| | The US and EU step up sanctions on Russia, a major meeting of China’s top brass, and playing the cla͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - New sanctions on Russia

- China’s two-speed economy

- Tesla sales up, profits down

- Euro firms’ Starlink rival

- Meta’s AI layoffs

- Record coal use last year

- Peru crime emergency

- Rise of migrant workers

- African medical tourism

- Clarinet in brain surgery

A sweeping novel about Tunisian history. |

|

US, EU step up pressure on Russia |

Yoruk Isik/File Photo/Reuters Yoruk Isik/File Photo/ReutersThe US unveiled new sanctions on Russia’s biggest oil producers as Washington ramped up pressure on Moscow to end the war in Ukraine. The sanctions on Rosneft and Lukoil were accompanied by further penalties from the EU, sending global oil prices almost 4% higher. Meanwhile, The Wall Street Journal reported that Washington lifted restrictions on Ukraine’s use of European long-range missiles, enabling Kyiv to attack deeper into Russia: It has recently been targeting key oil and gas infrastructure, kneecapping the industries that drive roughly a fifth of Russia’s GDP. It’s “time to stop the killing and for an immediate ceasefire,” US Treasury Secretary Scott Bessent said. |

|

Beijing quiet on life after Xi |

Florence Lo/File Photo/Reuters Florence Lo/File Photo/ReutersA four-day meeting of the Chinese Communist Party’s top brass concluded today, with Beijing facing momentous challenges at home and abroad. Policymakers must contend with a two-speed economy, The Economist argued: While domestic consumption has flatlined and youth unemployment soars, strong exports continue to drive economic growth, and Chinese tech firms have become global industry leaders. Though investors remain bullish on Chinese stocks, analysts are awaiting a readout of the meeting to see where Beijing’s economic priorities lie. One increasingly important topic likely not discussed at the gathering was Chinese leader Xi Jinping’s succession plans. Though Xi, 72, retains a firm grip on power, the lack of successors has raised fears of an internecine struggle, The New York Times reported. |

