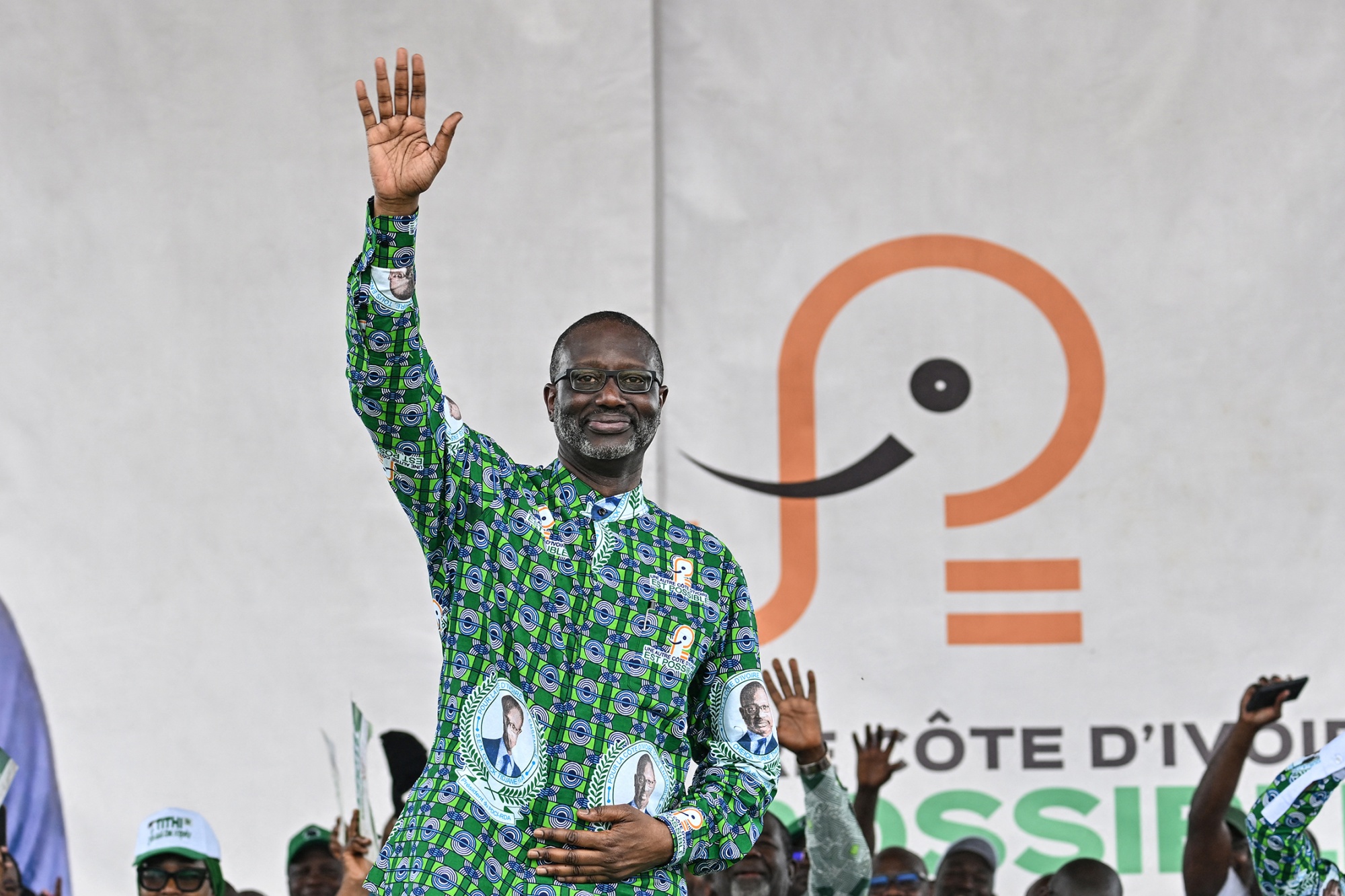

| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. Tidjane Thiam’s resignation as the head of Ivory Coast’s main opposition party seemingly signals an end to his ambition of leading the West African nation. The former Credit Suisse CEO was barred from running for president because he held French citizenship until February, when he registered. But he may still have a say in determining the outcome of October elections in which incumbent leader Alassane Ouattara is likely to seek a fourth term — despite question marks over his eligibility to do so.  Tidjane Thiam. Photographer: Sia Kambou/AFP/Getty Images In a carefully worded resignation letter, Thiam said he remained committed to leading the Democratic Party of Ivory Coast to victory in the vote — a clear indication that he has no intention of exiting the political fray. And his retention of the post of deputy chairman of the party means he’ll likely influence the appointment of its new leader later this week. It’s a playbook that worked in nearby Senegal where Ousmane Sonko, barred from running for the top post, was named prime minister after his ally Bassirou Diomaye Faye won the presidency. Thiam’s party, which has failed to unite a fractured opposition, still faces an uphill battle to unseat Ouattara, who has presided over a flourishing economy. And in a political arena known for big-man personalities, a lesser-known candidate is likely to be at a severe disadvantage. Whatever the election outcome, Thiam’s disqualification threatens to undermine Ouattara’s efforts to present Ivory Coast as a stable and growing democracy. Disputes over the eligibility of presidential contenders in 1995 and 2000 elections divided the country and spurred conflict that lasted for a decade until 2011. Risks lie ahead. — Katarina Hoije and Antony Sguazzin Key stories and opinion:

Thiam Steps Down as Leader of Ivory Coast Opposition Party

Thiam Election Ban Sparks Fears of Ivory Coast Unrest

Ex-Credit Suisse CEO Thiam Disqualified From Ivorian Polls

Ivorian Presidential Hopeful Thiam Gives Up French Citizenship

West Africa Says Goodbye to Francafrique: Justice Malala Dozens of White Afrikaners arrived in the US from South Africa, the first beneficiaries of a controversial resettlement program instigated by President Donald Trump. The immigrants landed at Washington Dulles International Airport on Monday and were greeted by US officials. Deputy Secretary of State Christopher Landau said the Afrikaners had suffered from “unjust racial discrimination,” an allegation Pretoria denies. While the original criteria targeted farmers, the US has widened it to persecuted racial minorities.  