| | In this edition: Shell’s new investment in Nigeria, a growing call for reparations, and celebrating ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Algiers Algiers |   Freetown Freetown |   Grand-Bassam Grand-Bassam |

| Africa |  |

| |

|

- S. Africa’s challenges

- Shell’s new investment

- Call for reparations

- Transaction costs

- EU’s pesticide exports

- Guinea-Bissau coup fallout

The Week Ahead, and a new photo fair in Côte d’Ivoire. |

|

S. Africa’s manufacturing woes |

Sentiment among South African manufacturers dropped sharply in November due to weak export sales, an influential survey showed. The monthly purchasing managers’ index, sponsored by South African bank Absa, showed sentiment had hit its lowest level since the COVID-19 pandemic. South Africa’s exports have been sluggish since late 2024, but a key shift is that domestic demand has faltered after a brief recovery in the third quarter, Absa said in a statement. The survey results underscored the fragility of South Africa’s manufacturing sector, with demand and production declines overshadowing modest employment gains and easing cost pressures. Pretoria faces increased trade pressure after the US this year imposed a 30% tariff on South African imports over laws the Trump administration claims unjustly discriminate against white South Africans. Domestic consumption was hit by high unemployment, of around 30%, that rose in the first two quarters of this year. Despite the downbeat mood among manufacturers, South Africa has had some recent positive economic news. Last month the continent’s largest economy secured its first credit rating upgrade since 2005, an improved assessment which — along with its removal from a global financial watchdog’s “gray list” of countries monitored for money laundering — looks set to cut the cost of borrowing. — Alexis Akwagyiram |

|

Shell ups stake in Nigerian oil field |

Akintunde Akinleye/Reuters Akintunde Akinleye/ReutersBritish oil giant Shell acquired an additional 10% stake in a Nigerian offshore oil field from France’s TotalEnergies, completing a $510 million deal that was first announced in May. Shell’s Nigeria subsidiary now owns 65% of the deepwater Bonga field in southern Nigeria. The deal demonstrates the operational shift by international oil companies (IOC) into Nigeria’s offshore industry, turning away from onshore assets following a wave of theft and vandalism along oil pipelines. Shell is one of at least four IOCs that have sold their onshore assets in the country to African operators in recent years. Companies such as Mauritius-based Chappal Energies and Nigeria’s Heirs Energies and Renaissance Africa Energy have become the new faces of the onshore scene. TotalEnergies sold its remaining 2.5% in Bonga to a Nigerian subsidiary of Italy’s ENI while gaining two other offshore oil blocks in September. |

|

Push to recognize colonial crimes |

Stringer/Reuters Stringer/ReutersAfrican leaders gathered in Algiers to push for the recognition of colonial-era crimes through reparations. The conference sought to advance an African Union resolution passed earlier this year calling for slavery, deportation, and colonization to be formally defined as crimes against humanity. “Africa is entitled to demand the official and explicit recognition of the crimes committed against its peoples,” Algeria’s foreign minister said in his opening speech, adding that it was an era for which the continent continues “to pay a heavy price.” At least 12.5 million people were enslaved and forcibly transported from Africa between the 15th and 19th centuries, and the economic toll to the continent of colonization is estimated to run into trillions of dollars. United Nations Secretary-General António Guterres has long supported the call for reparations, which most former colonial powers have rejected. |

|

The value of transactions processed by African instant payment systems in 2024, a new report found. The number of instant payment systems in Africa rose to 36 across 25 countries between July 2024 and June this year — up from 31 the previous year. Eswatini, Sierra Leone, and Somalia were among the countries that introduced such systems in the past year, according to the report by AfricaNenda Foundation, the World Bank, and the United Nations Economic Commission for Africa. The near $2 trillion transaction value follows an average annual growth rate of 26% since 2020 and comprises more than 64 billion transactions. Most instant payment systems in Africa are designed to connect mobile money platforms, processing low-value transactions of about $11 on average. But systems connecting banks are growing too, with a 50% rise in transaction volumes between 2023 and 2024, the report found. — Alexander Onukwue |

