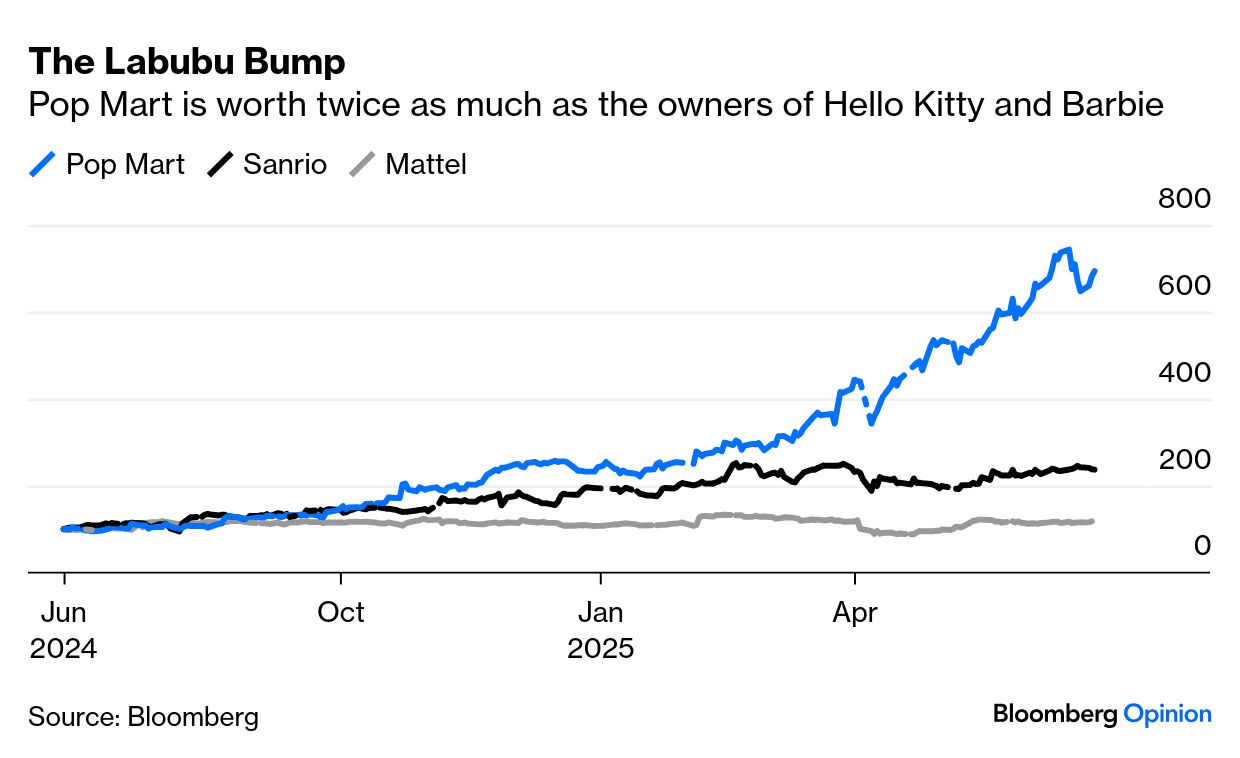

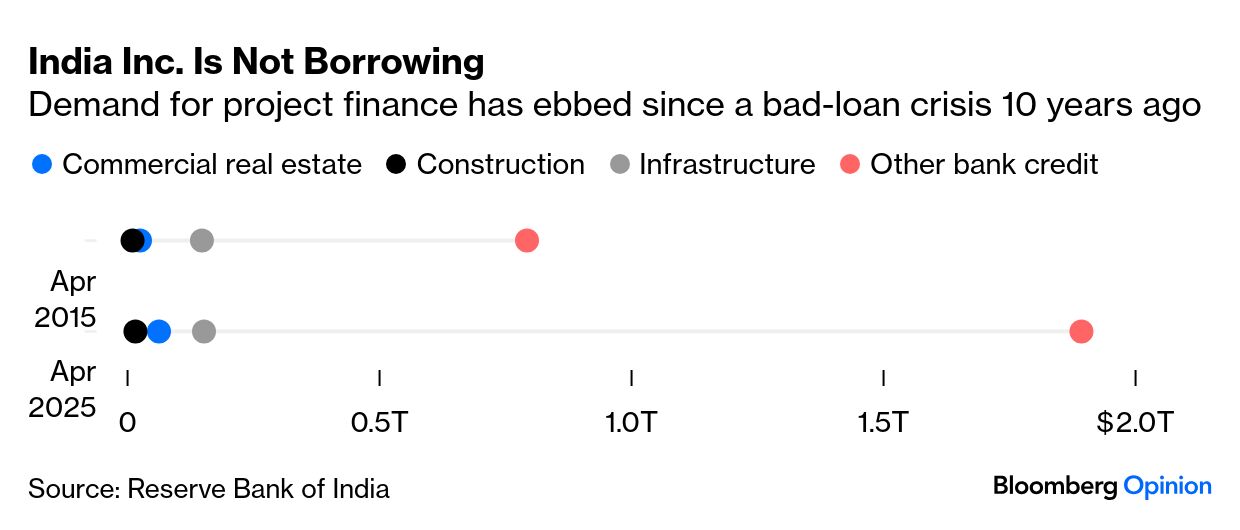

| This is Bloomberg Opinion Today, a dramaturgical dollhouse of Bloomberg Opinion’s opinions. Sign up here. Are You Delulu Over Labubu? | I’ve avoided the global Labubu phenomenon for months, even since I saw the ugly creatures pop up on the social media feeds of addled influencers. But now the ever-astute Shuli Ren has taken note of the toy’s enormous popularity and profitability— and how that very success betrays a weakness in the business plan of its Beijing-based manufacturer Pop Mart International Group Ltd. For readers who are new to Labubu, they are rabbit-eared, subtly anthropomorphic dolls that are both googly-eyed, cute and menacingly fanged (with a smirk of a smile). Designed by the Hong Kong-born artist, Belgium-based Kasing Lung, Labubus are inspired by Nordic folklore and exude the charm of bull terriers (or the petulant appeal of one of Yoshitomo Nara’s malevolent tots). It’s the type of animal magnetism that has attracted celebrities such as Kim Kardashian, Rhianna and Dua Lipa — and increased Pop Mart’s market cap to $43 billion, more than double that of Sanrio Co. (owner of Hello Kitty) and Mattel Inc. (parent of Barbie).  That’s attracted copycats (Wakuku and Lafufu). But the main problem, Shuli points out, is the enormous sums generated by the secondary market — profits that Pop Mart does not directly enjoy. At original retail, a doll costs just $15 to $30. But good luck finding one at that price. A one-of-a-kind four-foot tall Labubu sold at auction for $150,000. And a set of more regular Labubus — sold in blind boxes so buyers don’t know what color and theme they are purchasing — fetched a total of more than $300,000 on Joopiter, the online auction house founded by Pharrell Williams. “Right now,” Shuli says, “Pop Mart’s biggest puzzle is to figure out what percentage of its Labubu sales is going to resellers.” The company has experimented with pre-sale auctions but can’t really do too much without hurting the secondary market that gives Labubu its resale market appeal. (Those with long memories can probably relate this to an episode of the original Star Trek.) The market is also a quandary for China’s ultra-competitive AI industry which is seeing domestic companies duke it out viciously for dominance in the mainland. Catherine Thorbecke says, “the biggest risk for Chinese AI firms may not be Washington’s chip curbs or other external factors, but each other.” DeepSeek’s open-source, lower-cost reasoning model, she says, “has only spurred fresh pandemonium.” Ominously, Catherine