|

Abbott Laboratories touches almost every part of healthcare.

From infant formula to the sensors that help diabetics manage their glucose, and even the tests doctors use to diagnose heart attacks.

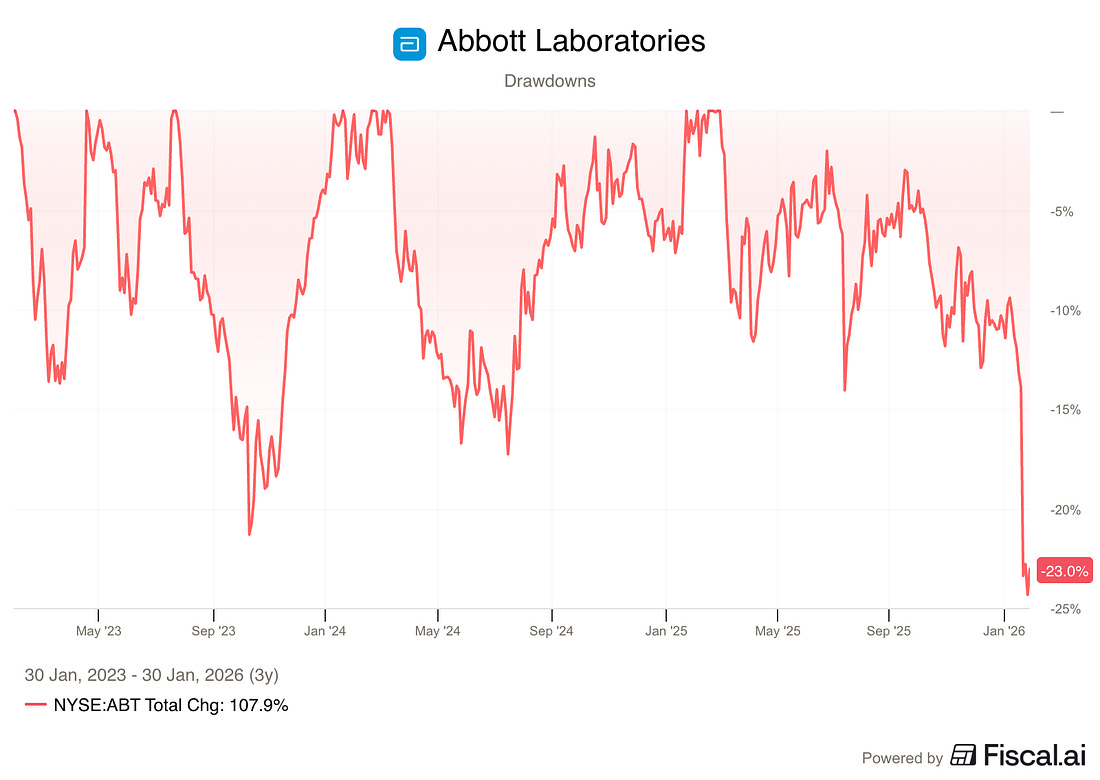

But after earnings, the stock dropped 10% and is now down about 15% on the year - is Abbott an interesting Dividend King to buy?

Let’s find out!

Right now, the company is facing some challenges:

Legal battles over specialty infant formula

Inflation forced them to raise prices, but customers started pushing back and demand weakened.

The massive COVID-testing market has declined

All of that means the stock has hit a 52-week low, and for the first time in a while, the dividend yield is pushing toward 2.4%.

|

Abbott Laboratories

Abbott is a global healthcare company that makes a wide variety of medical products.

They have four main businesses:

Medical devices: heart and diabetes devices

Diagnostics: lab testing equipment

Nutrition: shakes and baby formula

Established Pharmaceuticals: generic medicines sold in emerging markets

Their business model tends to be stable because it’s built on products people need regardless of how the economy is doing.

Company name: Abbott Laboratories

✍️ ISIN: US0028241000

🔎 Ticker: $ABT

📚 Type: Dividend Growth Stock

📈 Stock Price: $109

💵 Market cap: $184.4 Billion

📊 Average daily volume: $851.4 Million

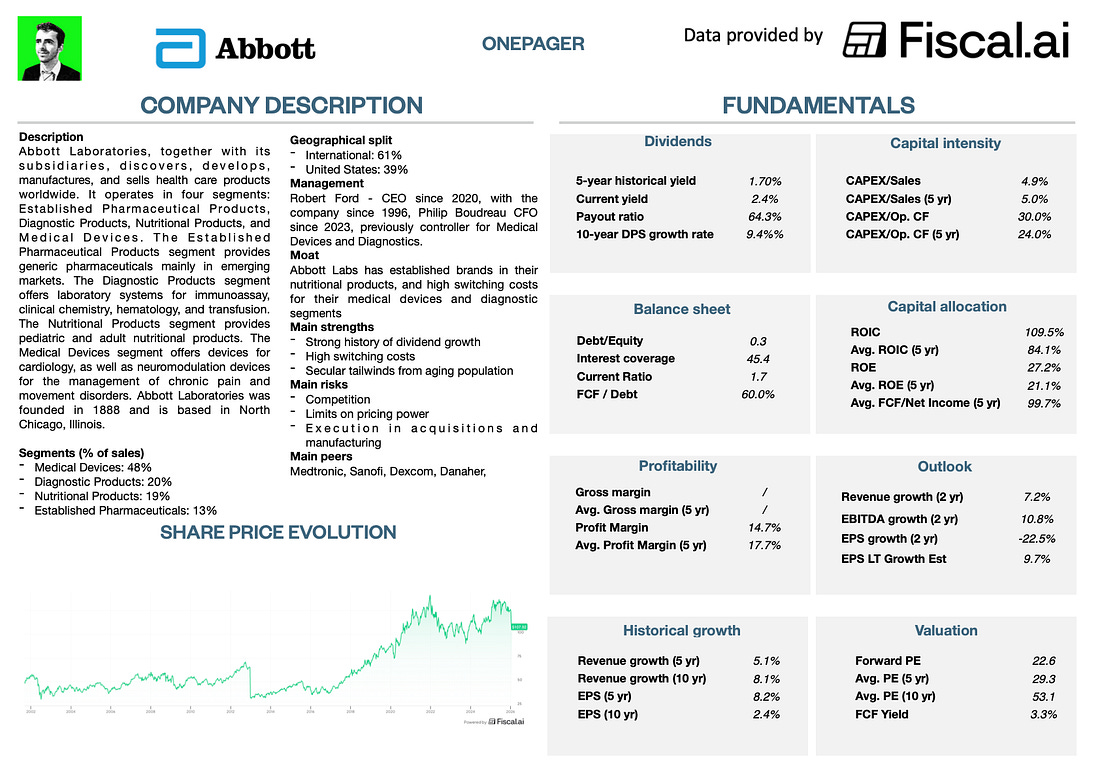

Onepager

Don’t know Abbott Laboratories?

Here are the basics (click on the picture to expand):

Now let’s dive into the full investment case!

1. Do I understand the business model?

Abbott operates as a diversified healthcare conglomerate.

Instead of being a pure-play drug company or a pure-play device maker, they spread their risk across four segments.

They focus heavily on high-growth areas like

Diabetes care, where their FreeStyle Libre system is the world leader

Branded generics in emerging markets like India and Brazil, where they sell trusted versions of medicines that no longer have patents.