| | In today’s edition: President Donald Trump weighs in on Saudi-UAE feud, and Riyadh overhauls its agi͏ ͏ ͏ ͏ ͏ ͏ |

| |   Abu Dhabi Abu Dhabi |   Washington DC Washington DC |   Riyadh Riyadh |

| Gulf |  |

| |

|

- Trump on Saudi-UAE rift

- HUMAIN pours $3B into xAI

- MGX’s AI strategy

- Iraq-UAE fiber link

- Saudi creates aviation jobs…

- … overhauls Riyadh airport

- UAE lures tech leaders

Shorter work hours, grocery shopping frenzy… Ramadan begins. |

|

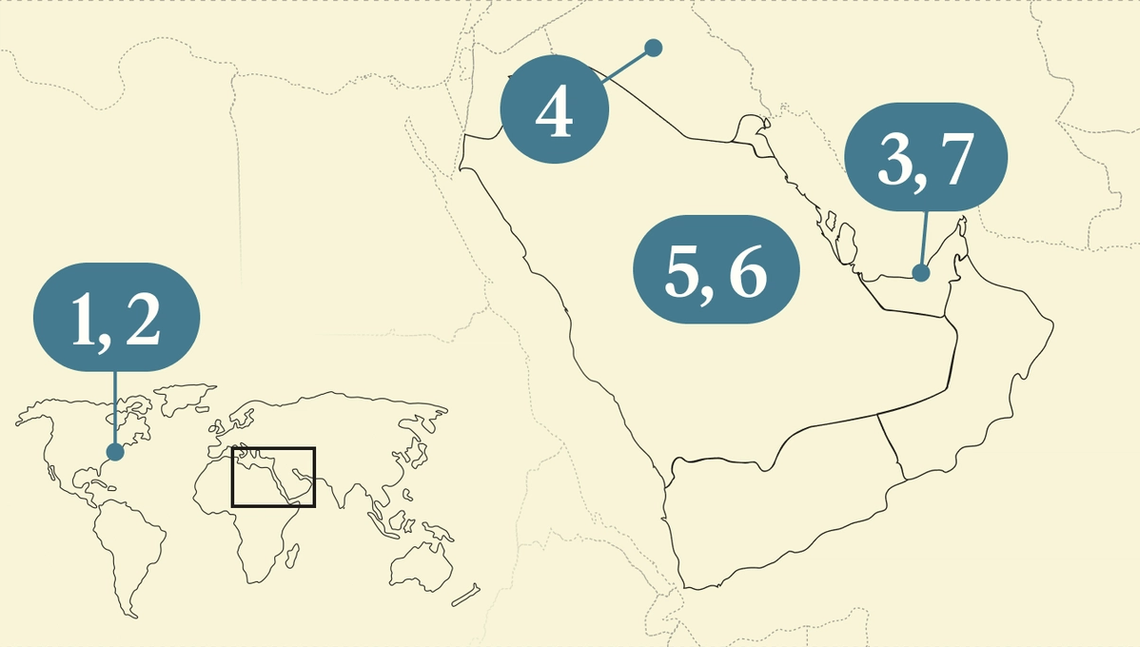

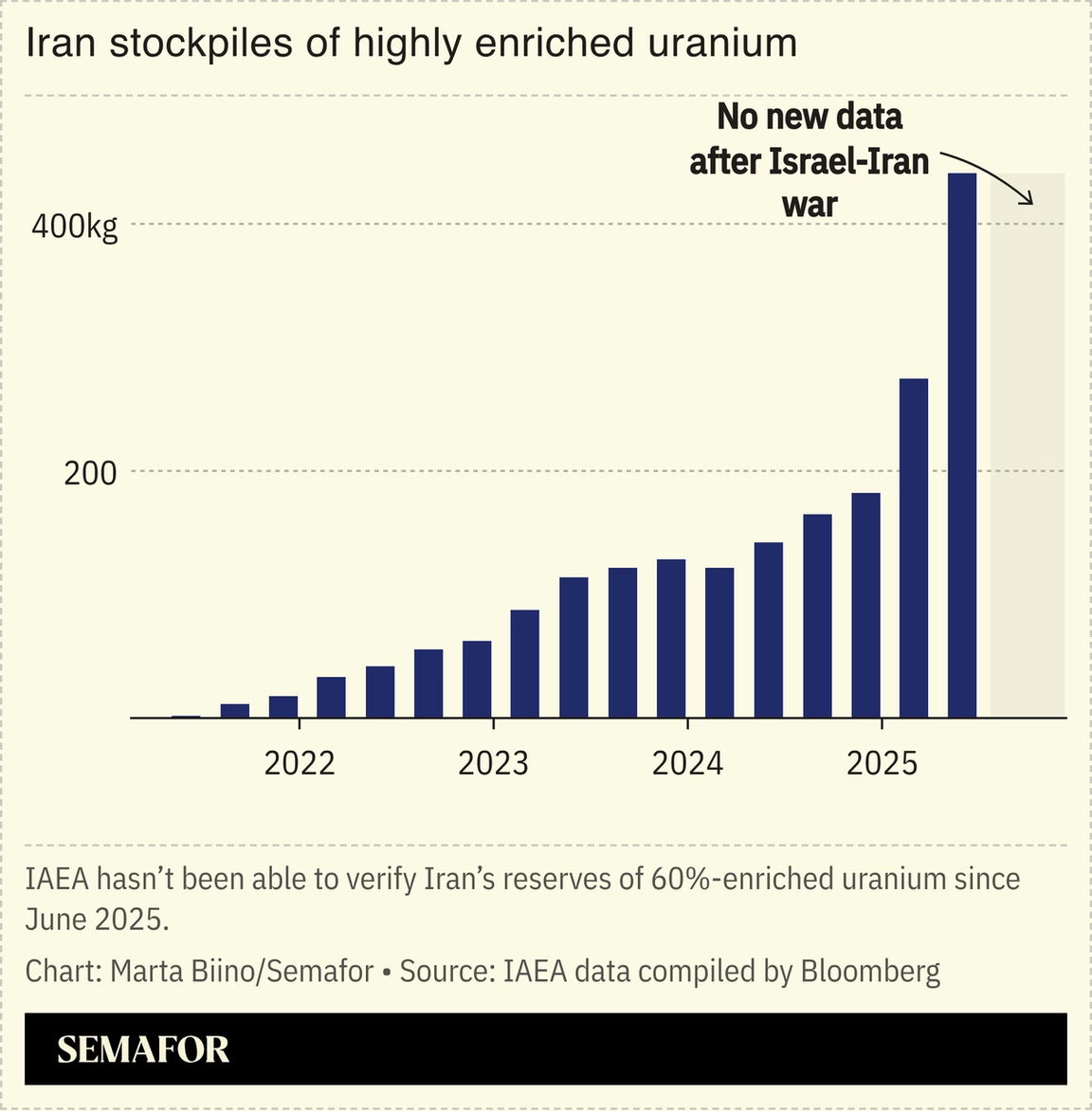

Trump keeps options open on Iran |

There was limited progress in the indirect talks between the US and Iran — via Oman’s foreign minister — in Geneva yesterday, but not enough to stall the US military buildup in the Gulf. A deal isn’t imminent, according to Iran’s foreign minister, and negotiations over Tehran’s nuclear program are expected to resume within two weeks. In the meantime, American aircraft carriers and air defense systems are arriving in the Gulf. Iran responded to the assembling forces with a drill that briefly disrupted traffic in the Strait of Hormuz and warned of retaliation for any US strike. US President Donald Trump is “in a sweet spot,” as the Hudson Institute’s Walter Russell Mead puts it — able to push for regime change, take a deal, let Israel strike, or give Tehran a reprieve — but Gulf states are concerned about escalation that could draw them into a conflict. Oil markets appear to be pricing in diplomacy, with Brent declining about 2% after signs of tentative progress in Switzerland. The standoff comes as Saudi Arabia and the UAE continue their own feud. Trump told reporters he isn’t involved in efforts to mediate between the two, but if he were to engage, he could “settle it very easily.” — Mohammed Sergie |

|

HUMAIN’s $3B xAI investment |