adds, “There were more than 3,700 registered generative AI tools operating in China, according to one analysis of government registration data as of April, and cyberspace administrators were approving roughly 250 to 300 new products per month. Not all will survive.” Everybody Loves a Winner (Wink, Wink) | The reception of the US president at this week’s NATO summit in The Hague was a textbook example of Machiavellian groveling, writes Max Hastings. “National leaders who may have wondered what life was like under a Roman emperor now know from experience. As they struggle to do business with the most powerful man on earth, they are obliged to abase themselves, to pander, to profess assent when privately many dissent.” NATO Secretary-General Mark Rutte congratulated the visitor on his “decisive action” in Iran. Still, says Max, “No one in the room… save the principal guest believed his claim that US and Israeli bombs had set back Iran ‘by decades.’ But they kept silent, and will continue to do so, lest they provoke his wrath, so easily roused.” While disgusted by the behavior, Max isn’t opposed to it: “Like it or not, Trump is apparently unchallenged master of the richest nation on earth.” He sadly concludes: “Many of us feel sad that we have shrunk so far that we must make this gesture. But just as Trump has no respect for others, so the rest of us must, I suppose, sacrifice our self-respect to him. If it helps to save Ukraine, it will be worth it.” “There’s plenty of talk about how India’s 600-million-strong workforce gives it a unique edge in the US-China spat over trade and technology. But to be the world’s next factory, the most-populous nation will need a strong domestic investment impulse. The data don’t show any evidence of that. … Sanjay Malhotra, the new Reserve Bank of India governor, has thrown the kitchen sink at what is basically a problem of comatose animal spirits. … But how will funds flow into projects that create new assets, when the bottleneck is not in supply of credit but demand?” — Andy Mukherjee in “India’s Banks Will Lend. Will Tycoons Borrow?”  “Following a surge in new listings by special purpose acquisition companies, one can’t help but worry about how astonishingly short Wall Street’s memory is. These cash shells experienced a spectacular boom and bust in 2020-2022 as unrealistic valuations and retail investor enthusiasm for firms with little or no revenue ended in bankruptcies, shareholder litigation and financially painful liquidations. Now, this maligned asset class is off to the races again. ... Yet SPACs may still have misaligned