| | In this edition, how the political battles between Musk and Trump, and Unilever and Ben & Jerry’s, i͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Big, beautiful bill passes

- Unilever loses patience

- Nobody likes Tesla

- Apple’s AI woes

- UK warns on M&A leaks

- AI tests call centers

|

|

There are two ways to succeed in business: build a better product or build a better brand. The best companies do both, but over time tend to lean more on the latter because innovating (New Coke!) is harder than advertising (Coke Classic!). The same is true of universities and other institutions that are now, like big companies, caught resting on reputations built during a different era. Today, we have that story served two ways. First, nobody wants a Tesla. For years, Elon Musk was Tesla’s brand, building a rabid investor fanbase that kept the company afloat and attracting engineers and designers who built beautiful, category-creating cars. But that car is now a commodity, and not a particularly unique or affordable one. That leaves Tesla reliant on a brand that Musk has spent the past year tarnishing, first with Democrats and now, as we reveal below, with Republicans. Second, a scoop on the escalating fight between Unilever and Ben & Jerry’s, whose do-gooderism the UK giant embraced, then quietly tolerated, and is now at the end of its patience with. The drama carries a lesson for big companies chasing new customers with niche tastes: They come with niche politics, too. If Sir Kensington’s hasn’t been the thorn in Unilever’s side that Ben & Jerry’s has been, it’s because ketchup fans aren’t (yet!) radicalized. Companies trying to keep up with the long tail of consumer loyalties — particularly among Gen Z shoppers who remain a mystery to marketers — can end up with a tail that wags the corporate dog. |

|

Big, beautiful, boisterous, and on its way |

Nathan Howard/Reuters Nathan Howard/ReutersThe Senate on Tuesday narrowly passed President Donald Trump’s sweeping tax and spending cuts bill, handing the president a win ahead of his imposed July 4 deadline. Vice President JD Vance broke a 50-50 tie after three Republicans voted against the bill, whose tax cuts and spending are expected to add trillions to the deficit. A late-night wrangling session removed a provision aimed at stopping states from regulating artificial intelligence — a win for Anthropic and a hit to other big players who would prefer dealing with Washington than state authorities. Senators also scrapped a punishing tax on wind and solar energy and tempered cuts to clean energy subsidies, which were a key accomplishment of the Biden administration but were widely dispersed to red states, whose leaders are now rallying to defend them. The mammoth measure heads back to the House, which narrowly passed its own version in late May, and is expected to vote on the final bill as soon as Wednesday. |

|

Unilever cuts off Ben & Jerry’s charity |

Xavi Lopez/SOPA Images/Sipa USA via Reuters Xavi Lopez/SOPA Images/Sipa USA via ReutersUnilever is cutting off millions in funding for Ben & Jerry’s charitable foundation after it refused to provide audit documents, escalating what has become a microcosm for corporate “woke” wars, Semafor scoops. Peter ter Kulve, who runs Unilever’s ice cream business, told Ben & Jerry’s executives in an email that the foundation’s trustees “have continued to resist basic oversight” and are not cooperating with corporate auditors ahead of the ice cream business’ spinoff from Unilever. The Ben & Jerry’s foundation distributed more than $5 million of Unilever’s money in 2022 to mostly progressive organizations, including pro-Palestinian giving that has become a headache for the British giant. Its trustees’ resistance to an audit “represents a marked departure from the norms of charitable organizations, for whom transparency is typically a bedrock operating principle,” wrote ter Kulve, adding that Unilever remains committed to Ben & Jerry’s “social mission.” Representatives for Unilever, Ben & Jerry’s, and a lawyer for the foundation’s trustees did not respond to requests for comment. |

