| | In this edition: South Africa’s president in US for crunch talks, Starlink’s Africa strategy, Kenya’͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Ramaphosa’s crunch US talks

- Starlink takes off

- Trump’s Africa strategy

- MultiChoice takeover

- Boosting solar power

- Cocoa farmers’ new bet

- China smartphone surge

A Togolese band inspired by Voodoo traditions prepares for its Europe tour. |

|

Hello! When South Africa’s President Cyril Ramaphosa meets with US President Donald Trump today, many US-Africa policy watchers will be holding their breath. Their anxiety is understandable. Many of us knew before the administration came in that Trump had some South Africa skeptics in his team. What we had not factored in was the huge influence of the Pretoria-born Elon Musk on the administration. Musk’s complaints about “white genocide” against Afrikaner farmers caught Trump’s ear and have added fuel to long-simmering right-wing concerns, including fury with South Africa’s “Gaza genocide” court case against Israel and Pretoria’s cozy relations with US adversaries including China, Russia, and Iran. Cameron Hudson, Africa director in George W. Bush’s White House, told me that the South African president will have to battle the interests of several “powerful” constituencies on the right, while an Africa-focused Capitol Hill aide called the meeting a “high risk” for Ramaphosa. Ultimately, South Africa has relatively little to offer this transactional White House unless it is prepared to completely sell out on its long-held post-apartheid principles. Ramaphosa, who is bringing along one of Trump’s golf buddies Ernie Els and South Africa’s richest man Johann Rupert, will likely offer Washington some sort of free-trade deal and critical minerals access among other things. But it will probably be insufficient to completely win Trump over. I can understand the nervousness. |

|

Crunch talks for South Africa-US |

Siphiwe Sibeko/File Photo/Reuters Siphiwe Sibeko/File Photo/ReutersSouth Africa’s President Cyril Ramaphosa is in Washington for a high-stakes meeting with US President Donald Trump, as Pretoria seeks to mend sharply deteriorating bilateral ties. The leaders are set to discuss trade, South Africa’s treatment of its Afrikaner minority, and Pretoria’s genocide case against Israel. A US official told Semafor that they hoped the meeting would not devolve into “another Zelenskyy moment,” referring to the Oval Office clash between the Ukrainian leader and Trump. Because South African diplomats including special envoy Mcebisi Jonas have struggled to make headway in Washington, the official said, the meeting will provide a rare opportunity to “reset the discourse” between the two nations. One person familiar with the matter said there are no major bilateral business pacts expected out of the meeting, although Pretoria looks set to offer Trump ally Elon Musk a deal to bring Starlink to the country. Discussions reportedly concern bypassing South Africa’s Black Economic Empowerment laws to ease Starlink’s entry into the country — a strategy first reported by Semafor in February. The regulations have barred Starlink’s launch in Africa’s biggest economy since 2023. — Mathias Hammer |

|

Starlink eyes Africa expansion |

| |  | Olumuyiwa Olowogboyega |

| |

Boureima Hama/AFP via Getty Images Boureima Hama/AFP via Getty ImagesStarlink, Elon Musk’s satellite internet provider, is not trying to dominate any single African market but is aggregating small, high-value pockets across the continent, according to a Semafor analysis of its customer base. It’s a strategy that might not upend African connectivity overnight, but it could be enough to build a profitable niche. The company currently has a global user base of around 4.6 million, including about 350,000 spread across 18 African countries. The company is building a thin but continent-wide user base of early adopters, remote workers, oil & gas outposts, and government contractors: Adding 1 million African users across, say, 30 to 40 countries — many of which have cheaper, but slower and less reliable internet connectivity — would be meaningful without requiring deep national penetration. If, as reports suggest, Starlink is allowed to launch in South Africa, other African countries may change the way they weigh compliance, competition, and geopolitics in a suddenly satellite-friendly era. And it could help Starlink to eventually become the first internet provider to plant a flag in every African country. |

|

Parsing US ‘trade, not aid’ strategy |

Issouf Sanogo/AFP via Getty Images Issouf Sanogo/AFP via Getty ImagesMany African governments will be keen to welcome a pivot by the Trump administration to potentially see Africa as a serious commercial partner and not a recipient of handouts, writes W. Gyude Moore, a former Liberian minister. But he cautions that this new strategy unveiled by the US State Department’s top Africa official last week will likely face “serious challenges in both conception and execution.” “Governments across the continent will embrace any partnerships to improve the investment climate. They will, however, do well to push for a partnership that is mutually beneficial,” notes Moore, who is a fellow at the Center for Global Development think tank in Washington. He said the strategy was “skewed toward facilitating American business, not fostering mutual prosperity or supporting African enterprises.” |

