| The infamous bond vigilantes are starting to inflict some real pain, and they’re not coming for just the US. The suffering for holders of the longest-dated bonds is global, and the market’s informal enforcers have brought enough rope to ensnare them all.

It’s tempting to pile the sharp rise in 30-year yields uniquely on the US and its squabbling politicians, but other markets are seeing selloffs just as dramatic, often thanks to their own local factors. The US 30-year yield has just topped 5%, a round number that will always cause a frisson — but the UK, with the highest 30-year yield since 1997, and Japan, where it’s broken to an all-time high, saw bigger moves. All around the world, investors are more reluctant to lend to governments over long terms: The proximate trigger for the US bond market (described as “yippy” by President Donald Trump last month as rising yields prodded him into delaying tariffs) was a lackluster auction of 20-year debt. That had an instant effect: There were good candidates to explain the nerves. Moody’s downgrade, announced Friday, has little practical effect, but dampens sentiment. Confidence was also shaken by negotiations in Congress over what is now officially named The One Big Beautiful Bill Act. On its face, as Justin Fox explains, the bill is pretty ugly — cutting services for the poor and using the savings to cut taxes mostly for the wealthy, even as the deficit rises. Inequality doesn’t particularly bother bond investors, but the way legislators don’t seem even to be trying to cut the deficit is a big problem. Much remains up for negotiation, but the outcome will almost certainly be bond-negative. The question, according to TS Lombard’s Steven Blitz, is: “How much of a haircut are bondholders willing to accept, from dollar depreciation and/or inflation?” The proposed deficit rise for next year is $472 billion. Even if tariffs raise $250 billion in revenue to alleviate this, that would still leave a 13% increase compared to earlier estimates, Blitz says, before counting interest on the debt. Bond math means rising yields for the longest issues inflict particular pain on those holding them. To illustrate, this is the price of the Austria century bond, not due to pay out until 2120, over the last five years as its yield rose to 3% from 0.75%: Usually, rising yields help a currency, as they attract capital. That didn’t happen this time as the dollar fell and gave up much ground it had recently regained — a sign that the US is losing its status as a haven, even now that tariff anxiety is dissipating. Bloomberg’s dollar index, which compares it to developed and emerging market currencies, is back close to a three-year low that has been tested several times: One problem for the dollar is institutional. Once adopted, a US budget is hard to adapt, and the first fiscal package of any administration generally sets the template for four years. So if the US opts for fiscal policy that disappoints currency traders, they will have to live with it for a while. To quote George Saravelos, chief of FX strategy at Deutsche Bank AG: Whatever the Republican Congress decides to do with fiscal policy over the next few weeks, it will most likely be “locked in” for the remainder of the decade. The very difficult reconciliation process and the potential loss of a Republican majority in the mid-terms essentially leaves space for only one major fiscal event during the current Trump administration. Once this concludes, there will be very little that can be done to change the fiscal trajectory for the foreseeable future.