|

Nobody, on the left or right, wants a Tesla |

First, Elon Musk lost Democratic car shoppers, who stopped buying Teslas and slapped apologetic bumper stickers on ones they already owned. Now, he’s losing Republicans.  New data from EV Intelligence, shared exclusively with Semafor, shows Tesla’s popularity tanking with self-identified Republicans, who are 11 percentage points less likely to buy one than they were in April, before Musk’s messy split from Trump. “What he’s done by wrapping Tesla into his political adventures and, now, misadventures is very dangerous for the brand,” said Evan Roth Smith of Slingshot Strategies, which conducted the poll of 8,000 consumers. Musk has continued his criticism of Republicans’ tax and spending bill, vowing yesterday that he would back primary challengers to members of Congress who support it “if it is the last thing I do on this Earth.” (Mars or bust.) Trump threatened to end federal subsidies for Tesla and SpaceX and hinted that he could look into Musk’s status as a naturalized citizen. EV industry executives had hoped that Musk, whose MAGA conversion traces at least partly to being excluded from a Biden White House summit, might bring conservative shoppers into the market. “That would truly be a dark cloud with a slim silver lining,” Lucid’s then-CEO, Peter Rawlinson, told Semafor last year. That seems not to be happening: Popularity of nearly every EV company has slid in the past three months, Slingshot’s survey found. |

|

Apple’s AI woes force it to look to the outside |

Carlos Barria/File Photo/Reuters Carlos Barria/File Photo/ReutersApple’s AI challenges, which have provided an endless stream of schadenfreude in Silicon Valley, appear to have hit a tipping point. Bloomberg reports the company may use AI models from Anthropic or OpenAI to power a reboot of Siri, which pioneered AI assistants when it launched in 2010 but has now fallen behind, to both users’ and executives’ frustration. The news sent Apple shares up 4% but raises a longer-term question about whether the tech titan has lost its edge — especially as its former chief designer, Jony Ive, teams up with OpenAI to build an AI-native iPhone killer. Apple became the world’s most valuable company by mostly knowing where it had a right to win and leaning on partners where it didn’t. Still, its willingness to bring a competitor into its walled garden shows the danger of falling behind in a fast-moving AI war. |