|

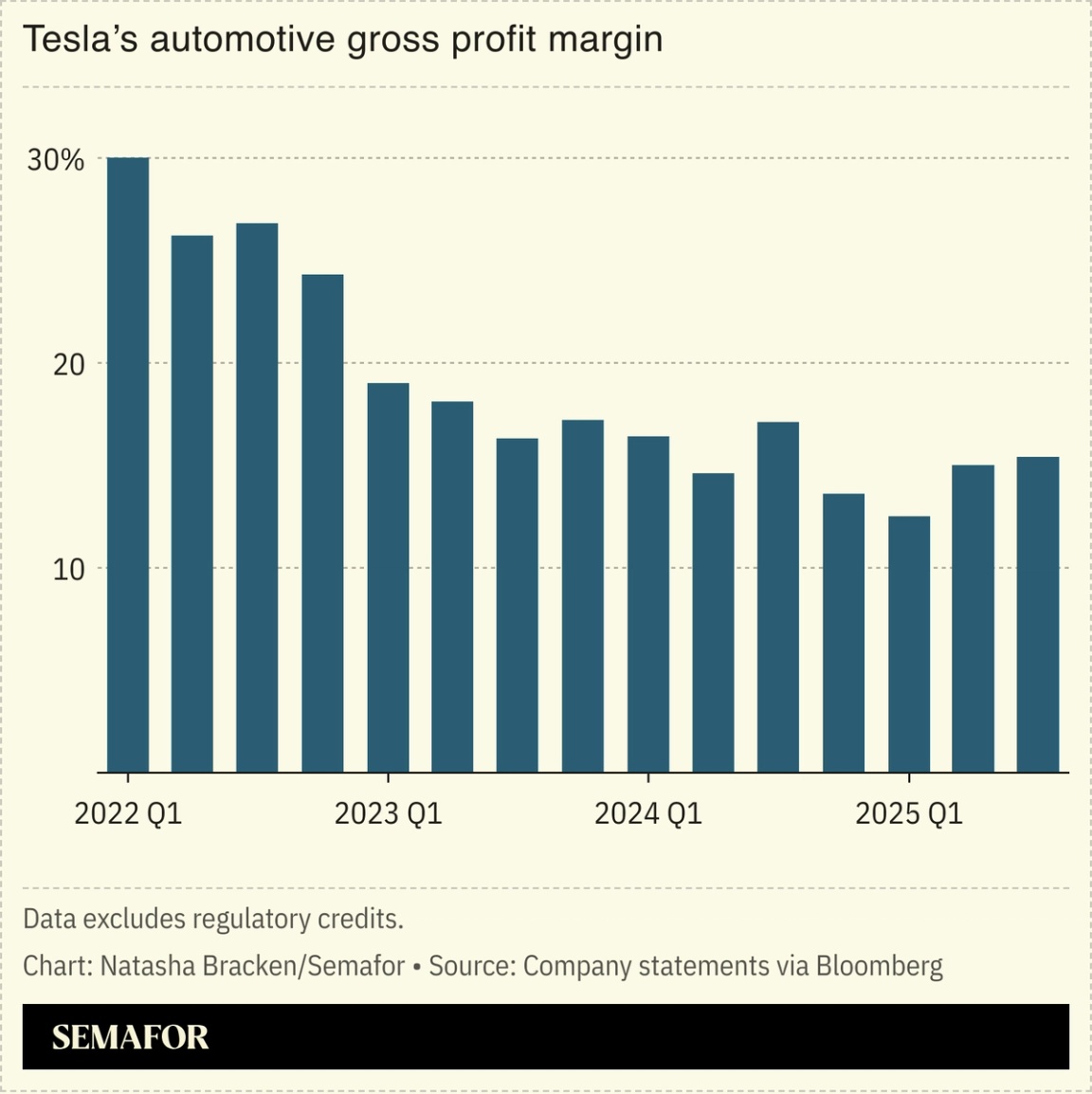

Tesla sales up, but profits down |

Tesla sold a record number of cars in Q3 2025, but still saw profits drop by 37% year-on-year as high spending, tariffs, and an end to US subsidies hit its margins. US consumers raced to buy EVs before tax credits ended on Sept. 30, meaning Tesla sold an unprecedented 497,099 units worldwide. But the trade war has made vital components more expensive, and changes to US law mean Tesla can no longer sell emissions credits to more polluting rivals. The company has also spent heavily on recruiting AI talent to boost its self-driving and robotics ambitions. Tesla stocks fell 3.5% on the news, which comes as CEO Elon Musk pushes for a new $1 trillion share package. |

|

European firms plan Starlink rival |

Mohammed Badra/File Photo/Pool via Reuters. Mohammed Badra/File Photo/Pool via Reuters.Three European aerospace giants will reportedly merge their space businesses to create a broadband satellite company to rival Starlink. Airbus, Leonardo, and Thales’s “Project Bromo” will launch from 2027, Reuters reported. The plan represents a departure for Europe’s top satellite makers, which have traditionally focused on large, complex spacecraft in high orbits, but the industry has been disrupted by Starlink’s small, relatively cheap, low-orbit machines. Several other groups are trying to compete with SpaceX — two Chinese state-backed organizations and Jeff Bezos’ Project Kuiper have begun putting satellites in space — but Starlink is the runaway leader on space broadband: It has over 8,000 active satellites and an estimated million terminals, and represents over 50% of all satellites in space. |

|

Carlos Barria/Reuters Carlos Barria/ReutersMeta will cut about 600 roles from its “superintelligence” team, potentially signaling an end to the company’s aggressive AI expansion. CEO Mark Zuckerberg personally led a hiring spree that reportedly included $100 million salaries for top talent poached from rivals. Meta said that the cuts were to make its AI divisions more flexible, meaning “fewer conversations will be required to make a decision” according to an internal memo seen by Axios. But Zuckerberg has been concerned that the company’s investments have not led to rapid progress, and has attempted a reorganization. Wider AI investment is not slowing down, but there are growing concerns that it is a bubble masking deeper problems in the economy. |

