| | In today’s edition: PIF lines up IPOs, Iran threatens to strike US bases, and MBS’ gaming room.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- PIF lines up IPOs

- Masdar long on the US

- Fossil fuels at ADSW

- Gulf economies to grow

- Dubai’s port in Somaliland

- Inside MBS’ gaming room

Saudi women take to the stands, and the field. |

|

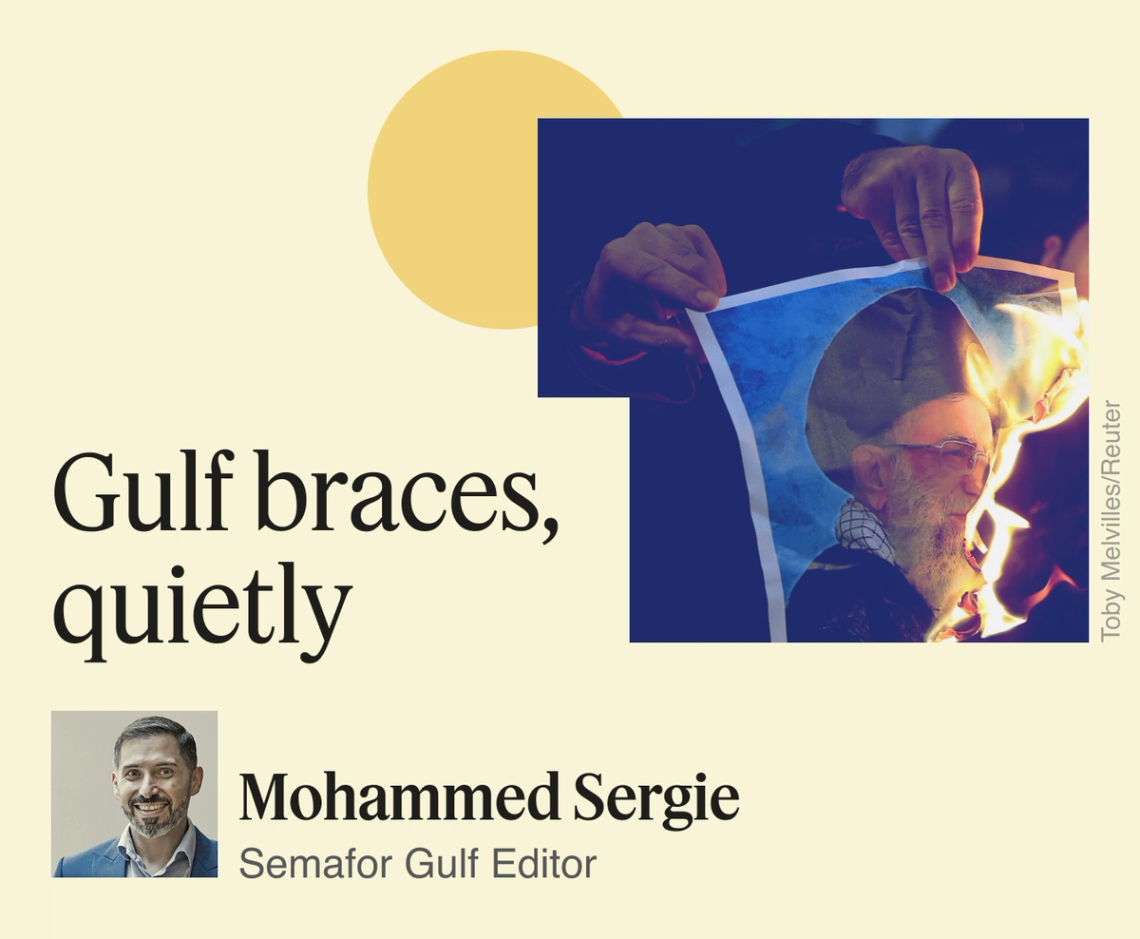

As Iranian protesters keep up the pressure on their regime — and bodies mount amid a brutal crackdown — diplomats are scrambling to avert a possible US response that could ripple across the Middle East. US President Donald Trump’s threat to intervene is being taken seriously, although it is not clear what American forces could do to help the demonstrators. Gulf countries know the stakes: During the June war between Iran and Israel, they were stuck in the middle. Tehran has warned that US bases in the region would be targeted if Washington acts. On Wednesday, Reuters reported that some personnel were advised to leave Al Udeid Air Base in Qatar, which Iran attacked in June. Disruptions to tankers in the Strait of Hormuz, a chokepoint that carries about a fifth of the world’s oil shipments and all of Qatar’s liquefied natural gas exports, is the immediate concern. The UAE is also among the countries most affected by Trump’s announcement of a 25% secondary tariff on Iran’s trading partners. While most Gulf states have little sympathy for the Islamic Republic — and have paid a price for the violence of its proxies — Iran’s weakening over the past year has also opened space to stabilize the region and fill the vacuum. A direct confrontation or regime collapse introduces new risks, threatening the economic development and new security arrangements the Gulf is pursuing. |

