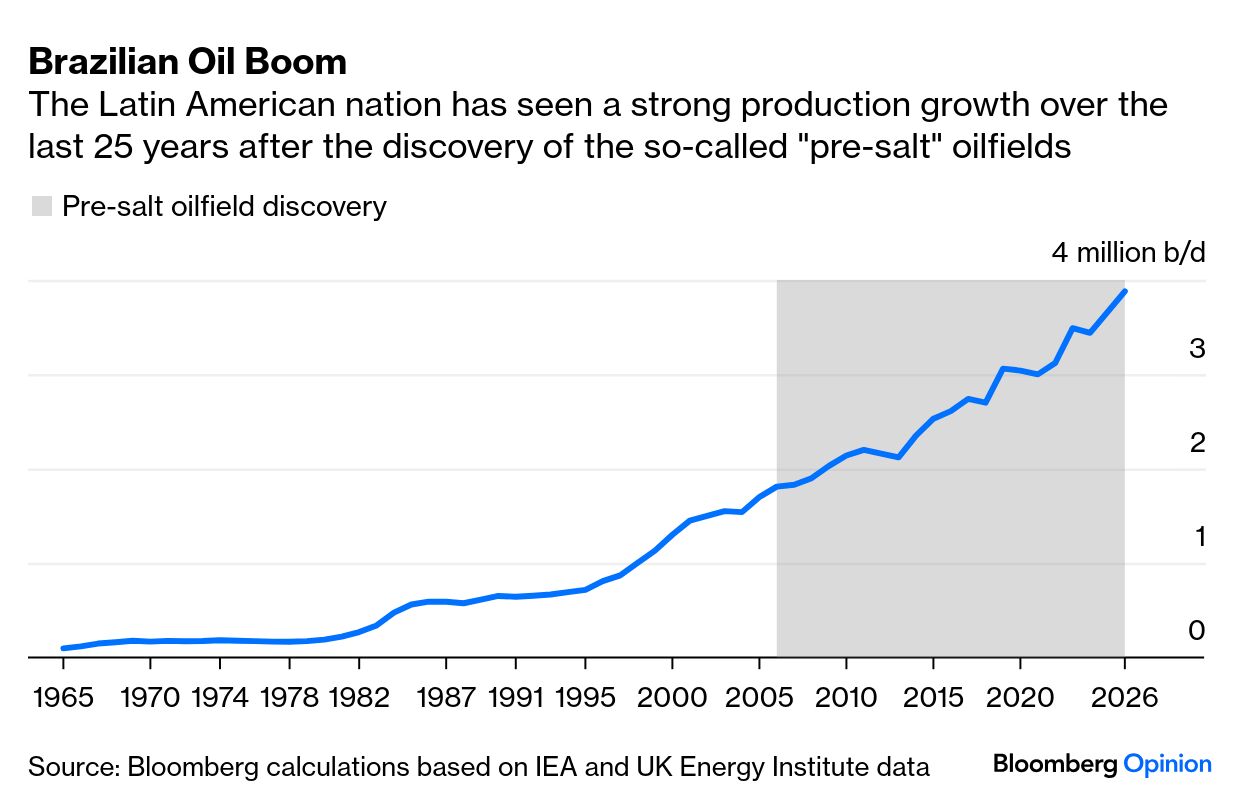

| This is Bloomberg Opinion Today, a phlegmatic phenomenology of Bloomberg Opinion’s opinions. Sign up here. A Framework for Catastrophe | In the first hours after Israel escalated its conflict with Iran, there was commentary about it being the latest of the world’s “forever wars” — hostilities that have no end. Marc Champion says there are several factors to consider, most of all nuclear retaliation if Tehran gets the nuclear weapons Israel so desperately wants to prevent it from developing. “It’s more likely that Israel can do no more than delay Iran’s nuclear program by a few years,” writes Marc. “And if that’s the case, it becomes impossible to justify the certain bloodshed and unknowable consequences of starting this war, because it would at best gain no more than the diplomacy it displaced.” If the US continues Donald Trump’s pro-Israel but hands-off position, any future nuclear exchange between the two countries would devastate both — but Israel is geographically tiny, and a single successful detonation may be enough to destroy it. Meanwhile, Israel’s conventional assault on Iran’s nuclear facilities continues. (James Stavridis has written about what a joint US-Israel campaign against Iran might look like.) There are other political considerations: Israeli Prime Minister Benjamin Netanyahu, says Marc. “A conflict with Iran promises to again rally Israelis around the flag in ways that his policies in Gaza no longer do.” Iran’s supreme leader, Ayatollah Ali Khamenei, has local concerns as well, even as he figures out how to retaliate in the wake of the loss of so many high military officials in this attack. “The risk to Netanyahu is that Khamenei can walk this tightrope between hitting back hard enough that he isn’t damaged at home by appearing weak, but not so hard as to draw in the US and its bunker-busting bombs. If he can pull that off, then Israel’s attack risks spectacular blowback, even while showing its continued technological and military superiority. Rather than destroy or even delay Iran’s emergence as a nuclear power, this war of choice risks bringing it closer,” says Marc. An Immigrant Turns On Others | Two things are often elided about Hello Kitty: 1) She is not a cat, but a little girl; 2) Her first name is indeed Kitty but her surname is White (even if Japanized as howaito or ホワイト in katakana). That’s because, according to her half-century old origin story, she’s from the suburbs of London. Yes, one of Japan’s most famous modern icons is British. Oh the infamy then for said icon to disparage foreigners and migrants. Ok, maybe not Kitty herself but someone who speaks for her. Megumi Hayashibara, who provides the voice for Japan’s most famous cat, demanded in a blogpost that the government get tough on foreigners, including rule-breaking tourists and overseas students she says are freeloading on Japan’s generous scholarship programs. She said they were like the “invasive species” that supplant local animal life. After she was brickbatted online, she deleted the comparison to alien invaders. Still, Hayashibara was voicing — perhaps too cartoonishly — the sentiment of many Japanese. As Gearoid Reidy says, “Hayashibara’s complaints about bad manners will be familiar to those who live in Japan, foreign or local; everyday annoyances have increased since