|

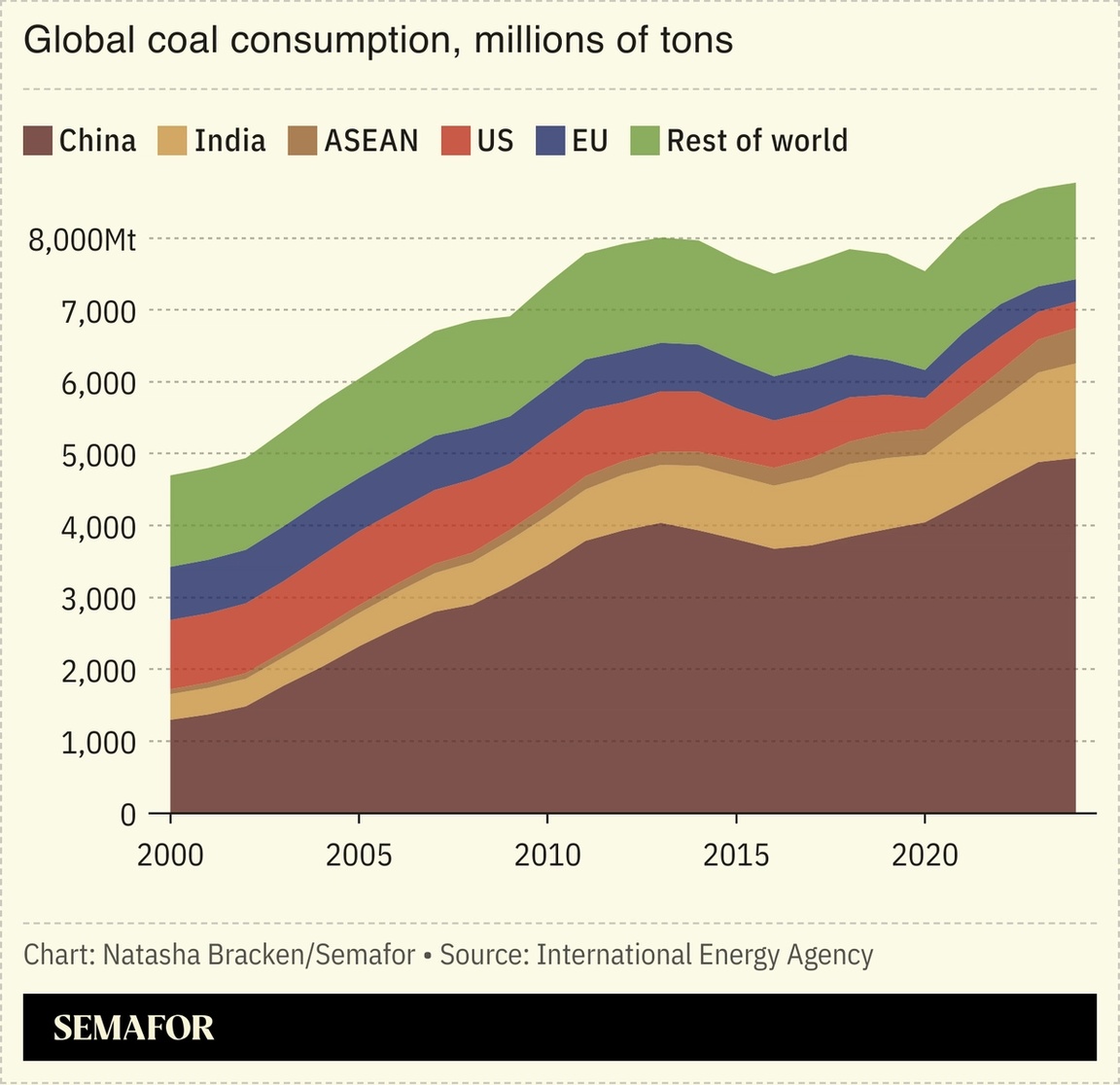

Coal use up despite renewables surge |

Global use of coal hit a record high in 2024, despite growing use of renewable energy sources. A new report found that coal’s share of total power generation was falling, but increasing electricity demand meant that the absolute quantity used increased. Most countries have pledged to wean themselves off coal, but some remain keen, because it is cheap even if it is polluting. India recently marked passing 1 billion tonnes of coal production this year, while US President Donald Trump has backed fossil fuels. South Africa, on the other hand, announced a plan to reduce its dependency on coal from 58% of its energy mix now to 29% by 2039, in particular planning to boost spending on nuclear. |

|

Peru declares crime emergency |

Sebastian Castaneda/Reuters Sebastian Castaneda/ReutersPeru’s prime minister asked Congress for extraordinary powers to pass harsher security laws, a move that comes a day after President José Jerí declared a state of emergency in the capital amid spiraling crime. The once-safe Andean nation has been gripped by a recent wave of violence which forced former President Dina Boluarte from power this month. Crime such as theft and extortion is rampant across Peru, as is transnational drug trafficking: A surge in cocaine production in neighboring Colombia has set off a fight between cartels for control of Peru’s ports on the Pacific, the most common route for drug trafficking to North America, the world’s biggest market. |

|

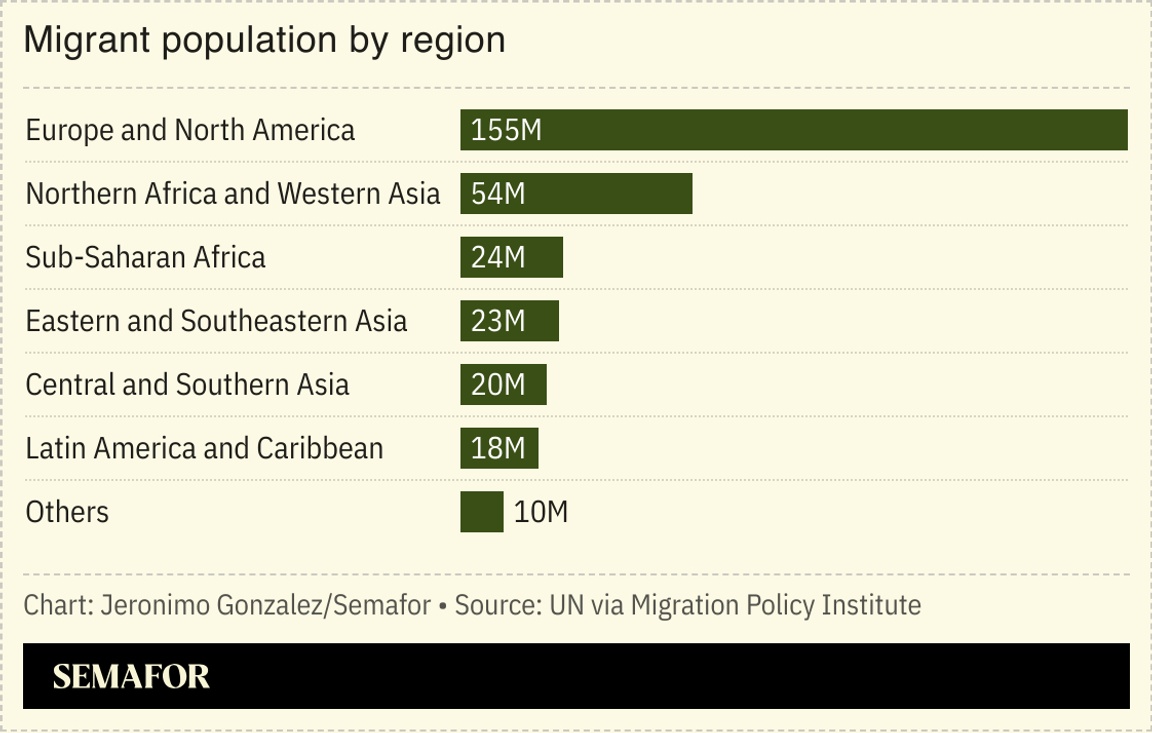

The rise of guest worker schemes |

Guest worker schemes are on the rise, offering a way of threading the needle between immigration’s economic necessity and political unpopularity. Across the OECD, temporary working visas rose from 1.5 million in 2014 to 2.5 million in 2023; even anti-immigration governments such as Italy and Hungary have increased them. Rome introduced “one of the [world’s] most progressive” labor mobility agreements with India, one recruiter said. The rich world needs workers, but low-skilled arrivals on long-term visas may be “a false economy” in countries with generous welfare states, and anti-immigration populism is on the rise. “Temporary migration is a pretty good alternative to the permanent sort,” The Economist argued, although there is “squeamishness” over issues of integration and abuse. |

|

African leaders’ health tourism |

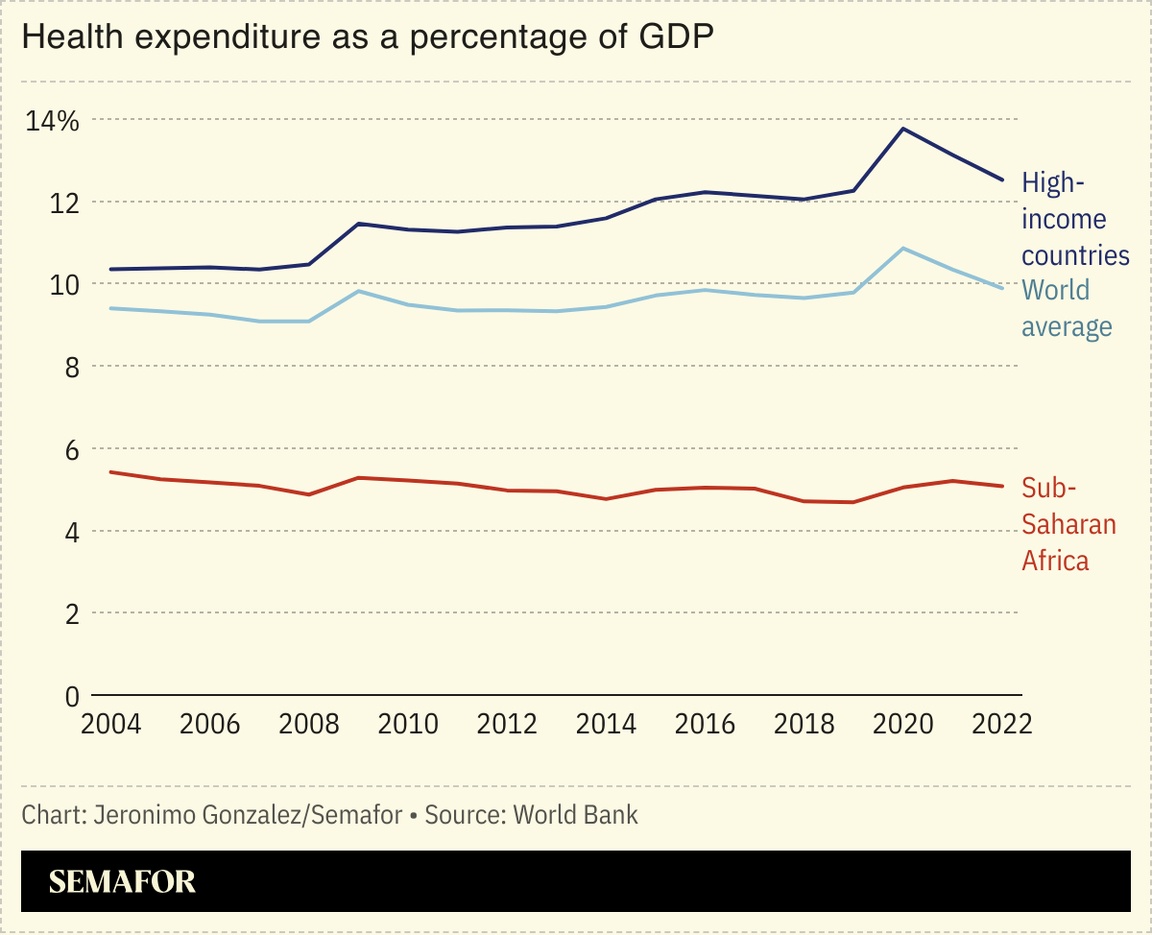

African leaders’ medical tourism is undercutting the continent’s health industry, a prominent analyst argued. Leaders across the region often travel to Europe or East Asia for healthcare despite promises to end medical trips abroad, with a senior South African minister questioning how the world can take Africa seriously “if its heads of state did not trust their own healthcare systems.” Though African Union countries have pledged to spend 15% of their GDP on health, current spending across sub-Saharan Africa is just 5%, with some countries losing billions of dollars a year to medical tourism. “So long as Africa’s political leaders and elites are able to enjoy foreign healthcare, they’re unlikely to tackle the shortcomings of their… institutions,” Justice Malala argued. |

|

In an era of meme stocks, crypto bubbles, and skyrocketing housing costs, Michael Lewis’ The Big Short hits harder than ever. A lot has changed since Lewis wrote The Big Short, but some things — such as who really pays for an unchecked financial system — are as relevant as ever. Narrated by the author himself for the first time, The Big Short audiobook is a playbook for understanding today’s economic uncertainty. Listen to The Big Short now. |

|

|