| | DTEK’s Maxim Timchenko says smart investors should see the opportunity in rebuilding Ukraine’s energ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Kyiv Kyiv |   Philadelphia Philadelphia |   Santiago Santiago |

| Net Zero |  |

| |

|

- Copper jumps

- Power bills jump

- Energy CEO’s war strategy

- Shrugging off sustainability

- Wind and solar boom

Big offshore wind deals, and Trump prospects for critical minerals across Africa. |

|

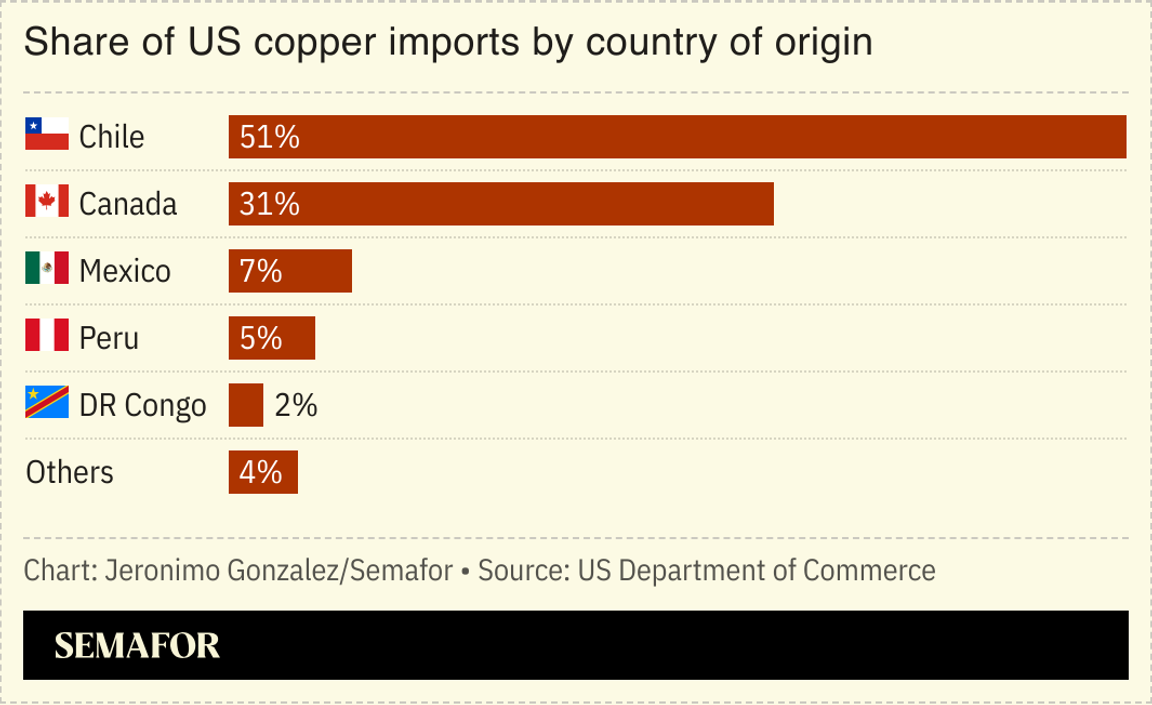

US President Donald Trump said he will impose a 50% tariff on all copper imports, a plan that could lead to sharply higher energy prices. Copper prices hit a record high this week, as manufacturers of almost any product using electronics rushed to stockpile the metal. The ostensible aim of the tariffs — for the US to quickly ramp up its own copper mining and refining capacity — will be nearly impossible to achieve, analysts believe. And so, because the US remains highly reliant on copper imports, especially from Chile, essential hardware for solving what Trump has identified as an energy “emergency” — including transmission cables, batteries, and renewables — will become much more expensive, raising power costs for households, data centers, and other consumers. Copper prices are also set to rise because of climate change, a PwC report warns, as droughts dry up the necessary water resources for mining. |

