| | In today’s edition: Saudi cafe IPOs, Mecca megaproject, and why the US should prioritize AI chip exp͏ ͏ ͏ ͏ ͏ ͏ |

| |   Riyadh Riyadh |   Jerusalem Jerusalem |   Abu Dhabi Abu Dhabi |

| Gulf |  |

| |

|

- Saudi cafes join IPO pipeline

- PIF’s Mecca project…

- … and green bonds push

- Abu Dhabi invests in Aramco

- UAE presses on AI

- Syria-Gulf tied by ‘destiny’

- Fears of the Gaza spoiler

The looming succession in Tehran, and other weekend reads. |

|

Saudi chains join the IPO rush |

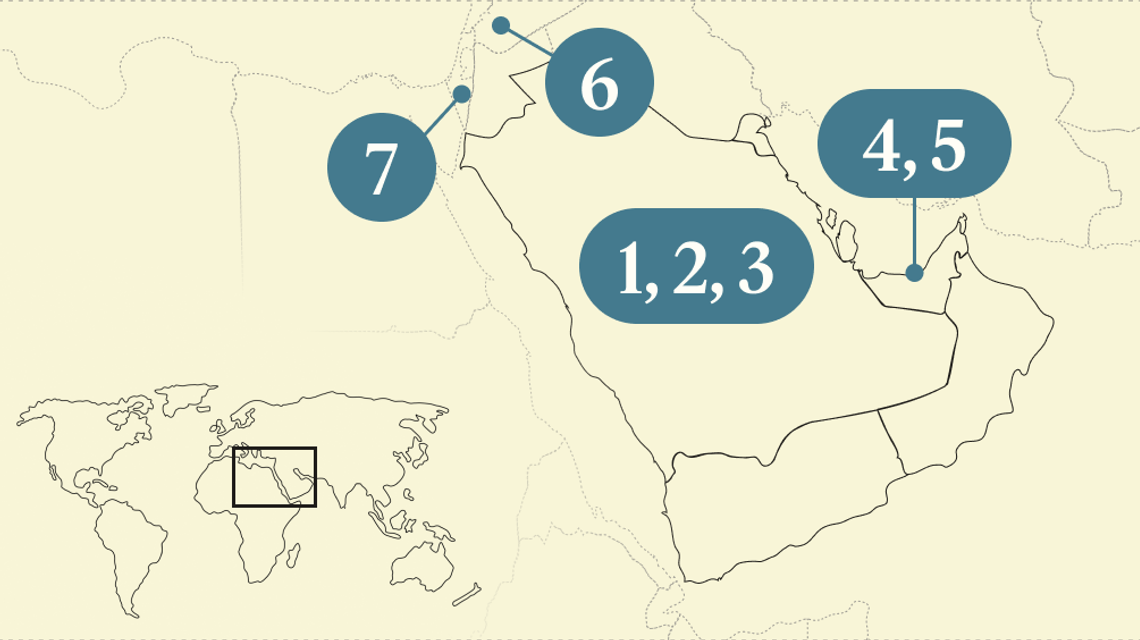

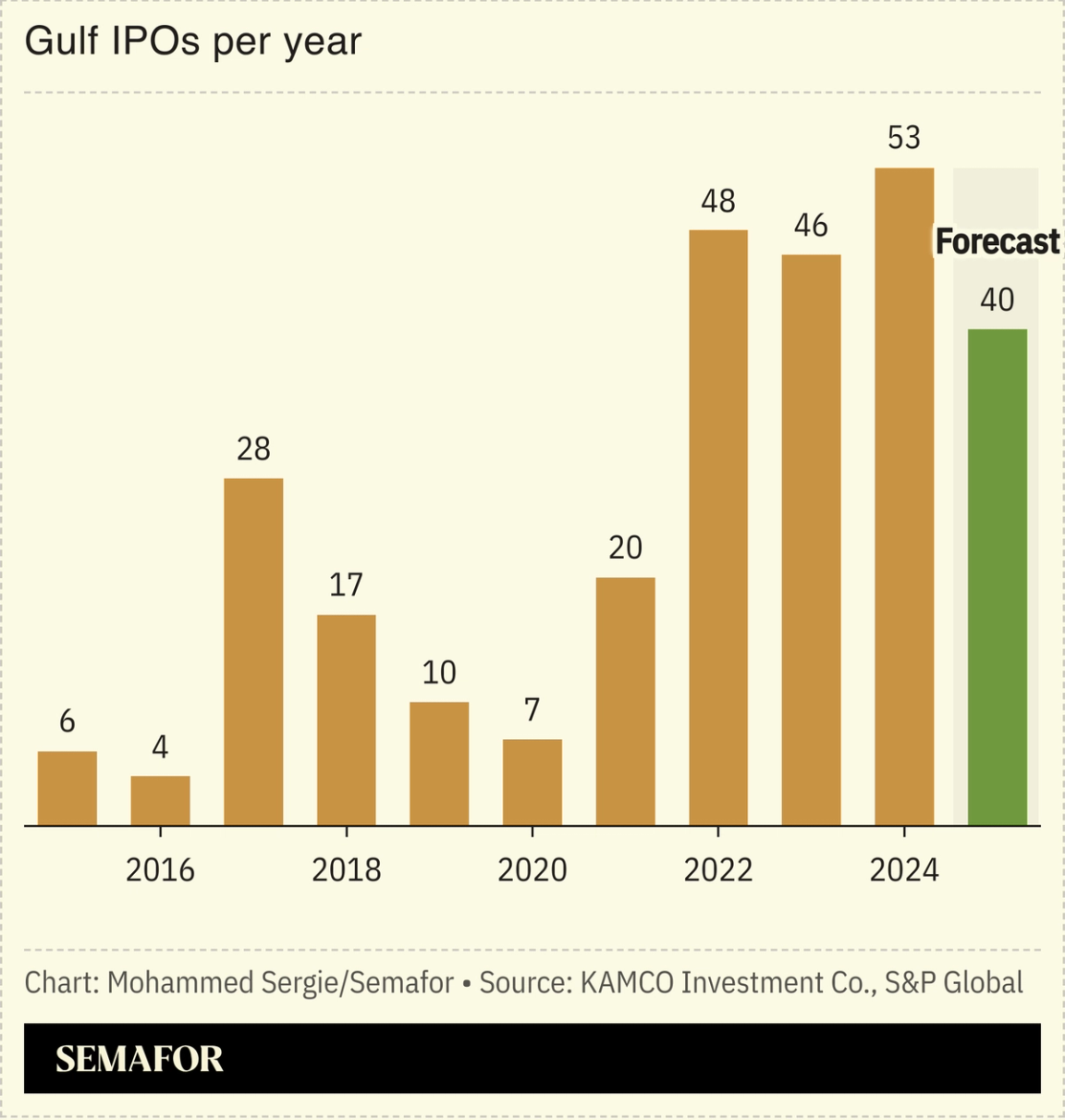

Rising Saudi consumer spending is fueling a coffee shop and retail IPO rush. Several Saudi companies are lining up to sell shares on the local exchange next year: Half Million, the coffee chain founded by two scions of the billionaire Al Rajhi banking family, has hired EFG Hermes and SNB Capital to advise on an initial public offering; and two other local cafes — Barns and The Coffee Address — have started talks with banks about potential share sales. Luxury retailer and restaurant chain Bateel is in discussions with advisers after already hiring Morgan Stanley, according to people familiar with the matter. Spending on restaurants and cafes is among the biggest categories of consumer outlays in the kingdom, with $2 billion spent in August — nearly 12% of total spending captured from payment machines, according to Saudi Central Bank data. That appetite is driving a wave of cafe and restaurant openings, as young Saudis with higher disposable incomes and fewer social restrictions flock to public spaces where gender mixing was prohibited just five years ago. — Matthew Martin |

|

Saudi plans giant Mecca development |

