| | In the latest edition, new Senate momentum for Russia oil sanctions, the prospects for biodiversity ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Hong Kong Hong Kong |   San Francisco San Francisco |   Beijing Beijing |

| Net Zero |  |

| |

|

- GOP’s Russia crackdown

- Trees grow money

- Free the carbon data

- Underestimating AI

- China still top miner

Solar, and nuclear, expansion in the US. |

|

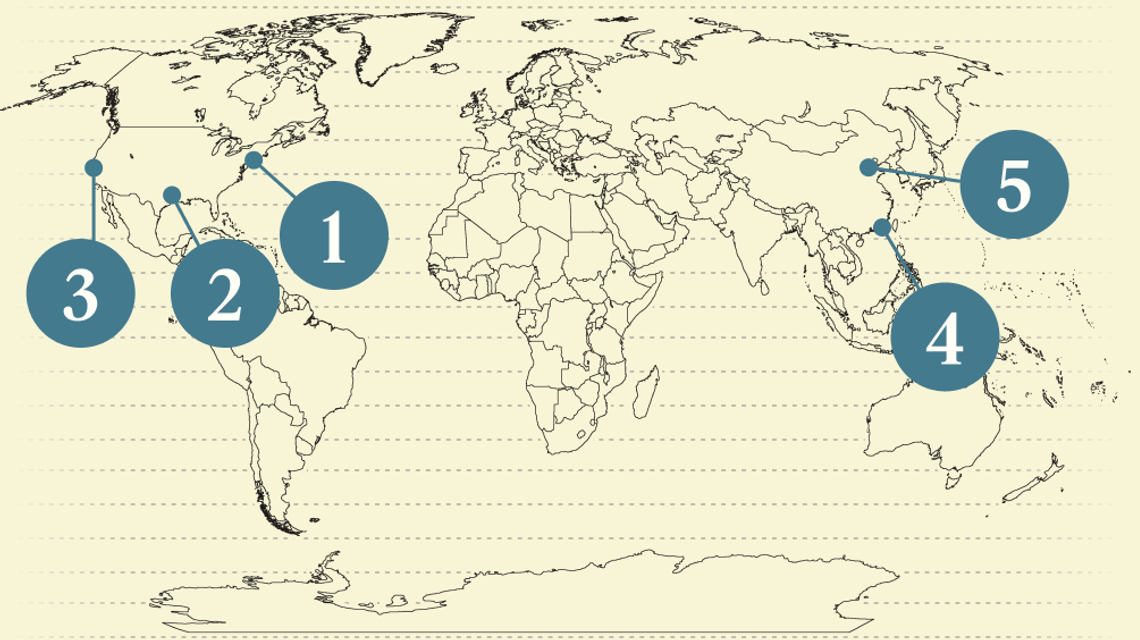

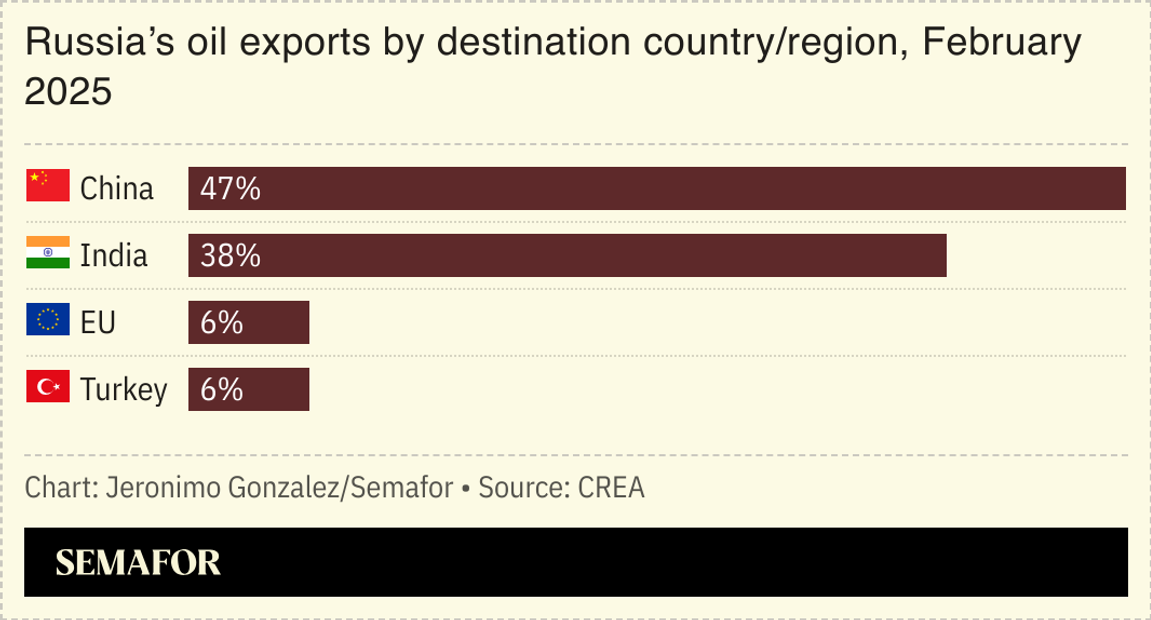

US senators press for Russia oil sanctions |

Momentum is building in the US Senate for new sanctions on Russia’s oil and gas exports. As Russian President Vladimir Putin continues to drag his feet on peace talks, some Republicans are ready to step up measures targeting his fossil fuel-financed war effort — with or without backing from the White House, Burgess Everett and Morgan Chalfant report. “I think we should bring it to the floor,” Sen. Todd Young, R-Ind., said. “I’ve waited long enough.” Secretary of State Marco Rubio argued this week that sanctions will shut down talks with Russia to end the war with Ukraine, a sign the administration would rather lean on diplomacy — for now. But some Republicans think if they move forward by imposing steep tariffs on countries that buy Russian oil and gas, it strengthens Trump’s hand. “It doesn’t mean he has to sign it into law right now, but absolutely we want to keep moving forward so that Vladimir Putin knows we are serious,” said Sen. Joni Ernst, R-Iowa. |

|

Biodiversity credits slowly find a market |

| |  | Tim McDonnell |

| |

Wikimedia Creative Commons Photo/William L. Farr/CC 4.0 Wikimedia Creative Commons Photo/William L. Farr/CC 4.0Outside the small town of Merryville, Louisiana, an experiment in a new kind of climate finance is taking root. Qarlbo Biodiversity, a Swedish startup backed by hedge fund billionaire Conni Jonsson, said it has completed the first deal in the US to sell “biodiversity credits” from its 16-square-mile stand of pine trees. Biodiversity credits are today where the carbon offset market was 30 years ago: An obscure frontier for a handful of risk-tolerant buyers, where the opportunities for growth and actual environmental benefits remain uncertain. Since 2022, somewhere between $325,000 and $1.9 million in biodiversity credits have been sold worldwide, according to the consulting firm Pollination (the wide range is due to a lack of price transparency; the Qarlbo deal also did not disclose a price). But there are some key differences between monetizing biodiversity and monetizing carbon that have some experts skeptical about whether biodiversity can follow carbon into becoming a multitrillion-dollar market. |

|

Pexels Creative Commons Photo/Pixabay CC0 Pexels Creative Commons Photo/Pixabay CC0A new open-source dataset for emissions could provide a backstop to the Trump administration’s rollup of federal climate data services. Watershed, a startup that helps companies analyze and act on their carbon footprint, uses a proprietary dataset that contains emissions estimates for about 400 products and services in each of about 150 countries. This data can be used to trace emissions up a company’s