|

Have you ever heard of the Dogs of the Dow?

It’s one of the simplest, contrarian strategies in the investing world.

You buy the 10 stocks in the Dow Jones Industrial Average (DJIA) with the highest dividend yield at the start of the year, hold them for 12 months, then repeat.

Why are they called “Dogs”?

The theory is that a high yield often indicates a stock that has fallen out of favor with the market. That it’s a company that’s “in the doghouse.”

But because these are Dow companies - blue-chip, financially sound giants, the issues that are pushing the price down are usually temporary.

And the market has usually overreacted.

By buying the “Dogs,” you’re betting on a recovery while getting paid a large dividend to wait.

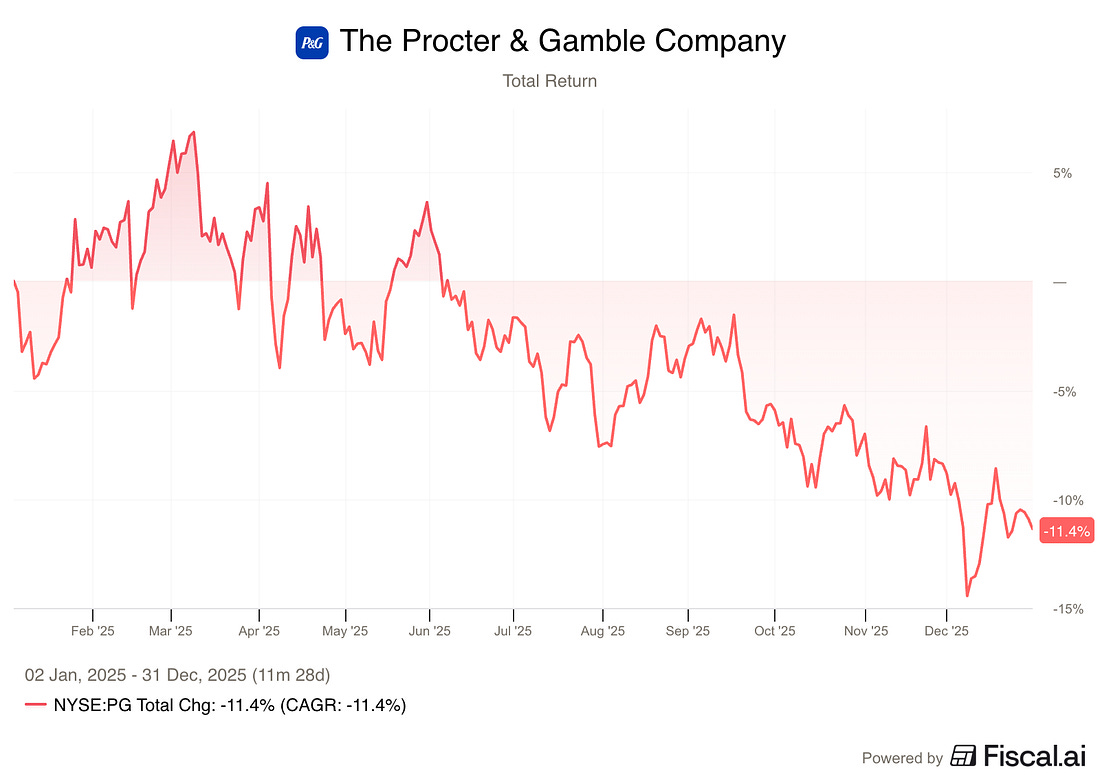

Out of the ten Dogs of the Dow 2025, only one generated a negative return - Proctor & Gamble, down -11.4% in 2025.

|

For the overall Dogs portfolio, the 2025 price return was 14.96% with a total return of 18.9%.

This total return beat both the Dow Jones Industrial Average, and the S&P 500, which returned 14.9% and 17.9%.

Let’s look at the 10 Dogs of the Dow for 2026 and see if we can find any interesting opportunities for this year.

The 10 Dogs of the Dow for 2026

10. Johnson & Johnson ($JNJ)

How does the company make money?

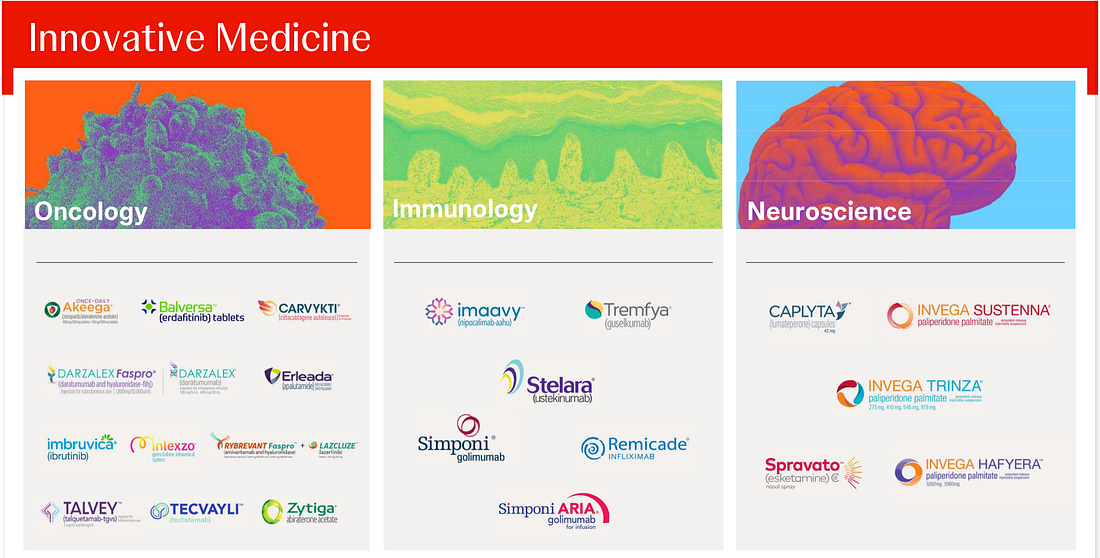

J&J is now a pure-play healthcare company following the spin-off of its consumer division (Kenvue). It now focuses entirely on high-margin Innovative Medicine (pharmaceuticals) and MedTech (robotic surgery and cardiovascular devices).

Why It’s Interesting

J&J is very solid financially. It is one of only two U.S. companies with a AAA credit rating - higher than the U.S. government (Microsoft is the other one).

It’s got very diverse revenue sources, and generates a lot of cash. That lets it pay out reliable dividends, while still investing around $15 billion every year in R&D.

Current Yield: 2.4%