| | In today’s edition: Regional diplomacy on Iran ramps up, Qatar locks in LNG sales, and more tunnels ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Erdoğan visits Riyadh

- Chip R&D shop in Doha

- Qatar locks in LNG sales

- Saudi preps Syria deals

- Dubai’s Boring traffic plan

- Saudi artist’s record sale

A decade of (legislated) happiness in the UAE. |

|

Erdoğan and MBS firm up ties |

Turkish President Erdoğan visits Saudi Arabia. Murat Cetinmuhurdar/Turkish Presidential Press Office/Handout via Reuters. Turkish President Erdoğan visits Saudi Arabia. Murat Cetinmuhurdar/Turkish Presidential Press Office/Handout via Reuters.Saudi Arabia and Türkiye solidified their increasingly close diplomatic and trade relations this week, with a slew of commitments to coordinate on defense and investment. Turkish President Recep Tayyip Erdoğan met Saudi Crown Prince Mohammed bin Salman in Riyadh, his first trip to the kingdom in more than two years. The two have steadily rebuilt ties that had reached a low ebb in 2017 to 2020, when Ankara sided with Qatar in a regional dispute; the regional rift is now between Riyadh and Abu Dhabi and Türkiye again appears to have picked a side. There was no announcement on a rumored security pact between Ankara and Riyadh, although a joint statement said they would “strengthen and develop their defense relations.” They also agreed to develop a $2 billion solar project in Türkiye — likely to be built by Saudi sovereign wealth fund-backed ACWA Power — and set a goal of nearly doubling the value of bilateral trade to $10 billion over the medium term. — Matthew Martin |

|

Doha lands renowned semiconductor R&D lab |

Courtesy of imec Courtesy of imecOne of the world’s leading semiconductor research labs will open its first Gulf R&D center in Doha this year. Belgium-based Imec is looking to hire 100 people in the city by 2030, including research engineers, in a boon to the Qatari capital’s efforts to build a homegrown technology industry. Imec, a 42-year-old research juggernaut, generates $1.3 billion in annual revenue by bridging cutting-edge academic research with commercial applications, an executive told Semafor. Imec considered opening in Abu Dhabi or Riyadh, the person said, but chose Qatar after being impressed by its effort to build a training pipeline rather than simply buying and importing technology. Doha is also attractive as a base for engineers from South Asia, the executive added, as immigration uncertainty in the US looms large for foreign talent. This week Qatar expanded its visa program to offer long-term residency to entrepreneurs and executives. It also signed a deal to set up an innovation hub in Doha in partnership with Germany’s DEEP Institute for Deep Tech Innovation, and signed a training deal with California-based Scale AI. — Kelsey Warner |

|

Qatar signs long-term LNG contracts |

The length of a liquefied natural gas supply contract between QatarEnergy and Japan’s biggest power generator JERA, as the Gulf country continues to sign up long-term customers for its principal export. The deal was signed on the sidelines of the LNG 2026 conference in Doha and covers up to 3 million tons of LNG a year, starting in 2028. A similar 20-year deal with Malaysia’s Petronas involves 2 million tons a year. Doha is doubling its LNG production to 160 million tons a year and officials insist that global economic growth — including the expansion of AI data centers — means demand will remain robust, despite the rise of renewable energy. QatarEnergy Chief Executive Saad Sherida Al-Kaabi told the conference: “We are doing our best to… reduce emissions,” but added “It is important for policymakers to be realistic about what can and cannot be delivered.” |

|

PIF-backed firms plan Syria projects |

Saudi Crown Prince Mohammed bin Salman and Syrian President Ahmed al-Sharaa. Saudi Press Agency/Handout via Reuters. Saudi Crown Prince Mohammed bin Salman and Syrian President Ahmed al-Sharaa. Saudi Press Agency/Handout via Reuters.Saudi Arabia is expected to soon provide more clarity on its investments in Syria. Low-cost carrier Flynas, ACWA Power, and telecoms company stc — all backed by Public Investment Fund — are planning to establish a new airline, build a water desalination plant, and upgrade Syria’s mobile and internet networks respectively, Al Arabiya reported. The privately owned BinDawood Holdings also plans to develop and operate Aleppo’s airport as part of a multibillion-dollar package of deals. Riyadh has provided diplomatic, economic, and security support to Damascus over the past year, taking a leading role in helping Syria’s post-war recovery. Six Saudi billionaires visited the country in July, and a joint Saudi-Syrian investment committee has been set up to identify projects and ease the path for foreign investments which could kick-start the economy. |

