| | In this edition, can iPhone designer Jony Ive create another legendary invention for OpenAI? And the͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Bond mutiny continues

- Jensen: Export controls a dud

- Fed warns on private credit

- Texas courts companies

- A world without coders

- DEI retreat, by the numbers

RIP pennies… |

|

Will we look back on May 2025 as the beginning of the end of mobile? OpenAI’s acquisition of Jony Ive’s studio startup is a bet that the man who designed the iPhone can create another category- and culture-defining product — this time in a world ruled by embedded AI, not smartphones. The announcement yesterday, accompanied by an odd, and oddly touching, corporate engagement photo, shaved $60 billion off of Apple’s market value. It’s a fear that’s been building in Cupertino: “You may not need an iPhone 10 years from now,” Apple executive Eddy Cue said earlier this month. I have a theory that when Hollywood starts making movies about the 2010s and early 2020s, characters walking around glued to screens will be the exaggerated shoulder pads of period pieces set in the 1980s — a cultural calling card that feels comically dated. But it’s less clear exactly what replaces mobile, whose swift conquering of desktop in the 2000s was obvious to everyone except Microsoft. Sales of Apple Watches and Fitbits have slowed sharply. Wearable pins have flopped. Google is trying again with glasses, announcing a new partnership with Warby Parker a decade after its first effort failed. Altman is betting that Ive, the creative sidekick to Steve Jobs’ ruthless Howard Hughes, can figure it out. Ive is famously obsessive about design — you have him to thank for the slow whoosh that iPhone boxes make upon opening — and skeptical about wearables. (Whatever he and Sam Altman are building, it’s not glasses.) They have a chance to seize on growing uneasiness with screen time and mounting data of its associated brain rot. Even Gen-Zers know they are phone-addicted and want a way out. While the deal’s $6.4 billion price tag is expensive even by goofy Silicon Valley math, it has M&A merit. OpenAI brings engineers and a cost of capital that is (for now) essentially zero. Ive brings a track record in building the next big thing. It might not work but bears watching. |

