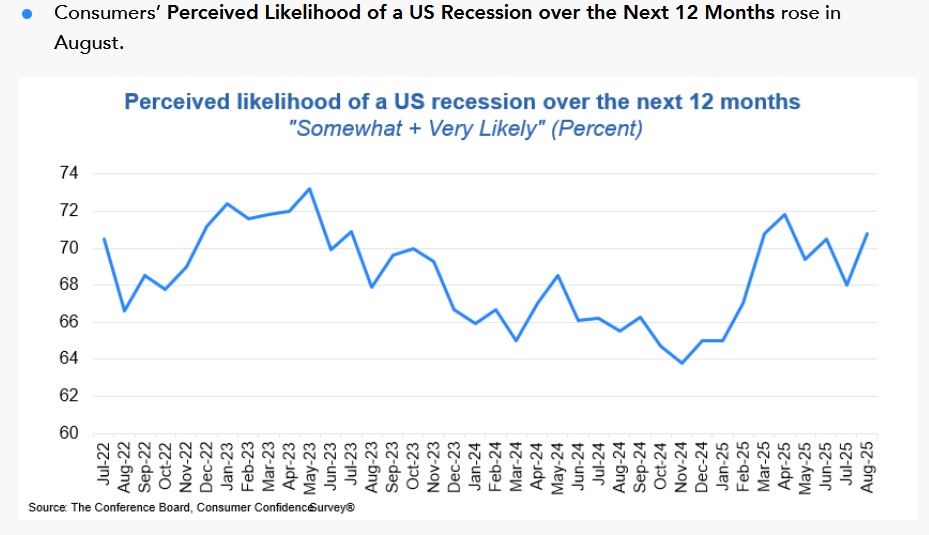

| It’s logical to wonder why, if core annual inflation is still around 3%, the Nasdaq 100 Index just hit a record high and leaders in the AI industry are talking about a bubble, the Fed is lowering rates in the first place. Here’s a chart I used last week that explains why we’re likely getting cuts. The record number of jobs subtracted from employment in recent downward revisions shows the labor-market expansion in 2024 was weaker than we thought heading into this year’s immigration slowdown. That suggests the rate hikes in 2022 and 2023 acted with a lag to slow the economy. It aligns with the steady rise in underemployment since 2023. And it signals that, if the Fed doesn’t ease now, the lag before its policy takes effect could tip the US into recession. One way to think about the post-rate-hike economy is as a bifurcation between haves and have-nots as rising underemployment, sticky inflation and higher interest rates hit lower-income households more. Small businesses have also suffered disproportionately from high interest rates and tariffs. High-income households are basically keeping the economy afloat — helped in no small part by elevated home prices, the AI boom, steady interest income and the surge in stock prices. However, looking at Black unemployment, which typically leads the rise in overall unemployment, you could argue that large parts of the US economy are already in a recession. The tick-up in 2025 in Black unemployment is worrying because it’s happening right now. Mark Zandi, chief economist for Moody’s Analytics, has shown that the US economy is increasingly dependent on spending from the upper decile of households. And he’s saying now that there’s a 50% chance of a recession in the next 12 months — in part because of strains on lower-income households. And that echoes what consumers are actually saying. The Conference Board has found that there are nearly as many consumers — more than 70% — saying there’s a likelihood of recession in the next 12 months as there were at the peak of recession angst in 2023.  Source: The Conference Board |