| | In today’s edition: The world’s biggest energy conference kicks off in Abu Dhabi, and carbon trading͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Relentless energy demand

- Microsoft to ship UAE chips

- Saudi carbon market takeoff

- Bahrain’s Alba goes shopping

- DP World’s India ambition

UAE telecom offers crypto mining subscription. |

|

Energy addition. Power is knowledge. Yes, and. These are some of the phrases kicking around Abu Dhabi’s annual energy convention ADIPEC, the world’s biggest. Largely absent: environment, climate, net zero. Energy executives aren’t saying they will maximize carbon emissions, of course. The tone — set by the opening remarks of host Sultan Al Jaber, UAE Minister of Industry and Advanced Technology and ADNOC’s group CEO — is that demand for oil, gas, and electricity is growing at a pace that shouldn’t be slowed by regulations or climate targets. At last year’s event, which began with US President Donald Trump’s acceptance speech (where he told Robert F. Kennedy Jr. to “stay away from the liquid gold”), sustainability was a major headline, along with artificial intelligence. This has now shifted firmly to the latter: how to power data centers and deploy the technology to improve operations and transform the economy are the priorities, a departure from almost a decade during which energy transition messaging was the norm. Unsurprisingly, the pivot was welcomed by the speakers who succeeded Al Jaber onstage, as well as five senior executives I spoke to this morning in Abu Dhabi. The consensus is that decarbonization, or at least reducing the “carbon intensity” of fossil fuel production, is still desirable, but the goal will be met by technology, and not by swapping hydrocarbons for renewables. |

|

‘Energy realism’ defines ADIPEC 2025 |

Courtesy of ADNOC Courtesy of ADNOCThe world is entering an era of explosive growth in energy demand, and leaders should “tune out the noise, track the signal,” said Sultan Al Jaber, UAE Minister of Industry and Advanced Technology and ADNOC’s managing director and group CEO. The trend line — he noted in his opening address at ADIPEC, the energy exhibition and conference — shows that all sources of energy must be harnessed to meet surging electricity consumption driven by urbanization, two billion more air conditioners globally, and the expansion of AI, as well as the doubling of airline fleets to 50,000 planes by 2040. Oil demand will remain above 100 million barrels a day beyond 2040, LNG output will rise 50%, and about $4 trillion in annual capital investment will be needed for grids, data centers, and all sources of energy to meet future demand, Al Jaber said. Other industry leaders agreed with the outlook. US Interior Secretary Doug Burgum — conveying greetings from President Donald Trump and affirming that Washington shares these energy values and policies — quipped that “a kilowatt of electricity is more valuable than ever,” adding that throughout history, knowledge was power, but now, thanks to AI, “power is knowledge.” — Mohammed Sergie |

|

Microsoft goes bigger in UAE |

The amount Microsoft has committed to investing in the UAE from 2023 to the end of the decade. The American technology giant, a crucial partner in the Gulf country’s AI ambitions, is exporting advanced Nvidia chips to the Emirates, building more data centers, and training 1 million people in technical know-how. The $3.85 trillion company has secured export licenses for Nvidia’s advanced GPUs into the country, providing the equivalent of over 60,400 A100-class chips, according to a statement. From 2023 to the end of this year, Microsoft will have poured over $7.3 billion in the UAE, including its equity investment in G42 that saw its President Brad Smith join the Abu Dhabi AI conglomerate’s board last year. By 2030, Microsoft has committed to spending another $7.9 billion. The moves follow a familiar Microsoft playbook: Smith has made similar announcements in the last few years in Indonesia, France, and the UK, among others. But those agreements — usually to the tune of around $2-$3 billion in infrastructure and training investments — have paled in comparison to Microsoft’s commitment in the Emirates. “This is not money raised in the UAE. It’s money we’re spending in the UAE,” Smith said. Microsoft is also deepening its ties to ADNOC, signing a deal this week to collaborate on developing AI agents for the energy sector. — Kelsey Warner |

|

Saudi carbon market to double in 2026 |

Shafiek Tassiem/Reuters Shafiek Tassiem/ReutersSaudi Arabia’s Voluntary Carbon Market Co. projects 20 million carbon credits will be traded next year, double the total contracts that have exchanged hands since 2022. The emissions trading platform — a joint venture between Public Investment Fund and the local exchange — is part of the kingdom’s efforts to reach net zero by 2060. The company’s acting CEO Fadi Saadeh told Semafor that it established an advisory service offering to help companies understand the role of carbon credit trading in their net zero plans. “When we started there was zero demand and zero supply,” Saadeh said. There are now around 70% of Saudi firms trading on the exchange along with others from countries including Brazil, China, France, Japan and the US. “Getting to net zero is a very long journey, and companies need to have an option for them to offset their carbon emissions until we get there.” — Matthew Martin |

