|

B2B auth that grows with your business (Sponsor)

Adding auth to your product starts out simple, but can quickly spiral into a ton of feature requests that distract you from your main mission.

With PropelAuth, you can add common auth features with just a click of a button, like:

Organizations

Roles & permissions

Enterprise SSO (SAML/OIDC)

Custom security policies

MCP support

Don’t get bogged down fighting with subpar auth tools - try PropelAuth today.

Anthropic is squeezed between its founding commitment to cautious, safety-first AI development and the relentless demands of a hyper-competitive market dominated by OpenAI and Microsoft.

As revenue forecasts soar to $26 billion in 2026 and enterprise tools proliferate, the company grapples with escalating capital needs and shifting alliances that blur partner and rival lines.

This tension tests Anthropic’s ability to scale without sacrificing its “moral high ground.”

Let’s dissect Anthropic’s strategic maneuvers, the forces straining its identity, and the profound implications—including tailored takeaways for key tech industry players.

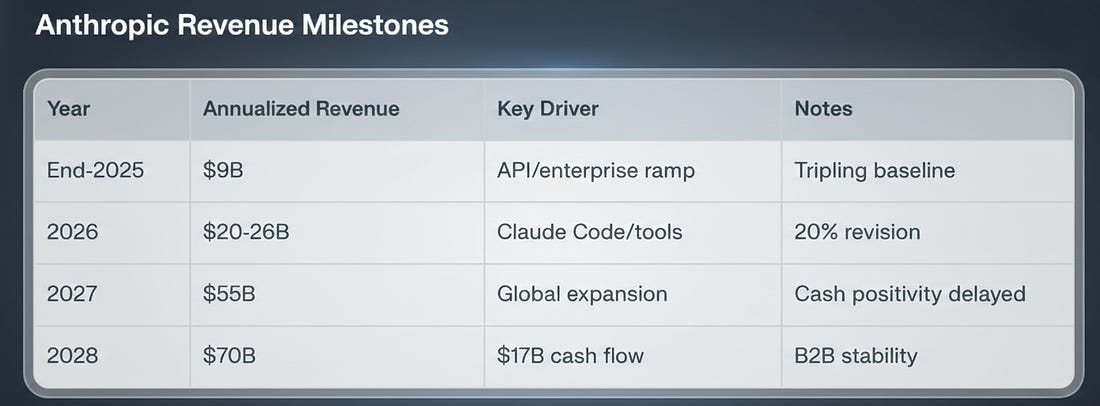

Explosive Revenue Ambitions Fuel Enterprise Pivot

Anthropic’s growth trajectory has stunned observers, targeting nearly $9 billion in annualized revenue by end-2025, ballooning to $20-26 billion in 2026—a near tripling—with recent 20% hikes pushing 2027 toward $55 billion and $70 billion by 2028. About 80% stems from 300,000+ enterprise clients via APIs and Claude Code, which hit a near-$1 billion run rate post-launch. This B2B focus delivers predictable revenue amid infrastructure debates.

Safety Identity Under Market Strain

Founded in 2021 by ex-OpenAI leaders, Anthropic’s “Constitutional AI” embeds ethics into Claude models, prioritizing throttled reliability over speed.

Capital from Amazon/Google ($6B total) fuels scaling, but these partners now compete, demanding faster launches. Safety investments delay cash-flow positivity to 2028, yet Anthropic bets this becomes a premium moat amid regs like EU AI Act.

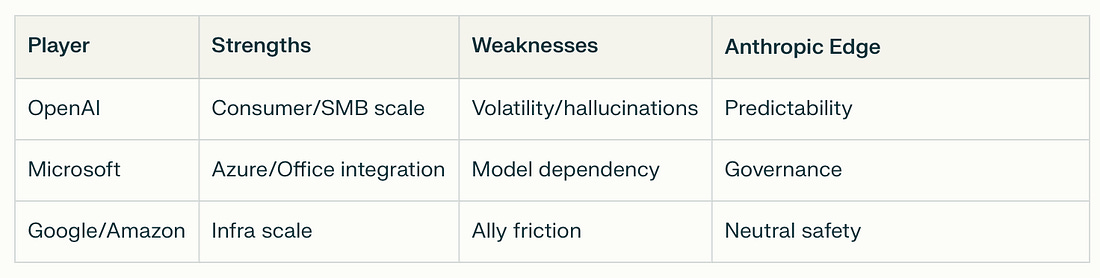

Rivalry Heats: Partners Become Predators

Enterprise tools like Claude Enterprise target devs, clashing with OpenAI’s SMB push and Microsoft’s bundling. Super Bowl ads loom as Altman courts CEOs.

Competitive Landscape

What Anthropic’s Strategy Means for Tech Industry Players

Anthropic’s high-stakes balancing act reverberates across the tech ecosystem, forcing strategic recalibrations. Here’s how key players should respond, with actionable implications drawn from its enterprise surge and safety moat.

For OpenAI: Accelerate Enterprise Trust-Building

OpenAI dominates consumers but trails in Fortune 500 predictability—Anthropic’s 80% B2B revenue share signals vulnerability. Altman must invest heavily in compliance certifications and rate-limit transparency to stem defections.

Expect pricing wars; OpenAI could bundle GPTs with premium support to match Claude Code’s $1B run rate. Long-term, mimic “Constitutional AI” to neutralize safety critiques, or risk ceding high-margin enterprise to rivals.

Pivot: Launch audited enterprise tiers.

For Microsoft: Double Down on Ecosystem Lock-In

With Copilot embedded in Office/Azure, Microsoft faces Anthropic’s independent