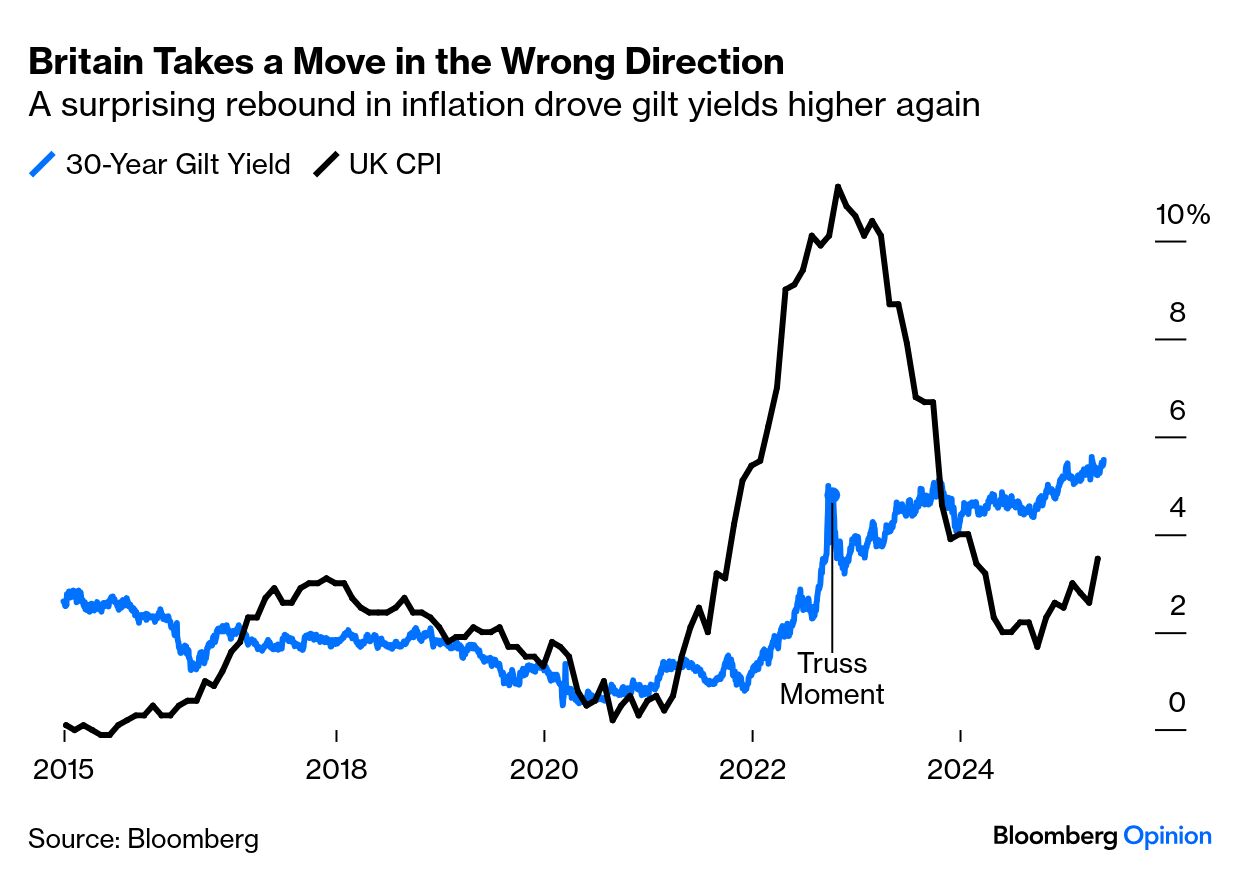

He points out that European countries can pivot on fiscal policy (within days when Germany created space for more defense spending, or in the UK during Liz Truss’s premiership in 2022). On that subject, the UK’s 30-year gilt yield is now higher than it was during the Truss crisis. As the chart shows, her move to introduce unfunded tax cuts was disastrously timed, just as inflation was peaking at above 10%.

Many blame the vigilantes or, as Truss herself does, the nameless “blob” of the British civil service for a disastrous premiership that was outlasted by a lettuce. But the greatest problem lay in the madness of trying to stimulate the economy when inflation was already through the roof:  The resurgence in consumer price inflation in April, published Wednesday, came as a bona fide and very unpleasant surprise. Of the major economies, the UK looks to be the one with a realistic threat of stagflation, which means a dilemma for the Bank of England. According to Bloomberg’s World Interest Rate Probabilities, the market-implied Bank Rate for the end of this year has risen to 3.83% from 3.5% this month, as cuts look more problematic. The most dramatic move is in Japan, which not long ago was intervening to keep 10-year yields to zero. On Tuesday, Tokyo held its own disappointing auction of 20-year debt, while a hideous gaffe by Prime Minister Shigeru Ishiba, who told parliament that the fiscal situation was worse than Greece’s before the euro-zone crisis, further rattled confidence. The yield curve is now its steepest since 2012. Demand for a premium for the risk of lending over long periods to the government has returned:  Finally, any analysis of rising yields would be incomplete without a reminder that they’re good news for someone — pension fund managers and their pensioners. Higher yields make it cheaper for defined benefit plans to fund the guarantees they have made to savers, and mitigate falling equity prices. As the consulting actuary Mercer shows in this chart, corporate pensions run by S&P 1500 companies are now fully funded, meaning that their assets are worth more than their liabilities. In 2019, they were starting at a deficit of more than 20%: It’s an ill wind. But for most of us, the upward drift in long yields is a problem that can no longer be ignored. |