|

PayPal reported earnings yesterday, and the stock went down 20%.

They fired their CEO and replaced him with Enrique Lores, HP’s current CEO.

Is this a failing business that we need to sell?

Investors on social media frequently call PayPal PainPal because the stock price has had such a wild ride.

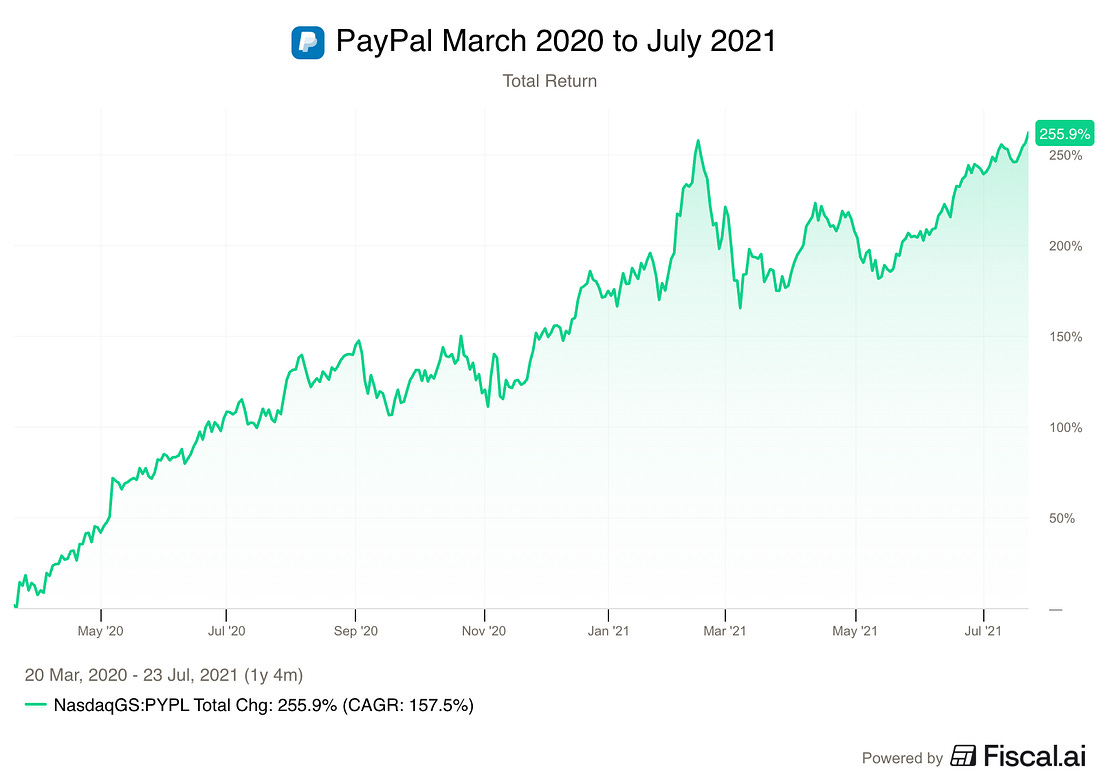

From March of 2020 to July of 2021, PayPal shot up 250% as people bought everything online.

|

Investors were way too optimistic and were paying more than 100x earnings at the peak.