Afrikaners from South Africa arrive in Dulles, Virginia. Photographer: Saul Loeb/AFP/Getty Images BluePeak Private Capital is on track to raise $250 million for its African private credit fund that will invest in mid-sized companies. It’s already raised $80 million from European development finance institutions including British International Investment, FMO, Swedfund and Swiss Investment Fund for Emerging Markets. “The demand for private credit on the continent will get even further exaggerated with what is happening globally,” BluePeak co-founder Walid Cherif said in an interview. Guinea will hold elections in December that will return the country to constitutional order after more than three years of military rule. The vote in the world’s biggest bauxite exporter will follow a September referendum on a new constitution, Prime Minister Amadou Oury Bah said. The nation has been led by a junta since General Mamadi Doumbouya ousted President Alpha Conde in September 2021.  Doumbouya and Guinean special forces members at the Peoples Palace in Conakry in September 2021. Photographer: John Wessels/AFP/Getty Images The southern African Kingdom of Eswatini plans to start a sovereign wealth fund of around $275 million to help channel investment into areas such as manufacturing and agriculture. Legislation to establish the fund, drawn up with the Commonwealth’s help, will likely be finalized in the next three months, Finance Minister Neal Rijkenberg said in an interview. The government will capitalize it with assets including land and shares in state-owned firms, banks, insurance companies and mines. Senegal began converting a power plant to operate on liquefied natural gas after exporting its first consignment of the fuel last month. The first phase of the project at the Bel Air plant will involve converting its engines, while a second phase later this year will change the facility’s fuel source to LNG. Senegal currently relies on imported gas, but intends tapping the BP-operated Greater Tortue Ahmeyim field. It aims to develop more than three gigawatts of gas-to-power capacity by 2050.  Fishermen near the Greater Tortue gas field in Senegal. Photographer: Anadolu/Getty Images Removing Nigeria’s high tariffs and import bans could significantly boost tax revenue, while benefitting consumers and lowering poverty rates, according to the World Bank. Africa’s largest oil producer currently bans imports of cement and some food items, footwear and over-the-counter drugs, while its average tariff rate is twice that of sub-Saharan Africa. Reforms would provide relief from high living costs, said Alex Sienaert, the lender’s lead economist for Nigeria. Thank you for your responses to our weekly Next Africa Quiz and congratulations to Sayen Gohil who was first to identify White Afrikaners as the group that has been offered refugee status by the US. South Africa’s unemployment rate rose more than expected in the first quarter as the construction and trade sectors shed jobs. The rate increased to 32.9% in the three months through March, the national statistics agency said. With 8.2 million people unemployed, South Africa has one of the highest jobless rates globally — undermining government efforts to boost revenue, curb debt and deliver on promises of faster economic growth. Thanks for reading. We’ll be back in your inbox with the next edition on Friday. Send any feedback to mcohen21@bloomberg.net |