| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. The fate of one of the world’s biggest gold mines hangs in the balance. A court in Bamako is due to decide if Mali’s military government can take over operations at Barrick’s Loulo-Gounkoto complex. The hearing is set for Monday after being postponed five times — likely a reflection of the sensitivities of the case and its wider implications. While the junta running the West African nation has aggressively renegotiated revenue-sharing terms with all major mines, it’s only the Canadian company that’s on the verge of losing control of its asset — at least temporarily.  A gold ingot at the Loulo-Gounkoto complex, then operated by Randgold Resources, in 2013. Photographer: Simon Dawson/Bloomberg The government escalated its standoff with Barrick last month, asking a judge to appoint an interim administrator to manage the site that produced 723,000 ounces of gold in 2024. It wants to restart operations at the mine that were suspended in January following the Malian authorities’ move to block bullion exports. A key question is whether the government wants to seize Loulo-Gounkoto or is trying to force Barrick into a settlement. For its part, the Toronto-based firm — which has initiated international arbitration proceedings against Mali — says it’s already agreed several accords, only for the government to backtrack. The high-stakes brinkmanship over such a significant asset is being monitored closely in neighboring nations, where rulers are devising plans to generate better returns from their minerals.  Supporters hold a poster depicting junta leaders, Assimi Goïta of Mali and Guinea’s Mamadi Doumbouya, in Bamako in September 2022. Photographer: Ousmane Makaveli/AFP/Getty Images Burkina Faso (also run by the military) has nationalized some smaller mines and junta-led Guinea has revoked a slew of permits. Ivory Coast is revising legislation governing the sector, while Senegal is reviewing oil and gas contracts. Meanwhile, the mine that last year was the No. 2 contributor in Barrick’s portfolio — spanning from Nevada to Papua New Guinea — is stranded at a time of record gold prices. Its travails may be a warning to Western firms mulling investment in the coup-prone region. — William Clowes Key stories and opinion:

Barrick Says Mali’s Bid to Take Over Gold Mine Lacks Legal Basis

Guinea Takes Endeavour Gold Permits in Latest Round of Removals

Barrick CEO Vows to Defend Rights as Mali Junta Seeks More Money

Mali Junta Leader Gets Backing to Serve as President Until 2030

What’s Driving the Coups Across Sub-Saharan Africa?: QuickTake

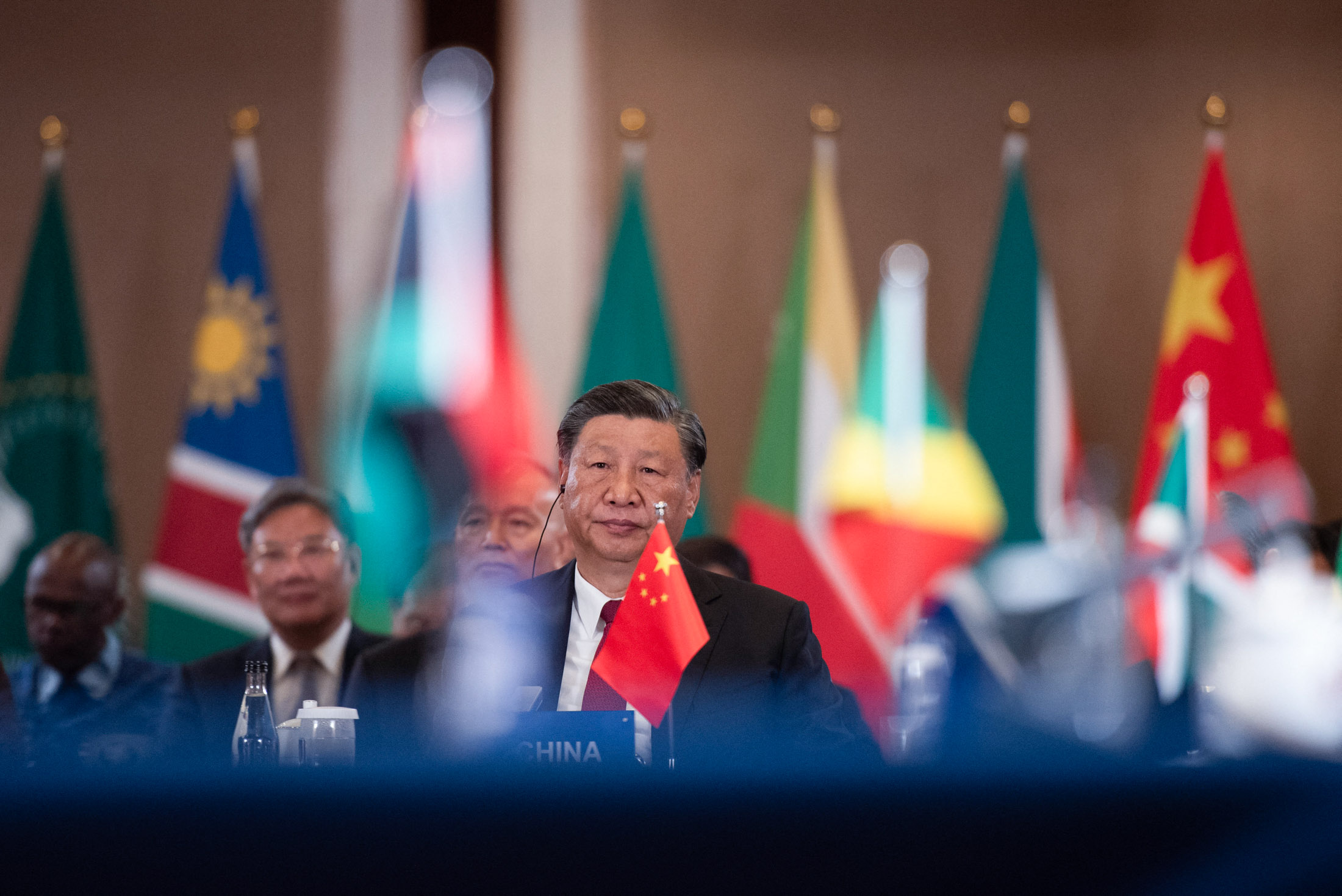

Jennifer Zabasajja joins Lydiah Kemunto Bosire, the founder of New York-based 8B Education Investments, and Nigerian Bureau Chief Anthony Osae-Brown to discuss a proposed US tax on remittances in this week’s episode of the award-winning Next Africa podcast. China plans to remove tariffs on imports from almost all African countries to further cement close relations with the continent as it deals with the fallout of US President Donald Trump’s trade wars. The 53 African nations that have diplomatic ties with China — Eswatini has allied with Taiwan — will be accorded “zero-tariff treatment for 100% tariff lines,” according to a letter issued to foreign ministers. South Africa sees scope to ease its dispute with Washington over agricultural trade tariffs and regulations.  President Xi Jinping at a China-Africa meeting at the 2023 BRICS Summit in Johannesburg. Photographer: Alet Pretorius/AFP/Getty Images The International Monetary Fund is seeking more clarity on a $7 billion fiscal hole discovered under Senegal’s previous administration before it can discuss a fresh program with the new government. The Washington-based lender is awaiting a final audit outcome following an earlier review that found former President Macky Sall’s administration misreported debt and budget-deficit data. Separately, the IMF wants to see the ZiG “fully becoming a national currency” as it weighs whether to place Zimbabwe on a staff-monitored program. East African finance chiefs increased planned spending to a record to sustain economic growth and mitigate the effects of geopolitical risks and cuts in foreign aid. Kenya, Rwanda, Tanzania and Uganda plan to boost expenditure by a combined $5.5 billion in the 12 months through June 2026 compared with the year before, despite rising debt payments and limited room to lift taxes. Kenyan police used teargas to disperse protesters in the capital, Nairobi, ahead of Treasury Secretary John Mbadi’s speech. Also, columnist Justice Malala looks at how democracy is dimming in the region.  A protest in Nairobi on Thursday. Photographer: Simon Maina/AFP/Getty Images A World Bank-linked climate fund has backed South African plans to cut its reliance on coal, unlocking up to $2.6 billion in financing and giving its energy transition an unexpected boost. The decision rescues support that looked to be in peril after the government asked in September to alter an agreement originally endorsed in 2022, and after the US halted other projects. Meanwhile, diplomats in Washington working to repair frayed relations with Trump are confronting an additional headache: South Africa’s embassy was inundated by storm water and raw sewage, leaving it partially inoperable. In one of Mali’s oldest towns, poverty and climate change are eroding the resolve of residents to safeguard a slice of the planet’s architectural heritage. Djenné’s iconic mud buildings were designated a World Heritage Site in 1988, meaning they can’t be destroyed or modified. But in recent years, extreme rains have made the buildings harder to maintain, while political turmoil and safety fears have diminished the town’s appeal to tourists. Some local people say the UNESCO designation is a burden they’re struggling to bear.  Yehia Sarro, president of the Djenné youth association, in front of his office ruined by floodwaters in September. Photographer: Tiecoura N’Daou/Bloomberg African students are increasingly applying to MBA programs in the US. But the Trump administration’s anti-international-student stance could soon put a stop to this. In 2019, African students averaged just 4% of total international applications to two-year MBA programs in America and by last year the share ballooned to 27%. Nearly a quarter of programs report that the largest source of foreign applicants came from either Nigeria or Ghana. Next Africa Quiz — In which African country did the ruling party take all National Assembly seats in its parliamentary election this month? Send your answers to gbell16@bloomberg.net. Data Watch - Ivanhoe cut output guidance for its Kakula copper mine this year — and withdrew an estimate for 2026 — after restarting parts of the flood-hit operation in the Democratic Republic of Congo.

- Kenya’s central bank cut its benchmark interest rate for the sixth time in a row to help shore up the economy as inflation is expected to remain benign.

- Logistics giant DHL plans to invest about €500 million in health-care services in Africa and the Middle East over the next five years.

- South African lawmakers approved the Treasury’s fiscal framework, bringing the adoption of the annual budget a step closer after months of wrangling over tax increases.

Coming Up - June 16 Nigeria inflation data for May

- June 18 Namibia interest-rate decision, South Africa inflation for May & retail-sales data for April, Ghana producer inflation for May

- June 19 Botswana interest-rate decision, South Africa six-monthly Financial Stability Review

|