|

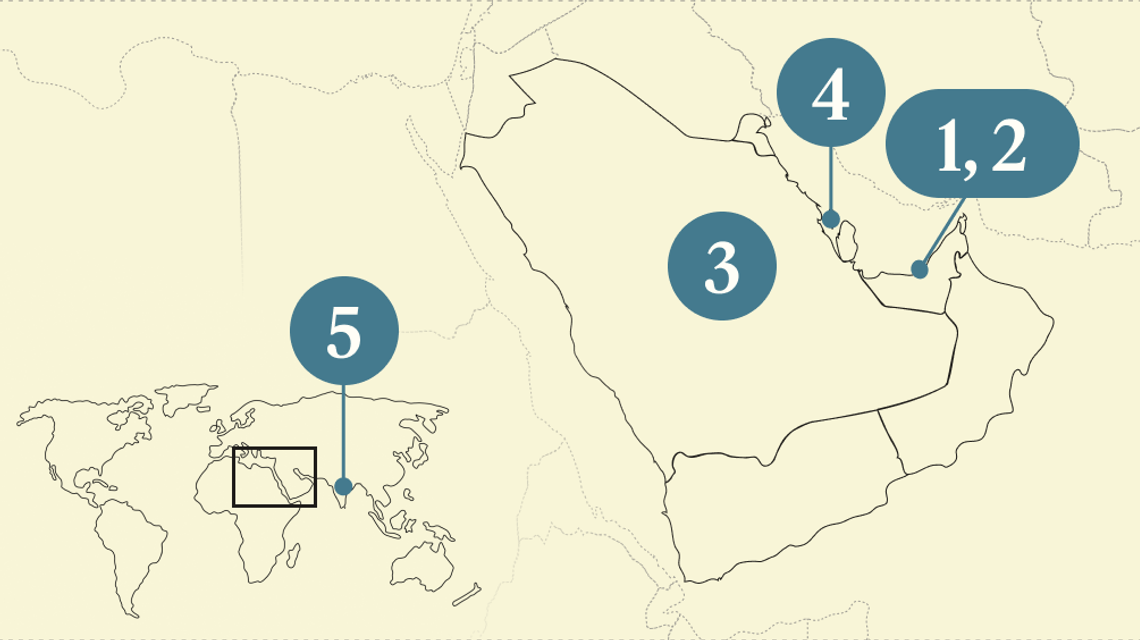

Bahrain’s Alba eyes Saudi listing |

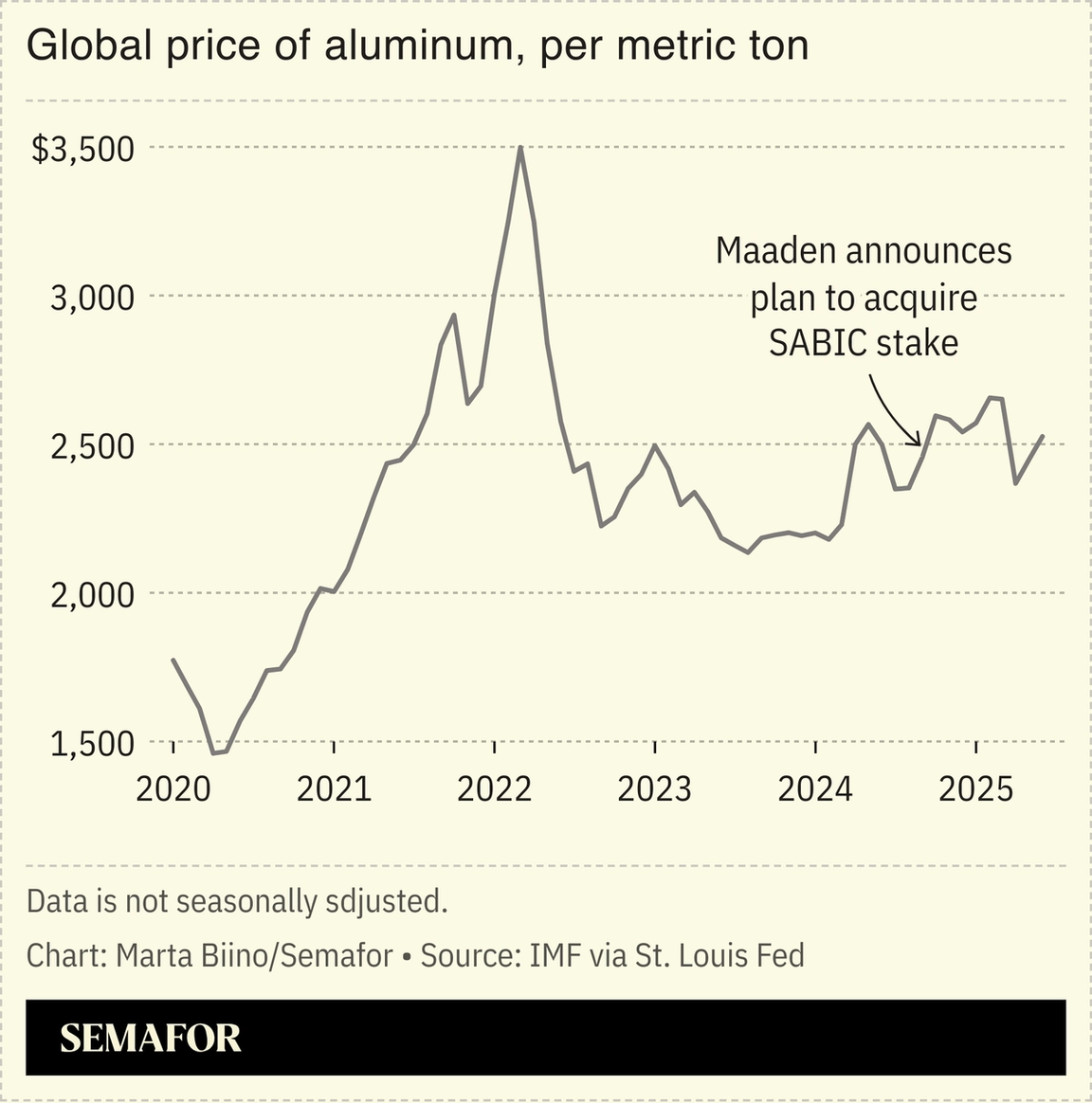

Aluminium Bahrain, one of the largest smelters in the Middle East, is looking at international investments as part of its plans to boost production and secure supply chains. Alba, as the firm is known, is also continuing to explore a potential secondary listing in Saudi Arabia that could involve a new share sale as part of a plan to increase its valuation, Khalid Al Rumaihi said in an interview in Manama. The state-controlled aluminum smelter, one of the largest producers of the metal outside China, is working with China’s Shandong Innovation and alternative asset manager BlueFive Capital on a potential investment in Indonesia that would involving building a new smelter and taking ownership of a bauxite mine, Al Rumaihi said. It’s also looking at potential investments in other aluminum companies around the world, he said. Alba is 70% owned by Bahrain’s sovereign wealth fund Mumtalakat, with another 20% owned by Saudi Arabia’s state-controlled mining firm Maaden. — Matthew Martin |

|

DP World invests $5 billion in India |

The container yard at Mundra terminal. Courtesy of DP World. The container yard at Mundra terminal. Courtesy of DP World.Emirati logistics company DP World committed $5 billion to expand its operations in India, adding to the $3 billion it has already invested over the past 30 years. The company plans to invest in green coastal shipping, shipbuilding, skills training, port upgrades, and freight systems. The company says the investments will help lower logistics costs, support manufacturing, and improve market access, part of a broader bet that India, where it already covers over 200 locations, will become a global trade hub. |

|

Checking In- Abu Dhabi will begin expanding Zayed International Airport within two years, pushing capacity beyond 65 million passengers to meet demand as national carrier Etihad targets doubling in size by 2030. The plan includes new AI systems and further scaling facial recognition tech to speed up queues. — The National