Rendering of the project. Courtesy of RUA AlHaram AlMakki Co. Rendering of the project. Courtesy of RUA AlHaram AlMakki Co.Saudi Arabia announced another new huge real estate project to be developed by its sovereign wealth fund. The King Salman Gate in Mecca will cover 12 million square meters including prayer areas, residential units, hotels, and shops adjacent to the Grand Mosque as part of plans to expand religious tourism. No price tag for the development was announced, but it comes at a time when some other projects being developed by Public Investment Fund have faced budget cuts. Crown Prince Mohammed bin Salman has made tourism, including pilgrimages to Islam’s most revered sites, a key part of his plan to diversify the Saudi economy. The government is pouring billions of dollars into developing Mecca and Medina, with a view to accommodating 30 million worshippers a year by 2030. |

|

PIF to boost green bond issuances |

Princess Rasees Al Saud. Paul Morigi/Getty Images for Semafor. Princess Rasees Al Saud. Paul Morigi/Getty Images for Semafor.Saudi Arabia’s sovereign wealth fund plans to accelerate green bond issuances as investors clamor to put their money into clean energy projects. Speaking at Semafor’s World Economy Summit in Washington, DC, Princess Rasees S. Al Saud, Public Investment Fund’s head of financial institutions and investor relations, said that since 2022, the fund’s green bonds have been oversubscribed by five or six times. Looking ahead, she expects demand to remain strong. The fund has fully allocated proceeds from its $11 billion in green bond issuances over the past two years, with 95% directed to new projects. The $1 trillion PIF is tasked with diversifying the kingdom’s economy, and many of its projects, such as the resorts along the Red Sea, are fully powered by renewable sources, Al Saud said. |