HUMAIN CEO Tareq Amin. Hamad I Mohammed/Reuters. HUMAIN CEO Tareq Amin. Hamad I Mohammed/Reuters.Saudi Arabia’s AI champion HUMAIN announced its splashiest direct investment yet, putting $3 billion into Elon Musk’s xAI ahead of its recent merger with SpaceX. The PIF-backed fund became “a significant minority shareholder” in xAI, according to a statement from HUMAIN, with its holdings since converted into SpaceX shares. Qatar Investment Authority and Abu Dhabi’s MGX were previously named as investors in the Series E round in January. The deal builds on HUMAIN and xAI’s plan to develop a 500MW data center in the kingdom, and to deploy xAI’s Grok platform in Saudi Arabia. The chatbot is being investigated by the EU’s European Commission over sexualized deepfake images. |

|

A peek at the MGX playbook |

Khaldoon Al Mubarak. Hamad I Mohammed/Reuters. Khaldoon Al Mubarak. Hamad I Mohammed/Reuters.Part of the playbook for Abu Dhabi’s AI fund MGX — how it gets those “exquisite opportunities that most people can’t access,” as one executive put it — is revealed in a Bloomberg profile. Having powerful principals in Sheikh Tahnoon bin Zayed and Mubadala chief Khaldoon Al Mubarak helps, as does a New York office staffed with venture and private equity veterans, and other global funds that are eager to partner on deals. Executives from both Mubadala — one of the world’s most active sovereign wealth funds — and AI conglomerate G42 are on the board of MGX, and Ahmed Yahia Al Idrissi, the CEO of Mubadala’s direct investments platform, was tapped to run the fund when it launched in 2024, at the start of the AI investment fervor. MGX aims to get $10 billion worth of deals out the door annually, Semafor reported in April. MGX has backed OpenAI, Anthropic, and xAI. Where some might see conflict, the fund views each as distinct: OpenAI has the consumer advantage; Anthropic is for business; and xAI is the winner in robotics, according to its investment chief. |