- Qatar’s bet on its massive airport remaining relevant after the 2022 men’s soccer World Cup is paying off. The country’s visitor numbers are still climbing, up around 2% in the first nine months of 2025 compared to a year ago, as it leans on a lineup of sports and cultural events, from Formula One to art exhibitions, to maintain momentum. — The Peninsula

Infrastructure- Kuwait’s government-owned Fund for Arab Economic Development has signed a $25 million loan agreement with Pakistan to fund a hydropower dam project — the second tranche of a $100 million commitment aimed at boosting Pakistan’s energy and water infrastructure.

Industry- Chinese economic zone Tianjin Binhai New Area unveiled an $80 million investment in a Gulf-focused fund launched by ewpartners that will invest in sectors from digital tech to advanced manufacturing and logistics and aims to connect Chinese businesses to Gulf opportunities.

Markets- Stock exchange operator Boursa Kuwait is riding a wave of renewed interest in the country’s stocks. The company’s net profit is up 60% in the first nine months of 2025 compared to a year earlier, with trading volume almost doubling in the period. — AGBI

|

|

A crypto mine in the US. Alan Freed/Reuters. A crypto mine in the US. Alan Freed/Reuters.In the UAE, you can now mine Bitcoin with a phone plan. Telecom provider du launched a subscription-based service that lets residents rent crypto mining power through an online auction. The company aims to make crypto mining easier and more secure, with built-in ID checks and simple contracts. The UAE has embraced the virtual assets industry, introducing regulations that have attracted some of the world’s biggest exchanges to set up operations in the country. The Middle East accounts for roughly 7% of global virtual asset transaction value. A growing number of regional institutions are big holders, and about a quarter of the UAE’s population owns virtual assets. |

|

|