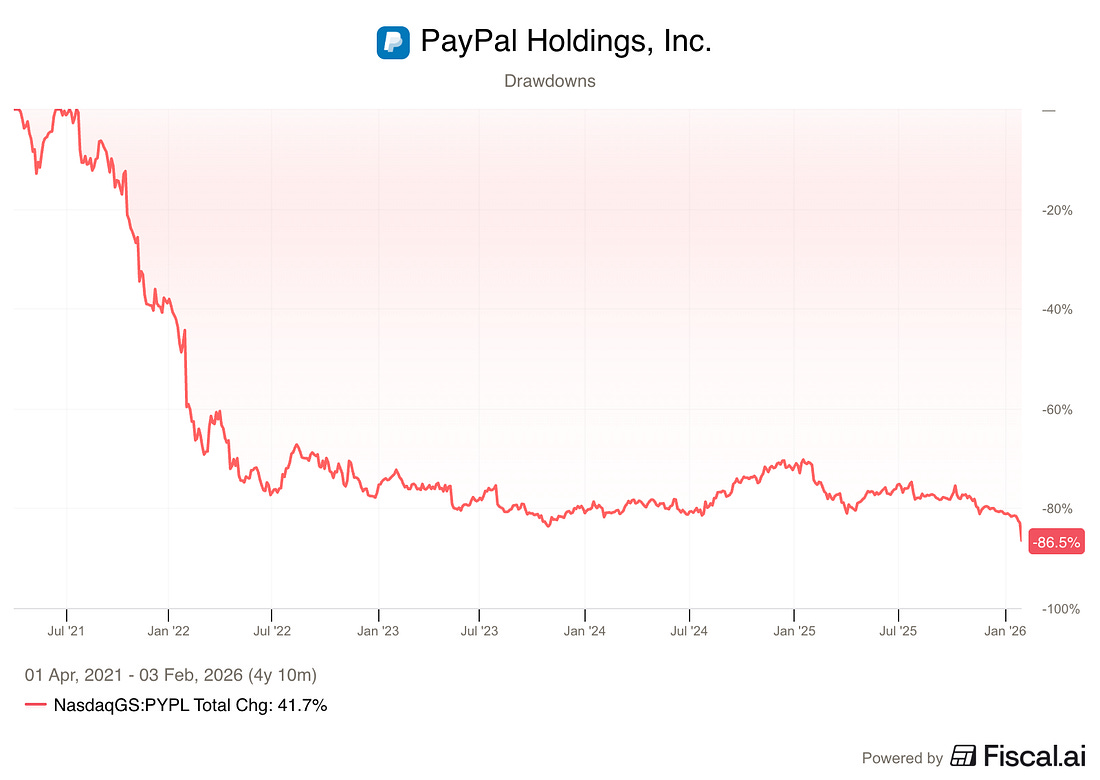

That optimism flipped and PayPal is now down more than 85% (!) from the pandemic highs, earning it the PainPal nickname.

|

A stock this beaten down is obviously a company going out of business, right?

Let’s look.

Is PayPal a broken business?

