| | In today’s edition: Saudi sovereign fund doubles down on Japan and UAE gambling goes online.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Saudi’s Japan double-down

- Kuwait’s stealth wealth

- Gulf insurance rollup

- Saudi to unveil 2026 budget

- Riyadh’s airport expansion

- UAE starts up online gambling

The birth of the Emirates. |

|

Saudi to double Japan investments |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersSaudi Arabia’s sovereign wealth fund is planning to more than double its investments in Japan by 2030. Public Investment Fund had invested $11.5 billion in Japan by the end of 2024, but Governor Yasir Al-Rumayyan said at the Future Investment Initiative conference in Tokyo that the figure would reach “about $27 billion by the end of 2030.” He praised Japan’s leadership for shifting the country’s economy away from savings and promoting investment and consumption. Japan has increasingly been catching the attention of Gulf investors as its stock market soars and governance reforms encourage corporate dealmaking. In November, the Qatar Investment Authority launched a $2.5 billion investment fund, with Tokyo-based asset manager ORIX, focused on Japanese buyouts, and last year PIF signed preliminary agreements with five Japanese lenders worth up to $51 billion. Japan is already one of Saudi Arabia’s top trading partners, driven by the kingdom’s oil exports and purchases of Japanese cars, machinery, and electronics. — Matthew Martin |