|

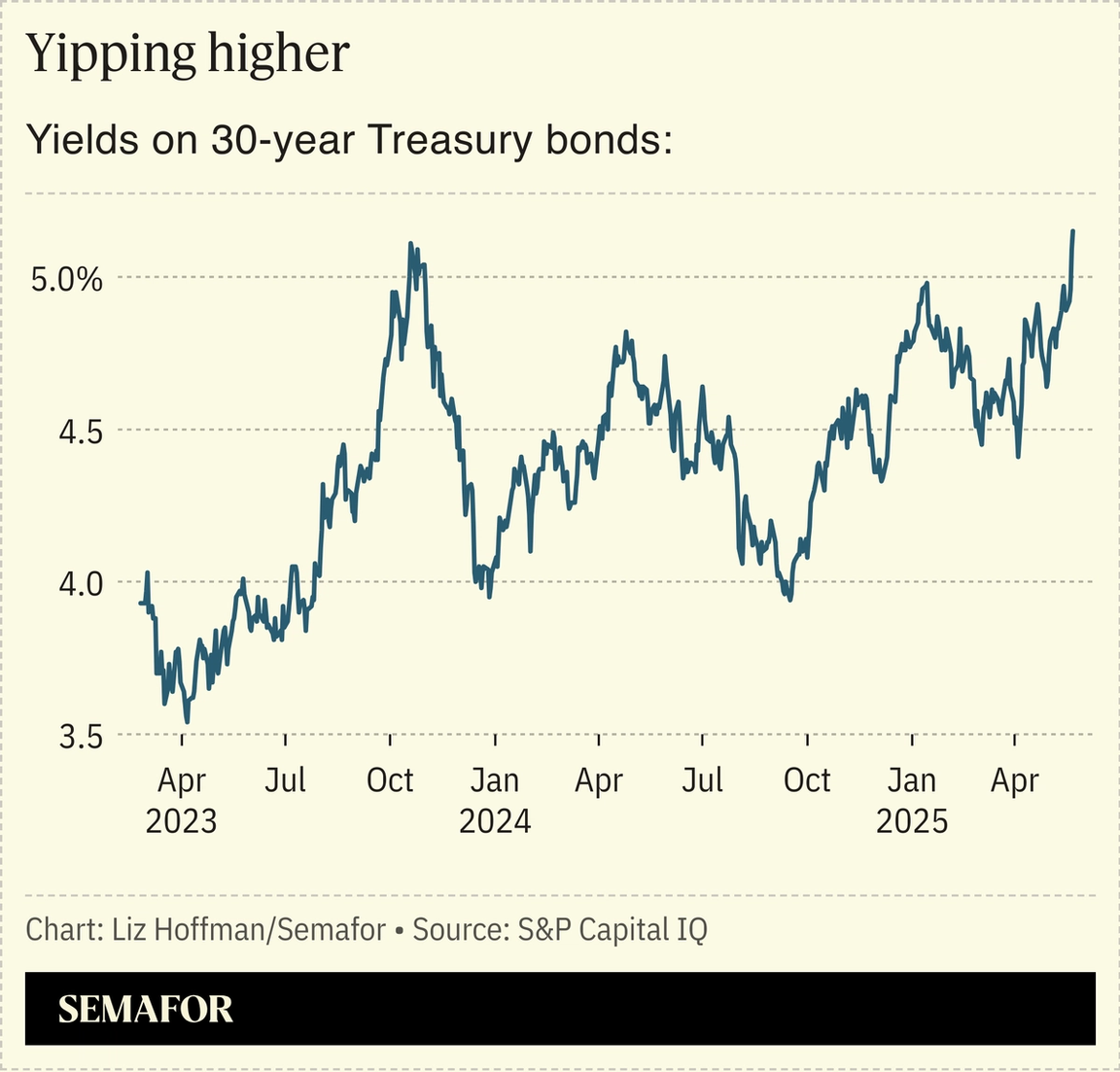

‘Big, beautiful bill’ passes, bondholders revolt |

Yields on 30-year Treasury bonds hit their highest levels since 2007 this morning after House Republicans passed a sweeping tax and spending bill that will necessitate trillions of dollars in new borrowing.  The bill, which passed by a single vote and with no support from Democrats, is expected to add at least $3.3 trillion to the deficit by 2034, and raises the country’s debt ceiling by $4 trillion to compensate. That should avoid emergency measures and a messy congressional fight this summer, but it alarmed bond investors, whose pushback to the Trump agenda is starting to feel less like a spontaneous protest and more like an organized rebellion. Yields on 30-year Treasury bonds spiked this morning to 5.15%, up from the mid-4% range at the beginning of the month. Higher borrowing costs will stretch the budget further: Already interest payments are set to exceed spending on national defense this year. Spiraling yields “will become a problem quite quickly,” Adam Abbas, head of fixed income at Harris Oakmark, a division of Natixis, tells Semafor. “It’s not a theoretical exercise. The math breaks down… If the market wants to force discipline, it can do that.” |

|

‘Export control was a failure,’ Nvidia’s Huang says |

Ann Wang/Reuters Ann Wang/ReutersUS restrictions on the sale of advanced AI chips to China backfired, Nvidia CEO Jensen Huang said. Export controls opened an opportunity for China’s Huawei and pushed Beijing to encourage production of newer models that aren’t yet as powerful as Nvidia’s — or produced at the same scale — but work well enough to be competitive. “AI researchers are still doing AI research in China,” Huang said at a conference in Taiwan Wednesday. “All in all, the export control was a failure.” (Nvidia sold advanced chips in China until the Biden administration blocked it in 2023.) Huang’s comments come amid a debate about the sale of high-tech US chips to Middle East countries. Critics say recent deals, including the sale of Nvidia chips to the United Arab Emirates, could send AI jobs overseas and give the region an advantage over the US in the global race for AI supremacy. |

