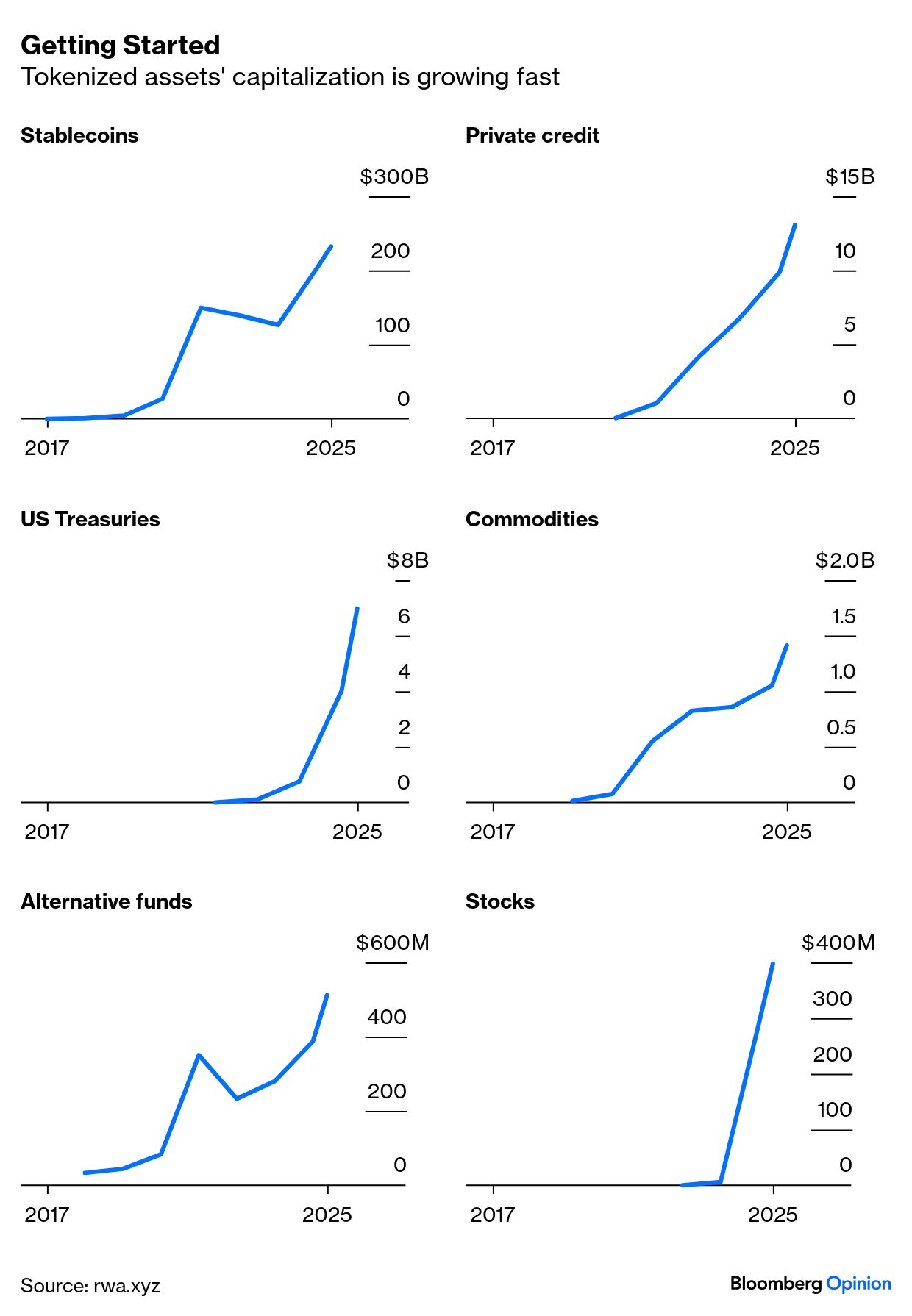

| So much for “I’ll end the war on day one!” After a two-hour phone call with Russian President Vladimir Putin on Monday, Trump determined that the war in Ukraine is “a European situation” and rid himself of the matter. Unless Congress forces Trump to intervene, Marc Champion says the US president “can leave the long, thankless task of mediating a peace settlement to the pope, Turkey’s President Recep Tayyip Erdogan or whomever wants to take it on.” “The US president didn’t fail to end this war, because he never tried,” Marc argues (free read). While a Nobel Peace Prize would have been nice, unity was never the true goal of his bromance with Putin: “His focus was from day one to achieve a reset with Russia that would deliver an economic bounty to the US.” Putin is now free to drag out negotiations and “Ukrainians have little choice but to fight on,” Marc writes. “Without the future ability to defend itself, their country will no longer exist as a sovereign state. As far as Moscow is concerned, Ukraine is a Frankenstein nation, patched together from others.” Europe’s leaders now face a choice: Do they cobble together funds to help Ukraine make ends meet? Or do they leave it defenseless? Trump made his bed, but the Old World doesn’t have to lie in it. Bonus Russia Reading: Centrists are winning elections again, thanks to US chaos and Russian aggression — but not for long. — Marc Champion Crypto!! We haven’t talked about it in a while. It’s still very much a thing — see: this Senate bill, this crime wave and this memecoin dinner — but Andy Mukherjee says central bankers are having a hard time navigating this uncertain chapter of monetary policy history. Could Bitcoin eventually throw their beige book out the window? If it does, will the Fed become irrelevant? A new report assessing whether central banks can use their monetary tools with tokens — dubbed “Project Pine” — sheds some light on the subject. “The Fed needn’t fear a tokenized world,” writes Aaron Brown. Andy agrees, but warns that the transition might get messy: “As the use of tokens increases, demand for bank reserves could become volatile and hard to predict.”  If you thought Trump’s on-again, off-again tariff talk was gonna spark a shipping logistics nightmare à la the LOL Surprise Doll Scare of 2021, Thomas Black says you’re sorely mistaken. Sure, some retailers will rush to get their goods from China before the 90-day pause is up, but “the feared tsunami [of goods] may turn out to be more of a minor swell,” he writes. “Even if there were a strong surge of shipments, it won’t cause anywhere near the kind of prolonged chaos at ports and warehouses that retailers suffered during the Covid pandemic. Consumers are in no mood nor in any kind of special circumstances, such as being locked down with government stimulus checks burning a hole in their pockets, to spend willy-nilly.” Europe must end its quest to grab a piece of London’s financial derivatives business. — Bloomberg’s editorial board Between tariffs and the House budget bill, expectations of lower borrowing costs this year are rapidly diminishing. — Robert Burgess Banning Bangladesh’s oldest party is not the step toward stable democracy investors were hoping for. — Mihir Sharma Luxury shoppers want the classics when times are tough, which is great news for Cartier and Van Cleef. — Andrea Felsted Hong Kong is getting back on its feet again — providing finance for Chinese businesses going global. — Shuli Ren Markets may have snapped back, but Moody’s nailed a broader truth — that US debt has surged. — John Authers Microsoft-backed Builder.ai filed for insolvency. The UN is warning that 14,000 babies could die in Gaza. Representative LaMonica McIver was charged with assaulting ICE agents. The hidden health risks of over-the-counter UTI drugs. Louisiana is hunting down inmates after a massive jailbreak. Everything is slop. (h/t Beth Kowitt) She makes $16 million a year selling sweatshirts. Will the Knicks-Pacers rivalry top 1993? Carrie Bradshaw’s favorite Choos are back. Champagne is … healthy? Hmmmm. |