|

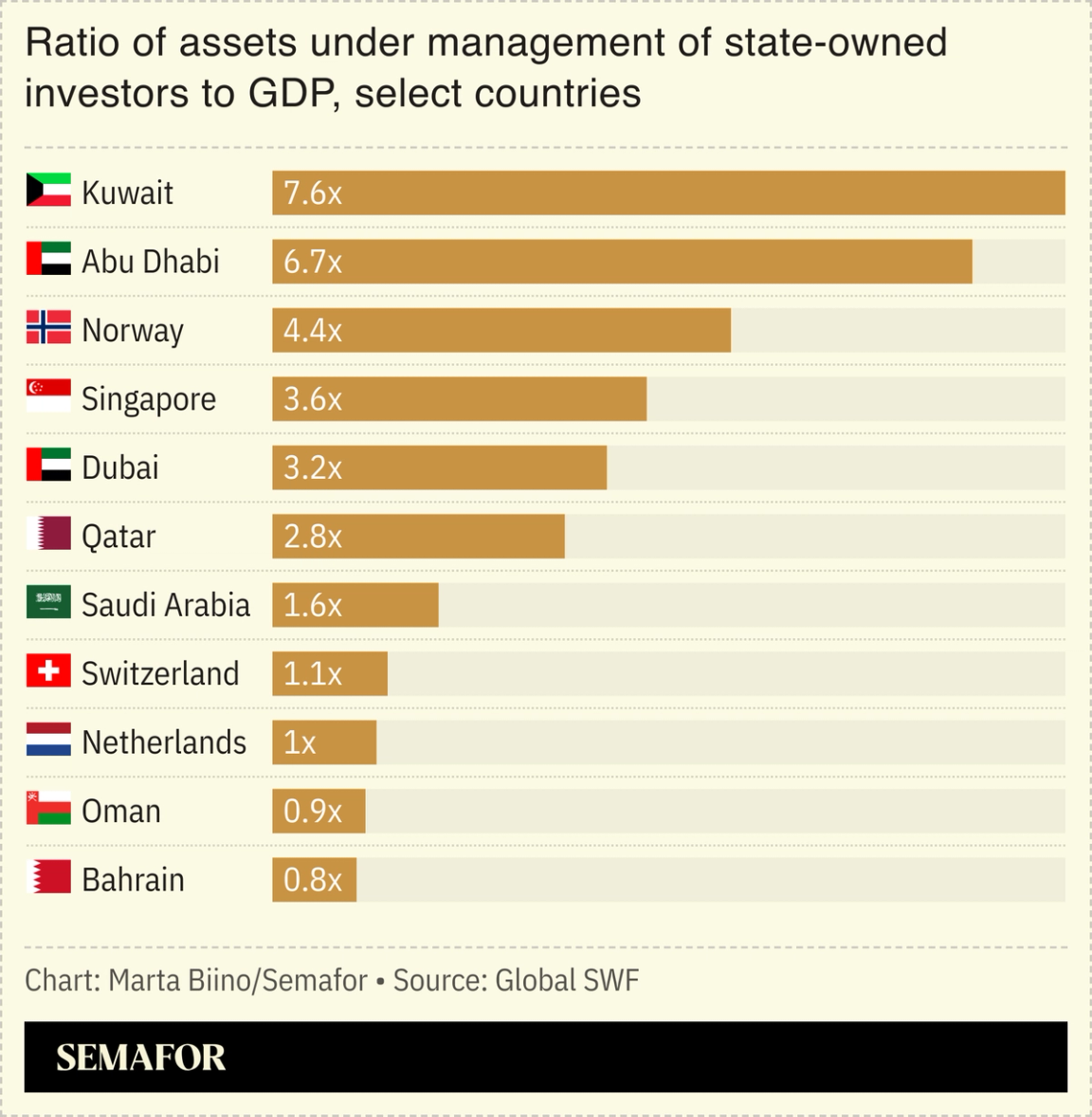

Kuwait is wealthier than it seems |

Kuwait controls more wealth as a proportion of its GDP than its regional peers, according to a new study by data platform Global SWF. While the Gulf nation’s economy lacks the dynamism of some of its neighbors, it has amassed $1.2 trillion worth of assets across its sovereign wealth funds, central bank, and public pension funds, equivalent to 7.6 times its economic output. That’s higher than Abu Dhabi, which is wealthiest in absolute terms, controlling investments of $2.2 trillion, 6.7 times its GDP. The latest Global SWF report also showed that the Qatar Investment Authority was the biggest spender among global sovereign funds in November, deploying $4.5 billion. The QIA is set to become increasingly active, as it looks to invest an expected windfall from the country’s expanding gas exports. — Matthew Martin |

|

BlueFive looks to consolidate Gulf insurers |

A view of ADGM. Courtesy of ADGM. A view of ADGM. Courtesy of ADGM.Abu Dhabi-based private equity firm BlueFive Capital has launched a new investment unit to buy up Gulf insurance companies, with a view to later expanding across Southeast Asia. The firm, which raised $2 billion for its first buyout fund this year, said the unit’s first deal would be a stake in Saudi Arabia’s Gulf General Cooperative Insurance, one of the smallest of the kingdom’s 25 players. BlueFive didn’t disclose the size or value of the stake, but aims to be a controlling shareholder and later rebrand the company and use it as a vehicle to acquire other firms, according to people familiar with the matter. The deal will be a welcome bit of foreign direct investment into the industry. Saudi regulators have been pushing insurers to consolidate for years, after too many licenses were issued, leaving many unprofitable. Ratings agency Fitch said in June that consolidation among Saudi firms would accelerate over the next two years, as new capital requirements and competition lead firms to join forces. — Matthew Martin |

|

Riyadh to unveil 2026 budget |

A view of King Salman Park, one of the projects under construction in Riyadh. Hamad I Mohammed/File Photo/Reuters. A view of King Salman Park, one of the projects under construction in Riyadh. Hamad I Mohammed/File Photo/Reuters.Saudi Arabia unveils its 2026 budget later on Monday, with investors and businesses watching to see how spending and borrowing plans will impact the economy at a time of weaker oil prices. The kingdom has already said it expects a wider budget deficit in 2026 than initially forecast, after lowering revenue projections and boosting spending. The budget will also be closely watched for indications about the direction Saudi Arabia, the swing producer in the OPEC+ group, expects oil revenues to take. Government spending, either directly through the finance ministry or indirectly through its giant Public Investment Fund, is still a key driver for the economy. Yet lower oil revenues and the spending commitments that come with hosting global events like Expo 2030 and the men’s soccer World Cup in 2034 have led to cutbacks at some megaprojects, including NEOM on the northwest coast. — Matthew Martin |

|

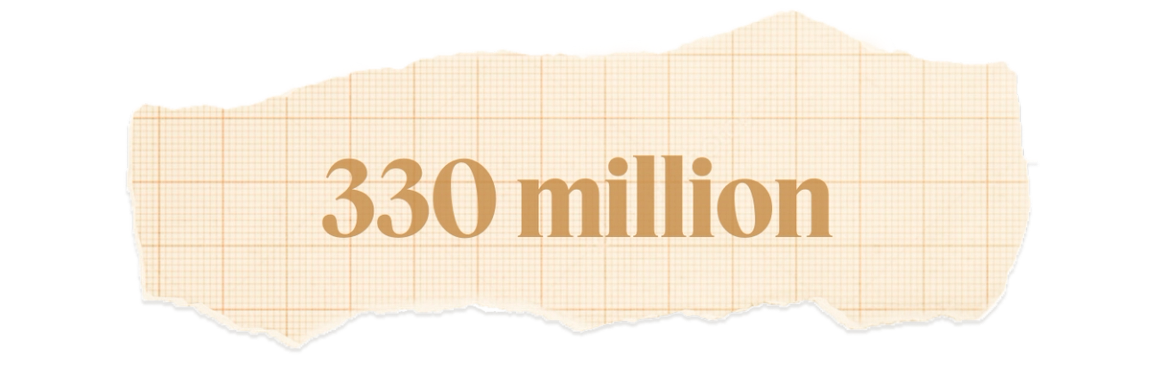

Saudi airports are getting bigger |

The number of travelers Saudi Arabia wants to move through its airports each year by 2030. To get there, Riyadh’s King Khalid International Airport is preparing its first full overhaul since opening more than 40 years ago. The plan, starting in 2026, will reshuffle terminals, boost capacity, and cut connection times. The initiative is part of the kingdom’s tourism push and its wider attempt to diversify its economy away from oil. The even bigger-ticket project is the yet-to-be-launched King Salman International Airport, designed to handle 100 million passengers a year by 2030. That would put Riyadh in the same league as Atlanta, the world’s busiest airport, which served 108 million passengers last year. By 2050, the kingdom wants King Salman Airport to handle 150 million passengers annually. The biggest Gulf hub, Dubai, is also expanding. The city is pouring $35 billion into developing Al Maktoum International Airport, with the aim of processing 260 million passengers annually. It is due to replace Dubai’s current airport in 2034. — Manal Albarakati |

|

UAE opens up to online gambling |

A rendering of the casino under construction in the UAE. Courtesy of Wynn Resorts. A rendering of the casino under construction in the UAE. Courtesy of Wynn Resorts.UAE residents and tourists who need a gambling fix can now get it online. The country’s first casino is under construction, reaching its full 70-storey height in late November. High rollers won’t be able to place any chips on the tables before 2027 at the earliest. In the meantime, online wagers are taking off, after the quiet launch of the country’s first sports betting site, TrueWin, and poker, roulette, and slots platform Dream Island, AGBI reported. The operator, Coin Technology Products, appears to be linked to Momentum Corporate Services, the company behind the UAE lottery. Wynn Resorts has spent $835 million on its casino project to date, with at least $525 million more due to be invested. It will have the offline market to itself when it opens, as no other projects have yet been announced. |

|

As one of the world’s foremost financial hubs, Abu Dhabi is emerging at the crossroads of innovation, investment, and inclusion — linking markets across the Middle East, Africa, and Asia. At an event held during Abu Dhabi Finance Week, Semafor will showcase insights from the upcoming Global Findex 2025 report and the Global Digital Connectivity Tracker, translating global research into practical, locally grounded conversations. With Abu Dhabi prioritizing sustainable finance, digital transformation, and cross-border collaboration, the city provides an ideal stage to explore how technology and capital can work together to expand access, inclusion, and economic opportunity. Dec. 11 | Abu Dhabi | Request Invitation |

|

Deals- Saudi Arabia’s Public Investment Fund is in talks to invest in a unit of Italian defense firm Leonardo; the deal could be sealed at a meeting between Saudi Crown Prince Mohammed bin Salman and Italian Prime Minister Giorgia Meloni in Bahrain this month. — Bloomberg

Commodities- Saudi Arabia imported its first cargo of barley from Canada since 2017, marking a return to a major commodity trade that was halted amid a diplomatic dispute between Riyadh and Ottawa over criticism of the kingdom’s human rights record. — The Western Producer

Energy- The UAE plans to invest $1 billion in Yemen to develop solar, wind, and battery energy storage, delivered by Abu Dhabi-based Global South Utilities. The country has suffered from an electricity crisis that has lasted nearly 30 years, exacerbated by war. — Reuters

- Saudi Arabia’s renewables push continues to be led by ACWA Power, with the company working on $10 billion worth of projects spanning clean energy, storage, and infrastructure across the Gulf, China, Central Asia, and Africa. $6 billion of the total is for domestic projects, implemented alongside Aramco and PIF-owned Badeel.

Regulation- Bahrain has opened up its power generation, port management, and data consultancy sectors to international investors, in its latest efforts to attract capital and spur wider economic growth. International players will also now be able to market properties within freehold areas like Bahrain Bay and Durrat Al Bahrain that allow foreign ownership.

|

|

| This week in Gulf history |

Courtesy of the Arabian Gulf Digital Archives Courtesy of the Arabian Gulf Digital ArchivesOn Dec. 2, 1971, six rival sheikhs made a historic decision, forming the UAE a day after Britain ended decades of close involvement with Gulf states and pulled its military out of the region. With no international protection and rising regional tensions after Iran seized islands still claimed by the UAE, the sheikhdoms sought strength in unity. Bahrain and Qatar chose to go their own way at the last minute, after years of negotiations, but Abu Dhabi, Ajman, Dubai, Fujairah, Sharjah and Umm Al Quwain moved ahead with a federation. Ras Al Khaimah joined in early 1972. The population at the time was under 300,000, but has since grown to more than 10 million, mostly expats. Oil had been discovered, but large-scale exports |

|

|