|

UAE links to Türkiye via Iraq |

Workers install an undersea cable on a beach. Rogan Ward/Reuters. Workers install an undersea cable on a beach. Rogan Ward/Reuters.The UAE is part of a $700 million plan to lay an internet cable to Türkiye via Iraq, as the network for transferring data across the Middle East becomes more robust — and countries vie to tap growing demand for connectivity. The project, dubbed WorldLink, calls for an undersea cable from the UAE to Iraq’s Faw peninsula on the Gulf, which will then run overland to the Turkish border, Ali El Akabi, head of Iraq’s Tech 964, which is part of the project, told Reuters. The cable is privately funded and will be rolled out in phases over the next five years, according to El Akabi. The aim is to reduce transit times compared to traditional cable routes through the Suez Canal. The plan follows the announcement of a Saudi-backed fiber-optic project in Syria earlier this month; last week, the world’s largest subsea cable system came ashore in the UAE. — Kelsey Warner |

|

Saudia promises hiring spree |

The number of jobs Saudi Arabia’s national airline Saudia aims to create over the coming years, alongside a huge fleet renewal program — a welcome signal for the local economy at a time when unemployment is creeping back up. Saudia recently held a graduation ceremony for more than 1,000 Saudi men and women — the largest cohort to complete its training programs to date. It has 185 planes on order, both for Saudia and its low-cost subsidiary Flyadeal, and needs people to fly and maintain those aircraft, as well as work in ground services, logistics and other areas. Aviation is seen by the government as a key way to expand and diversify the economy, not least by drawing in more tourists. If it can create more jobs in the future, that will add to its value. |

|

A guide to Riyadh’s airport reshuffle |

Ahmed Yosri/Reuters Ahmed Yosri/ReutersIf you’re flying out of Riyadh over the next 10 days, double check your terminal. King Khalid International Airport is reshuffling airline operations in its biggest overhaul in decades. Terminals 1 and 2 now handle international flights operated by Saudi carriers. Starting from Feb. 24, all domestic flights will move to Terminals 3 and 4, while foreign airlines will shift to Terminal 5. The transition is designed to ease congestion and prepare the airport for rising volumes as the kingdom pushes to attract more tourists and expand air traffic. It also lays the groundwork for Riyadh Air’s rollout; the new airline plans to begin commercial flights this year and will ramp up to serve 100 destinations. The overhaul is a stopgap until a large expansion of the airport is completed in 2030, at which point it will be renamed King Salman International Airport. |

|

View: Why tech leaders flock to the UAE |

Courtesy of Hub71 Courtesy of Hub71The UAE has created an environment where tech companies can thrive, with a recent ranking showing that almost half of the region’s industry leaders are based in the country, Tareq Alotaiba, a former Emirati official, writes in a Semafor column. “The UAE’s advantage is not a first-mover advantage alone — it stems from decades of investment in internal competitiveness and human capital development,” Alotaiba wrote, adding that for other countries to replicate that model it “will require structural changes, in addition to a large checkbook.” |

|

On Tuesday, March 24, Semafor will convene with leaders in Nairobi to advance financial inclusion at the intersection of long-term capital, policy, and financial infrastructure. Bringing together investors, policymakers, and financial system leaders, the conversation will move beyond ecosystem-building toward action — mobilizing capital, strengthening infrastructure, and closing persistent access and affordability gaps. Join us as we dive into how coordinated public-private efforts can accelerate inclusive growth across East Africa and other emerging markets. March 24 | Nairobi | Request Invitation |

|

Cybersecurity- Passports and other documents belonging to prominent attendees at Abu Dhabi Finance Week in December were reportedly found on an unprotected server. ADFW confirmed some documents were vulnerable and said it has secured them. — Financial Times

Diplomacy- Qatar’s Prime Minister Sheikh Mohammed bin Abdulrahman al-Thani flew into Venezuela yesterday, where he was greeted on arrival by Foreign Minister Yvan Gil. The visit comes after US Energy Secretary Chris Wright said revenues from Venezuela’s oil sales will no longer pass through Qatar, but will instead go via a US Treasury Department account. — Reuters, CNBC

Real Estate- UAE-based fractional property platform Stake has raised $31 million in a financing round led by Emirates NBD which also included a Mubadala Investment Company fund, Saudi Aramco-backed Wa’ed Ventures, and others. Stake will use some of the money to expand in Saudi Arabia. — Wamda

|

|

|