incentives; insiders can make money even when others don’t, and not finding a deal risks a loss of their capital. Moreover, these investment vehicles are increasingly seeking to merge with crypto companies.” — Chris Bryant in “SPACs Are Back. What Could Go Wrong This Time?” The White House is loving Pakistan again. — Mihir Sharma Hey! What happened to my miles? — Marc Rubinstein Does Britain still know how to pay for infrastructure? — Matthew Brooker Deportations can’t fix US immigration. — The Editorial Board How to make carbon removal really British. — Lara Williams Private equity’s no longer king in British M&A. — Chris Hughes The world’s getting emotional about trade. — Daniel Moss Walk of the Town: When in Rome, Don’t Roam Here | I was in Rome this week to catch up with how Pope Leo XIV has been doing since assuming the papacy on May 8. I did manage to catch a glimpse of him and hear him speak (in Italian and Latin) in St. Peter’s Square. I hadn’t been to the city in more than a dozen years. For those of you who’ve been, walking is probably the most efficient way to get from place to place, especially in the center of town. The mapping apps are especially helpful. But why must almost every route take me through the Trevi fountain, one of the most tourist-congested areas in the Italian capital? It’s a spectacle, of course. But once you’ve seen it, you get the proto-Disney appeal and move on. Or could there be a real reason why it’s so central to Roman foot traffic?  Aiyee! It’s the Trevi Fountain again. Photograph by Howard Chua-Eoan/Bloomberg As it turns out, the name of the fountain derives from tre vie, or three roads ,because it was a triple convergence point. It was also where a major aqueduct delivered water for the city (and its baths) during the Roman Empire. Today, it’s a few minutes walk from both the country’s parliament and the Quirinale (the official residence of Italy’s president and originally a papal palace). Not too far away are the Pantheon and Piazza Navona and the stores and hotels of the Via Corso. So, if you’re coursing your way through the must-see sights of Rome, it almost can’t be avoided. Even if you’ve seen it again and again. After this trip, though, I’ve learned to take the long way around the fountain. It’ll add a couple of minutes to the walk, but there’s so much less aggravation. There’s always a first time for everything.  “Captain, don’t worry. Wikipedia says submarines aren’t its natural prey.” Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send appetizing innovations and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |