% next year, mostly driven by the non-oil sector. Crude sales are still a key factor for the economy though, making up 54% of government revenue. Capital Economics estimates the 2026 budget is based on an oil price of around $68 a barrel, and that next year’s deficit will likely be deeper than the government expects because of weaker oil prices. The other big factor for the economy will be how much the government’s Public Investment Fund follows through on a pledge to boost spending next year, even as it conducts its own review of domestic outlays. — Matthew Martin |

|

Riyadh insists oil demand still growing |

Saudi Arabia has no worries about future oil demand and continues to invest in boosting its crude export capacity, Finance Minister Mohammed Al-Jadaan said in a briefing to reporters. “The worry we have is not oil demand” but output, he said. Spare production capacity globally is “under pressure” and “not as big as it’s perceived to be,” leaving the oil market more prone to price shocks, Al-Jadaan said. The kingdom has “defeated” forecasters who predicted that oil demand was no longer growing, he added, with some organizations forced to “adjust their projections on a continuous basis.” The International Energy Agency recently revised its prediction that oil demand could peak this year, saying demand could now keep growing to 2050. Saudi Arabia is continuing to invest in gas production and renewable energy for domestic power generation, which could free up 1 million barrels a day of crude for export, Al-Jadaan said. — Matthew Martin |

|

PIF hasn’t hit a debt ceiling |

The ratio of debt to assets that Saudi Arabia’s Public Investment Fund aims to stay under, according to S&P Global Ratings. PIF currently carries about $55 billion in debt, spread across bonds, loans, and sukuk. That is only about 6% of its total asset base of $909 billion, offering plenty of room to borrow more. The agency expects the fund to “seek increasingly diversified sources of debt,” backed by further transfers from the government and returns from portfolio companies. S&P says it expects PIF to keep reviewing its portfolio to focus on the highest impact opportunities while scaling back on less viable projects. The fund aims to invest $40 billion a year in its home economy, and to create a total of 1.8 million direct and indirect jobs. |

|

Two Omani green hydrogen projects end |

A green hydrogen plant in Spain. Jon Nazca/Reuters. A green hydrogen plant in Spain. Jon Nazca/Reuters.Two of Oman’s nine green hydrogen projects have been shelved, amid industry concerns about a mismatch between supply and demand for the low-emissions fuel. Hydrogen Oman (Hydrom) Managing Director Abdulaziz Al Shidhani told a conference in Muscat this week that they were both ended “by mutual agreement” with the developers — BP in one case, and the other involving France’s Engie and South Korean steelmaker Posco. Hydrom says the seven remaining projects are still progressing, with a target of producing 1 million tonnes of green hydrogen a year by 2030. It is also moving forward with a third auction of land for green hydrogen projects, this time with $3.6 billion of additional incentives. The problems in Oman follow reports in May that the green hydrogen program in Saudi Arabia’s NEOM was also having difficulties signing up customers. |

