| | In this edition: Nigeria’s new eurobond, RSF agrees to a truce, and the cost of Tanzania’s internet ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Nigeria’s $2.35B eurobond

- Ecobank eyes agriculture

- RSF agrees to ceasefire

- Internet shutdown costs

- IPO winner’s new AI fund

- Weekend Reads

A debut photo book that reframes African tourism. |

|

Lagos. Olympia de Maismont/AFP via Getty Images. Lagos. Olympia de Maismont/AFP via Getty Images.Nigeria issued a $2.35 billion eurobond to support budget financing, against the backdrop of threats by the US government to initiate military action in the country. High demand for the offering, which attracted buy and sell orders of $13 billion, reflects confidence in the policy measures taken in the last two years by President Bola Tinubu’s administration to revive one of Africa’s largest economies, the country’s debt office said. Nigeria has come under fire from US President Donald Trump for supposedly failing to quell violence against Christians. On Wednesday, Trump asked the US House of Representatives appropriations committee to “look into this matter,” alluding to his earlier threats to cut financial assistance to the continent’s most populous nation. The US Africa Command, meanwhile, has drawn up targets for a potential strike in Nigeria, according to The New York Times. On Tuesday, Tinubu requested parliament’s approval for new borrowing to cover a $9.7 billion deficit in Nigeria’s budget for this fiscal year. Nigeria is the latest to issue an African sovereign debt note, despite concerns about debt distress on the continent. Angola and Kenya have each raised more than $1.5 billion this year through eurobond offerings. — Alexander Onukwue |

|

| |  | Alexander Onukwue |

| |

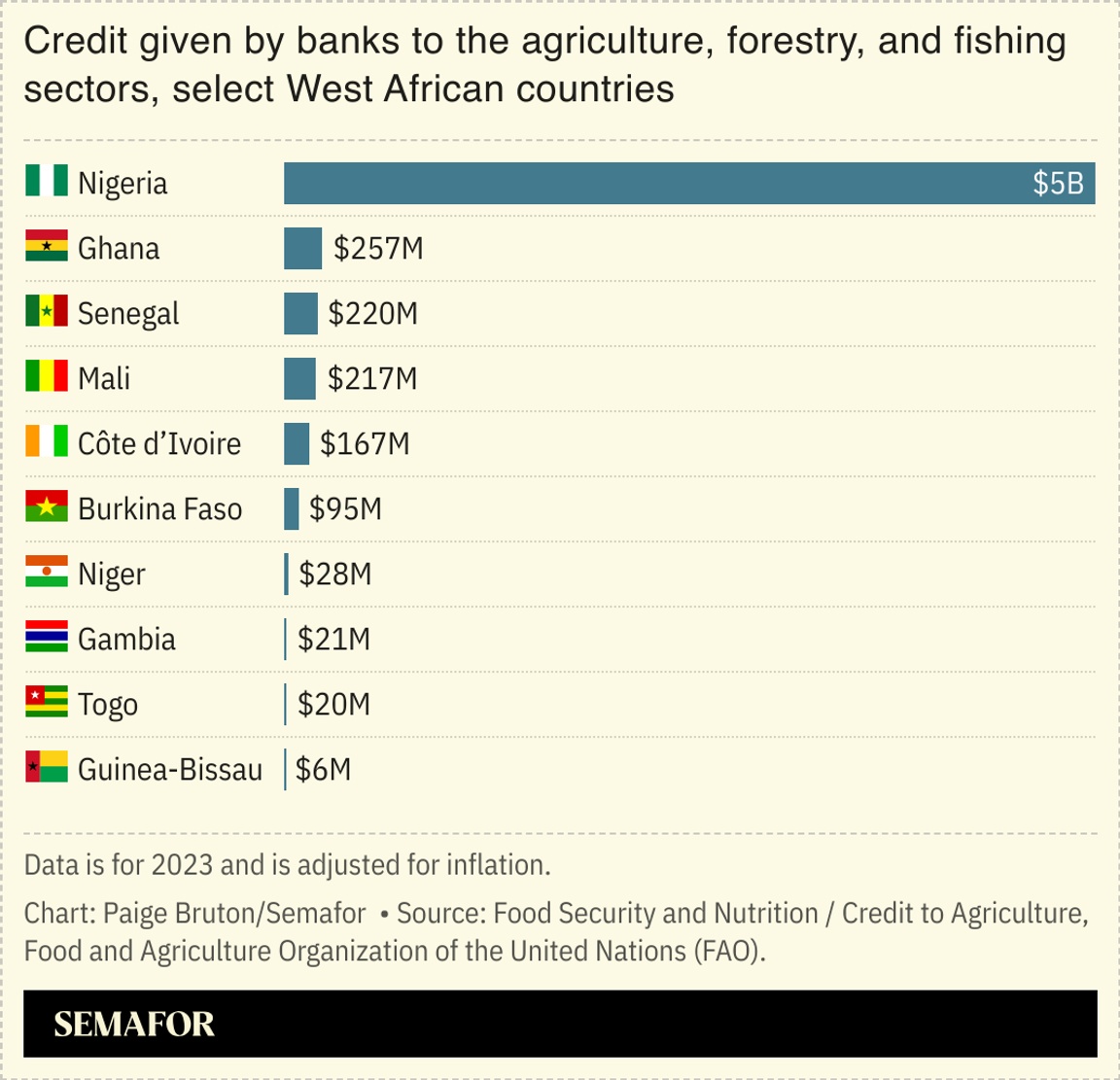

African lender Ecobank is developing a new strategy to tap into the continent’s underinvested agriculture sector, the bank’s CEO told Semafor, after recording its fastest revenue growth in a decade. Ecobank, which operates on nearly two-thirds of the continent, saw its revenue rise 18% year-on-year to $1.8 billion in the first nine months of 2025. The growth was boosted in part by the company’s corporate and investment banking sector, CEO Jeremy Awori said. Agriculture — which the World Bank has referred to as the “sleeping giant” of Africa’s growth — presents an opportunity for Ecobank to tap an underserved sector, Awori said. The sector accounts for around 30% of national output in many African countries, but investment in agriculture typically falls far short of that economic contribution. The Togo-headquartered lender has hired agronomists to advise on its approach and will build on its year-to-date performance by exploring new agricultural products. “We didn’t have a coherent agriculture strategy but have now worked on one,” Awori said in an interview. |

|

Sudan’s RSF agrees to ceasefire |

RSF leader Mohamed Hamdan Dagalo. Mohamed Nureldin Abdallah/Reuters. RSF leader Mohamed Hamdan Dagalo. Mohamed Nureldin Abdallah/Reuters.Sudan’s Rapid Support Forces militia agreed to a US and Arab proposal for a humanitarian ceasefire in a civil war that has killed more than 150,000 people and displaced 12 million — but the military-led government has not yet responded. Around 24 million are facing acute food shortages in Sudan and famine has been declared in el-Fasher, the capital of north Darfur that was seized by the RSF after an 18-month siege during which the group has been accused of mass killings. The proposal from the US, United Arab Emirates, Saudi Arabia, and Egypt calls for a three-month humanitarian truce followed by a permanent ceasefire and a transition to civilian rule. The UAE has come under increasing pressure to end its alleged support for the RSF, with a recent Wall Street Journal report detailing how the Arab state was sending weapons, including Chinese drones, to the rebel forces. The UAE has denied accusations that it is arming the RSF. |