|

Leah Millis/File Photo Leah Millis/File PhotoUS consumers should brace for higher power prices this year, as electric utilities point to data centers as a justification to significantly hike their rates. Utilities nationwide have asked regulators to approve $29 billion in higher rates so far this year, 142% more than the same period last year, a report by the advocacy group PowerLines found. Much of that growth is linked to skyrocketing demand from data centers, meaning homeowners will have to subsidize tech giants’ AI ambitions. The problem is particularly acute in the northeastern grid network PJM, where prices could jump 20% this summer; the governor of Pennsylvania threatened to pull his state out of the network unless more price controls are put in place. But there’s some hope on the horizon there: Constellation Energy’s deal with Microsoft to restart the Three Mile Island nuclear plant will give the grid a significant boost if it meets its 2028 launch target. |

|

An energy CEO’s wartime strategy |

| |  | Tim McDonnell |

| |

Roman Baluk/Reuters Roman Baluk/ReutersThe energy ceasefire deal between Moscow and Kyiv brokered in March has held firm enough that another winter of blackouts in Ukraine is unlikely this year, the CEO of the country’s top private energy company told Semafor. Maxim Timchenko, who leads DTEK Group, said that although facilities close to the front line are still sustaining regular damage, none of the company’s power stations have suffered large long-range missile attacks since the deal was announced. That has granted DTEK enough breathing room to rebuild much of the thermal power generation capacity that, at its worst point in summer 2024, was 90% destroyed by Russian drones and missiles. That includes restoring devastated coal-fired power plants, and building a new generation of wind and solar farms. DTEK is a unique case study in how the green transition is upending conventional notions of energy security. For the past few decades, that term has mainly referred to the security of fossil fuel supply chains. For Ukraine, that wasn’t enough: DTEK, which produces about one-quarter of the country’s power, supplies all of its own coal, but still found itself scrambling to mitigate blackouts for the past several winters and summers since so much of its physical infrastructure was destroyed. Renewables, Timchenko said, aren’t just the center of the company’s long-term profit strategy: They’re also much harder to destroy, making a decentralized energy system fundamental to Ukraine’s national security. |

|

Matthew Martin. Semafor. Matthew Martin. Semafor.We are ramping up our investment in the Gulf: Matthew Martin — the star Bloomberg business and finance reporter — has joined Semafor as Saudi Arabia Bureau Chief and Global Head of Sovereign Wealth Fund Coverage. Martin brings deep expertise and sharp analysis to unpack money flows, and dive into Gulf wealth funds’ roles in revamping their economies and projecting soft power internationally, including in Africa and elsewhere. He’ll lead our growing team in Riyadh, which is focused not just on the region but its impact on the world beyond — from South Africa to Silicon Valley, and from Lagos to London. |

|

Shrugging off sustainability |

Share of professional investors who prioritize sustainability considerations in their investment decisions, according to an HSBC survey. That’s up from 17% last year. The survey, of more than 100 global investors representing nearly $5 trillion in assets under management, also found that 55% still don’t incorporate sustainability into their decision-making at all. There’s a deepening divide, the survey concludes, between professional investors who feel strongly that sustainability does matter — and those who don’t. |