|

UK regulator warns on M&A leaks |

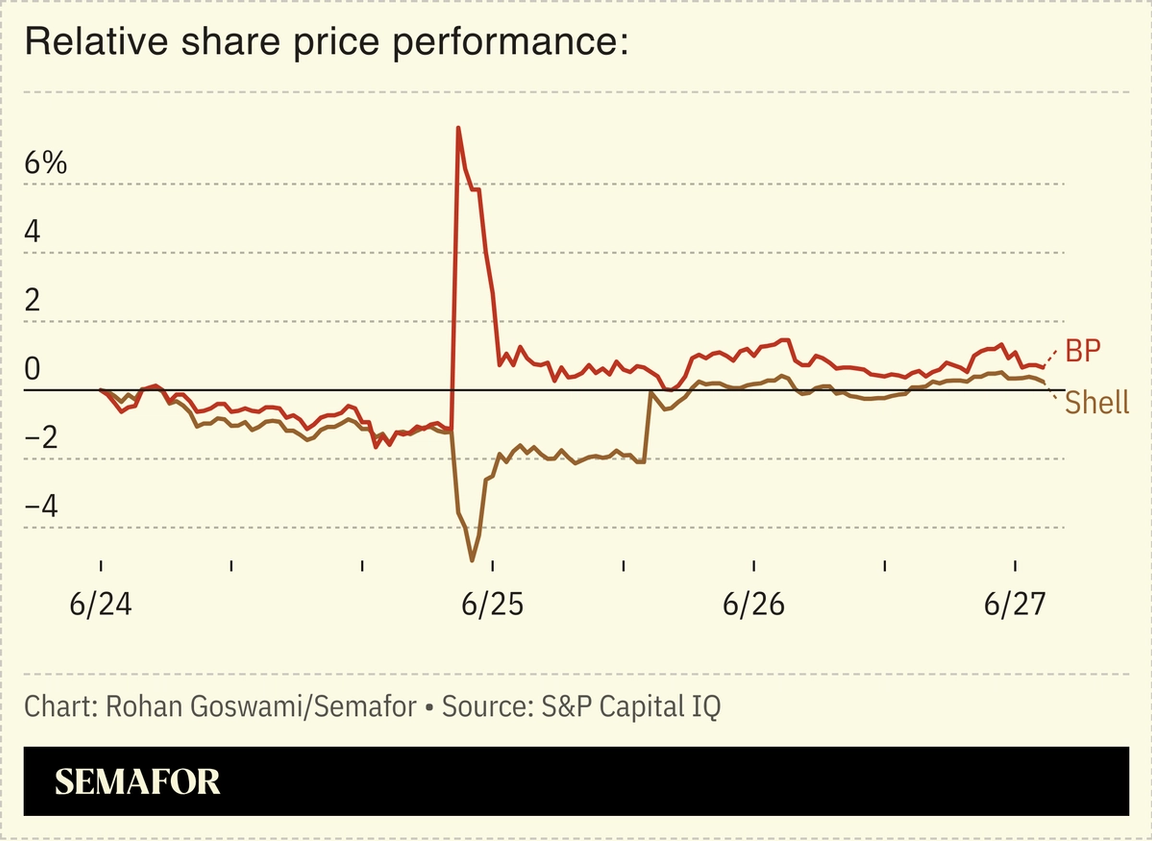

The UK’s deals watchdog is crying foul over London’s leaky M&A scene, days after Shell was forced to deny a report it was in talks to buy rival BP. Britain’s Takeover Panel sets strict rules on how deals are announced — a boon for journalists, who can generally expect public confirmation of their scoops, and for investors, who can pile into a stock with more comfort.  But two out of every five UK deals in the past 14 months broke in the press rather than official channels, according to Financial Conduct Authority documents provided to the Financial Times through a public-records request. The FCA says leaks are costly for acquirers because surging stock prices can reset the floor for negotiations. |

|

Will AI kill call centers? Here’s a test. |

Kecko/Flickr/CC BY-ND 2.0 Kecko/Flickr/CC BY-ND 2.0As apocalyptic warnings for the job-killing potential of AI mount, here comes a test for Wall Street. Verint Systems, a $1.2 billion maker of software for call centers, has hired bankers to seek a buyer, according to people familiar with the matter. The process will give an early indication of AI’s disruption to long-established industries — why sit on hold in a world where personal AI agents can negotiate refunds and flight changes? And importantly for companies, why employ thousands of humans to answer those calls? Verint’s software has allowed Western companies to tap low-cost call center workforces in places like the Philippines and India. Still, its stock is down about 25% year-to-date, despite efforts to position itself to the market as an AI-forward company. It did not immediately return a request for comment. — Rohan Goswami |

|

Want to get the latest investing news as soon as markets close? Brew Markets is a daily newsletter breaking down everything from AI revolutions to tariff turmoil, all with a dash of Morning Brew’s signature humor. Subscribe for free today. |

|

➚ BUY: Senior(s). Musk’s xAI cinched a fresh $10 billion, much of it in debt secured by its assets, which include at least 200,000 GPUs installed at its Memphis server farm. ➘ SELL: Juniors. TPG became the latest firm to pause the insanely early recruiting schedule for young talent, a move that will placate investment banks trying to keep young employees focused and — more interestingly — buy PE shops time to figure out their AI strategy. |

|

Companies & Deals- Long arm of the law: Standard Chartered faces a $2.7 billion lawsuit in Singapore from liquidators seeking to recover funds siphoned off during the years-long 1MDB scandal in Malaysia.

- Fusion test-fire: Google signed a deal to buy power generated through nuclear fusion, the second such deal involving a technology with promising potential but no commercial results yet.

Watchdogs- Think of the desert tortoises: California dismantled a 50-year-old landmark environmental law that hampered housing and infrastructure development. State lawmakers exempted most housing projects from requirements that they study their environmental impacts, allowing quicker construction.

|

|

|