| Read in browser | ||||||||||||

Good morning, it’s Carmeli in Sydney here to bring you all the latest news. Today’s must-reads:

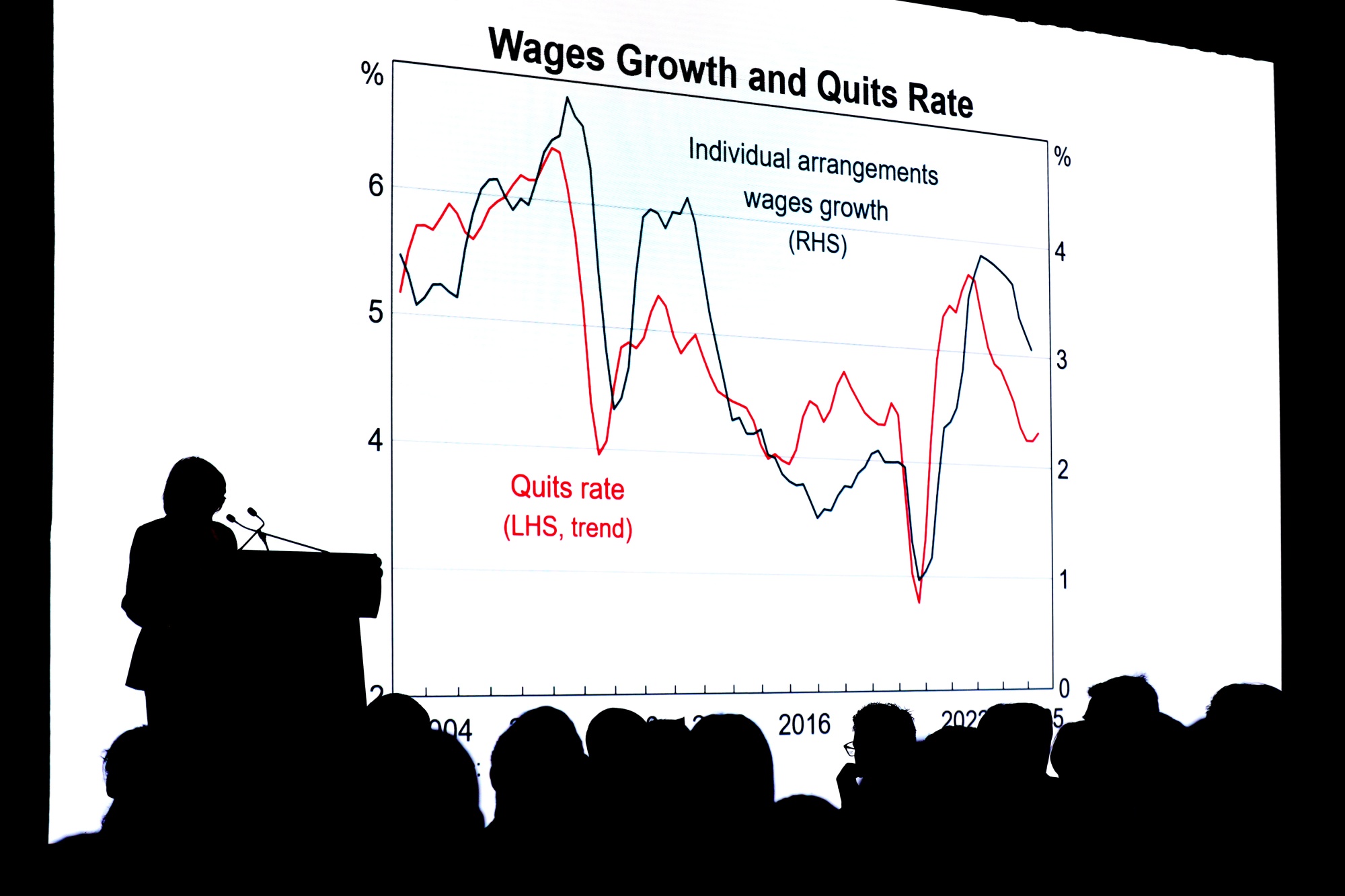

What’s happening nowAhead of next week’s RBA decision, the monetary policy board will have to decide whether to lower interest rates further to support the labor market or stand pat in order to maintain downward pressure on inflation, Governor Michele Bullock told a forum of economists on Monday.  Photograph: Lisa Maree Williams/Bloomberg Bloomberg Rio Tinto said the Tomago aluminum smelter in New South Wales may close as a projected increase in power costs from 2029 would leave operations unviable. Rio owns 51.55% of Tomago Aluminium Co. Meanwhile, a Rio Tinto subsidiary is conducting an internal investigation into allegations of corruption and unethical conduct at its copper operations in Mongolia and has sought help from law enforcement. Bond sales in Australia are poised to hit new highs this year as the government’s rare AAA ratings fuel the appeal of the market. Australian-dollar debt offerings climbed about 1% to A$282 billion so far in 2025, a year-to-date record, according to data compiled by Bloomberg.  What happened overnightHere’s what my colleague, market strategist Mike “Willo” Wilson says happened while we were sleeping… Stocks surged and gold slumped below $4,000 on trade optimism in the run-up to Donald Trump’s meeting with Xi Jinping. As an indicator of the strong appetite for risk assets and currencies, Aussie dollar was back above 100 yen. Kiwi gained and the greenback edged lower. The Goldilocks scenario of benign inflation data coupled with solid company earnings heading speaks to more of the same in the near-term. Today’s economic calendar is pretty bare as markets eagerly await a US interest rate decision on Wednesday. It’s unlikely that the soft opening for local stocks as implied by ASX futures will last long. Chinese and US trade negotiators have lined up diplomatic wins for Donald Trump and Xi Jinping to unveil at a summit, including China resuming soy purchases and America walking back its latest tariff threat.  US President Donald Trump arrives in Japan. Photographer: David Mareuil/Anadolu Agency/Bloomberg Amazon.com Inc. plans to cut corporate jobs in several key departments, including logistics, payments, video games and the cloud-computing unit, according to people familiar with the matter. Treasury Secretary Scott Bessent on Monday confirmed the names of five finalists to succeed Federal Reserve Chair Jerome Powell, with the president saying he expected to make his decision by year-end. A resounding win for Javier Milei’s party in midterm elections late Sunday — with a lifeline from the US — gave the libertarian president new momentum for his quest to overhaul Argentina and break the country’s cycle of debt, default and crisis. One more thing...South Korean supergroup BTS is planning its biggest tour ever. The group temporarily disbanded as its members undertook their mandatory military service. With that done, BTS has been working on a new album over the past few months with Hybe Co. The album, the group’s first full record in six years, will be released at the end of March 2026.  Jungkook, from left, Jin, Jimin, V, RM, and J-Hope of BTS perform onstage at MGM Grand Garden Arena on in Las Vegas, Nevada, in 2022. Getty Images North America We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|