|

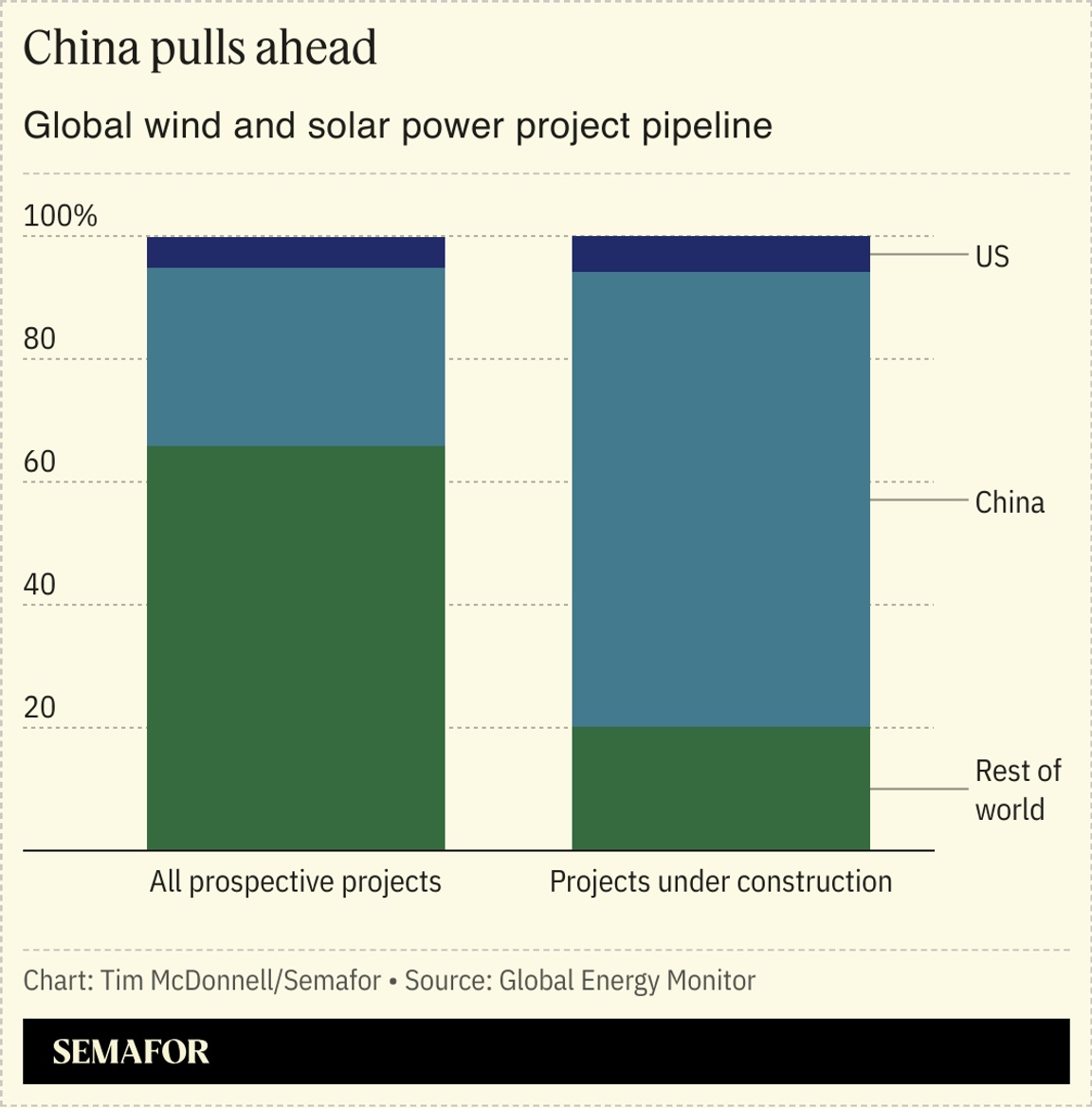

China is extending its lead in the clean energy race, hosting nearly three-quarters of all wind and solar projects under construction globally, according to a new report.  In the first quarter of this year, China’s wind and solar generating capacity outstripped that of coal and gas power for the first time, Global Energy Monitor said, and accounted for 23% of power consumption. New wind and solar projects currently under construction — not counting those in earlier planning phases — will nearly double that capacity. Offshore wind is a particularly strong segment: Half of the offshore wind farms under construction globally are in China, and although the sector has faced the same challenges of rising costs that it has everywhere else, the near-term decarbonization targets of coastal provinces are driving projects forward, the report found. The US, meanwhile, accounts for fewer than 6% of projects under construction. |

|

Can we reconnect a generation? A mental health crisis is gripping young people, with rates of depression, anxiety, and loneliness rising. As social bonds fray and digital life deepens isolation, experts are sounding the alarm and demanding action. Join Semafor at The Gallup Building to hear from Sen. Katie Britt, R-Ala.; Sen. John Fetterman, D-Penn; Carley Ruff; Senior Director of US Government Relations, Habitat for Humanity; Mark Dalton, Senior Policy Director, Technology and Innovation, R Street; Sara DeWitt, Senior Vice President and General Manager of PBS KIDS; and more, as Semafor explores the complex drivers of youth wellbeing, highlighting opportunities to rebuild social ties, foster resilience, and develop lasting strategies to improve the mental health of young people. July 16, 2025 | Washington, DC | RSVP |

|

New Energy Tom Little/File Photo/Reuters Tom Little/File Photo/ReutersFossil FuelsFinancePolitics & PolicyMinerals & MiningPersonnel |

|

|