|

Canal+ takeover of MultiChoice |

Riccardo Milani/Hans Lucas via Reuters. Riccardo Milani/Hans Lucas via Reuters.South Africa’s Competition Commission approved the acquisition of pan-African broadcaster MultiChoice by France’s Canal+. Owned by the Paris-based entertainment group Vivendi, Canal+ has a 45.2% stake in MultiChoice and made an offer last year to buy the remaining shares it did not own, for 35 billion rand ($1.9 billion). The antitrust regulator said on Wednesday that the acquisition “is unlikely to substantially lessen or prevent competition in any market.” However, it imposed conditions for the transaction, including a three-year freeze on MultiChoice job cuts and ensuring the broadcaster maintains its headquarters in South Africa. The commission’s approval brings Canal+ — which broadcasts in French-speaking African countries — closer to its ambition of expanding to 50 countries across Africa and serving more than 30 million customers. — Alexander Onukwue |

|

Investing in Nigeria’s solar potential |

| |  | Alexander Onukwue |

| |

Kola Sulaimon/AFP via Getty Images Kola Sulaimon/AFP via Getty ImagesA Kenya-based solar power company is planning to use an $80 million loan from the World Bank’s private investment arm to rapidly scale up sales in Nigeria, the world’s most electricity-deprived country. For nearly two decades, Sun King has sold solar-powered electronics to African households and small businesses with unreliable connections to grids, spreading full product payment over up to two years. Its equipment is made in China and is now available in 11 African countries. Nigeria is the firm’s fastest-growing market and Sun King hopes to target the nearly 90 million Nigerians estimated to be without electricity, CEO T. Patrick Walsh told Semafor. He said the company has sold two million kits in Nigeria since 2022 and aims to triple that figure in the next few years. Malawi, Tanzania, and Togo are other markets targeted for growth. |

