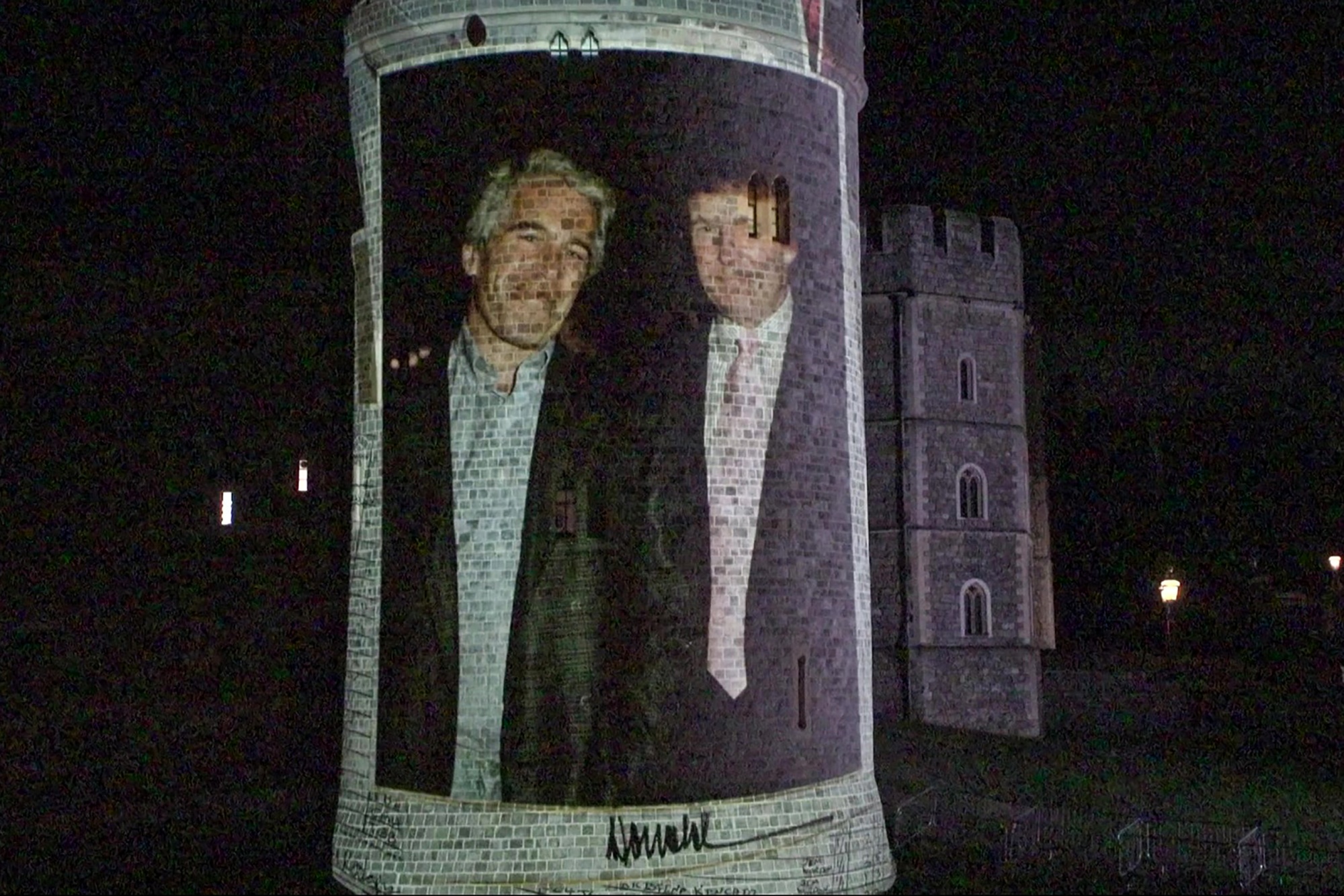

| Do you know how hard it’s been to sit at my desk all day, pretending to work, while knowing the moment was almost here? I’ve been going through the motions, answering emails, sipping my iced coffee, but in the back of my mind, the anticipation was killing me. All I could think about was the DRAMA that was about to unfold. We’ve been building up to this for months, but today — Wednesday, Sept. 17 — is the culmination of it all. Everyone knows what’s coming, but the question remains: How far will they go? You might think I’m talking about Fed Day, but you’d be wrong. The last-ever episode of The Summer I Turned Pretty dropped at 3 a.m. New York time and I — like many other sane individuals who refuse to get up at the crack of dawn to watch a show made for teenagers — have yet to watch it. But I did watch our Fed Day livestream, so let me walk you through it. The central bank opted for a modest quarter-point move, not the “jumbo” cut that some were hoping for. Jonathan Levin was surprised to learn there was only one dissent from the newly-admitted Stephen Miran, and so was Allison Schrager. “When you have the whole committee in lockstep, that to me suggests some serious groupthink and overconfidence,” she said. Kathryn Anne Edwards was skeptical as well: “Will this be enough … given that the pressure is coming from mainly tariffs, rather than a slowdown in the economic cycle?” Some investors are crossing their fingers that the Fed’s cut will be the first of many so that longer-term interest rates go down. While that’d be a dream for homebuyers, the US government and corporate America, Jonathan says there’s pretty much zero chance of that happening. The last time the Fed cut under similar conditions in 2024, yields on 10-year Treasury notes surged. As he writes in his column, “the bond market has a mind of its own.” So, too, does Belly Conklin. Really, the overlap between the FOMC and TSITP cannot be overstated. They both have confusing acronyms. They both have a chokehold on society. They both have amazing playlists. Seriously: This Fed Day Soundtrack curated by Bloomberg Opinion? It gives Jenny Han a run for her money. And, much like the rate cut, we haven’t had a present-day Conrad-Belly kiss since last season. Eeek! Bonus Economy Reading: The “smart money” crowd has a poor investing record, and they may be timing the market badly again. — Nir Kaissar President Trump’s big trip to the UK “has become a profoundly unpopular charade,” writes Max Hastings. Behind closed doors, King Charles and Queen Camilla “expressed dismay” at the visit. If that weren’t bad enough, the prime minister is, in Max’s words, “a duck so lame that he can scarcely waddle.” And then there’s “the supreme embarrassment” of him having to fire an ambassador to the US who was embroiled with the late pedophile Jeffrey Epstein, the face of whom was projected onto Windsor Castle on Tuesday evening:  Photographer: Lena Voelk/AFP “I have occasionally had the privilege of attending state banquets for foreign leaders at Buckingham Palace. These are wondrous, glittering affairs that humble even the most world-weary guests,” Max writes. “But the dinner at Windsor for Donald Trump will be a travesty, because almost none of the invited British guests, save a few City of London fat cats who love this president because he makes them even richer, will want to be there.” Perhaps the most exciting guests, then, will be the Silicon Valley royalty that Parmy Olson says accompanied Trump. Although Nvidia CEO Jensen Huang and OpenAI CEO Sam Altman promised to inject grand sums of money into the UK economy during their trip, Parmy says the UK ought to take such commitments with a pinch of salt. “There’s an impossibly wide gap between Britain and America on AI infrastructure,” she warns. There’s also an impossibly wide gap in etiquette, something I expect we’ll hear more about tomorrow after this evening’s opulent state banquet. Apparently, there’s even a bespoke cocktail to symbolize America’s “special relationship” with the UK. But for the guest of honor, a glass of Diet Coke will do. Bonus UK Reading: Each of Keir Starmer’s radioactive missteps is coming harder on the heels of the next. — Rosa Prince |