|

Sovereign funds join $11B Aramco deal |

Dado Ruvic/Reuters Dado Ruvic/ReutersSovereign wealth funds from Saudi Arabia, Singapore, and the UAE have joined an $11 billion deal to support Aramco’s plan to boost gas production, according to people familiar with the matter. The consortium, led by BlackRock’s Global Infrastructure Partners (GIP), includes Saudi Arabia’s Public Investment Fund and its Hassana pension fund, one of the world’s largest. Abu Dhabi’s Mubadala Investment Co and Lunate, Bahrain’s Abrdn Investcorp Infrastructure Partners, and Singapore’s GIC also joined the deal, the people said. Aramco announced in August that a GIP-led group would acquire a 49% stake in Jafurah Midstream Gas Co., which will lease development and usage rights for a gas processing facility before leasing them back to Aramco. The Jafurah deal is one of Saudi Arabia’s largest single inflows of foreign direct investment since Aramco sold leasing rights to some of its infrastructure assets in 2022. The presence of Abu Dhabi funds is noteworthy, marking one of the first times that state-controlled investors from the emirate have put money into a Saudi entity. — Matthew Martin |

|

Major progress on Stargate UAE |

A view of construction progress at the Stargate UAE data center in Abu Dhabi. Courtesy Emirates News Agency-WAM. A view of construction progress at the Stargate UAE data center in Abu Dhabi. Courtesy Emirates News Agency-WAM.Construction is underway on Stargate UAE, a 1 gigawatt data center project in Abu Dhabi that will anchor a mammoth planned UAE-US AI Campus. The first 20% of the site — developed by G42’s Khazna Data Centers with participation from OpenAI, Oracle, and Nvidia — is on schedule to open in 2026. G42 is in advanced talks with Google, Microsoft, AMD, Cerebras Systems, and Qualcomm to be part of the campus, Semafor previously reported. Progress comes as US export rules for cutting-edge chips remain undefined. Former US energy and infrastructure envoy Amos Hochstein has thrown his support behind the Gulf getting chips: “I’d rather work with the UAE than with Spain… they’ve put Huawei in their intelligence systems,” he said Thursday at Semafor’s World Economy Summit. The US has “never been able to restrict technology,” he added, and should instead aggressively court allies that could otherwise fall into China’s sphere of influence. — Kelsey Warner |

|

Syria seeks sanctions relief |

Paul Morigi/Getty Images for Semafor Paul Morigi/Getty Images for SemaforSyrian officials in Washington this week are lobbying for the removal of sanctions. At stake: more than $10 billion in investments pledged by Gulf countries. Speaking at Semafor’s World Economy Summit on Thursday, Syria’s economy minister said it’s a natural fit for his country to partner with Gulf nations: “This is our destiny… it’s not a choice, it’s not an option,” he said. Qatar and Saudi Arabia recently pledged $89 million to cover Syrian government workers’ salaries for three months, the latest support from Gulf states since the overthrow of the Assad regime in December. The minister said Damascus is “not looking for” loans, aid, and donations — though “of course we’re not going to refuse it if it comes” — and is instead focused on finding lasting partners who will invest in the country’s growth. — Mohammed Sergie and J.D. Capelouto |

|

View / Arabs cheer Trump’s peace deal |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersArab leaders are cautiously optimistic that the war in Gaza is over and US President Donald Trump’s peace plan will hold. But they are worried about the spoilers, Faisal J. Abbas, the Editor-in-Chief of Arab News, writes in a Semafor column. “President Trump has made a bold move, and Arab nations are ready to be partners in peace. He has earned the admiration of many,” Abbas wrote. “But for his triumph to be complete, he must confront the one actor [Israeli Prime Minister Benjamin Netanyahu] capable of unraveling it all, or face the consequences of letting history repeat itself.” |

|

On Nov. 12 at Cipriani South Street in New York, the Dubai Business Forum will convene CEOs, senior executives, and policymakers for a day of high-level conversations on global growth, AI disruption, and cross-border collaboration — examining the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Featured speakers include H.E. Sultan bin Saeed Al Mansoori (Chairman, Dubai Chambers), Jose Minaya (Global Head, BNY Investments and Wealth), Jared Cohen (President of Global Affairs and Co-Head of the Goldman Sachs Global Institute, Goldman Sachs) and Ola Doudin (CEO, BitOasis). Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams, with select editorial sessions independently developed and led by Semafor’s newsroom. |

|

Deals- Sheikh Tahnoon bin Zayed’s conglomerate International Holding Co. plans to combine Multiply Group, 2PointZero, and Ghitha Holding into a single Abu Dhabi-listed firm, 2PointZero, with some $33 billion in assets and operations in 85 countries. The merged vehicle will tap rising demand for energy, AI solutions, and food security.

Defense- Saudi Arabia and China launched their third joint naval drills in Jubail, which a focus on maritime terrorism and piracy. The last edition saw simulations of hijacked vessels and joint rescue missions. — The National

|

|

|