|

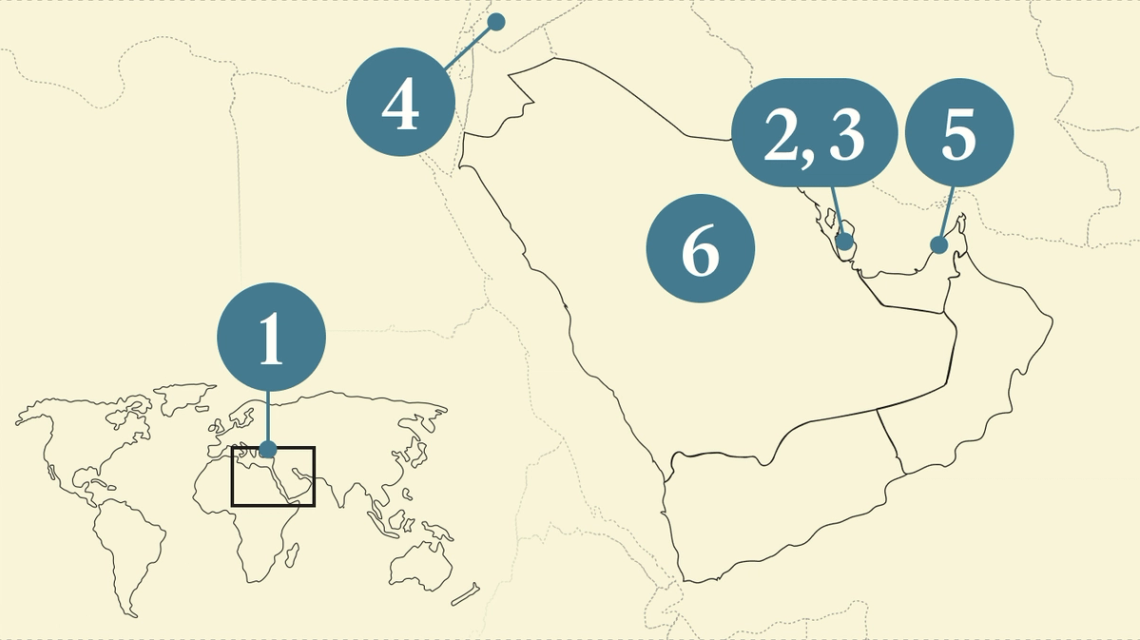

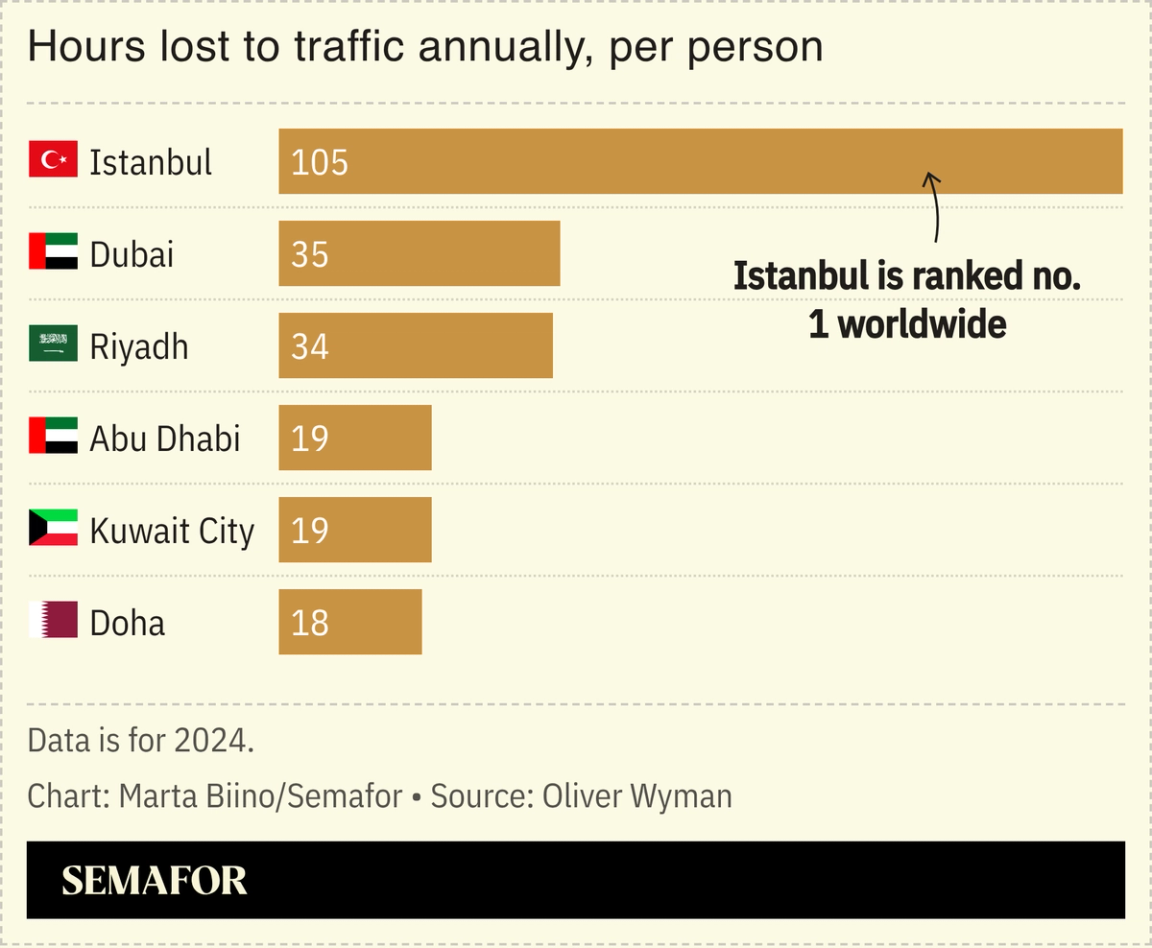

Dubai taps Boring Co. to ease gridlock |

Traffic complaints dominate Dubai small talk — and the city’s ever-expanding public transit networks have yet to put a stop to the habit. The latest idea to ease travel times is the Dubai Loop: a planned underground mass-transit system using Tesla cars traveling along dedicated tunnels. Construction is due to start later this year and officials told AGBI the first phase will be ready in two years. The Boring Company, Elon Musk’s brainchild that has brought a similar network to Las Vegas, will develop the first six kilometers, linking the DIFC financial zone to Dubai Mall at a cost of around $163 million. It is expected to move some 13,000 passengers a day, while the entire project will cover roughly 22 kilometers and aims to serve 30,000 daily commuters. But given Dubai’s public transit system carries more than 2 million people a day, it is unlikely to make a significant dent to above-ground traffic flows. |

|

Gulf art hits new heights |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersA piece by the late Safeya Binzagr, widely known as the mother of Saudi art, set a new record for a Saudi artist at the latest Riyadh sale run by Sotheby’s. The auction house’s second Saudi event brought in a total of $19.5 million, led by Arab modernists and regional names — Binzagr’s 1968 painting Coffee Shop on Madina Road went for $1.6 million — as well as a $1.3 million Picasso lot. Nearly a third of buyers were from Saudi Arabia. The sale took place against a busy cultural backdrop in the Gulf: the Diriyah Contemporary Arts Biennale is running until early May, and Art Basel opens in Doha tomorrow. Despite a budding ecosystem, there are also signs of strain in the kingdom’s arts sector amid wider government spending cuts. A $200 million Saudi investment deal with New York’s Metropolitan Opera remains in limbo, and there have been reports from the industry of delayed payments from the kingdom. — Manal Albarakati |

|

Debt- Ruya Partners, an Abu Dhabi-based firm backed by Mubadala and PIF, is raising $400 million — poised to be one of the Middle East’s largest private credit funds — to meet growing demand for alternative financing as Saudi Arabia faces a credit crunch. — Bloomberg

Diplomacy- Oman looks set to host the latest round of indirect talks between the US and Iran, after Tehran pushed back against the original proposed venue of Türkiye. Tensions have been heightened after the US shot down an Iranian drone, saying it had “aggressively approached” an American aircraft carrier. — Reuters

- Adnoc’s international investment arm XRG agreed to acquire a stake in the Southern Gas Corridor, which supplies Caspian Sea gas to Europe, during a visit by Azerbaijan’s President Ilham Aliyev to the UAE. Aliyev also met UAE President Sheikh Mohamed bin Zayed Al Nahyan, with the two announcing a letter of intent on defense cooperation.

- Ukraine-US-Russia talks returned to Abu Dhabi today, with tensions higher than the last round, after Moscow launched a large attack on Ukraine’s energy infrastructure on Tuesday. Ukraine’s president said the negotiators’ assignment will be “adjusted” to reflect that Russia doesn’t “take diplomacy seriously.” — Euronews

Real Estate- Qatar Investment Authority has backed the $6.3 billion Singapore Central Private Real Estate Fund, a vehicle set up by Hongkong Land Holdings to focus on prime commercial properties in Singapore’s central business district and Orchard Road retail zone. — Zawya

- Abu Dhabi’s mall culture is in for an upgrade: Mubadala and the UAE capital’s largest developer, Aldar, have formed a joint venture to consolidate their luxury retail holdings as the city undertakes a major expansion to its main commercial district.