|

PIF preps for a wave of IPOs |

Courtesy of Saudi Press Agency Courtesy of Saudi Press AgencySaudi Arabia’s sovereign wealth fund is considering share sales this year for a raft of companies it controls, pinning its hopes of raising additional sources of cash on parallel government efforts to revive the local stock market by attracting more foreign investors. Public Investment Fund has historically used the proceeds of selling down parts of its domestic portfolio for new investments. Over the past five years, it has raised several billion dollars from local stock sales, which helps it pay for gigaprojects at home and deals abroad. The proposed IPOs of as many as eight companies — including ArcelorMittal Jubail, a metal pipes producer, events management company Sela, Saudi Global Ports, Alkhorayef Petroleum, and Cloudkitchens, according to people familiar with the matter — come as new listings have lost their luster. Several recent IPOs on the Saudi stock market have performed poorly, with shares falling below their offer price. Secondary offerings from companies that are already public have also struggled. Reviving the domestic stock market in 2026 will be key for Saudi Arabia, which in addition to issuing debt has used equity sales to fund economic diversification projects. — Matthew Martin |

|

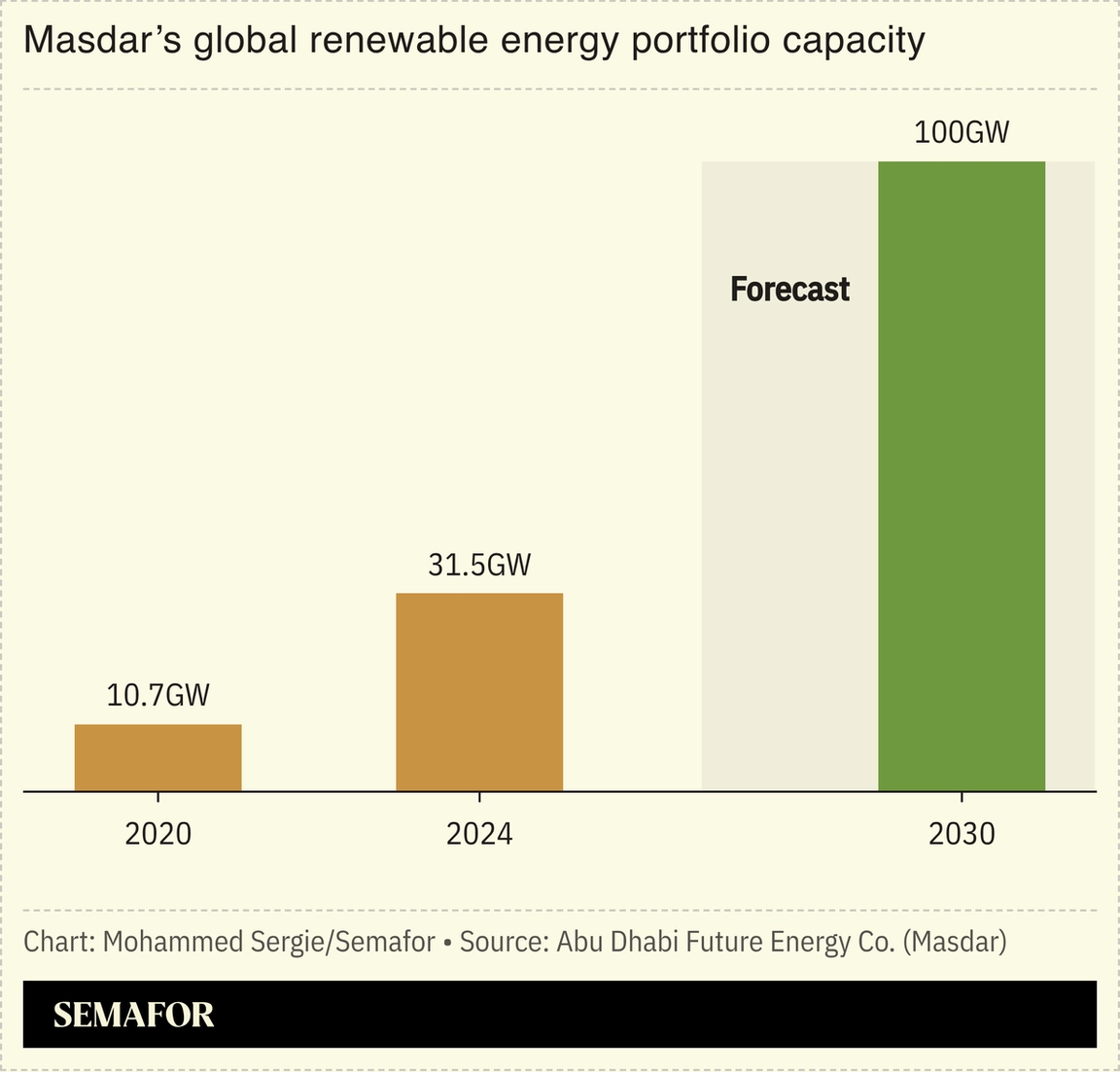

Masdar eyes US despite Trump policies |

The rollback of renewable energy policies in the US under the Trump administration “is not good for business,” the CEO of Masdar said in an interview. But with billions to invest and a willingness to be patient for returns, the Abu Dhabi renewable energy giant is looking to pick up struggling wind and solar assets in the world’s largest economy. “We love the US,” Mohamed Jameel Al Ramahi told Semafor, and Masdar “wants to deploy more capital there.” Abu Dhabi’s pursuit of renewable energy at home and abroad is based on a conviction that electrification is growing at breakneck speed, driven in part by the proliferation of data centers, but also rising urbanization. Masdar’s interest in upping its renewables exposure in the US — as well as the Gulf, Africa, and Europe — is part of a plan to invest up to $35 billion globally over the next four years. — Kelsey Warner |

|

AI shines at sustainability forum |

Sultan Al Jaber. Courtesy of Abu Dhabi Sustainability Week. Sultan Al Jaber. Courtesy of Abu Dhabi Sustainability Week.Artificial intelligence will be the driver, the disruptor, and the savior of economic growth — and the energy demand to go with it — in the coming decades, according to Sultan Al Jaber, UAE minister of industry and advanced technology, group CEO of oil firm ADNOC, and chairman of renewables major Masdar. In his opening address at Abu Dhabi Sustainability Week, Al Jaber said that meeting rising energy demand “means coming to terms with reality.” “By 2040, data center power demand is expected to grow by over 500%. At the same time, energy demand is accelerating across every dimension. Air travel will double. Cities will expand by 1.5 billion people … Over 70% of this energy will still come from hydrocarbons,” he said. — Kelsey Warner |

|

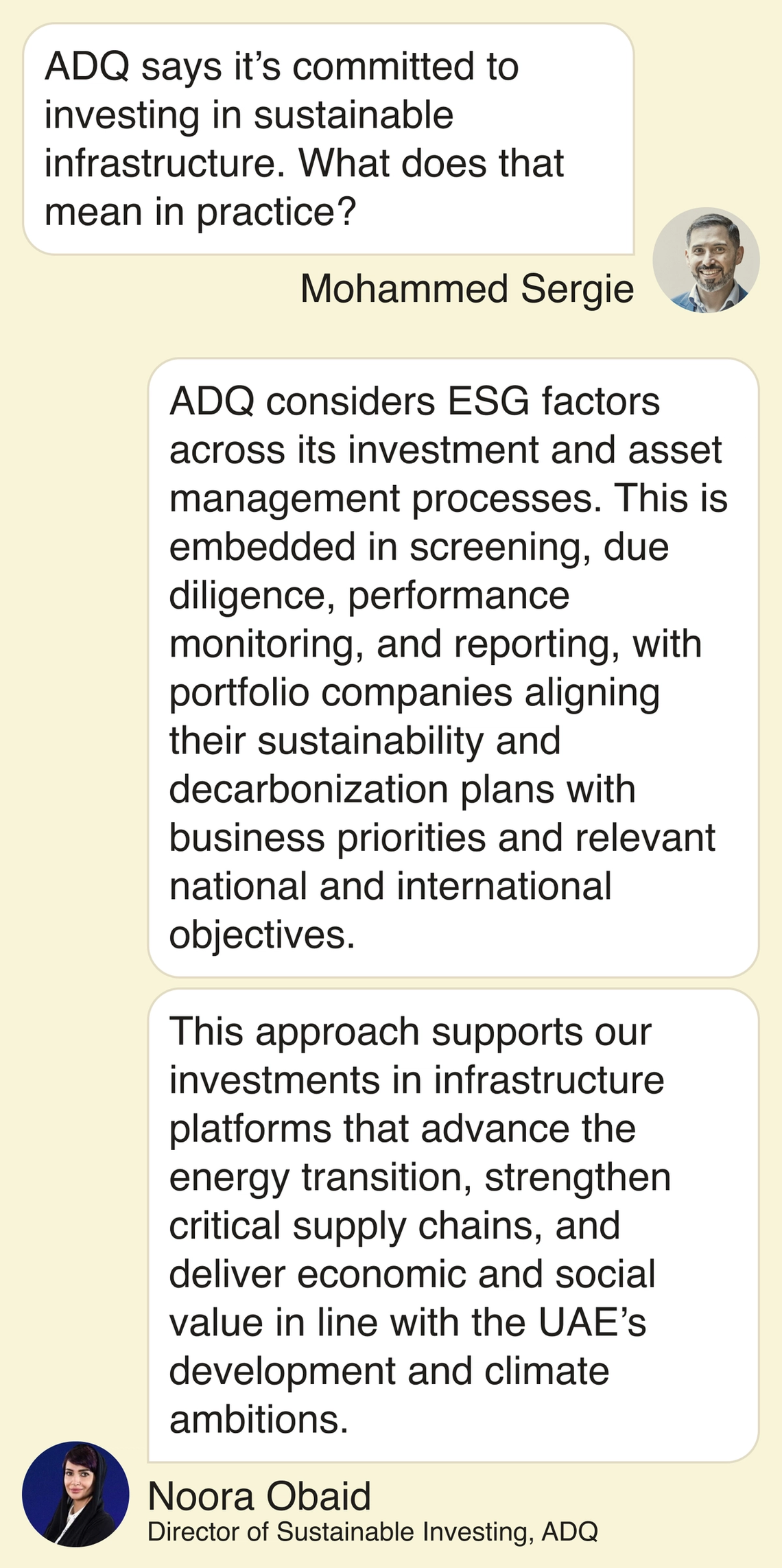

Noora Obaid is the director of sustainable investing at Abu Dhabi sovereign wealth fund ADQ.  |