|

Boston Fed sounds alarm on private credit |

Financial links between big banks and fast-growing nonbank lenders pose a risk to the financial system, the Federal Reserve Bank of Boston warns. It’s the second recent warning about unappreciated risks bubbling up inside the new financial world that emerged from the 2008 crisis. Fitch Ratings found last week that US banks lent $1.2 trillion as of March 31 to private credit funds, up 20% from a year earlier, and that the secrecy around these loans makes “second order effects …more difficult to quantify.” The Fed researchers warned that if those loans start to go bust, banks could face steep losses. Borrowers are mostly smaller, private-equity-backed companies already struggling with higher interest costs. And these loans usually aren’t rated by firms like Moody’s, whose track record is far from flawless but which are at least a check on Wall Street’s worst instincts. |

|

Texas beckons corporate America |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersTexas rewrote its business laws, hoping to lure companies that are souring on Delaware. A bill passed earlier this week makes it harder for shareholders to bring lawsuits like the one that challenged Elon Musk’s $56 billion pay package in 2017 and caused the billionaire to move Tesla’s legal home from Delaware to Texas. The new law lets companies require investors to hold at least 3% of outstanding shares to file a common type of lawsuit. It also would replace trial by jury — a big risk for companies, given their unpredictability — with a hearing by a judge in a special court for business disputes created last year. Tesla, the biggest company incorporated in Texas, moved last week to adopt that 3% litigation threshold — at current prices, a $31.5 billion bar cleared only by Musk and a few big index funds that are unlikely to ever sue. As the company’s board weighs a fresh pay package for the CEO, who has said he will soon refocus on Tesla, it can do so knowing it’s unlikely to be sued. Marketplace of ideas: Texas is competing with Nevada to win Delaware expats. Mercado Libre is asking shareholders to approve a move to Texas. Affirm and Roblox, both controlled by insiders, are moving to Nevada. Meta considered a Texas move, The Wall Street Journal reported, but didn’t put the question to shareholders this year. |

|

A world without coders may be closer than we think |

Semafor SemaforCompanies may be just months away from being able to develop and operate software without an engineering team, the CEO of AI startup Replit told Reed Albergotti at a Semafor Tech event Wednesday. Amjad Masad is certainly talking his own book — Replit makes software that uses AI to write code — but he joins a growing group of tech executives warning that human developers may soon be obsolete. Mark Zuckerberg thinks Meta will be able to replace mid-level engineers with AI this year. Masad said startups at Y Combinator are going months without needing to hire a chief technology officer: “I don’t think we’re there yet, where they can run the entire company without hiring engineers,” Masad said, “but that might be a year, 18 months away.” |