Sports- LIV Golf kicks off in Riyadh today with a $30 million purse, including a $20 million winner’s check. Funded by PIF, the tournament features 57 players and will host concerts by both international and local stars, from Akon and Tyga to Syrian artist Al Shami. — TimeOut Riyadh

- Saudi football fans were left in limbo after Cristiano Ronaldo missed Monday’s Al-Nassr match, after reportedly going on strike due to frustration with PIF’s management and the signing by rival club Al-Hilal of Karim Benzema. — BBC

|

|

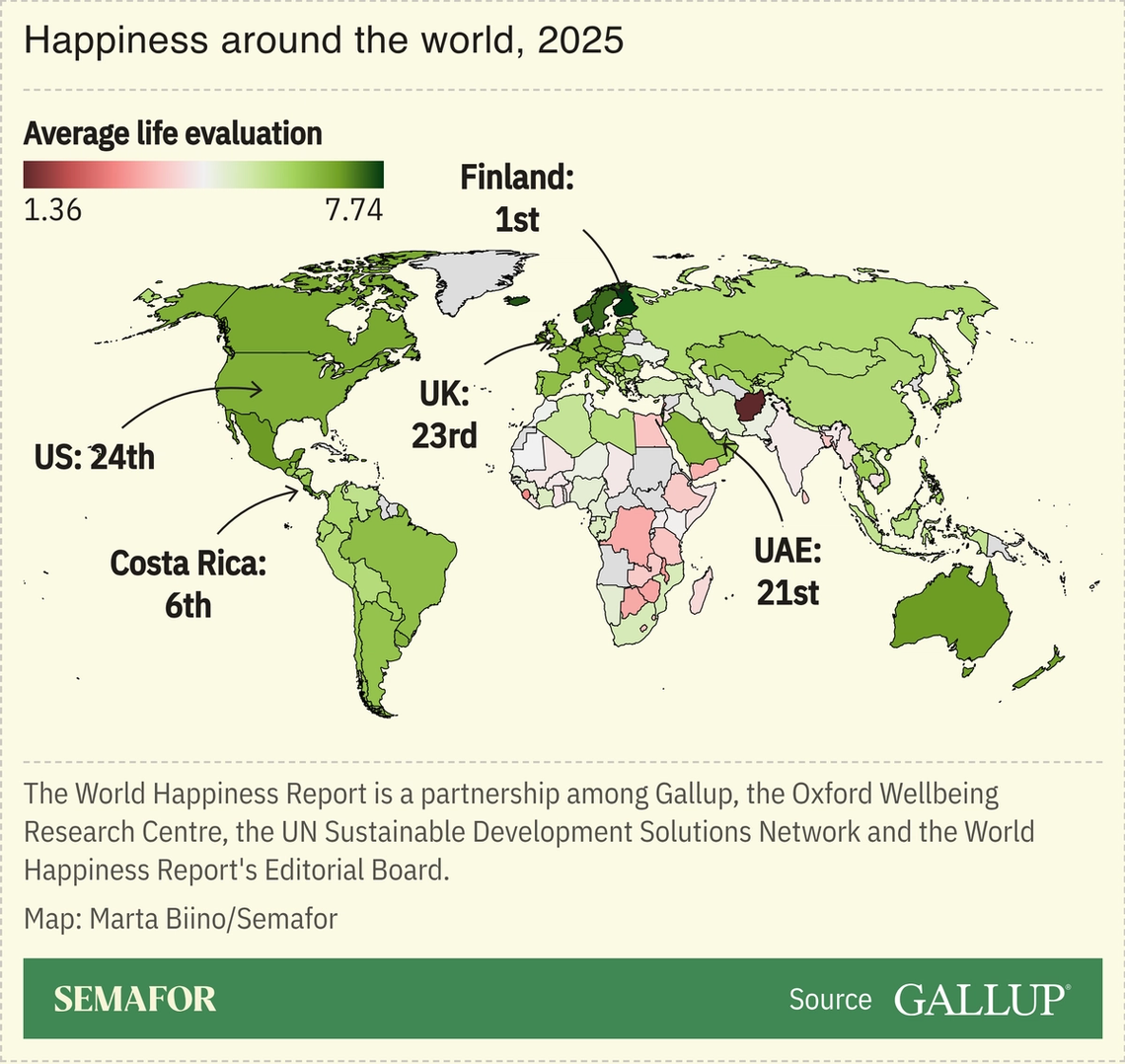

Ten years ago this week, the UAE decided that if you can’t buy happiness, you can at least legislate it. On Feb. 9, 2016, Dubai’s Ruler Sheikh Mohammed bin Rashid Al Maktoum announced a cabinet shake-up at the World Government Summit, introducing a minister of state for happiness. The move was part of a broader strategy to create a “young and flexible” government. While critics initially dismissed the move as a PR play, it turns out the UAE might have been on to something. In the 2025 World Happiness Report, compiled by polling company Gallup, the country climbed to 21st globally, and first regionally. The government declared 2025 the “Year of Community,” and the International Day of Happiness — not a public holiday — is now marked by the country on March 20 each year. — Manal Albarakati |

|

< < |

|

|