|

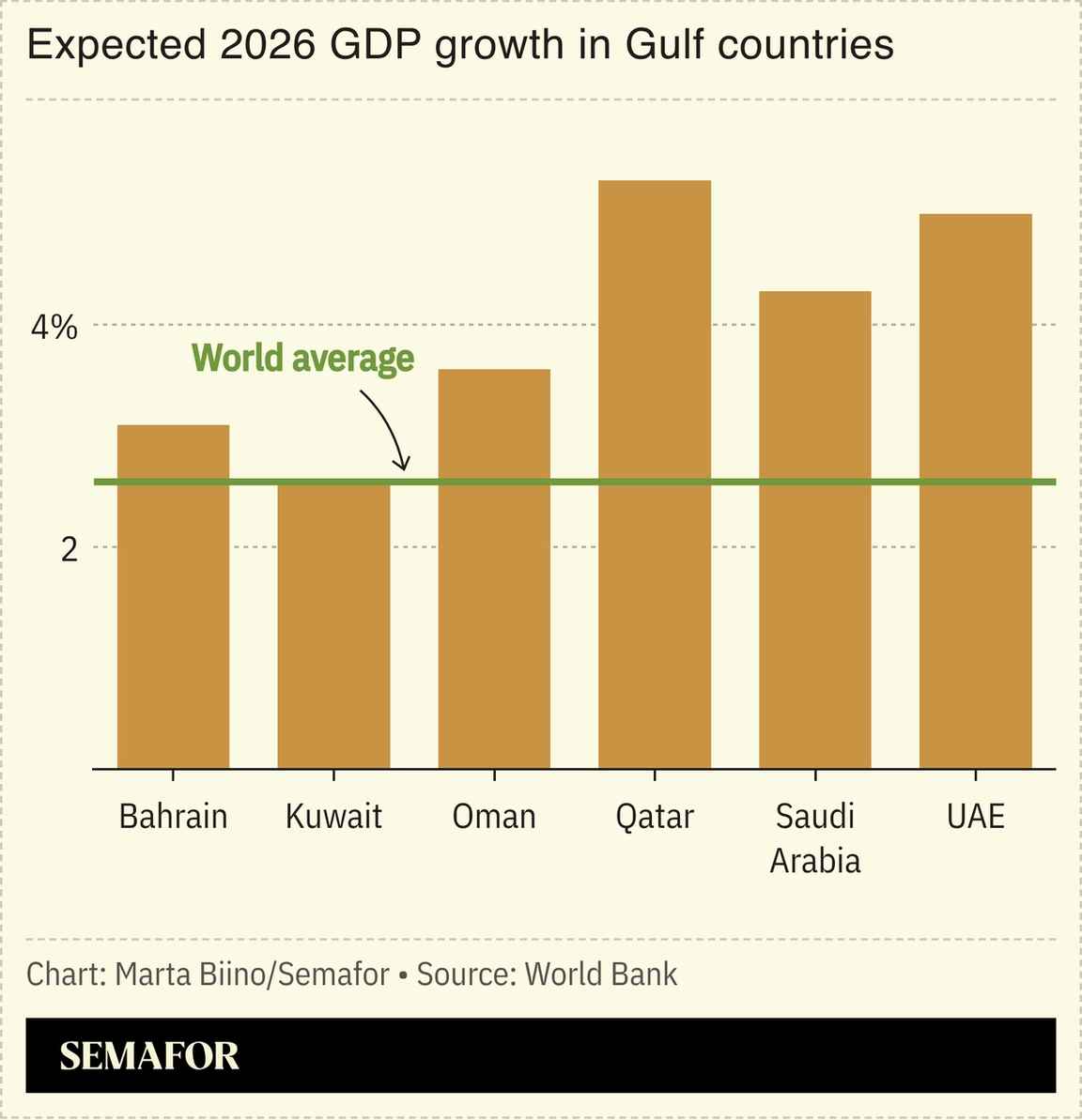

Gulf economies to beat global growth |

Gulf economies should easily outpace global growth this year, according to the World Bank. The region stands to benefit from an anticipated rise in oil output and large investments in non-oil activity in Kuwait and Saudi Arabia, as diversification efforts intensify. The standout performer is expected to be Qatar, with growth forecast to be more than double the global average, helped by rising natural gas output. Bahrain should benefit from surging demand for its aluminum, which is used in solar panels, wind turbines, EVs, and other aspects of the energy transition. Next year, the region could do even better, with the bank forecasting growth across the Gulf of 4.6% in 2027. |

|

DP World stays course in Somaliland |

The Port of Berbera in Somaliland. Courtesy of DP World. The Port of Berbera in Somaliland. Courtesy of DP World.Dubai port operator DP World said its Berbera facility in Somaliland continues to operate under existing agreements, despite Somalia’s move to annul all deals with the UAE. Israel became the first country to recognize Somaliland last month, a move condemned by the African Union and many Muslim-majority countries, but thought to have been facilitated by Abu Dhabi. The breakaway territory was allegedly used by the UAE to evacuate a Yemeni separatist leader this month, and Riyadh has reportedly urged Mogadishu to curb ties with the Emirates. DP World has invested around $450 million to develop the port of Berbera and is developing a logistics and industrial zone there. The UAE has also funded the expansion of an airport in nearby Puntland and trains security forces there. |

|