|

Cocoa farmers’ market bet |

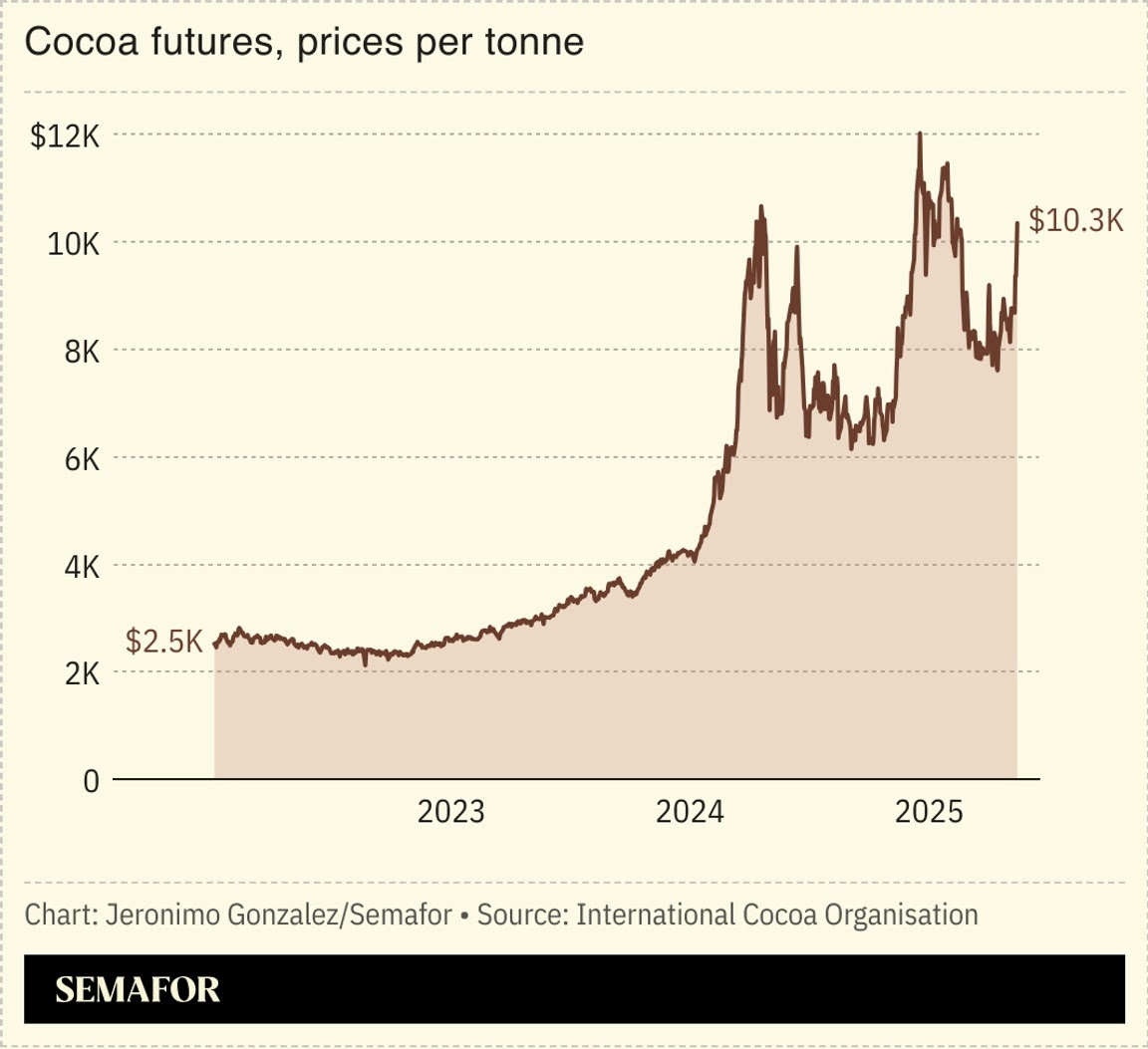

Cocoa growers in West Africa are holding back their stock, betting that changing climate patterns will result in more favorable prices. Farmers in the region have historically sold their goods months in advance on futures markets, to guarantee their future income. But bad weather driven by climate change in recent years has pushed up “spot” prices, which farmers in Côte d’Ivoire and Ghana — the world’s largest cocoa producers — have been unable to capitalize on. This year, they are increasingly opting for the spot market, Bloomberg reported, but the choice is a risky one, dependent on short-term weather patterns. “If there is a problem, they will have made the right call,” an agriculture sales executive said, “but if it’s decent then they are in trouble.” |

|

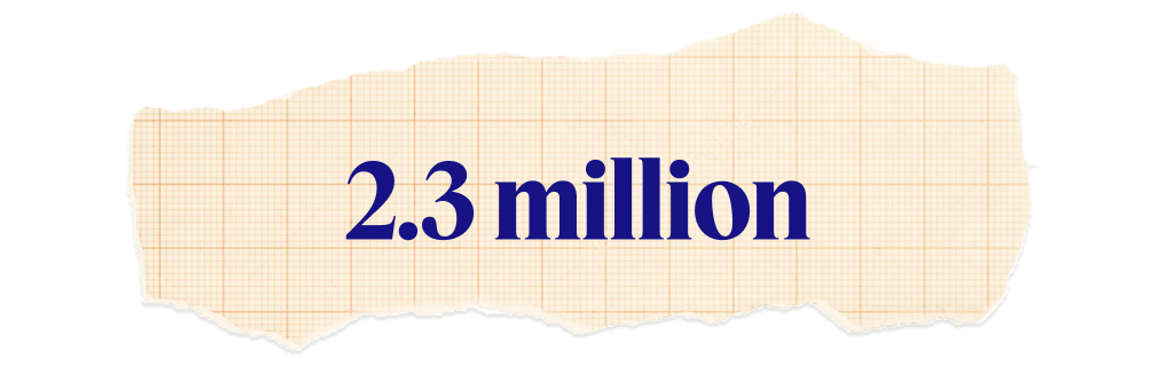

Record Chinese smartphone imports |

The number of smartphones Kenya imported from China last year. That’s a more than 70% increase from the 2023 tally, according to Chinese authorities. The rise in shipments pushed total Kenyan imports from the country to 576 billion shillings ($4.5 billion), Kenya’s Eastleigh Voice reported, the fastest pace of growth since 2015. Kenya has one of Africa’s largest trade imbalances with China: Beijing’s 2023 trade deficit with the continent hit $63 billion in 2023, more than half the value of its imports, the think tank ODI Global noted. The continued increase in Chinese imports has widened consumer choice but “placed pressure on domestic manufacturers who struggle to compete with cheaper Chinese goods,” noted the news outlet. |

|

Business & Macro |

|

|