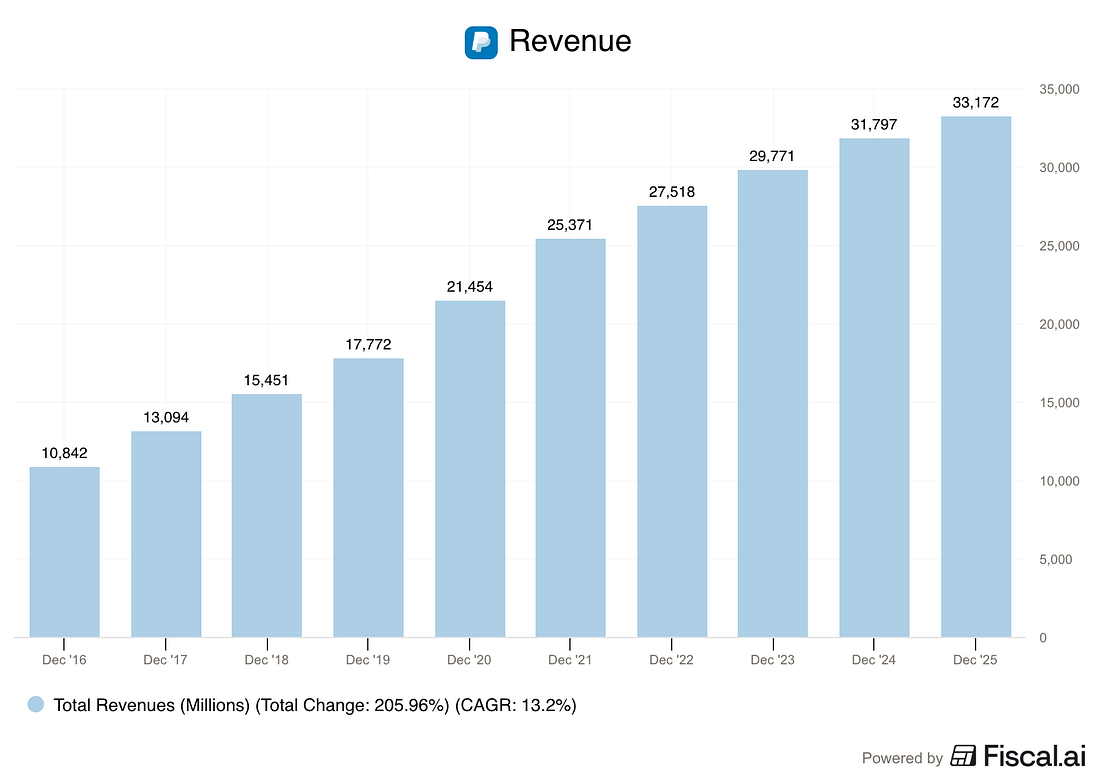

A broken business would surely have falling sales. Does PayPal?

|

Nope.

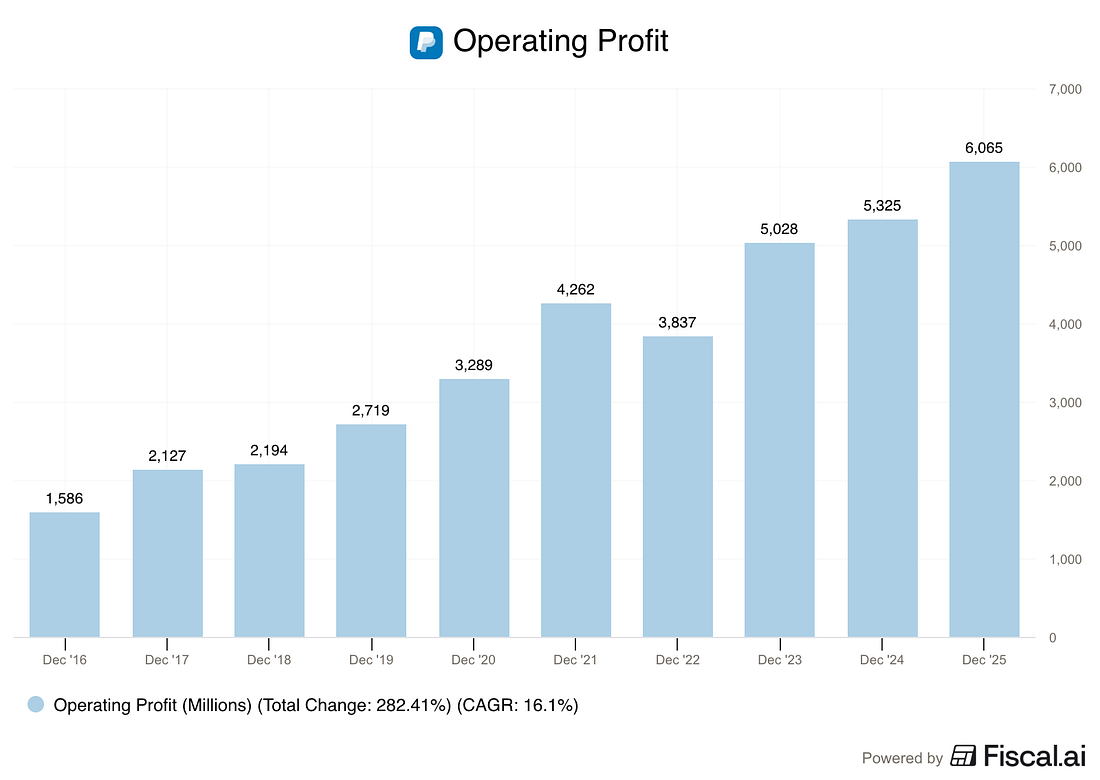

But revenue growth can be created by reducing profits… maybe PayPal has falling profits.

|

Nope.

Here’s their Operating and Net Margins: