|

A Few Things I’m Pretty Sure About

An iron rule of math is that 50% of the population has to be below average. It’s true for income, intelligence, health, wealth, everything. And it’s a brutal reality in a world where social media stuffs the top 1% of moments of the top 1% of people in your face.

best survival strategy in an uncertain world is to overworry. When you look back, you forget about all the things you worried about that never came true. So life appears better in the past because in hindsight there wasn’t as much to worry about as you were actually worrying about at the time.

Why You Can’t Time the Market (Even When You Know the Future)

Lessons from Warren Buffett’s Shareholder Letters (1977 - 1980)

Most of our large stock positions are going to be held for many years and the scorecard of our investment decisions will be provided by business results over that period, not by prices on any given day. Just as it would be foolish to focus unduly on short term prospects when acquiring an entire company, we think it equally unsound to become mesmerized by prospective near term earnings or recent trends in earnings when purchasing small pieces of a company

Both our operating and investment experience cause us to conclude that “turnarounds” seldom turn, and that the same energies and talent are much better employed in a good business purchased at a fair price than in a poor business purchased at a bargain price

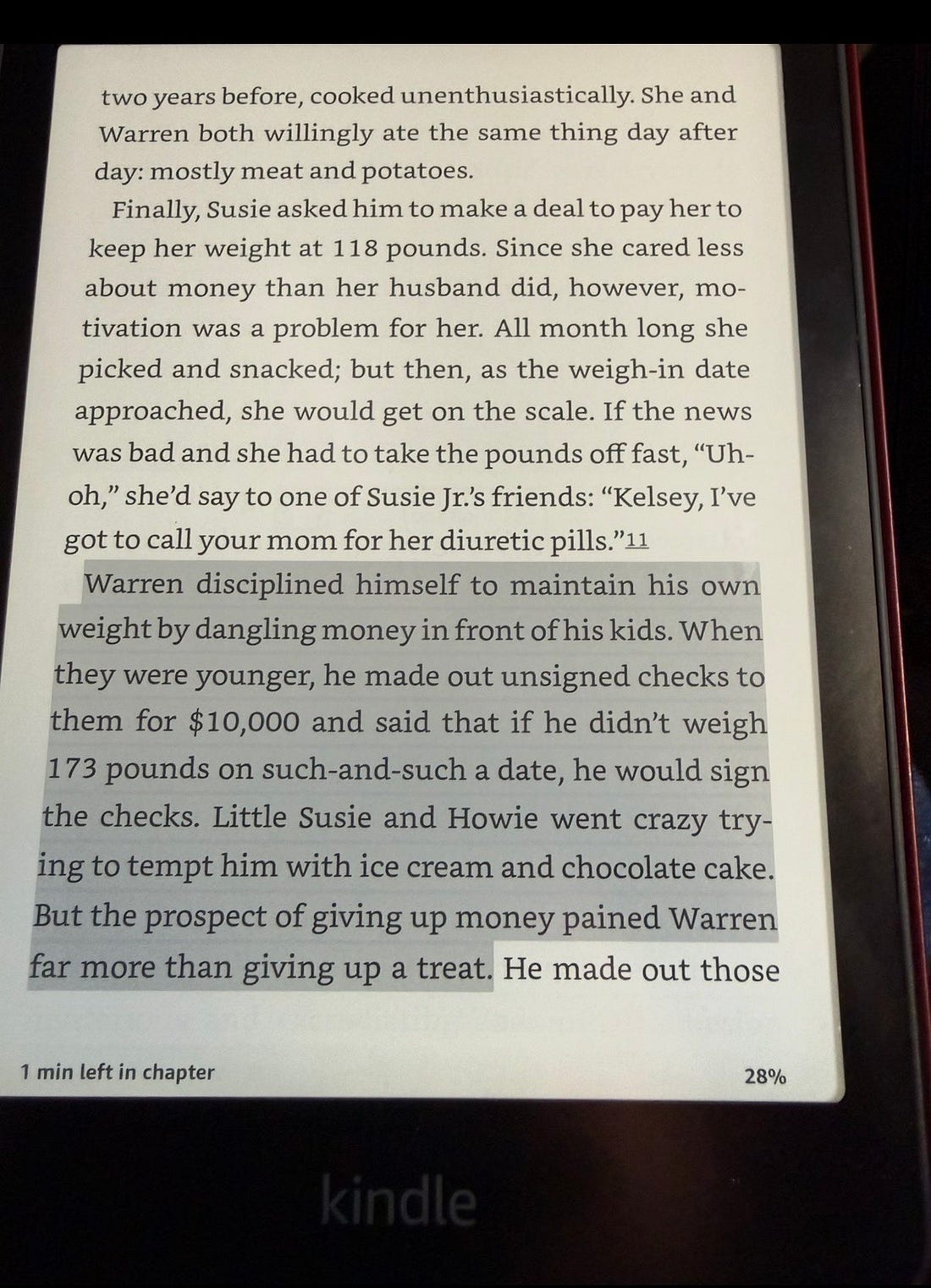

How Warren Buffett stopped himself from getting fat (Credit)

Announcing: Investing Eleven Conclave 2026

🚀 Investing Eleven Conclave 2026

📅 8 Feb 2026 | 10 AM–7 PM | Online

👥 11 real fund managers & investors

🧠 Frameworks, market outlook, high-conviction ideas

🎥 Recording included

🎯 For serious long-term investors (not traders)

💰 Fee: ₹2,499

👉 Register: Click Here

This is a rare chance to hear how real fund managers actually think, how they judge risk, build conviction, and stay invested through ups and downs. No stock tips or hype. Just clear thinking, real experiences, and lessons you can use for years.

Price: ₹2,499 — kept intentionally affordable so serious long-term investors can learn directly from practitioners, not marketing slides.