|

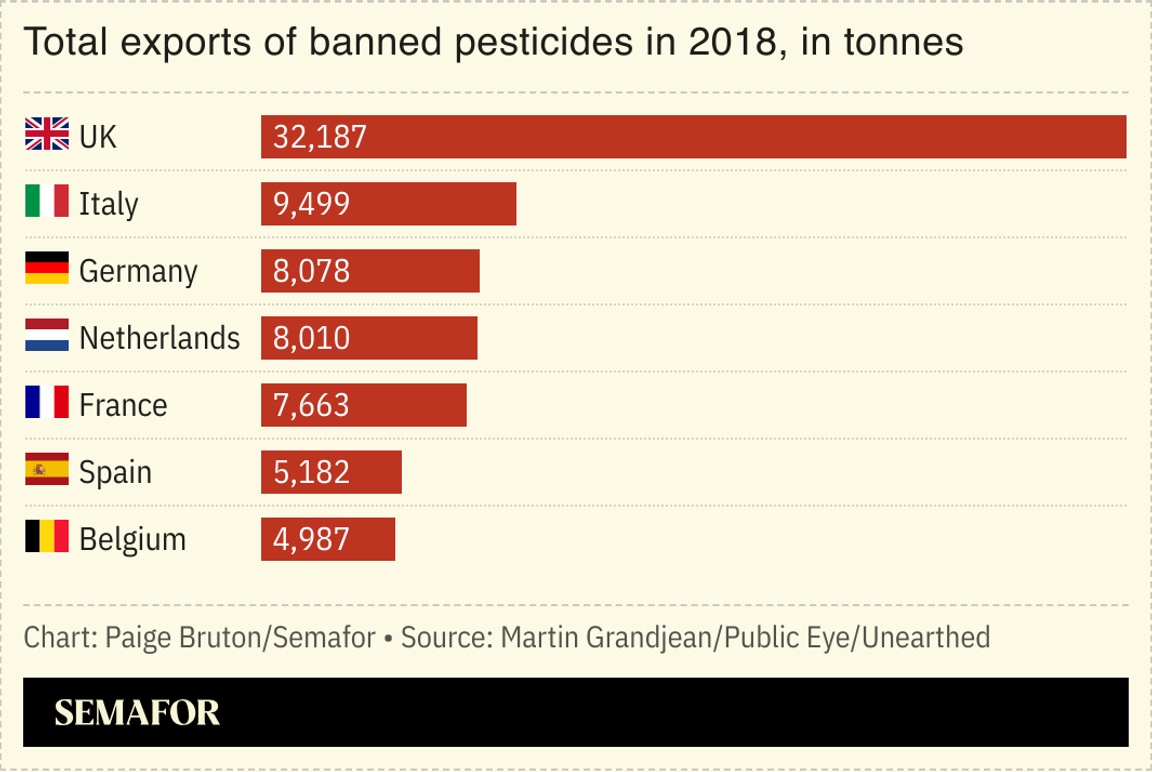

Thousands of tonnes of pesticides banned for use in the EU have been exported for use in Africa, according to a recent study by Swedish NGO Swedwatch. Agriculture employs more than half of the continent’s population and contributes around 35% of its GDP, yet many countries lack sufficient pesticide regulation. In Kenya, which banned 77 highly hazardous pesticides in June, annual imports of the chemicals — nearly a third of which come from the EU — more than doubled between 2015 and 2018. As much as 34% of the active ingredients in these products were not approved in Europe. “The trade in toxic pesticides is not only unethical but economically irrational,” the report said, noting that for Kenya’s exported products, EU border controls regularly stop shipments containing excessive levels of banned pesticides. — Paige Bruton |

|

As one of the world’s foremost financial hubs, Abu Dhabi is emerging at the crossroads of innovation, investment, and inclusion — linking markets across the Middle East, Africa, and Asia. Held at Abu Dhabi Finance Week, Semafor will showcase insights from the upcoming Global Findex 2025 report and the Global Digital Connectivity Tracker, translating global research into practical, locally grounded conversations. With Abu Dhabi prioritizing sustainable finance, digital transformation, and cross-border collaboration, the city provides an ideal stage to explore how technology and capital can work together to expand access, inclusion, and economic opportunity. Dec. 11 | Abu Dhabi | Request Invitation |

|

Guinea-Bissau coup fallout |

The timing of last week’s coup in Guinea-Bissau raises important questions about whose interest the takeover serves, a commentator wrote in a new column for Semafor. “Everything about Guinea-Bissau’s coup is off,” said Tomi Oladipo, a journalist specializing in African security and geopolitics, pointing to how it was carried out just before presidential election results were due to be announced. He also pointed to former Nigerian President Goodluck Jonathan, who led the West African Elders Forum observer mission to the elections, describing it as a “ceremonial coup,” noting that the incumbent president’s conduct suggested he had colluded with the junta, which would imply he was likely to lose at the polls. |

|

Business & Macro

|

|

|