|

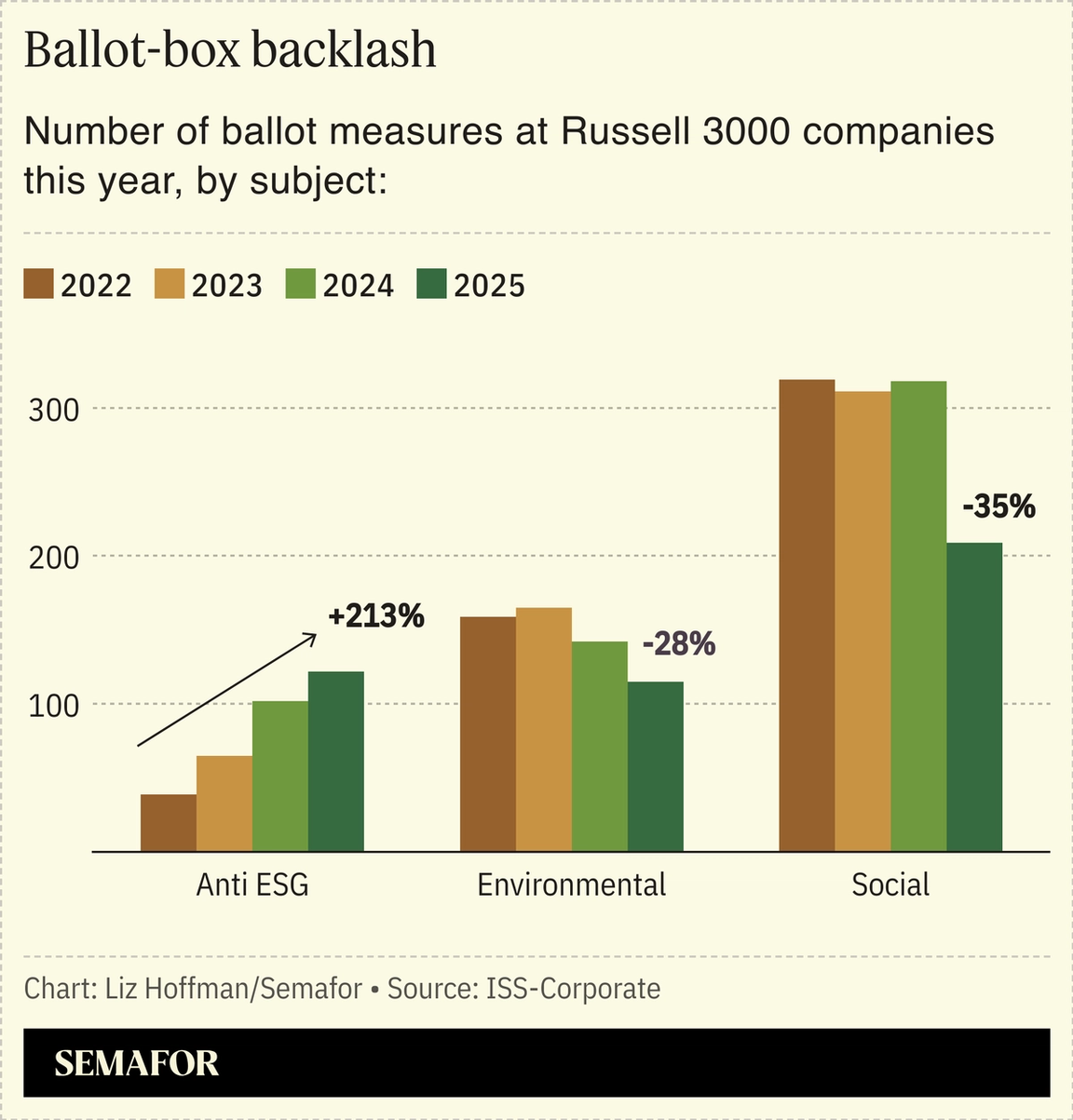

DEI retreat on display in corporate elections |

Today is the peak corporate-annual-meeting day, with shareholders at 137 public companies voting on ballot measures. But their agendas look different this year, reshaped by a rightward shift and backlash to progressive campaigns, new data from ISS-Corporate shows.  Anti-ESG proposals have surged 213% since 2022, while ESG proposals continued to drop off. Those anti-ESG proposals, which push companies to abolish DEI policies or produce data justifying them, typically get little support among shareholders. But companies are in full DEI retreat anyway, wiping language from their websites and adding conservative figures to their boards and executive ranks. |

|

As electricity demand soars — driven by the rapid expansion of data centers and AI — pressure is mounting to scale secure and reliable energy resources. Join Semafor for a timely conversation with Rep. Brett Guthrie, R-Ky., and Aamir Paul, President of North American Operations at Schneider Electric, as they discuss how the new Administration plans to accelerate domestic energy production — and whether current infrastructure is up to the task. The discussion will also explore the innovative policies and technologies that could help close the growing supply-demand gap. June 11, 2025 | Washington, DC | RSVP |

|

➚ BUY: Telegram. The messaging platform turned a $540 million profit last year, the FT reported, despite the ongoing legal problems of its billionaire founder, who was detained by French authorities and accused of allowing criminal content to proliferate unchecked. ➘ SELL: Telehealth. Shares of Hims fell 4% today as a regulatory loophole allowing Americans to buy cheap weight-loss drugs through “compounding pharmacies” closed. It’s good news for Novo Nordisk and Eli Lilly, which sell more expensive branded versions. |

|

Companies & Deals- Shelf space: Walmart announced it will cut 1,500 corporate jobs in a restructuring, less than a week after Trump told the company to “eat the tariffs” instead of raising prices.

- Parting shot: Nestlé’s CEO said his predecessor’s pivot toward health care “weakened the fabric” of a company once known for chocolate bars, Purina, and Nescafe coffee. Nestlé’s shift, which included acquiring weight-loss companies and Nature’s Bounty supplements, came

|

|

|