the borders were reopened after Covid. In a Justice Ministry survey, nearly 78% said they most wanted foreign residents to follow local rules and customs.” The problem, of course, is that Japan’s distinct ability to uphold centuries-old order and traditions into the 21st century has made the country a magnet for the rest of the world. The tourist windfall is greatly appreciated, but not the mess that comes with visiting hordes. “Only now,” says Gearoid, is the government “discussing simple issues, such as stopping tourists with unpaid medical debt from returning or rejecting visa extensions for those who haven’t paid healthcare.” A graver issue is that Japan’s population continues to fall. Says Gearoid: “Working-age locals fell by 224,000 last year.” That means the country will need foreigners not just to visit, but to help keep the economy going by working. He adds: “[T]he thing many love about Japanese society — the ‘it just works’ nature of public life, from mass transit to healthcare to the low crime rate — is deeply dependent on everyone following the rules.” When the Dollar Goes Digital | The financial world is fascinated by Bitcoin because of its wild and often lucrative gyrations in value (it dipped 3% in Singapore markets right after the Israeli strike on Iran; also see this ongoing contretemps over investing strategy). But stablecoins — which are pegged to the price of assets like gold or the currencies — could shake up the future in more practical ways. Especially when it comes to trade wars. Lionel Laurent notes that Circle Internet Group Inc., which issues digital currencies that replicate the US dollar, “has tripled in value since going public and is worth $23.6 billion.” That is 150 times its earnings last year. “Europeans are watching the froth with concern,” he says. “officials fear virtual currencies are a serious financial threat for the continent and an extension of Trump’s ambitions of bringing global trade to heel. And they may be right to worry.” Why? “Right now,” Lionel writes, “stablecoins are essentially used for crypto trading. But imagine if Amazon.com Inc. were to come up with irresistible shopping discounts for customers paying in AmazonBucks? Multiply an annual shopping basket of $2,700 by 350 million Europeans and you start to get to serious money — money which would indirectly contribute to keeping demand for dollar debt afloat in a more uncertain world.” Andy Mukherjee raises the specter of crypto bros using stablecoin to destabilize the world. Says Andy: “Barely a decade old, issuers of stablecoins have already come to acquire bigger positions in short-term US securities than amassed by major investors like China. The issuers’ hunger for safe assets has its costs. It locks up securities that are needed by the world’s monetary authorities, banks, insurers and pension providers.” Andy warns: “With the US and China holding on to a fragile truce over tariffs and technology, policymakers globally may have a moment of reprieve. They must use the interlude to pay attention to crypto.” “After a very poor 2024, [Brazil], the Latin American oil giant is entering one of those phases of rapid growth. On current trend, Brazil will become the second-largest source of incremental non-OPEC+ oil production this year, only behind the US and ahead of Guyana, the other South American oil star that typically gathers more attention, and Canada. The timing couldn’t be worse for OPEC+, already battling with an oversupplied market and falling prices.” — Javier Blas in “With Friends Like Brazil, OPEC+ Doesn’t Need Enemies.”  “From artificial intelligence to military defense, China has offered a few DeepSeek moments this year, showcasing that the country is more than just the world’s biggest factory, and that it also can compete with the US on the technology front. Now biotech is having its own. In late May, Pfizer Inc. agreed to pay a record $1.25 billion upfront to license an experimental cancer drug from Shenyang-based 3SBio Inc., as well as making a $100 million equity investment in the Hong Kong-listed biotech company. Two weeks later, Bristol-Myers Squibb Co. said it would pay BioNTech SE $1.5 billion guaranteed to license a similar cancer asset.” —Shuli Ren in “Why China Biotech Is Getting a DeepSeek Moment, Too.” Tulsi Gabbard’s TikTok-style nuclear war video. — Marc Champion Who will win the fintech upstart wars? — Paul J. Davies Oil’s getting another lost decade. — David Fickling Go ahead, prep for Armageddon. — Lara Williams The US shouldn’t go soft on chips. — Hal Brands AI criticism can’t just be political theater. — Parmy Olson London’s incredible shrinking stock market. — Marc Rubinstein FIFA is its own foe. — Adam Minter Walk of the Town: A Very Happy Unbirthday, Charlie! | Apart from their shares in the origin story of Hello Kitty, Japan and the UK are both constitutional monarchies. The royals of the two archipelagos are experts at noblesse oblige and a kind of haughty humility that many find appealing. But they are also patently dissimilar in character. Japan’s Imperial Household Agency manages the contemporary emperor and his family almost tyrannically, rarely allowing individuality to emerge beyond the official roles. The British monarchs, on the other hand, have always been the subject of popular and maudlin stories for centuries. In fact, you might argue there’s too much royal personality! In fact, the British monarch often has two birthdays. If you’re visiting London this weekend, you probably know it’s Trooping the Colour on The Mall that radiates from Buckingham Palace this Saturday to commemorate the king’s birthday. Royal watchers among you will also know that June 14 isn’t the day Charles III was born. That would be Nov. 14. The king — still recovering from cancer treatment — will not be on horseback this year. Instead, he will ride in a carriage with Queen Camilla as he did in 2024. The reason for the dual birthdays? The public military ceremony — full of horses and historic regalia — is better done in the warmer months. And Charles was born practically on the cusp of winter. Unfortunately, rain is predicted for this weekend, so bring an umbrella. I will be avoiding the area of The Mall, for practical pedestrian considerations. For reasons that Timothy O’Brien lays out in his column, I will already be perturbed by the hubbub surrounding another birthday parade across the Atlantic, where it really is the anniversary of the celebrant’s birth. Oh, behave!  “We know you’re the biggest Godzilla fan, but they won’t let you in on a tourist visa.” Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send monster mash-ups and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads.

|