supply chain, especially when accurate, real-time data can be hard to come by (for a specific parts factory in China that doesn’t monitor its own emissions, for example). Many carbon accounting firms rely on emissions data from the US Environmental Protection Agency, but it’s limited in scope, often outdated, and, in an administration dismantling much of the government’s climate data capabilities, at risk of disappearing. Watershed’s dataset will now be publicly available for free. Michael Steffen, the company’s head of climate analytics, said that the decision is a bet to encourage more companies to probe Watershed’s carbon details for the first time — and hopefully end up as paying customers. |

|

AI’s opaque energy demand |

Dado Ruvic/Illustration/File Photo/Reuters Dado Ruvic/Illustration/File Photo/ReutersA lack of transparency and tracking around the energy usage of artificial intelligence obscures the full scale of its impact on the grid, MIT Technology Review argued. A single query on ChatGPT or another chatbot isn’t very energy-intensive, but taken in aggregate, the AI boom demands a “staggering” amount of resources, the magazine wrote in a sweeping analysis: “It’s likely that our AI footprint today is the smallest it will ever be.” Tech firms are investing heavily in data centers to keep up, but some of the largest AI models, which aren’t open-source, “are serving up a total black box” on their energy consumption, one expert said, making it difficult to plan for future energy grids. |

|

China maintains minerals dominance |

China has maintained its dominance over critical minerals, despite US and European efforts to diversify supply chains, the International Energy Agency found.  The average market share of copper, lithium, nickel, cobalt, graphite, and rare-earth elements by the world’s top three producers reached 86% in 2024, up from 82% in 2020. “Almost all supply growth” came from a single top supplier, the IEA said: Indonesia for nickel, and China for everything else. “Even in a well-supplied market, critical mineral supply chains can be highly vulnerable to supply shocks, be they from extreme weather, a technical failure, or trade disruptions,” the agency’s executive director said. However, more concentrated investment by China and major players, combined with slowing activity elsewhere, is set to significantly widen the supply deficit by 2035. This could pose particular concern for copper, a critical resource for countries working to expand their electricity grids, Bloomberg noted. — Paige Bruton |

|

New EnergyFossil FuelsFinanceTechPolitics & PolicyMinerals & Mining |

|

Cheryl Evans/Arizona Republic via Reuters Cheryl Evans/Arizona Republic via ReutersTSMC, the Taiwanese chips giant of key strategic importance to the US, has sought advice from an unlikely place to help navigate Washington: middle market investment firm Cantor Fitzgerald, Semafor’s Rohan Goswami reported. “While we do not comment on clients or potential clients, the statements regarding Cantor Fitzgerald are baseless and false,” said a spokesperson for Cantor — which, until this week, was majority-owned by longtime CEO and current Commerce Secretary Howard Lutnick. |

|

|