|

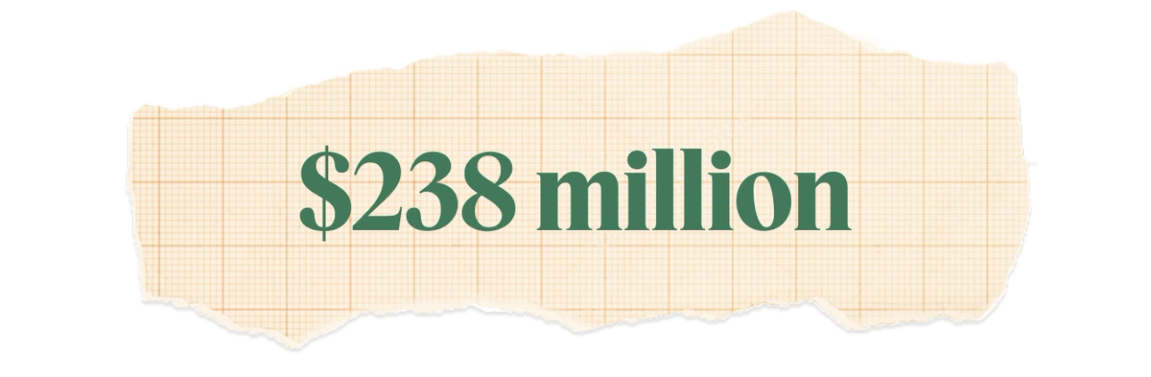

Tanzania’s internet blackout costs mount |

The cost to the Tanzanian economy of the nearly six-day nationwide internet shutdown after last week’s election, according to an internet monitoring group. NetBlocks’ Cost of Shutdown Tool draws on data from the World Bank, International Telecommunication Union, and Eurostat to quantify the direct economic harm of shutdowns and platform blocks. The shutdown, and the ongoing suspension of social media platform X, has reignited worries about the use of state-ordered internet blackouts on the continent during elections or unrest. Internet shutdowns across Africa have doubled since 2016, new research showed, with more than 190 recorded in 41 African countries between 2016 and 2024. Rights groups said Tanzania’s internet outage, which began on election day, directly impacted democratic participation. “Authorities made it clear that they wanted to silence dissent and control the narrative,” Felicia Anthonio from the digital rights group Access Now told Context. African Union observers said the election failed to comply with democratic standards. The bloc’s monitors said they witnessed ballot stuffing, violence, and abductions by government forces. |

|

Person of Interest: Romeo Kumalo |

Frennie Shivambu/Gallo Images/Getty Images Frennie Shivambu/Gallo Images/Getty ImagesFormer telecoms executive Romeo Kumalo’s investment firm plans to raise a $200 million fund to back AI-driven ventures in Africa. The South African entrepreneur, whose LLH Capital recently sold a major portion of its stake in the fintech Optasia, said the fund aimed to “fuel founders who are building solutions that change lives and deliver meaningful, risk-adjusted returns.” Kumalo, previously the chief operating officer of Vodacom International, is an alumni of Harvard Business School. He’s also a well-known business personality thanks to his role as one of the investors on the South African edition of Shark Tank in 2016. The 53-year-old is now betting on the impact of AI across the continent. Optasia debuted on the Johannesburg Stock Exchange earlier this week with a valuation of about $1.4 billion. “This IPO has shown us what the future is for technology and companies driven by artificial intelligence in Africa,” Kumalo told Bloomberg. |

|

- African women are being tricked into building drones in Russia, according to a BBC investigation. Adau from South Sudan says she traveled to Russia on the promise of a job after seeing a program advertised on social media. She applied to be a crane driver, but soon after arriving became one of an estimated 1,000 African women working in Russian weapons factories. “It felt horrible having a hand in constructing something that is taking so many lives,” she says.

- Guinea’s Simandou iron ore mine — the largest of its kind in the world — is due to load its first cargo this month and begin exports by the end of the year. For decades, political instability, remoteness, and corruption scandals have prevented construction at Simandou, Bloomberg explains. Now that progress has begun, the mine and Rio Tinto, which is co-leading the project, face hurdles, including falling iron ore prices and serious competition from China.

- In Kenya and Ethiopia, China is using debt distress as an opening to expand use of the yuan, a world politics lecturer writes in The Diplomat. Converting some of Kenya’s $3.5 billion Chinese-loaned railway debt means the country saves around $215 million annually. Ethiopia is reportedly considering a similar deal. Converting African debts means Beijing advances its objective of “embedding the [Chinese currency] more deeply within the global financial system,” posits Monique Taylor.

- Poverty is pushing farmers into illegal rosewood logging that is driving a surging cross-border trade, HumAngle reports. Alamin Umar and Saduwo Banyawa examine the rosewood value chain and explore the effects of deforestation on farmers as well as locals. The wood is especially prized in China for its durability and capacity for intricate carving.

|

|

FSD Africa Chief Investment Officer Anne-Marie Chidzero will join the stage at The Next 3 Billion ON TOUR. On the sidelines of the G20 in Johannesburg, Semafor convenes The Next 3 Billion ON TOUR to explore how South Africa’s leadership can help scale inclusive solutions across borders — from interoperable digital payments and cross-regional investment to expanding connectivity. As one of Africa’s most industrialized economies and a G20 member, South Africa stands at the center of efforts to advance digital and financial inclusion across the continent. With its strong financial infrastructure and growing influence through the G20 and B20, the country is uniquely positioned to drive the next wave of innovation and access. Nov. 18 | Johannesburg | Request Invite |

|

Business & Macro |

|

|