|

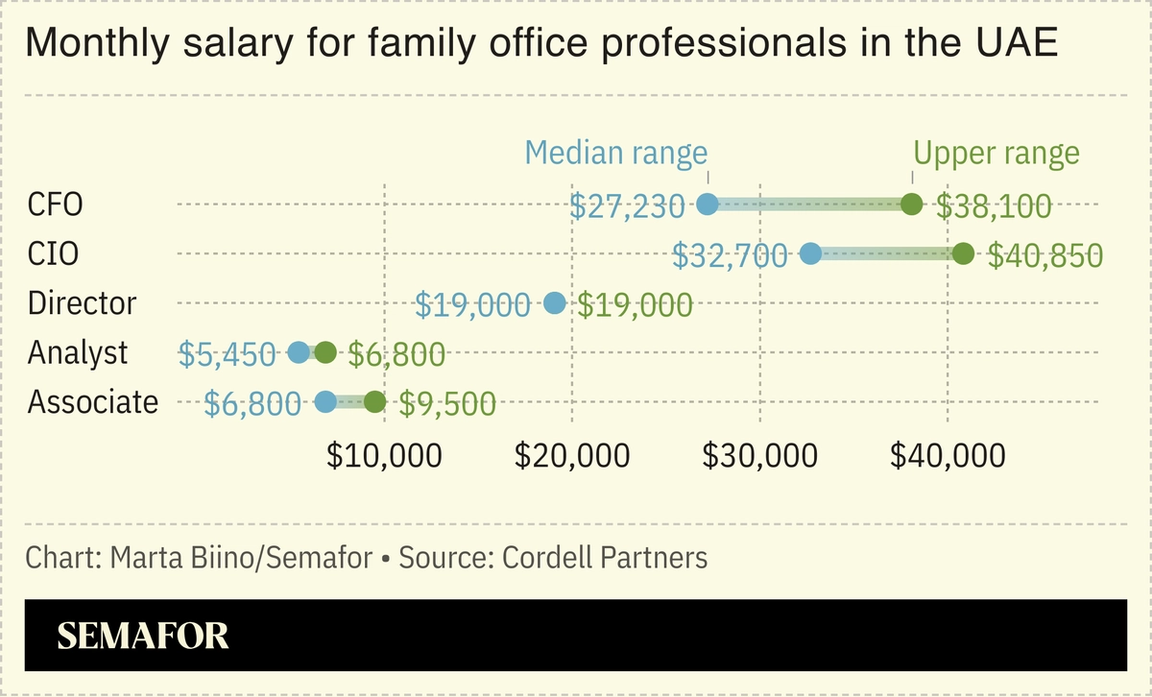

Family office comp lags high finance |

A generational shift at UAE family offices is reshaping how much they pay staff, but compensation still lags the richest global finance hubs. The top-paid investment and finance chiefs in the emirates earn well below the $1 million mark, and fixed pay for preserving the wealth of ultra-high-net worth families in Abu Dhabi and Dubai is typically lower than at other private finance firms, according to UAE headhunter Cordell Partners. Carry — or compensation tied to gains on investments — remains rare. Still, there are other perks: Schooling for children and accommodation allowances are often added on top of base pay and bonuses. Cordell’s report likens family offices to “cruise liners turning round in the figurative canal, slowly but steadily lurching to their full form,” with a shift away from passive holdings like real estate — preferred by the founding generation of the 1960s and ’70s — towards more sophisticated, multistrategy portfolios, under the helm of the next generation, who are eyeing eight-year exit horizons and show a preference for hedge funds, digital assets, and technology. — Kelsey Warner |

|

Crypto- Abu Dhabi’s Financial Services Regulatory Authority has approved the use of the Ripple USD stablecoin in the ADGM financial zone. Earlier this year, the Dubai International Financial Centre authorised the use of Circle’s USDC and EURC stablecoins.

Deals- Qatar Investment Authority is selling more shares in British supermarket chain Sainsbury’s, cutting its stake to less than 7% and ending a two-decade run as the grocer’s largest shareholder. — AGBI

- Abu Dhabi Investment Authority, PIF, and QIA are reportedly considering investing in Paramount Skydance’s offer to buy all, or part of, Warner Bros. Discovery. The main backer of the deal is the Ellison family. — Variety

Checking In- Saudi Arabia signed its first mutual visa exemption for ordinary passport holders, with Russia, allowing visa-free travel for up to 90 days a year. The announcement came on the sidelines of the Saudi-Russia investment forum in Riyadh last week, extending the countries’ deepening relationship beyond oil and business deals to the ordinary citizen. — Argaam

Security- Gulf leaders descended on Bahrain on Dec. 3 for the annual GCC Summit, with security issues likely to feature strongly, including the conflicts in Gaza and Sudan, and concerns about Israel’s military actions in countries around the region. — Asharq Al-Awsat

You’ll get mail- Kuwait has invited consultants to bid for a contract to set up a new postal service. Kuwait Post Company will be run as a public/private partnership and could eventually be floated on the local stock market. — Arab Times

|

|

@redsea_mc/Instagram @redsea_mc/InstagramSaudi Arabia is showcasing its role in regional and continental trade with a new Red Sea Museum. Set to open on Dec. 6 inside the restored historic Bab Al-Bunt building in Jeddah’s UNESCO-listed old town, the museum features more than 1,000 artifacts, including Chinese porcelain, coral jewelry, navigational tools, and sacred manuscripts, displayed across 23 galleries. The building itself, once Jeddah’s main port terminal, serves as the first exhibit. The initiative seeks to add a certain historical depth to the Red Sea region, which has in recent years become better known for luxury — whether it be resorts, a film festival, or a spot on the Formula One calendar. |

|

|