MBS’ Nvidia-powered gaming room |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersNvidia CEO Jensen Huang offered a rare glimpse into self-proclaimed “gamer” Crown Prince Mohammed bin Salman’s private residence, describing an “esports room” fitted with almost a dozen top-end gaming PCs running Nvidia technology. In an interview with Time last month, Huang said Saudi Arabia’s de-facto ruler has been a customer of the GeForce graphics card for “a very long time,” and is “grateful for everything we’ve done to help him” secure US government approval to buy advanced Nvidia chips. During his visit to the White House in November, the crown prince pledged a $50 billion investment in semiconductors. This was highlighted on Nvidia’s earnings call that month, when Huang pointed to Humain, the AI arm of the Saudi government’s Public Investment Fund, as a key revenue driver. The shout-out followed a White House state dinner attended by both men. Coinciding with the trip, Humain announced a deal with Nvidia and Amazon to deploy 150,000 chips in a new “AI Zone” in Riyadh. — Manal Albarakati |

|

Semafor has expanded the Semafor World Economy Global Advisory Board, a group of visionary business leaders representing nearly every sector across the US and G20 — who will help guide the largest gathering of global CEOs in the United States of America. Our co-chairs — Ken C. Griffin, founder and CEO of Citadel; Henry R. Kravis, co-founder and co-executive chairman of KKR; Penny S. Pritzker, former US Secretary of Commerce; and David M. Rubenstein, co-founder and co-chairman of the Carlyle Group, continue to lead this effort joined by a broadened roster shaping this year’s program. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

|